Third Point Investors Ltd - Third Point Releases Q3 2024 Investor Letter

18 Outubro 2024 - 3:00AM

UK Regulatory

Third Point Investors Ltd - Third Point

Releases Q3 2024 Investor Letter

PR Newswire

LONDON, United Kingdom, October 18

18 October 2024

Third

Point Publishes Q3 2024 Investor Letter

Third

Point LLC, the Investment Manager of Third Point Investors Limited

(“TPIL”

or the “Company”)

announces that it has published its quarterly investor letter for

Q3 2024. The full letter can be accessed at the Company’s

website:

https://www.thirdpointlimited.com/resources/portfolio-updates

Highlights:

-

Third

Point’s flagship Offshore Fund (the “Master

Fund”)

generated a 3.9% gain in the Third Quarter, driven by equity

investments in industrials, utilities, materials, and other

housing-sensitive sectors, as well as a private position in R2

Semiconductor.

-

For the

year-to-date period, the Master Fund has posted a 14.0% net

return.

-

Third

Point LLC (“Third

Point” or the

“Investment

Manager”)

outlined its view on the macroeconomic environment as well as

several portfolio positions, including DSV, Cinemark, and R2

Semiconductor. It also provided updates on the corporate credit and

structured credit portfolios.

Performance

Key Points:

-

Third

Point returned

3.9% in the Master Fund during the Third Quarter of 2024, bringing

the year-to-date return to 14.0%.

-

The top

five positive contributors for the quarter were R2 Semiconductor,

Pacific Gas & Electric Co., Vistra Corp., KB Home, and Danaher

Corp.

-

The top

five negative contributors for the quarter were Bath & Body

Works Inc., Amazon.com Inc., Advance Auto Parts Inc., Alphabet

Inc., and Microsoft Corp.

Outlook

and Market Commentary:

-

Global

equity markets continued their strong performance, but returns were

driven by substantially more market breadth than over the previous

year and a half. Rate sensitive stocks and cyclicals significantly

outperformed the “Magnificent Seven” as the market shifted its

focus to the Fed’s long-awaited easing cycle.

-

Third

Point has a broad range of investment themes outside of large cap

technology, and these types of investments in industrials,

utilities, materials, and other housing-sensitive stocks led the

portfolio for the Third Quarter.

-

Many

pundits saw the market selloff in the beginning of August as a

warning that the market had more room to drop. While Third Point

was affected by this volatility, it stayed committed to its

positions, took the view that this market rotation would continue,

and increased its investments in event-driven and value-oriented

positions.

-

Third

Point believes the likelihood of a Republican victory in the White

House has increased, which it believes will have a positive impact

on certain sectors and the overall market. The Investment Manager

also believes Republican should garner a majority in the Senate,

regardless of the outcome in the presidential race.

-

A

Republican administration would likely increase domestic

manufacturing, infrastructure spending, and prices of certain

materials and commodities, and less onerous regulation should

unleash productivity and a wave of corporate activity, which Third

Point believes will benefit its event-driven positions.

-

In the

economy, the Investment Manager sees slowing inflation and a real

interest rate that still needs to come down. It also believes a

recession is unlikely. This is a positive set-up for event-driven

investing, in Third Point’s view.

Position

Updates

-

DSV

- During the

Third Quarter, Third Point initiated a new position in the Danish

freight forwarder DSV. DSV has come a long way from its origins as

a Nordic road-hauler to become the world’s third largest freight

forwarder, with a formidable track record of consolidating the

fragmented global freight forwarding industry.

- DSV

emerged as the leading bidder in the auction of DB Schenker, a

subsidiary of German state-owned Deutsche Bahn AG, and one of its

largest competitors. DB Schenker is similar in size to DSV but only

half as profitable. Third Point believes the integration and

synergy capture expected from this combination will follow a proven

playbook and drive earnings accretion in excess of 30%.

-

Cinemark

- Earlier

this year, Third Point took a stake in Cinemark, the third largest

movie theatre chain in the U.S. The Investment Manager believes

Cinemark is poised for underappreciated growth over the next few

years as the supply of theatrical releases rebounds from pandemic-

and strike-related headwinds.

- In

addition, Third Point believes Cinemark will gain share from

undercapitalized competitors.

-

R2

Semiconductor

- In

March 2024, Third Point disclosed

that it was supporting R2 Semiconductor, a private company in which

the firm invested in over 15 years earlier, as it sought to enforce

its patented technology against Intel.

- The

technology, developed by R2’s founder David

Fisher, relates to integrated voltage regulation, which

plays an essential part in reducing power consumption by microchips

while maintaining product reliability.

- At the end

of August, Intel announced that its dispute with R2 had been fully

settled in all jurisdictions. The terms of the settlement are

confidential, but Third Point is pleased with the outcome, which

resulted in a significant gain in the position for the

quarter.

Credit

Updates

-

Corporate

Credit

- The high

yield market returned 5.3% during the quarter, in line with the

strong performance of the S&P 500. Spreads tightened marginally

with most of the return driven by the decline in interest

rates.

- Third

Point’s corporate credit portfolio slightly lagged the high yield

market during the quarter, due mostly to its positions in

telecom/cable, which generally have been poor performers

year-to-date due to the overhang of competition from wireless cable

and increased fiber builds.

- Late in

the quarter, however, the cable sector re-rated on two developments

that highlighted the value in the space: Lumen’s announcement that

it was building fiber infrastructure to support AI growth, and

Verizon’s acquisition of Frontier Communications.

- While the

high yield market has rallied, Third Point continues to find

opportunity in a few areas. The firm has bought into several

credits that have gone through liability management deals. These

businesses were improving, and recapitalization was comprehensive

enough to fix the balance sheet. The Investment Manager is also

finding value in several loan-only structures that have lagged the

rally in the high yield market.

-

Structured

Credit

- While the

Treasury market has likely overestimated the magnitude of potential

Fed rate cuts for this year, Third Point took advantage of that

market window and exercised its call rights on eight reperforming

mortgage deals during the quarter.

- The

Investment Manager priced a new mortgage securitization in August

with AAA’s pricing inside of 5%, closer to the investment grade

yields seen in 2019 and early 2020.

- As

insurance companies and private credits funds actively look for

investment grade risk, Third Point has been able to access, in its

view, attractive cost of funds across structured credit

loans.

- Given the

decline in new mortgage originations and newly issued

mortgage-backed securities, the Investment Manager has seen an

improvement in the technical backdrop for existing securities and

loans. Third Point believes this dynamic gives the firm an

advantage as it continues to sell and optimize its existing

mortgage portfolio.

Press

Enquiries

|

Third

Point

Elissa

Doyle, Chief Communications Officer and Head of ESG

Engagement

edoyle@thirdpoint.com

Tel: +1

212-715-4907

|

Buchanan

Charles

Ryland

charlesr@buchanan.uk.com

Tel: +44

(0)20 7466 5107

Henry

Wilson

henryw@buchanan.uk.com

Tel: +44

(0)20 7466 5111

|

Notes

to Editors

About

Third Point Investors Limited

www.thirdpointlimited.com

Third

Point Investors Limited (LSE: TPOU) was listed on the London Stock

Exchange in 2007 and is a feeder fund that invests in the Third

Point Offshore Fund (the Master Fund), offering investors a unique

opportunity to gain direct exposure to founder Daniel S. Loeb’s

investment strategy. The Master Fund employs an event-driven,

opportunistic strategy to invest globally across the capital

structure and in diversified asset classes to optimize risk-reward

through a market cycle. TPIL’s portfolio is 100% aligned with the

Master Fund, which is Third Point’s largest investment strategy.

TPIL’s assets under management are currently $500 million.

About

Third Point LLC

Third

Point LLC is an institutional investment manager that actively

engages with companies across their lifecycle, using dynamic asset

allocation and an ethos of continuous learning to drive long-term

shareholder return. Led by Daniel S.

Loeb since its inception in 1995, the Firm has a 46-person

investment team, a robust quantitative data and analytics team, and

a deep, tenured business team. Third Point manages approximately

$11.3 billion in assets for sovereign

wealth funds, endowments, foundations, corporate & public

pensions, high-net-worth individuals, and employees.

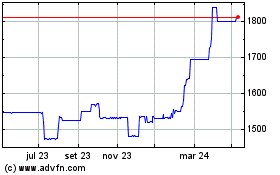

Third Point Investors (LSE:TPOS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

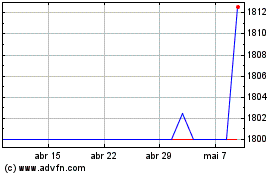

Third Point Investors (LSE:TPOS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024