As

filed with the Securities and Exchange Commission on August 30, 2024.

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

F-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

GALMED

PHARMACEUTICALS LTD.

(Exact name of registrant as specified in its

charter)

| State

of Israel |

|

2834 |

|

Not

Applicable |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

c/o

Meitar Law Offices Abba Hillel Silver Rd.

Ramat

Gan 5250608 Israel

Tel:

(+972) (3) 693-8448 |

|

Puglisi

& Associates

850

Library Ave.,Suite 204

Newark,

DE 19711

Tel:

(302) 738-6680 |

(Address,

including zip code, and telephone number,

including area code, of registrant’s principal executive offices) |

|

(Name,

address, including zip code, and telephone

number, including area code, of agent for service) |

Copies

to:

Gary

Emmanuel, Esq.

Greenberg

Traurig, P.A.

One

Azrieli Center

Round

Tower, 30th floor

132

Menachem Begin Rd

Tel

Aviv 6701101

Tel:

+972 (0) 3.636.6000 |

|

Mike

Rimon, Adv.

Elad

Ziv, Adv.

Meitar

| Law Offices

16

Abba Hillel Silver Rd.

Ramat

Gan 52506, Israel

Tel:

+972-3-610-3100 |

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date hereof.

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act, check the following box. ☒

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☐

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

†

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards

Board to its Accounting Standards Codification after April 5, 2012.

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the

Commission, acting pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

SUBJECT

TO COMPLETION |

DATED

AUGUST 30, 2024 |

Up

to 416,667 Ordinary Shares

Galmed

Pharmaceuticals Ltd.

This

prospectus relates to the offer and sale of up to 416,667 of our ordinary shares, par value NIS 1.80 per share, by YA II PN, LTD., or

YA or the Selling Shareholder, a Cayman Islands exempt limited partnership.

The

ordinary shares represented by ordinary shares being offered by the Selling Shareholder are to be issued pursuant to the Standby Equity

Purchase Agreement dated August 30, 2024 that we entered into with YA, or the Purchase Agreement. We are not selling any securities

under this prospectus and will not receive any of the proceeds from the sale of our ordinary shares by the Selling Shareholder. However,

we may receive up to $10.0 million in aggregate gross proceeds from sales of our ordinary shares to YA that we may make under the Purchase

Agreement, from time to time during the 36 months following the execution of the Purchase Agreement, or the Advance Shares. Pursuant

to the Purchase Agreement, we agreed to issue an aggerate of 31,566 ordinary shares to YA as consideration for its irrevocable

commitment to purchase our ordinary shares under the Purchase Agreement, or the Commitment Shares, to be issued in four installments,

of which 7,892 ordinary shares were issued on the date of execution of the Purchase Agreement, or the Initial Commitment

Shares, and an aggregate of 23,674 ordinary shares will be issued in three equal installments 90 calendar days following

the due date of the immediately preceding installment until all four installments have been issued, or the Subsequent Commitment Shares.

The additional 385,101 ordinary shares representing Advance Shares, that may be offered pursuant to this prospectus would be purchased

by YA from time to time pursuant to the Purchase Agreement at a price equal to 97% of the lowest of the three daily volume weighted average

prices, or VWAPs, during a pricing period as set forth in the Purchase Agreement and would be subject to certain limitations.

The

Selling Shareholder may sell the ordinary shares included in this prospectus in a number of different ways and at varying prices. We

provide more information about how the Selling Shareholder may sell the shares in the section entitled “Plan of Distribution.”

The Selling Shareholder is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended,

the Securities Act.

The

Selling Shareholder will pay all brokerage fees and commissions and similar expenses in connection with the offer and sale of the shares

by the Selling Shareholder pursuant to this prospectus. We will pay the expenses (except brokerage fees and commissions and similar expenses)

incurred in registering under the Securities Act the offer and sale of the shares included in this prospectus by the Selling Shareholder.

See “Plan of Distribution.”

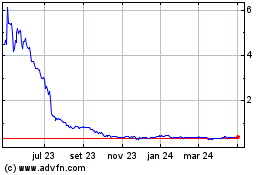

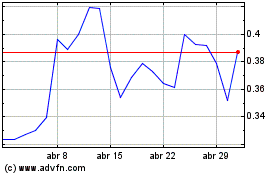

Our

ordinary shares are listed on the Nasdaq Capital Market, or Nasdaq, under the symbol “GLMD.” On August 29, 2024, the

last reported sale price of our ordinary shares on Nasdaq was $0.2635 per ordinary share, which is equal to $3.1620, as adjusted

to give effect to the 1-for-12 reverse share split of our ordinary shares that was effected on August 29, 2024.

We

are a “foreign private issuer,” as defined under the U.S. federal securities law and are subject to reduced public company

reporting requirements. See “Prospectus Summary – Implications of Being a Foreign Private Issuer” for additional information.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 6.

Neither

the Securities and Exchange Commission (or the SEC), nor any state or other foreign securities commission has approved nor disapproved

these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2024.

TABLE

OF CONTENTS

This

prospectus is part of a registration statement on Form F-1 that we filed with the Securities and Exchange Commission, or the SEC. The

Selling Shareholder may, from time to time, sell the securities described in this prospectus.

The

Selling Shareholder may resell, from time to time, in one or more offerings, the ordinary shares offered by this prospectus. Information

about the Selling Shareholder may change over time.

You

should rely only on the information contained in this prospectus. We have not, and the Selling Shareholder has not, authorized anyone

to provide you with different or additional information from that contained in this prospectus, any amendment or supplement to this prospectus

or in any free writing prospectus prepared by us or on our behalf. We take no responsibility for, and can provide no assurance as to

the reliability of, any information that others may give. Neither the delivery of this prospectus nor the sale of our ordinary shares

means that information contained in this prospectus is correct after the date of this prospectus.

This

prospectus is an offer to sell only our ordinary shares offered hereby, but only under circumstances and in jurisdictions where it is

lawful to do so. The Selling Shareholder is not making an offer to sell our ordinary shares in any jurisdiction where the offer or sale

is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted

to make such offer or sale.

Persons

who come into possession of this prospectus and any applicable free writing prospectus in jurisdictions outside the United States are

required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any

such free writing prospectus applicable to that jurisdiction.

For

investors outside of the United States: Neither we nor the Selling Shareholder has done anything that would permit this offering or possession

or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You

are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

We

are incorporated under Israeli law and under the rules of the United States Securities and Exchange Commission, or the SEC, we are currently

eligible for treatment as a “foreign private issuer.” As a foreign private issuer, we will not be required to file periodic

reports and financial statements with the SEC as frequently or as promptly as domestic registrants whose securities are registered under

the Securities Exchange Act.

In

this prospectus, “we,” “us,” “our,” the “Company” and “Galmed” refer to Galmed

Pharmaceuticals Ltd. and its subsidiaries, unless the context otherwise requires. All references to Aramchol mean Aramchol acid or Aramchol

meglumine (salt), unless the context otherwise requires. All references to “shares” or “ordinary shares” are

to our ordinary shares, NIS 1.80 nominal par value per share. All references to “Israel” are to the State of Israel. “U.S.

GAAP” means the generally accepted accounting principles of the United States.

Unless

otherwise stated, all of our financial information presented in this prospectus, or incorporated by reference into this prospectus, has

been prepared in accordance with U.S. GAAP. Any discrepancies in any table between totals and sums of the amounts listed are due to rounding.

Unless otherwise indicated, or the context otherwise requires, references in this prospectus, or incorporated by reference into this

prospectus, to financial and operational data for a particular year refer to the fiscal year of our company ended December 31 of that

year. Our reporting currency and financial currency is the U.S. dollar. In this prospectus, “NIS” means New Israeli Shekel,

and “$,” “US$” and “U.S. dollars” mean United States dollars.

All

trademarks or trade names referred to in this prospectus are the property of their respective owners. Solely for convenience, the trademarks

and trade names in this prospectus are referred to without the ® and ™ symbols, but such references should not be construed

as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do

not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship

of us by, any other companies.

This

prospectus includes statistical, market and industry data and forecasts which we obtained from publicly available information and independent

industry publications and reports that we believe to be reliable sources. These publicly available industry publications and reports

generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy

or completeness of the information.

Effective

August 29, 2024, we effected a 1-for-12 reverse share split, or the Reverse Split, of our authorized ordinary shares, including our issued

and outstanding ordinary shares, and the par value of each share was accordingly increased from NIS 0.15 per share to NIS 1.80 per share.

Unless specifically provided otherwise herein, the share and per share information that follows in this prospectus, other than in the

historical financial statements and related notes included elsewhere in this prospectus, assumes the effect of the Reverse Split.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in or incorporated by reference into this prospectus that we consider important. This

summary does not contain all of the information you should consider before investing in our securities. Before you decide to invest in

our securities, you should read the entire prospectus carefully, including the “Risk Factors” section and the financial statements

and related notes incorporated by reference into this prospectus and the other documents incorporated by reference into this prospectus,

which are described under “Incorporation by Reference” before making an investment in our securities.

Company

Overview

We are a biopharmaceutical company focused on the development of Aramchol. We have focused almost exclusively on

developing Aramchol for the treatment of liver disease and have been developing Aramchol for PSC and exploring the feasibility of developing

Aramchol for other fibro-inflammatory and oncological indications outside of liver disease. We are also collaborating with the Hebrew

University in the development of Amilo-5MER, a 5 amino acid synthetic peptide.

We

believe that our lead product candidate, Aramchol, has the potential to be a disease modifying treatment for fatty liver disorders, including

NASH, which is a chronic disease that constitutes a large unmet medical need.

Aramchol

is a synthetic conjugate of 3-amino cholic acid, or a type of modified bile acid, and arachidic acid, or a type of saturated fatty acid,

which in its non-synthetic forms, is naturally occurring. The conjugated molecule acts upon important metabolic pathways, reducing fat

accumulation in the liver, improving fatty acid oxidation and regulating the transport of cholesterol. The ability of Aramchol to decrease

liver fat content may also reduce the inflammation and fibrosis in the liver and the risk of cardiovascular complications associated

with NASH. Pre-clinical studies suggest Aramchol’s effect on fibrosis is also direct via collagen production from human hepatic

stellate cells. We believe that Aramchol’s ability to reduce liver fat and liver fibrosis and the safety profile observed to date

will enable it to be a treatment for all stages of NASH in patients who are overweight or obese and have pre diabetes or type II diabetes

mellitus and prevent the hepatic complications associated therewith.

In

September 2019, we initiated our Phase 3 ARMOR Study to evaluate the efficacy and safety of Aramchol in subjects with NASH and fibrosis.

The ARMOR Study was originally comprised of two parts, a randomized, double-blind, placebo-controlled histology-based registrational

part and a clinically based part where subjects will continue with the same treatment for approximately five years. In December 2020,

we announced the addition of a 150-patient open label part to the ARMOR Study and suspended randomization of new patients into the double-blind,

placebo-controlled histology-based registrational part of ARMOR as all enrolled patients were transitioned to the open label part.

In

May 2022, we announced our plan to expand into new anti-fibrotic indications to maximize the potential of Aramchol while at the same

time discontinuing the open label part of its ARMOR Study having reached its objectives. Simultaneously, we initiated a cost reduction

plan and initiated a process to evaluate our strategic alternatives. Following the discontinuation of our open label part of the ARMOR

Study, we do not currently expect to initiate the second part of the ARMOR Study in the near term.

In

May 2023, we announced the initiation of a new clinical program to evaluate Aramchol meglumine for the treatment of PSC, a rare disease

for which there is no approved treatment. The randomized,

double-blind, proof-of-concept clinical study (NCT06095986) will evaluate the effects of 48 weeks of treatment with Aramchol meglumine

vs. placebo in approximately 24 patients with PSC. The study’s endpoints will include the conventional relevant laboratory parameters

(alkaline phosphatase and bilirubin), sophisticated imaging including liver stiffness using MR Elastography (MRE), imaging of the biliary

tract using MR cholangiopancreatography, or MRCP, and hepatocyte-specific contrast agents, histological fibrosis and molecular assessment

as well as a range of biomarkers of disease activity and fibrosis. These endpoints are expected to provide a robust assessment of the

underlying disease and the effects of Aramchol.

While

PSC is more common in men, especially in Northern European heritage, and is often diagnosed between ages 30-40, we currently estimate

that the number of patients to be around 60,000, or 1 per 10,000, consisting of around 33,5000 patients in the United States and 32,500

patients collectively in France, Germany, Italy, Spain and the United Kingdom. In the preclinical stage, PSC likely involves ulcerative

colitis (UC) leading to biliary inflammation. As biliary fibrosis progresses to cirrhosis, it is coupled with complications and competing

risks, while about 50% of patients with PSC report clinical symptoms. While there are currently no approved drugs for the treatment of

PSC, there is a potential to gain orphan drug status.

We initially planned to initiate a Phase 2 study in the last quarter of

2023 to evaluate Aramchol meglumine for the treatment of PSC. This study was to be followed by a Phase 2b or a phase 2/3 confirmatory

adaptive design trial. As a result of the outbreak of the Hamas-Israel war, in November 2023, we determined that there would be a delay

of seven to nine months in the initiation of the Phase 2 PSC study. Currently, as we explore the feasibility of developing Aramchol for

other indications, we do not currently have a timeline for the commencement of the PSC trial we had been planning and can give no assurances

that we will commence this trial.

As PSC is a fibro-obliterative cholangiopathy where the disease progression is predominantly determined by biliary fibrosis, Aramchol

meglumine has been shown to downregulate Stearoyl-CoA desaturase 1 (SCD1), a key liver enzyme involved in lipid metabolism, attenuate

fibrogenesis by hepatic stellate cells (HSCs). Aramchol meglumine may have direct effects on cholangiocytes to reduce the production

of fibrogenic and inflammatory signals that activate HSCs suggesting that Aramchol meglumine may be beneficial in treating PSC.

In

addition, in May 2023, we entered into a definitive agreement, or the OnKai Agreement, for a $1.5 million equity investment in OnKai,

a US-based technology company developing an AI-based platform to advance healthcare for underserved populations across the United States

by facilitating alignment between healthcare stakeholders. The signing of the definitive agreement followed an announcement that we made

in January 2023 that we had entered into a non-binding termsheet for an equity investment in OnKai. The OnKai Agreement provided that

we will invest $1.5 million in exchange for series seed preferred shares of OnKai (which is in addition to a $1.5 million investment

that was made by us in OnKai through a Simple Agreement for Future Equity, or SAFE, and which converted at a 15% discount into series

seed preferred shares upon consummation of the Investment Round (as defined below)). Our investment in OnKai was part of an approximately

$6 million investment round, or the Investment Round, with other investors that was led by us of which SAFE notes of approximately $3.8

million were converted into preferred shares. On June 19, 2023, the Investment Round closed. Following the Investment Round, we hold

approximately 23.9% of the outstanding share capital of OnKai on an as-converted and fully diluted basis and our Chief Executive Officer

and director, Allen Baharaff serves as a board member of OnKai. In connection with the OnKai Agreement, our wholly-owned subsidiary,

Galmed Research and Development Ltd., or GRD, entered into a services agreement, or the OnKai Services Agreement, with OnKai. The OnKai

Services Agreement provides that GRD shall on a non-exclusive basis (i) provide support services to OnKai relating to finance, business

development, strategic planning, execution and others; and (ii) lend its experience to OnKai in building a strategy and for the development

of treatments for the underserved and that OnKai shall on a non-exclusive basis (i) take part in plan preparation to serve GDR’s

vision of developing drugs for the underserved population and (ii) when relevant, design a process on the clinical trial dashboard that

could potentially serve GDR’s future trial. See “Item 4. Information on the Company— Strategic Collaborations, Research

Arrangements and other Agreements—Onkai” in the 2023 Annual Report for additional information. In July 2023, we announced

that OnKai will apply its artificial intelligence models for enrollment and execution of clinical trials in underserved communities,

starting with our PSC clinical program.

Standby

Equity Purchase Agreement with YA

On

August 30, 2024, we entered into the Purchase Agreement with YA, pursuant to which YA has committed to purchase up to $10.0 million

of Advance Shares, or the Commitment Amount, at our direction from time to time, subject to the restrictions and satisfaction of the

conditions in the Purchase Agreement, during the period commencing on the date of execution of the Purchase Agreement until the earlier

of (i) the first day of the month next following the 36-month anniversary of the date of execution of the Purchase Agreement, and (ii)

YA’s purchase of the total Commitment Amount under the Purchase Agreement, such period the Commitment Period. Pursuant to the terms

of the Purchase Agreement, we have issued and agreed to issue the Commitment Shares to YA as consideration for its irrevocable commitment

to purchase the Advance Shares under the Purchase Agreement. The Commitment Shares are also covered by this prospectus.

This

prospectus covers the resale of up to 416,667 ordinary shares comprised of: (i) 7,892 ordinary shares issued as the Initial Commitment

Shares on the date of execution of the Purchase Agreement; (ii) 23,674 ordinary shares as the Subsequent Commitment Shares to

be issued to YA in three equal installments 90 calendar days following the due date of the immediately preceding installment until all

four installments have been issued; and (iii) 385,101 ordinary shares as the Advance Shares that that we have reserved for issuance

and sale to YA as Advance Shares under the Purchase Agreement from time to time during the Commitment Period, subject to the restrictions

and satisfaction of the conditions in the Purchase Agreement, if and when we determine to sell additional ordinary shares to YA under

the Purchase Agreement.

YA

has no right to require us to sell any ordinary shares to YA, but YA is obligated to make purchases of the Advance Shares as directed

by us, subject to the restrictions and satisfaction of conditions set forth in the Purchase Agreement upon receipt of a notice sent by

us to YA setting forth the number of ordinary shares that we desire to issue and sell to YA, or an Advance Notice. Actual sales of the

Advance Shares to YA from time to time will depend on a variety of factors, including, among others, market conditions, the trading price

of our ordinary shares and determinations by us as to the appropriate sources of funding for us and our operations. The purchase price

of the Advance Shares that we may direct YA to purchase from time to time under the Purchase Agreement will be equal to 97% of the lowest

of the three daily VWAPs during the three consecutive trading day period commencing on the date that we deliver any Advance Notice to

YA, or the Pricing Period.

As

of August 30, 2024, there were 643,694 ordinary shares outstanding, of which 47,173 ordinary shares were held by non-affiliates.

If all of the 416,667 ordinary shares offered by YA under this prospectus were issued and outstanding, such shares would represent approximately

5.4% of the total number of ordinary shares outstanding and approximately 5.8% of the total number of outstanding ordinary shares held

by non-affiliates, in each case as of August 30, 2024. The Purchase Agreement provides that we may sell up to an aggregate of

$10.0 million of ordinary shares to YA. We have filed the registration statement that includes this prospectus so that we may issue and

sell to YA up 416,667 ordinary shares from time to time from during the Commitment Period, subject to the restrictions and satisfaction

of the conditions in the Purchase Agreement, through sales under the Purchase Agreement. Depending on the market prices of our ordinary

shares at the time we elect to issue such shares to YA under the Purchase Agreement, we may need to sell more ordinary shares to YA than

are offered under this prospectus to receive aggregate gross proceeds equal to the $10.0 million total commitment of YA under the Purchase

Agreement, in which case we must first register for resale under the Securities Act additional shares, which could cause additional substantial

dilution to our shareholders. The number of shares ultimately offered for resale by YA is dependent upon the number of shares we issue

and sell to YA under the Purchase Agreement.

The

net proceeds under the Purchase Agreement to us will depend on the frequency and prices at which we sell our ordinary shares, our ability

to meet the conditions set forth in the Purchase Agreement and any impacts of the Ownership Limitation (as defined below). We expect

that any proceeds received by us from such sales of ordinary shares under the Purchase Agreement will be used continued development of

our pipeline products, as well as the advancement of new programs, business development activities, and general corporate purposes.

There

are no restrictions on future financings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase

Agreement. In addition, YA has agreed that, during the term of the Purchase Agreement, neither YA nor its affiliates will engage in any

short sales or hedging transactions with respect to our ordinary shares, provided YA or its affiliates may (i) sell “long”,

as such term is defined in Rule 200 of Regulation SHO of the Exchange Act, the Commitment Shares and any Advance Shares issued and sold

by us to YA pursuant to an Advance Notice, and (ii) sell a number of ordinary shares equal to the number of Advance Shares that YA is

unconditionally obligated to purchase under a pending Advance Notice but has not yet received from us or our transfer agent pursuant

to the Purchase Agreement, or (i) and (ii) collectively, the Permitted Sales.

The

Purchase Agreement prohibits us from directing YA to purchase ordinary shares represented by ordinary shares if those shares, when aggregated

with all other shares of our ordinary shares then beneficially owned by YA and its affiliates, would result in YA and its affiliates

having beneficial ownership, at any single point in time, of more than 4.99% of the then total outstanding ordinary shares, as

calculated pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and Rule 13d-3 thereunder,

which limitation we refer to as the Ownership Limitation.

The

Purchase Agreement contains customary representations, warranties, conditions and indemnification obligations of the parties. The representations,

warranties and covenants were made only for purposes of such agreements and as of specific dates, were solely for the benefit of the

parties to such agreements and may be subject to limitations agreed upon by the contracting parties.

The

Purchase Agreement will automatically terminate upon the earliest of (i) the first day of the month next following the 36-month anniversary

of the date of execution of the Purchase Agreement, and (ii) YA’s purchase of the total Commitment Amount under the Purchase Agreement.

We have the right to terminate the Purchase Agreement at any time, at no cost or penalty, upon five trading days’ prior written

notice to YA, provided that (i) there are no outstanding Advance Notices, the Advance Shares under which have yet to be issued and (ii)

we have paid all amount owed to YA pursuant to the Purchase Agreement.

There

are substantial risks to our shareholders as a result of the sale and issuance of ordinary shares to YA under the Purchase Agreement.

These risks include substantial dilution, significant declines in our share price and our inability to draw sufficient funds when needed.

See “Risk Factors.” Issuances of our ordinary shares under the Purchase Agreement will not affect the rights or privileges

of our existing shareholders, except that the economic and voting interests of each of our existing shareholders will be diluted as a

result of any such issuance. Although the number of ordinary shares that our existing shareholders own will not decrease, the shares

owned by our existing shareholders will represent a smaller percentage of our total outstanding shares after any such issuances pursuant

to the Purchase Agreement.

Corporate

Information

Our

principal executive offices and registered office in Israel are located at c/o Meitar Law Offices Abba Hillel Silver Rd., Ramat Gan 5250608

Israel and our telephone number is +972-3-693-8448. Our website address is http://www.galmedpharma.com. The information contained on,

or that can be accessed through, our website is neither a part of nor incorporated into this prospectus. We have included our website

address in this prospectus solely as an inactive textual reference. Puglisi & Associates, or Puglisi, serves as our authorized representative

in the United States for certain limited matters. Puglisi’s address is 850 Library Avenue, Newark, Delaware 19711.

Implications

of Being a Foreign Private Issuer

We

are subject to the information reporting requirements of the Exchange Act that are applicable to “foreign private issuers,”

and under those requirements we will file reports with the United States Securities and Exchange Commission, or SEC. As a foreign private

issuer, we are not subject to the same requirements that are imposed upon U.S. domestic issuers by the SEC. Under the Exchange Act, we

are subject to reporting obligations that, in certain respects, are less detailed and less frequent than those of U.S. domestic reporting

companies. For example, although we report our financial results on a quarterly basis, we will not be required to issue quarterly reports,

proxy statements that comply with the requirements applicable to U.S. domestic reporting companies, or individual executive compensation

information that is as detailed as that required of U.S. domestic reporting companies. We also have four months after the end of each

fiscal year to file our annual reports with the SEC and are not required to file current reports as frequently or promptly as U.S. domestic

reporting companies. Furthermore, although the members of our management and supervisory boards will be required to notify the Israeli

Securities Authority, of certain transactions they may undertake, including with respect to our ordinary shares, our officers, directors

and principal shareholders will be exempt from the requirements to report transactions in our equity securities and from the short-swing

profit liability provisions contained in Section 16 of the Exchange Act. As a foreign private issuer, we are also not subject to the

requirements of Regulation FD (Fair Disclosure) promulgated under the Exchange Act. In addition, as a foreign private issuer, we are

permitted, and follow certain home country corporate governance practices instead of those otherwise required under the listing rules

of Nasdaq for domestic U.S. issuers. These exemptions and leniencies reduce the frequency and scope of information and protections available

to you in comparison to those applicable to a U.S. domestic reporting companies.

We

may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private

issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances

applies: (i) the majority of our executive officers or directors are U.S. citizens or residents; (ii) more than 50% of our assets are

located in the United States; or (iii) our business is administered principally in the United States.

Foreign

private issuers are also exempt from certain more stringent executive compensation disclosure rules. Thus, even if we remain a foreign

private issuer, we will continue to be exempt from the more stringent compensation disclosures required of companies that are neither

an emerging growth company nor a foreign private issuer.

The

Offering

| Ordinary

Shares Outstanding Prior to this Offering |

|

643,694

ordinary shares (as of August 30, 2024, which such number of ordinary shares includes the Initial Commitment Shares). |

| |

|

|

| Securities

Offered by the Selling Shareholder |

|

416,667

ordinary shares, represented as (i) 7,892 ordinary shares issued as the Initial Commitment Shares on the date of execution

of the Purchase Agreement; (ii) 23,674 ordinary shares as the Subsequent Commitment Shares to be issued to YA in three equal

installments 90 calendar days following the due date of the immediately preceding installment until all four installments have been

issued; and (iii) 385,101 ordinary shares as the Advance Shares that we may sell to YA under the Purchase Agreement from time

to time. |

| |

|

|

| Ordinary

Shares Outstanding Immediately After this Offering |

|

1,052,469

ordinary shares, assuming the issuance of the

Subsequent Commitment Shares and Advance Shares. The actual number of ordinary shares will vary depending upon the number of ordinary

shares represented by ordinary shares we sell under the Purchase Agreement. |

| |

|

|

| Use

of proceeds |

|

We

will not receive any proceeds from the sale of the YA Shares included in this prospectus by the Selling Shareholder. We may receive

up to $10.0 million aggregate gross proceeds under the Purchase Agreement from sales of ordinary shares that we elect to make to

YA as Advance Shares pursuant to the Purchase Agreement, if any, from time to time in our sole discretion, although the actual amount

of proceeds that we may receive cannot be determined at this time and will depend on the number of ordinary shares we sell under

the Purchase Agreement and market prices at the times of such sales. Any proceeds that we receive from sales of ordinary shares under

the Purchase Agreement will be used for continued development of our pipeline products, as well as the advancement of new programs,

business development activities, and general corporate purposes. See “Use of Proceeds.” |

| |

|

|

| Risk

factors |

|

Investing

in our securities involves a high degree of risk. You should read the “Risk Factors” section starting on page 6 of

this prospectus and “Item 3. - Key Information – D. Risk Factors” in our Annual Report on Form 20-F for the fiscal

year ended December 31, 2023, or the 2023 Annual Report, incorporated by reference herein, and other information included or incorporated

by reference in this prospectus for a discussion of factors to consider carefully before deciding to invest in our securities. |

| |

|

|

| Nasdaq

Capital Market symbol |

|

“GLMD”. |

The

number of the ordinary shares to be issued and outstanding immediately after this offering as shown above assumes that all of the ordinary

shares offered hereby are sold and is based on 643,694 ordinary shares issued and outstanding as of August 30, 2024. This number

excludes:

| |

● |

19,387

ordinary shares issuable upon exercise of outstanding stock options under our equity incentive plan, at a weighted average exercise

price of $474.00; |

| |

|

|

| |

● |

31,280

ordinary shares reserved for future awards under our equity incentive plan; |

| |

|

|

| |

● |

466,667

ordinary shares issuable upon the exercise of outstanding warrants, with exercise prices of

$15.00 per ordinary share; |

| |

|

|

| |

|

73,056

ordinary shares issuable upon the exercise of restricted stock units, or RSUs, under

our equity incentive plan; and |

| |

|

|

| |

● |

the

Subsequent Commitment Shares, the Advance Shares and any additional shares we may issue to YA pursuant to the Purchase Agreement

should we elect to sell such shares to YA. |

Unless

otherwise indicated, all information in this prospectus assumes or gives effect to:

| |

● |

no

exercise of the options, RSU’s warrants and pre-funded warrants described above; and |

| |

|

|

| |

● |

the

1-for-12 Reverse Split effected on August 29, 2024. |

RISK

FACTORS

You

should carefully consider the risks described below and the risks described in our 2023 Annual Report, which are incorporated by reference

herein, as well as the financial or other information included in this prospectus or incorporated by reference in this prospectus, including

our consolidated financial statements and the related notes, before you decide to buy our securities. The risks and uncertainties described

below are not the only risks facing us. We may face additional risks and uncertainties not currently known to us or that we currently

deem to be immaterial. Any of the risks described below, and any such additional risks, could materially adversely affect our business,

financial condition or results of operations. In such case, you may lose all or part of your original investment.

Risks

Related to the Offering

It

is not possible to predict the actual number of shares we will sell under the Purchase Agreement to the Selling Shareholder, or the actual

gross proceeds resulting from those sales.

On

August 30, 2024, we entered into the Purchase Agreement with YA, pursuant to which YA has committed to purchase up to $10.0 million

in ordinary shares, subject to certain limitations and conditions set forth in the Purchase Agreement. The ordinary shares that may be

issued under the Purchase Agreement may be sold by us to YA at our discretion from time to time during the Commitment Period.

We

generally have the right to control the timing and amount of any sales of our ordinary shares to YA under the Purchase Agreement. Sales

of our ordinary shares, if any, to YA under the Purchase Agreement will depend upon market conditions and other factors. We may ultimately

decide to sell to YA all, some or none of the ordinary shares that may be available for us to sell to YA pursuant to the Purchase Agreement.

Because

the purchase price per share to be paid by YA for the ordinary shares that we may elect to sell to YA under the Purchase Agreement, if

any, will fluctuate based on the market prices of our ordinary shares during the applicable Pricing Period for each purchase made pursuant

to the Purchase Agreement, if any, it is not possible for us to predict, as of the date of this prospectus and prior to any such sales,

the number of ordinary shares that we will sell to YA under the Purchase Agreement, the purchase price per share that YA will pay for

shares purchased from us under the Purchase Agreement, or the aggregate gross proceeds that we will receive from those purchases by YA

under the Purchase Agreement, if any.

Limitations

in the Purchase Agreement, including the Ownership Limitation, and our ability to meet the conditions necessary to deliver an Advance

Notice, could prevent us from being able to raise funds up to the Commitment Amount.

Moreover,

although the Purchase Agreement provides that we may sell up to an aggregate of $10.0 million of our ordinary shares to YA, only 416,667

ordinary shares are being registered for resale by YA under the registration statement that includes this prospectus, consisting of (i)

the Commitment Shares that we issued and agreed to issue to YA upon execution of the Purchase Agreement as consideration for its commitment

to purchase our ordinary shares under the Purchase Agreement, and (ii) the Advance Shares that we may elect to sell to YA, in our sole

discretion, from time to time from during the Commitment Period, subject to the restrictions and satisfaction of the conditions in the

Purchase Agreement, through sales under the Purchase Agreement. Even if we elect to sell to YA all of the shares being registered for

resale under this prospectus, depending on the market prices of our ordinary shares at the time of such sales, the actual gross proceeds

from the sale of all such shares may be substantially less than the $10.0 million Commitment Amount under the Purchase Agreement, which

could materially adversely affect our liquidity.

If

we desire to issue and sell to YA under the Purchase Agreement more than the a number of ordinary shares in excess of the YA Shares being

registered for resale under this prospectus, and the Ownership Limitation and other limitations in the Purchase Agreement would allow

us to do so, we would need to file with the SEC one or more additional registration statements to register under the Securities Act the

resale by YA of any such additional ordinary shares and the SEC would have to declare such registration statement or statements effective

before we could sell additional ordinary shares.

Any

issuance and sale by us under the Purchase Agreement of a substantial amount of ordinary shares in addition to the ordinary shares being

registered for resale by YA under this prospectus could cause additional substantial dilution to our shareholders. The number of our

ordinary shares ultimately offered for sale by YA is dependent upon the ordinary shares, if any, we ultimately sell to YA under the Purchase

Agreement.

The

resale by YA of a significant amount of shares registered for resale in this offering at any given time, or the perception that these

sales may occur, could cause the market price of our ordinary shares to decline and to be highly volatile.

Investors

who buy shares at different times will likely pay different prices.

Pursuant

to the Purchase Agreement, we will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold

to YA. If and when we do elect to sell ordinary shares to YA pursuant to the Purchase Agreement, YA may resell all, some or none of such

shares at any time or from time to time in its discretion and at different prices. As a result, investors who purchase shares from YA

in this offering at different times will likely pay different prices for those shares, and so may experience different levels of dilution

and in some cases substantial dilution and different outcomes in their investment results. Investors may experience a decline in the

value of the shares they purchase from YA in this offering as a result of future sales made by us to YA at prices lower than the prices

such investors paid for their shares in this offering.

We

may require additional financing to sustain our operations and without it we will not be able to continue operations.

The

extent to which we rely on YA as a source of funding will depend on a number of factors, including the prevailing market price of our

ordinary shares, our ability to meet the conditions necessary to deliver Advance Notices under the Purchase Agreement, the impacts of

the Ownership Limitation and the extent to which we are able to secure funding from other sources. Regardless of the amount of funds

we ultimately raise under the Purchase Agreement, if any, we expect to continue to seek other sources of funding. Even if we were to

sell to YA the total Commitment Amount under the Purchase Agreement, we expect that we will need additional capital to fully implement

our business plan.

The

sale of a substantial amount of our ordinary shares or ordinary shares, including resale of the held by the selling shareholder in the

public market could adversely affect the prevailing market price of our ordinary shares.

We

are registering for resale 416,667 ordinary shares. Sales of substantial amounts of shares of our ordinary shares or ordinary shares

in the public market, or the perception that such sales might occur, could adversely affect the market price of our ordinary shares,

and the market value of our other securities. We cannot predict if and when the selling shareholder may sell such shares in the public

markets. Furthermore, in the future, we may issue additional ordinary shares or ordinary shares or other equity or debt securities convertible

into ordinary shares or ordinary shares. Any such issuance could result in substantial dilution to our existing shareholders and could

cause our share price to decline.

Future

sales and issuances of our ordinary shares or other securities might result in significant dilution and could cause the price of our

ordinary shares to decline.

To

raise capital, we may sell ordinary shares, convertible securities or other equity securities in one or more transactions other than

those contemplated by the Purchase Agreement, at prices and in a manner we determine from time to time. We may sell shares or other securities

in any other offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing

shares or other securities in the future could have rights superior to existing shareholders. The price per share at which we sell additional

ordinary shares, or securities convertible or exchangeable into ordinary shares, in future transactions may be higher or lower than the

price per share paid by investors in this offering. Any sales of additional shares will dilute our shareholders.

Sales

of a substantial number of ordinary shares in the public market or the perception that these sales might occur could depress the market

price of our ordinary shares and could impair our ability to raise capital through the sale of additional equity securities. We are unable

to predict the effect that sales may have on the prevailing market price of our ordinary shares. In addition, the sale of substantial

numbers of our ordinary shares could adversely impact their price.

Management

will have broad discretion as to the use of the net proceeds from the Purchase Agreement.

Our

management will have broad discretion in the allocation of the net proceeds and could use them for purposes other than those contemplated

at the time of this offering. Accordingly, you will be relying on the judgment of our management with regard to the use of those net

proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately.

It is possible that, pending their use, we may invest those net proceeds in a way that does not yield a favorable, or any, return for

us. The failure of our management to use such funds effectively could have a material adverse effect on our business, financial condition,

operating results and cash flows.

Risks

Related to Our Operations in Israel

Our

headquarters and other significant operations are located in Israel and, therefore, our results may be adversely affected by political,

economic and military instability in Israel.

Our

executive office is located in Ramat Gan, Israel. In addition, certain of our key employees, officers and directors are residents of

Israel. Accordingly, political, economic and military conditions in the Middle East may affect our business directly. Since the establishment

of the State of Israel in 1948, a number of armed conflicts have occurred between Israel and its neighboring countries and terrorist

organizations active in the region, including Hamas (an Islamist militia and political group in the Gaza Strip) and Hezbollah (an Islamist

militia and political group in Lebanon).

In

October 2023, Hamas terrorists infiltrated Israel’s southern border from the Gaza Strip and conducted a series of attacks on civilian

and military targets. Hamas also launched extensive rocket attacks on Israeli population and industrial centers located along Israel’s

border with the Gaza Strip and in other areas within the State of Israel. These attacks resulted in extensive deaths, injuries and kidnapping

of civilians and soldiers. Following the attack, Israel’s security cabinet declared war against Hamas and a military campaign against

these terrorist organizations commenced in parallel to their continued rocket and terror attacks. In addition, since the commencement

of these events, there have been continued hostilities along Israel’s northern border with Lebanon (with the Hezbollah terror organization)

and southern border (with the Houthi movement in Yemen, as described below). It is possible that hostilities with Hezbollah in Lebanon

will escalate, and that other terrorist organizations, including Palestinian military organizations in the West Bank as well as other

hostile countries will join the hostilities. In addition, Iran recently launched a direct attack on Israel involving hundreds of drones

and missiles and has threatened to continue to attack Israel and is also believed to have a strong influence among extremist groups in

the region, such as Hamas in Gaza, Hezbollah in Lebanon, the Houthi movement in Yemen and various rebel militia groups in Syria and Iraq.

These situations may potentially escalate in the future to more violent events which may affect Israel and us. Such clashes may escalate

in the future into a greater regional conflict.

In

connection with the Israeli security cabinet’s declaration of war against Hamas and possible hostilities with other organizations,

several hundred thousand Israeli military reservists were drafted to perform immediate military service. Although many of such military

reservists have since been released, they may be called up for additional reserve duty, depending on developments in the war in Gaza

and along Israel’s other borders. While none of our employees in Israel have been called to active military duty, we rely on service

providers located in Israel and have entered into certain agreements with Israeli counterparties. Employees of such service providers

or contractual counterparties may be called for service in the current or future wars or other armed conflicts with Hamas as well as

the other pending or future armed conflicts in which Israel is or may become engaged, and such persons may be absent for an extended

period of time. As a result, our operations may be disrupted by such absences, which disruption may materially and adversely affect our

business and results of operations.

While

our executive offices are located in Ramat Gan, Israel, which is not near Israel’s borders where the main hostilities are currently

taking place and none of our employees have been called into military reserve duty, to help mitigate the effects of Israel’s war

with Hamas, we have taken several measures, including work-from-home measures and have a business continuity plan.

Disruptions

that could severely impact our business, clinical

trials, and supply chains, include:

| ● |

limitations

on employee resources that would otherwise be focused on the conduct of our business including because of military reserve duty call-ups

in the future that impact our employees and the affect the current war between Israel and Hamas on the productivity of our employees

and external partners; |

| |

|

| ● |

delays

in necessary interactions with vendors, local regulators, and other important agencies and contractors due to limitations in employee

resources; and |

| |

|

| ● |

impacts

from prolonged remote work arrangements, such as increased cybersecurity risks and strains on our business continuity plans. |

The

intensity and duration of Israel’s current war against Hamas and Hezbollah is difficult to predict, as are such war’s economic

implications on the Company’s business and operations, on Israel’s economy in general, on the trading price of shares of

our ordinary shares and could impact our ability to raise additional capital on a timely basis or at all. These events may be intertwined

with wider macroeconomic indications of a deterioration of Israel’s economic standing that may involve a downgrade in Israel’s

credit rating by rating agencies (such as the recent downgrade by Moody’s of its credit rating of Israel from A1 to A2, as well

as the downgrade of its outlook rating from “stable” to “negative” and Fitch Ratings of Israel’s Long-Term

Foreign-Currency Issuer Default Rating to “A” from “A+”), which may have a material adverse effect on the Company

and its ability to effectively conduct its operations. The impact of the current war between Israel and Hamas may also have the effect

of heightening many of the other risks described in the “Risk Factors” section of our 2023 Annual Report.

In

addition, some countries around the world restrict doing business with Israel and Israeli companies, and additional countries may impose

restrictions on doing business with Israel and Israeli companies if hostilities in Israel or political instability in the region continue

or increase. In addition, there have been increased efforts by countries, activists and organizations to cause companies and consumers

to boycott Israeli goods and services. In addition, in January 2024 the International Court of Justice, or ICJ, issued an interim ruling

in a case filed by South Africa against Israel in December 2023, making allegations of genocide amid and in connection with the war in

Gaza, and ordered Israel, among other things, to take measures to prevent genocidal acts, prevent and punish incitement to genocide,

and take steps to provide basic services and humanitarian aid to civilians in Gaza. There are concerns that companies and businesses

will terminate, and may have already terminated, certain commercial relationships with Israeli companies following the ICJ decision.

The foregoing efforts by countries, activists and organizations, particularly if they become more widespread, as well as the ICJ rulings

and future rulings and orders of other tribunals against Israel (if handed), may materially and adversely impact our business, clinical

trials, and supply chains.

Furthermore,

following Hamas’ attack on Israel and Israel’s security cabinet declaration of war against Hamas, the Houthi movement, which

controls parts of Yemen has launched attacks on Israeli-controlled or owned ships in the Red Sea, resulting in shipping companies rerouting

their cargo ships or ceasing shipments to Israel in the case of the latter. The hostilities with Hamas, Hezbollah, the Houthi movement

and other terrorist organizations, include and may include terror, missile and drone attacks. In the event that our facilities are damaged

as a result of hostile actions, or hostilities otherwise disrupt our ongoing operations, our ability to deliver or provide products and

services in a timely manner to meet our contractual obligations towards customers and vendors could be materially and adversely affected.

Any hostilities involving Israel or the interruption or curtailment of trade between Israel and its present trading partners could have

a material adverse effect on our business and could make it more difficult for us to raise capital. Our insurance policies do not cover

losses that may occur as a result of events associated with war and terrorism. Although the Israeli government currently covers the reinstatement

value of direct damages that are caused by terrorist attacks or acts of war, we cannot assure you that this government coverage will

be maintained or that it will sufficiently cover our potential damages. Any losses or damages incurred by us could have a material adverse

effect on our business. Any armed conflicts or political instability in the region would likely negatively affect business conditions

and could harm our results of operations.

Finally,

political conditions within Israel may affect our operations. Israel has held five general elections between 2019 and 2022, and prior

to October 2023, the Israeli government pursued extensive changes to Israel’s judicial system, which sparked extensive political

debate and unrest. In response to such initiative, many individuals, organizations and institutions, both within and outside of Israel,

voiced concerns that the proposed changes may negatively impact the business environment in Israel including due to reluctance of foreign

investors to invest or transact business in Israel, as well as to increased currency fluctuations, downgrades in credit rating, increased

interest rates, increased volatility in security markets and other changes in macroeconomic conditions. To date, these initiatives have

been substantially put on hold. If such changes to Israel’s judicial system are again pursued by the government and approved by

the parliament, this may have an adverse effect on our business, our results of operations and our ability to raise additional funds,

if deemed necessary by our management and board of directors.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and elsewhere, including in our 2023 Annual Report incorporated by reference herein, and other information included or incorporated

by reference in this prospectus, contains forward-looking statements concerning our expectations, beliefs or intentions regarding, among

other things, our product development efforts, business, financial condition, results of operations, strategies or prospects. Any statements

contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify

forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,”

“contemplate,” “continue,” “could,” “due,” “estimate,” “expect,”

“goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,”

“positioned,” “seek,” “should,” “target,” “will,” “would,” and

other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other

comparable terminology. Many factors could cause our actual activities or results to differ materially from the activities and results

anticipated in forward-looking statements, including, but not limited to, the factors summarized below:

| |

● |

our

ability to pursue, evaluate and complete any strategic alternative that yields value for our shareholders; |

| |

|

|

| |

● |

the

timing and cost of our planned Primary Sclerosing Cholangitis, or PSC, clinical trial and our pivotal Phase 3 ARMOR trial, or the

ARMOR Study, if re-initiated, for our product candidates, Aramchol and Amilo-5MER, or for any other pre-clinical or clinical trials; |

| |

|

|

| |

● |

completion

and receiving favorable results of our planned PSC clinical trial and the ARMOR Study (if re-initiated) for Aramchol or any other

pre-clinical or clinical trial; |

| |

● |

regulatory

action with respect to Aramchol or any other product candidate by the U.S. Food and Drug Administration, or FDA, the European Medicines

Authority, or EMA, or the Medicines and Healthcare Products Regulatory Agency, or the MHRA, including but not limited to acceptance

of an application for marketing authorization, review and approval of such application, and, if approved, the scope of the approved

indication and labeling; |

| |

|

|

| |

● |

the

commercial launch and future sales of Aramchol and any future product candidates; |

| |

|

|

| |

● |

our

ability to comply with all applicable post-market regulatory requirements for Aramchol, Amilo-5MER or any other product candidate

in the countries in which we seek to market the product; |

| |

|

|

| |

● |

our

ability to achieve favorable pricing for Aramchol, Amilo-5MER or any other product candidate; |

| |

|

|

| |

● |

our

expectations regarding the commercial market for PSC, non-alcoholic steato-hepatitis, or NASH (also known as MASH), in patients or

any other targeted indication; |

| |

|

|

| |

● |

third-party

payor reimbursement for Aramchol, Amilo-5MER or any other product candidate; |

| |

|

|

| |

● |

our

estimates regarding anticipated capital requirements and our needs for additional financing; |

| |

|

|

| |

● |

market

adoption of Aramchol or any other product candidate by physicians and patients; |

| |

|

|

| |

● |

the

timing, cost or other aspects of the commercial launch of Aramchol or any other product candidate; |

| |

|

|

| |

● |

our

ability to obtain and maintain adequate protection of our intellectual property; |

| |

|

|

| |

● |

the

possibility that we may face third-party claims of intellectual property infringement; |

| |

|

|

| |

● |

our

ability to manufacture our product candidates in commercial quantities, at an adequate quality or at an acceptable cost; |

| |

|

|

| |

● |

our

ability to establish adequate sales, marketing and distribution channels; |

| |

|

|

| |

● |

intense

competition in our industry, with competitors having substantially greater financial, technological, research and development, regulatory

and clinical, manufacturing, marketing and sales, distribution and personnel resources than we do; |

| |

|

|

| |

● |

the

development and approval of the use of Aramchol or any other product candidate for additional indications or in combination therapy; |

| |

|

|

| |

● |

our

expectations regarding licensing, acquisitions and strategic operations; |

| |

|

|

| |

● |

current

or future unfavorable economic and market conditions and adverse developments with respect to financial institutions and associated

liquidity risk; |

| |

|

|

| |

● |

security,

political and economic instability in the Middle East that could harm our business, including due to the recent attacks by Hamas

and other terrorist organizations from the Gaza Strip and elsewhere in the region and Israel’s war against them and military

hostilities with Hezbollah on the northern border of Israel |

| |

|

|

| |

● |

those

factors referred to in our 2023 Annual Report incorporated by reference herein in “Item 3. Key Information - D. Risk Factors,”

“Item 4. Information on the Company,” and “Item 5. Operating and Financial Review and Prospects,” as well

as in our 2023 Annual Report generally, which is incorporated by reference into this prospectus. |

Forward-looking

statements are based on our management’s current expectations, estimates, forecasts and projections about our business and the

industry in which we operate and our management’s beliefs and assumptions, and are not guarantees of future performance or development

and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. As a result, any or all

of our forward-looking statements in this prospectus may turn out to be inaccurate. Important factors that may cause actual results to

differ materially from current expectations include, among other things, those listed under “Risk Factors” and elsewhere

in this prospectus. Potential investors are urged to consider these factors carefully in evaluating the forward-looking statements.

The

forward-looking statements included in this prospectus speak only as of the date of this prospectus. Although we believe that the expectations

reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance

and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Except as required by law, we

assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in

the future. You should, however, review the factors and risks we describe in the reports we will file from time to time with the SEC

after the date of this prospectus. See “Where You Can Find More Information.”

USE

OF PROCEEDS

This

prospectus relates to our ordinary shares represented by ordinary shares that may be offered and sold from time to time by YA. All of

our ordinary shares offered by the Selling Shareholder pursuant to this prospectus will be sold by the Selling Shareholder for its own

account. We will not receive any of the proceeds from these sales.

We

may receive up to $10.0 million aggregate gross proceeds under the Purchase Agreement from any sales of ordinary shares we make to YA

pursuant to the Purchase Agreement. However, we are unable to estimate the actual amount of proceeds that we may receive, as it will

depend on the number of ordinary shares that we choose to sell, our ability to meet the conditions to purchases set forth in the Purchase

Agreement, market conditions and the price of our ordinary shares, among other factors.

We

currently intend to use the net proceeds of this offering for continued development of our pipeline products, as well as the advancement

of new programs, business development activities, and general corporate purposes. Although we have identified some potential uses of

the net proceeds to be received upon completion of this offering, we cannot specify these uses with certainty. Our management will have

broad discretion in the application of the net proceeds and could use them for purposes other than those contemplated as of the date

of this prospectus. Our shareholders may not agree with the manner in which our management chooses to allocate and spend the net proceeds.

Moreover, our management may use the net proceeds for corporate purposes that may not result in our being profitable or increase our

market value.

Our

expected use of net proceeds under the Purchase Agreement represents our current intentions based on our present plans and business condition,

which could change in the future as our plans and business conditions evolve. As of the date of this prospectus, we cannot predict with

certainty any or all of the particular uses for the net proceeds to be received under the Purchase Agreement, or the amounts, if any,

that we will actually spend on the uses set forth above. The amounts and timing of our actual use of the net proceeds may vary depending

on numerous factors, including our ability to obtain additional financing and changes we may make to our development plan. As a result,

our management will have broad discretion in the application of the net proceeds, which may include uses not set forth above, and investors

will be relying on our judgment regarding the application of the net proceeds from this offering.

Pending

the use of the net proceeds from this offering as described above, we intend to invest the net proceeds in a variety of capital preservation

investments, short and intermediate term, interest-bearing, investment-grade instruments, U.S. government securities and highly rated

corporate debt securities, although our investment policy may change following the date of this prospectus supplement. It is possible

that, pending their use, we may invest the net proceeds in a way that does not yield a favorable, or any, return for us.

CAPITALIZATION

The

following table sets forth our total capitalization as of June 30, 2024:

| |

● |

on

an actual basis; |

| |

|

|

| |

● |

on

an as adjusted basis, to give effect to (i) the issuance of 31,566 ordinary shares as the Commitment Shares and (ii) the issuance

and sale of 385,101 ordinary shares as Advance Shares, at an assumed offering price of $3.54 per ordinary share, which is

the last reported sales price of our ordinary shares on the Nasdaq on August 26, 2024 (as adjusted to give effect to the Reverse

Split), assuming the equity line will be partially utilized by us, after deducting the estimated offering expenses by us. |

The

as adjusted information set forth below is illustrative only and will be adjusted based on the actual public offering price and other

terms of this offering determined at pricing. You should read this information together with our consolidated financial statements.

The

information in this table should be read in conjunction with and is qualified by reference to the financial statements and notes thereto

and other financial information incorporated by reference into this prospectus.

| | |

As of June 30, 2024 (unaudited) | |

| (U.S. dollars in thousands) | |

Actual | | |

As Adjusted | |

| Cash and cash equivalents | |

$ | 1,837 | | |

$ | 11,737 | |

| | |

| | | |

| | |

| Shareholders’ equity: | |

| | | |

| | |

| Ordinary shares par value NIS 1.80 per share; authorized 1,666,667; issued and outstanding 529,896 ordinary

shares (actual) and 651,856 ordinary shares (as adjusted) | |

| 263 | | |

| 467 | |

| Additional paid in capital | |

| 207,305 | | |

| 217,002 | |

| Accumulated other comprehensive loss | |

| (435 | ) | |

| (435 | ) |

| Accumulated deficit | |

| (195,346 | ) | |

| (195,346 | ) |

| | |

| | | |

| | |

| Total shareholders’ equity | |

| 11,787 | | |

| 21,687 | |

The

number of the ordinary shares to be issued and outstanding immediately after this offering as shown above assumes that all of the ordinary

shares offered hereby are sold and is based on 529,896 ordinary shares issued and outstanding as of June 30, 2024. This number excludes:

| |

● |

19,387

ordinary shares issuable upon exercise of outstanding stock options under our equity incentive plan, at a weighted average exercise

price of $474.00; |

| |

|

|

| |

● |

31,280

ordinary shares reserved for future awards under our equity incentive plan; |

| |

|

|

| |

● |

466,667

ordinary shares issuable upon the exercise of outstanding warrants, with exercise price of

$15.00 per ordinary share; |

| |

|

|

| |

● |

77,500

ordinary shares issuable upon the exercise of outstanding pre-funded warrants, with exercise

prices of $0.015 per ordinary share; and |

| |

|

|

| |

● |

109,584

ordinary shares issuable upon the exercise of RSUs under our equity incentive plan;

and |

| |

|

|

| |

● |

the

Commitment Shares, the Advance Shares and any additional shares we may issue to YA pursuant to the Purchase Agreement should we elect

to sell such shares to YA. |

Unless

otherwise indicated, all information in this prospectus assumes or gives effect to:

| |

● |

no

exercise of the options, RSU’s, warrants and pre-funded warrants described above; and |

| |

|

|

| |

● |

the

1-for-12 Reverse Split effected on August 29, 2024. |

SELLING

SHAREHOLDER

This

prospectus relates to the possible resale from time to time by YA of any or all of the ordinary shares that are to be issued by us to

YA under the Purchase Agreement. For additional information regarding the issuance of ordinary shares covered by this prospectus, see

the section titled “Prospectus Summary—Standby Equity Purchase Agreement with YA” above. Except for the transactions

contemplated by the Purchase Agreement, YA does not, and has not had, any material relationship with us.

The

table below presents information regarding the Selling Shareholder and the shares ordinary shares that it may offer from time to time

under this prospectus. This table is prepared based on information supplied to us by the Selling Shareholder. The number of shares in

the column “Maximum Number of Ordinary Shares to be Offered Pursuant to this Prospectus” represents all of the ordinary shares

that the Selling Shareholder may offer under this prospectus. The Selling Shareholder may sell some, all or none of its shares in this

offering. We do not know how long the Selling Shareholder will hold the shares before selling them, and we currently have no agreements,

arrangements or understandings with the Selling Shareholder regarding the sale of any of the shares.

The

beneficial ownership of our ordinary shares is determined in accordance with the rules of the SEC. See “Principal Shareholders”

for additional information.

The

percentage of ordinary shares beneficially owned by the Selling Shareholder prior to the offering shown in the table below is based on