Critical Bitcoin Indicator: Analyst Foresees Major 75% Correction Ahead

04 Setembro 2024 - 5:00AM

NEWSBTC

The Bitcoin price has been unable to break out of its current

downtrend after losing the $60,000 mark this week, trading as low

as $57,790 on Tuesday. However, one indicator is pointing to

further price corrections for the largest cryptocurrency on the

market that could send the coin well below current levels.

Bitcoin Faces Major Risks In a recent social media post, crypto

analyst Ali Martinez has pointed to the Stochastic Relative

Strength Index (RSI) on Bitcoin’s 2-month chart, which has recently

indicated a trend reversal from bullish to bearish. This is

noteworthy because historical patterns over the past decade show

that similar signals have often preceded significant price

corrections of 84%, 59%, and an average of 75.5%. Related Reading:

Crypto Firm Galois Capital Faces $200K Fine From US SEC For

‘Investor Violations’ The Stochastic RSI is a momentum oscillator

that measures the level of a security’s closing price relative to

its price range over a specific period. When it indicates a bearish

trend, it suggests that the asset may be overbought and due for a

price drop. Interestingly, the last notable trend reversal occurred

in 2022 when Bitcoin was trading around $60,000. Following that

signal, the cryptocurrency plummeted to a cycle low of

approximately $16,000 before embarking on a recovery that

culminated in new all-time highs of $73,700 in March of this year.

If the current bearish trend holds, Bitcoin could face a dramatic

decline. Should a 75% correction materialize from its current

trading level of $57,000, the largest cryptocurrency could

potentially drop to around $14,200 per coin. Such a

significant downturn would likely dampen bullish expectations for

the market, especially in a year marked by the Halving event that

took place in April, which historically has been a catalyst for

price increases. Can BTC Bounce Back After September? In addition

to the bearish sentiment in the market, which could spell

short-term trouble for BTC, the leading cryptocurrency faces a

challenging September, historically known as its worst performing

month. Market expert Alex Thorn emphasizes that over the past

decade, Bitcoin has experienced declines in seven of the last ten

Septembers, with losses ranging from 5% to as much as 18%.

Related Reading: Stacks (STX) Drops 15% Despite Continuous On-Chain

Developments – Details However, Thorn points out that October tends

to provide a stark contrast to September’s declines. Historically,

October has been Bitcoin’s best month, with the cryptocurrency

often rebounding significantly. Gains in October have typically

ranged from 20% to 52%, making it a critical month for bullish

investors. If Bitcoin can maintain lower support levels and

successfully navigate September’s challenges, the market could be

poised for a robust performance in October. Featured image from

DALL-E, chart from TradingView.com

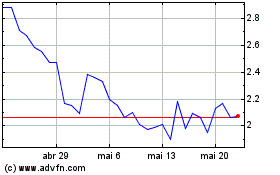

Stacks (COIN:STXUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Stacks (COIN:STXUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024