TIDMRHM

RNS Number : 7417R

Round Hill Music Royalty Fund Ltd

30 October 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF

THAT JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

FOR IMMEDIATE RELEASE

30 October 2023

RECOMMED CASH OFFER

for

ROUND HILL MUSIC ROYALTY FUND LIMITED ("RHM")

by

CONCORD CADENCE LIMITED ("Concord Bidco")

a newly formed company directly owned by

Alchemy Copyrights, LLC, trading as Concord ("Concord")

to be effected by means of a Court-sanctioned scheme of

arrangement under Part VIII of the Companies (Guernsey) Law 2008,

as amended

COURT SANCTION OF SCHEME OF ARRANGEMENT

On 18 October 2023, the board of RHM announced that at a Court

Meeting of Scheme Shareholders and General Meeting of RHM

Shareholders held on the same date as the announcement, the

necessary resolutions had been duly passed to implement the

recommended cash offer made by Concord Bidco to acquire the entire

issued and to be issued share capital of RHM (the "Acquisition") by

way of a Court-sanctioned scheme of arrangement under Part VIII of

the Companies (Guernsey) Law, 2008 (as amended) (the "Scheme").

RHM is pleased to announce that following the Court Hearing held

earlier today, the Guernsey Court has sanctioned the Scheme

pursuant to which the Acquisition is being implemented.

Pursuant to the Scheme Court Order granted today, the Scheme

shall become effective on delivery of the Scheme Court Order to the

Guernsey Registry which is scheduled to be tomorrow, 31 October

2023.

Suspension of trading of RHM Shares

Applications have been made for the suspension of trading in RHM

Shares on the London Stock Exchange's ("LSE") main market for

listed securities and the listing of RHM Shares on the premium

listing segment of the Official List of the Financial Conduct

Authority ("FCA") and such suspensions are expected to take effect

from 7.30 a.m. (London time) on 31 October 2023. The de-listing of

RHM Shares from the premium listing segment of the Official List of

the FCA and the cancellation of the admission to trading of RHM

Shares on the LSE's main market for listed securities have also

been applied for and is expected, subject to the Scheme becoming

effective, to take place by 8.00 a.m. (London time) on 1 November

2023.

Full details of the Acquisition are set out in the Scheme

Document.

General

The terms of the Scheme are set out in the scheme document

published by RHM on 25 September 2023, a copy of which is available

on RHM's website at www.roundhillmusicroyaltyfund.com. (the "Scheme

Document").

Capitalised terms used but not defined in this announcement

("Announcement") have the meanings given to them in the Scheme

Document. All references to times in this Announcement are to

London times, unless otherwise stated.

Enquiries

RHM Via Cavendish

Robert Naylor (Chairman)

Cavendish (Rule 3 Adviser,

Financial Adviser and Corporate

Broker to RHM)

James King +44 207 397 1913

William Talkington +44 207 397 1910

JTC (Company Secretary and

Administrator to RHM) +44 1481 702 485

Mariana Enevoldsen

Fourth Pillar (Financial PR

Advisers to RHM)

Claire Turvey +44 7850 548 198

Lynne Best +44 7763 619 709

Concord +1 629 401 3906

Kelly Voigt (SVP, Corporate

Communications

J.P. Morgan Cazenove (Sole

Financial Adviser to Concord

Bidco and Concord) +44 203 493 8000

Jonty Edwards

Brent Ballard

Rupert Budge

Edward Hatter

H/Advisors Maitland (PR Adviser

to Concord Bidco)

Neil Bennett +44 7900 000777

Sam Cartwright +44 7827 254561

Gowling WLG (UK) LLP is retained as legal adviser to RHM and

Reed Smith LLP is retained as legal adviser to Concord Bidco and

Concord.

Important notices

Cavendish Securities PLC (formerly Cenkos Securities PLC)

("Cavendish") which is authorised and regulated in the United

Kingdom by the FCA, is acting as Rule 3 financial adviser,

financial adviser and corporate broker exclusively to RHM and no

one else in connection with the Acquisition and the matters set out

in this Announcement and shall not be responsible to anyone other

than RHM for providing the protections afforded to clients of

Cavendish, nor for providing advice in connection with the

Acquisition or any matter referred to herein. Neither Cavendish nor

any of its subsidiaries, affiliates or branches owes or accepts any

duty or liability or responsibility whatsoever (whether direct,

indirect, consequential, whether in contract, in tort, under

statute or otherwise) to any person who is not a client of

Cavendish in connection with this Announcement, any statement or

other matter or arrangement referred to herein or otherwise.

J.P. Morgan Securities LLC, together with its affiliate J.P.

Morgan Securities plc (which conducts its UK investment banking

business as J.P. Morgan Cazenove and which is authorised in the

United Kingdom by the Prudential Regulation Authority (the "PRA")

and regulated in the United Kingdom by the PRA and the FCA)

(together "J.P. Morgan Cazenove"), is acting as financial adviser

exclusively to Concord Bidco and Concord and no one else in

connection with the Acquisition and will not be responsible to

anyone other than Concord Bidco and Concord for providing the

protections afforded to clients of J.P. Morgan Cazenove or its

affiliates, nor for providing advice in relation to the Acquisition

or any other matter or arrangement referred to herein.

Overseas shareholders

The implications of the Scheme for Overseas Shareholders may be

affected by the laws of their relevant jurisdictions. Overseas

Shareholders should inform themselves about and observe any

applicable legal requirements. It is the responsibility of each

Overseas Shareholder to satisfy himself as to the full observance

of the laws of the relevant jurisdiction in connection with the

Scheme, including the obtaining of any governmental, exchange

control or other consents which may be required, or the compliance

with other necessary formalities which are required to be observed

and the payment of any issue, transfer or other taxes due in such

jurisdiction.

This announcement does not constitute an offer to sell or issue

or the solicitation of an offer to buy or subscribe for shares in

any jurisdiction in which such offer or solicitation is

unlawful.

This announcement has been prepared for the purposes of

complying with English law, Guernsey law, the Takeover Code,

requirements of the Panel, the London Stock Exchange, the Listing

Rules and the FCA, and the information disclosed may not be the

same as that which would have been disclosed if this Announcement

had been prepared in accordance with the laws of any other

jurisdiction.

Forward-looking statements

This announcement (including information incorporated by

reference in this Announcement), oral statements made regarding the

Acquisition, and other information published by Concord Bidco or

RHM contain certain statements about Concord Bidco, RHM and/or the

Combined Group that are, or may be deemed to be, "forward-looking

statements". All statements other than statements of historical

facts included in this Announcement may be forward-looking

statements. Without limitation, any statements preceded or followed

by or that include the words "targets", "plans", "believes",

"expects","aims", "intends", "will", "may", "anticipates",

"estimates", "hopes", "projects", "continue", "schedule" or words

or terms of similar substance or the negative thereof, as well as

variations of such words and phrases, are forward-looking

statements. Such statements are qualified in their entirety by the

inherent risks and uncertainties surrounding future expectations.

Forward-looking statements include statements relating to the

following: (i) future capital expenditures, expenses, revenues,

earnings, synergies, economic performance, indebtedness, financial

condition, dividend policy, losses and future prospects; (ii)

business and management strategies and the expansion and growth of

Concord's or RHM's or the Combined Group's operations and potential

synergies resulting from the Acquisition; and (iii) the effects of

governmental regulation on Concord's or RHM's or the Combined

Group's business.

These forward-looking statements are not based on historical

fact and are not guarantees of future performance. By their nature,

such forward-looking statements involve known and unknown risks and

uncertainties that could significantly affect expected results and

are based on certain key assumptions. Many factors could cause

actual results to differ materially from those projected or implied

in any forward-looking statements. Many of these risks and

uncertainties relate to factors that are beyond the entities'

ability to control or estimate precisely. These factors include,

but are not limited to, the satisfaction of or failure to satisfy

all or any of the Conditions, as well as additional factors, such

as changes in political and economic conditions, changes in the

level of capital investment, retention of key employees, changes in

customer habits, success of business and operating initiatives and

restructuring objectives, the impact of any acquisitions or similar

transactions, changes in customers' strategies and stability,

competitive product and pricing measures, changes in the regulatory

environment, fluctuations of interest and exchange rates and the

outcome of any litigation. Neither Concord Bidco or RHM, nor any of

their respective associates or directors, officers, employees or

advisers, provides any representation, assurance or guarantee that

the occurrence of the events expressed or implied in any

forward-looking statements in this Announcement will actually

occur. Due to such uncertainties and risks, readers

are cautioned not to place undue reliance on such

forward-looking statements, which speak only as at the date of this

Announcement. All subsequent oral or written forward-looking

statements attributable to Concord Bidco or RHM or any of their

respective members, directors, officers, employees or advisers or

any persons acting on their behalf are expressly qualified in their

entirety by the cautionary statement above. Concord Bidco and RHM

disclaim any obligation to update any forward-looking or other

statements contained in this Announcement, except as required by

applicable law or by the rules of any competent regulatory

authority, whether as a result of new information, future events or

otherwise.

No profit forecast, estimate or quantified benefits

statements

No statement in this Announcement or incorporated by reference

into this Announcement is intended to constitute a profit forecast,

profit estimate or quantified benefits statements for RHM or

Concord Bidco for any period, nor should any statement in this

announcement or incorporated by reference into this announcement be

interpreted to mean that earnings or earnings per RHM Share for the

current or future financial years would necessarily match or exceed

the historical published earnings or earnings per RHM Share.

Publication on website

A copy of this Announcement (together with any document

incorporated by reference) and the documents required to be

published pursuant to Rule 26 of the Takeover Code will be made

available, free of charge, subject to certain restrictions relating

to persons resident in Restricted Jurisdictions, on RHM's website

at www.roundhillmusicroyaltyfund.com by no later than 12.00 pm

London time) on the date following the publication of this

announcement. Save as expressly referred to in this announcement,

neither the contents of RHM's website, Concord's website nor the

content of any other website accessible from hyperlinks on such

websites is incorporated into, or forms part of, this

announcement.

Requesting hard copy documents

In accordance with Rule 30.3 of the Takeover Code, any person

entitled to receive a copy of documents, announcements and

information relating to the Acquisition is entitled to receive such

documents (including information incorporated by reference into

such documents by reference to another source) in hard copy

form.

RHM Shareholders may request hard copies of this document by

contacting the Registrar, JTC Registrars Limited, at c/o JTC Group,

The Scalpel, 18(th) Floor, 52 Lime Street, London, United Kingdom

EC3M 7AF or by calling 01481 711 301 or from overseas +44 1481 711

301. Calls are charged at the standard geographical rate and will

vary by provider. Calls outside the United Kingdom or Guernsey will

be charged at the applicable international rate. Lines are open

between 9.00 a.m. and 5.00 p.m. (London time) Monday to Friday

(except public holidays in the UK and Guernsey). Please note that

JTC Registrars Limited cannot provide any financial, legal or tax

advice. Calls may be recorded and monitored for security and

training purposes.

Such persons may also request that all future documents,

announcements and information to be sent to them in relation to the

Acquisition should be in hard copy form.

Electronic communications

Please be aware that addresses, electronic addresses and certain

information provided by RHM Shareholders and other relevant persons

for the receipt of communications from RHM may be provided to

Concord Bidco during the Offer Period as required under Section 4

of Appendix 4 of the Takeover Code to comply with Rule 2.11(c) of

the Takeover Code.

Dealing disclosure requirements

Under Rule 8.3(a) of the Takeover Code, any person who is

interested in 1 per cent. or more of any class of relevant

securities of an offeree company or of any securities exchange

offeror (being any offeror other than an offeror in respect of

which it has been announced that its offer is, or is likely to be,

solely in cash) must make an Opening Position Disclosure following

the commencement of the Offer Period and, if later, following the

announcement in which any securities exchange offeror is first

identified.

An Opening Position Disclosure must contain details of the

person's interests and short positions in, and rights to subscribe

for, any relevant securities of each of (i) the offeree company and

(ii) any securities exchange offeror(s). An Opening Position

Disclosure by a person to whom Rule 8.3(a) of the Takeover Code

applies must be made by no later than 3.30 pm (London time) on the

10th business day following the commencement of the Offer Period

and, if appropriate, by no later than 3.30 pm (London time) on the

10th business day following the announcement in which any

securities exchange offeror is first identified. Relevant persons

who deal in the relevant securities of the offeree company or of a

securities exchange offeror prior to the deadline for making an

Opening Position Disclosure must instead make a Dealing

Disclosure.

Under Rule 8.3(b) of the Takeover Code, any person who is, or

becomes, interested in 1 per cent. or more of any class of relevant

securities of the offeree company or of any securities exchange

offeror must make a Dealing Disclosure if the person deals in any

relevant securities of the offeree company or of any securities

exchange offeror. A Dealing Disclosure must contain details of the

dealing concerned and of the person's interests and short positions

in, and rights to subscribe for, any relevant securities of each of

(i) the offeree company and (ii) any securities exchange offeror,

save to the extent that these details have previously been

disclosed under Rule 8 of the Takeover Code. A Dealing Disclosure

by a person to whom Rule 8.3(b) of the Takeover Code applies must

be made by no later than 3.30 pm (London time) on the business day

following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3 of the Takeover Code.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and 8.4 of

the Takeover Code).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the disclosure table on

the Panel's website at www.TheTakeoverPanel.org.uk , including

details of the number of relevant securities in issue, when the

Offer Period commenced and when any offeror was first identified.

You should contact the Panel's Market Surveillance Unit on +44

(0)20 7638 0129 if you are in any doubt as to whether you are

required to make an Opening Position Disclosure or a Dealing

Disclosure.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

SOABXBDGUXXDGXG

(END) Dow Jones Newswires

October 30, 2023 09:38 ET (13:38 GMT)

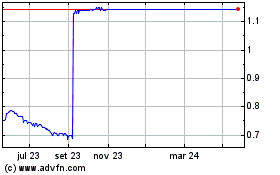

Round Hill Music Royalty (LSE:RHM)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Round Hill Music Royalty (LSE:RHM)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024