Australia Stocks Gain After Four-Session Run Lower

14 Setembro 2016 - 4:14AM

Dow Jones News

By Robb M. Stewart

MELBOURNE--Gains by major banks helped lift the Australian

equities market Wednesday after four straight sessions in

decline.

Each of the "Big Four" banks notched up gains, recovering some

of the ground lost of late as investors have focused on a possible

end to central bank easy-money policies. The gains offset losses

among resources stocks after a sharp fall in oil prices

overnight.

Still, there remains some nervousness in markets ahead of the

U.S. Federal Reserve's policy meeting next week. The local currency

dipped in Asia, caught in a global shift away from risk that

weighed on commodity prices on Tuesday.

"The share market will remain nervous while the current bond

sell-off continues," said Ric Spooner, chief market analyst at CMC

Markets.

He said that stocks remain vulnerable to a repeat of Tuesday's

action, when an early rally sparked another wave of selling.

The S&P/ASX 200 finished 19.9 points, or 0.4%, higher at

5227.7. The four largest banks collectively added more than 11

points to the index, while the energy sector fell 1.4% and the

basket of materials stocks slipped 0.6%.

Westpac Banking Corp. rose 1.5%, Commonwealth Bank of Australia

picked up 1% and Australia & New Zealand Banking Group Ltd. and

National Australia Bank Ltd. each added 0.6%.

CYBG, the British lender spun off by National Australia Bank

early this year, dropped 5.2%--its sharpest fall since late

June--after it told investors in London it was targeting further

cost cuts and expected to deliver a double-digit return on tangible

equity a year earlier than originally planned.

Among energy shares, Woodside Petroleum Ltd. was 0.7% lower, Oil

Search Ltd. lost 0.9% and Santos Ltd. sank 5.7%. Crude-oil prices

retreated overnight after the Paris-based International Energy

Agency cut its 2016 demand growth forecast by 100,000 barrels a day

to 1.3 million. That came a day after a report from the

Organization of the Petroleum Exporting Countries that pointed to a

world still awash in crude.

BHP Billiton Ltd. and Rio Tinto Ltd. were down 1% and 1.3%,

respectively. Iron-ore producer Fortescue Metals Group Ltd. was

1.7% weaker, and gold miner Newcrest Mining Ltd. fell 0.5%.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

September 14, 2016 02:59 ET (06:59 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

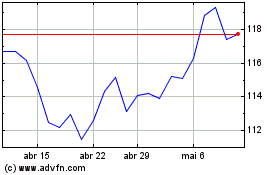

Commonwealth Bank Of Aus... (ASX:CBA)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Commonwealth Bank Of Aus... (ASX:CBA)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024