OPG Power Ventures plc Trading update and Update on Annual Accounts (3812N)

22 Setembro 2023 - 6:09AM

UK Regulatory

TIDMOPG

RNS Number : 3812N

OPG Power Ventures plc

22 September 2023

22 September 2023

OPG Power Ventures plc

("OPG", the "Group" or the "Company")

Trading update, Update on Annual Accounts and Suspension of

shares from trading on AIM

OPG Power Ventures plc (AIM: OPG), provides the following

trading update and an update in relation to its audited annual

report and financial statements for the year ended 31 March 2023

("FY23 Accounts").

Macro Outlook

In the current financial year, the macro environment has

improved with international coal prices having softened

significantly and the electricity demand trend remaining healthy

due to an improvement in economic activity. The Government of

India, in order to reduce dependence on imported coal, has opened

the mining sector to private players and traders. In the long term,

this will lead to an influx of cheaper Indian coal in the domestic

market.

During the current fiscal year, cumulative electricity demand

has increased by nearly 9 per cent y-o-y. Due to this consistent

growth in power demand and in the absence of any major increase in

capacity additions, India is still dependent upon coal-based

generation. The lower-than-expected addition in FY24 from the

renewables sector will lead to an increase in Plant Load Factors of

thermal power plants in the country.

Trading Update

As announced in the trading update on 20 June 2023, the Company

reported total generation for FY23 of 1.5 billion units and

repayment of Non-Convertible Debentures totalling GBP19.7 Million (

2 Billion) in May 2023. The Company's FY23 financial results are

expected to be in line with market expectations.

With a continual downward trend in coal prices, the industry and

the Company are seeing significant growth and OPG expects

materially increased generation and revenue in FY24 with plant load

factors expected to increase to approximately 58%. In addition to

the Long Term Power Purchase Agreement with Tamil Nadu State

utility for 74 MW, the Company secured a contract in September 2023

with another State utility up to 280 MW at an attractive tariff

which is valid for five months during H2 FY24.

OPG is pleased to announce that as at 31 August 2023 the Group

had cash and cash equivalents of GBP42.4 million and gross debt of

GBP23.8 million. Due to realisation of receivables, net cash as at

31 August 2023 was GBP18.6 million, compared with net debt of

GBP9.3 million as at 31 March 2023.

The numbers mentioned in this section are unaudited.

Update on FY23 Accounts

The Company is required under AIM Rule 19, to publish its FY23

Accounts, by 30 September 2023. There has been a delay in the

financial reporting close process for the FY23 Accounts and as a

result the audit has been delayed. The annual audit for FY23 is

still ongoing and the Company currently expects the audit to be

completed and the FY23 Accounts to be published by 31 October

2023.

As a result of the delay to the audit process, the Company's

ordinary shares will be suspended from trading on AIM with effect

from 7.30 a.m. on Monday 2 October 2023, pending publication of the

FY23 Accounts. The temporary suspension from trading on AIM will be

lifted once the FY23 Accounts have been published.

Notwithstanding the suspension of trading in the Company's

ordinary shares, with effect from 2 October 2023, the Company will

continue to make announcements as and when there are any

developments that require announcement in accordance with its

obligations under the AIM Rules and other applicable

regulation.

Change of Name of Nominated Adviser and Broker

The Company also announces that its nominated adviser and broker

has changed its name to Cavendish Securities plc (formerly Cenkos

Securities plc) following completion of its own corporate

merger.

Certain information contained in this announcement would have

been deemed inside information as stipulated under the UK version

of the EU Market Abuse Regulation (2014/596) which is part of UK

law by virtue of the European Union (Withdrawal) Act 2018, as

amended and supplemented from time to time, until the release of

this announcement.

For further information, please visit www.opgpower.com or

contact:

OPG Power Ventures PLC Via Tavistock

below

Ajit Pratap Singh

Cavendish Securities Plc (Nominated +44 (0) 20 7

Adviser & Broker) 220 0500

Stephen Keys/Katy Birkin

+44 (0) 20 7920

Tavistock (Financial PR) 3150

Simon Hudson / Nick Elwes

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSEWSUEEDSESU

(END) Dow Jones Newswires

September 22, 2023 05:09 ET (09:09 GMT)

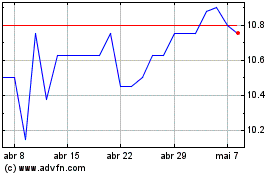

Opg Power Ventures (LSE:OPG)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Opg Power Ventures (LSE:OPG)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024