UBS AG (EPT) Form 8.5 (EPT/RI) - Segro Plc

27 Setembro 2024 - 8:06AM

RNS Regulatory News

RNS Number : 0577G

UBS AG (EPT)

27 September 2024

FORM 8.5

(EPT/RI)

PUBLIC DEALING DISCLOSURE BY

AN EXEMPT PRINCIPAL TRADER WITH RECOGNISED INTERMEDIARY STATUS

DEALING IN A CLIENT-SERVING CAPACITY

Rule 8.5 of the Takeover Code

(the Code)

1. KEY

INFORMATION

|

(a) Name of exempt principal

trader:

|

UBS Investment Bank, London

|

|

(b) Name of offeror/offeree

in relation to whose relevant securities this form

relates:

Use

a separate form for each offeror/offeree

|

SEGRO plc

|

|

(c) Name of the party to the

offer with which exempt principal trader is

connected:

|

SEGRO plc

|

|

(d) Date dealing

undertaken:

|

26 September 2024

|

|

(e) In addition to the

company in 1(b) above, is the exempt principal trader making

disclosures in respect of any other party to this

offer?

If

it is a cash offer or possible cash offer, state

"N/A"

|

YES

|

2. DEALINGS BY

THE EXEMPT PRINCIPAL TRADER

Where there have been dealings in more than one class of

relevant securities of the offeror or offeree named in 1(b), copy

table 2(a), (b), (c) or (d) (as appropriate) for each additional

class of relevant security dealt in.

The

currency of all prices and other monetary amounts should be

stated.

(a) Purchases and

sales

|

Class of relevant

security

|

Purchases/

sales

|

Total number of

securities

|

Highest price per unit

paid/received

|

Lowest price per unit

paid/received

|

|

10p

ordinary

|

Buy

|

283895

|

8.84649

GBP

|

8.69400

GBP

|

|

10p

ordinary

|

Sell

|

201956

|

8.84556

GBP

|

8.70200

GBP

|

(b) Cash-settled

derivative transactions

|

Class of relevant

security

|

Product

description

e.g. CFD

|

Nature of

dealing

e.g. opening/closing a

long/short position, increasing/reducing a long/short

position

|

Number of reference

securities

|

Price per

unit

|

|

10p

ordinary

|

CFD

|

Long

|

1077

|

8.72

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

460

|

8.792

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

357

|

8.736

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

35569

|

8.744295

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

490

|

8.758

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

13

|

8.702

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

4082

|

8.70763596415728

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

46456

|

8.74817816859652

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

17511

|

8.74069364664154

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

7745

|

8.73888650727954

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

339

|

8.776

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

19

|

8.735

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

609

|

8.722

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

26

|

8.738

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

10108

|

8.74533084

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

1

|

8.74

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

3244

|

8.748

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

13157

|

8.7492072318

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

651

|

8.7471252

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

1109

|

8.845555

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

2

|

8.7745

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

939

|

8.7420394028754

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

22

|

8.7209261

GBP

|

|

10p

ordinary

|

CFD

|

Long

|

365

|

8.76369326

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

37

|

8.72356757

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

231

|

8.73830583

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

134

|

8.73030555

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

6114

|

8.74816650310762

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

590

|

8.73567796610169

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

1206

|

8.72801824212272

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

64

|

8.7809375

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

862

|

8.779018

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

308

|

8.718872

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

59

|

8.752232

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

150

|

8.767877

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

1100

|

8.74816363636364

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

294

|

8.72853741496599

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

306

|

8.72480392156863

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

19

|

8.76421052631579

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

482

|

8.745758

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

15

|

8.759149

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

1

|

8.742

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

7780

|

8.748437

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

688

|

8.74843

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

6525

|

8.76260999900077

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

1970

|

8.75630799919797

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

264

|

8.76257576

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

19548

|

8.744918

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

1303

|

8.741032

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

131

|

8.846487

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

27923

|

8.749838

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

1211

|

8.751184

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

2

|

8.7745

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

2

|

8.796

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

8688

|

8.748

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

12121

|

8.7662989027308

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

2909

|

8.74816431763493

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

281

|

8.73565836298932

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

573

|

8.72806282722513

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

30

|

8.781

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

411

|

8.778796

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

29

|

8.751832

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

2891

|

8.790698

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

249

|

8.72433734939759

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

153

|

8.71843137254902

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

15

|

8.74066666666667

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

502

|

8.730046

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

545

|

8.78703733297248

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

1611

|

8.78490751

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

3924

|

8.730755355316

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

857

|

8.718

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

779

|

8.71416046156611

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

7644

|

8.74816588173731

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

737

|

8.73567164179104

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

1508

|

8.72801724137931

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

79

|

8.78088607594937

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

1078

|

8.779079

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

74

|

8.752311

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

2503

|

8.730115

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

24611

|

8.76629694039251

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

83972

|

8.74805749535464

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

3169

|

8.75286095426633

GBP

|

|

10p

ordinary

|

CFD

|

Short

|

218

|

8.75266972

GBP

|

(c) Stock-settled

derivative transactions (including options)

(i) Writing,

selling, purchasing or varying

|

Class of relevant

security

|

Product

description e.g. call

option

|

Writing, purchasing, selling,

varying etc.

|

Number of securities to which

option relates

|

Exercise price per

unit

|

Type

e.g. American, European

etc.

|

Expiry date

|

Option money paid/ received

per unit

|

|

|

|

|

|

|

|

|

|

(ii)

Exercise

|

Class of relevant

security

|

Product

description

e.g. call

option

|

Exercising/ exercised

against

|

Number of

securities

|

Exercise price per

unit

|

|

|

|

|

|

|

(d) Other dealings

(including subscribing for new securities)

|

Class of relevant

security

|

Nature of

dealing

e.g. subscription,

conversion

|

Details

|

Price per unit (if

applicable)

|

|

|

|

|

|

3. OTHER

INFORMATION

(a) Indemnity and

other dealing arrangements

|

Details of any indemnity or

option arrangement, or any agreement or understanding, formal or

informal, relating to relevant securities which may be an

inducement to deal or refrain from dealing entered into by the

exempt principal trader making the disclosure and any party to the

offer or any person acting in concert with a party to the

offer:

Irrevocable commitments and

letters of intent should not be included. If there are no such

agreements, arrangements or understandings, state "none

"

|

|

None

|

(b) Agreements,

arrangements or understandings relating to options or

derivatives

|

Details of any agreement,

arrangement or understanding, formal or informal, between the

exempt principal trader making the disclosure and any other person

relating to:

(i) the voting rights

of any relevant securities under any option; or

(ii) the voting rights or

future acquisition or disposal of any relevant securities to which

any derivative is referenced:

If there are no such

agreements, arrangements or understandings, state

"none"

|

|

None

|

Date of disclosure:

|

27 September

2024

|

Contact name:

|

Richard

Howard

|

Telephone number:

|

+44 (0)207 568

9128

|

Public disclosures under Rule 8 of the Code must be made to a

Regulatory Information Service and must also be emailed to the

Takeover Panel at monitoring@disclosure.org.uk

The

Panel's Market Surveillance Unit is available for consultation in

relation to the Code's dealing disclosure requirements on +44 (0)20

7638 0129.

The

Code can be viewed on the Panel's website at

www.thetakeoverpanel.org.uk.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

FERUBRARSVUKUAR

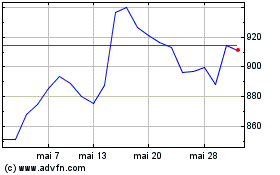

Segro (LSE:SGRO)

Gráfico Histórico do Ativo

De Ago 2024 até Set 2024

Segro (LSE:SGRO)

Gráfico Histórico do Ativo

De Set 2023 até Set 2024