2024 REVENUE DOWN 10% AFTER 51% GROWTH IN

2023

STRONG PERFORMANCE FROM THE GROUP’S TOP 4

CLIENTS (+13%) OFFSET BY DISRUPTION FROM 3 CLIENTS

STRONG VISIBILITY AND SOLID ORDER BACKLOG IN

AEROSPACE FOR 2025

2024 NET PROFIT: EUR 1,374K (10.9% OF

REVENUE)

2024 ADJUSTED EBITDA1: EUR 2,148K (17.0% OF

REVENUE)

RESILIENT PROFITABILITY MODEL CONFIRMED

DESPITE CHALLENGING ECONOMIC ENVIRONMENT

SUCCESSFUL COMPLETION OF TECHNICAL TESTS AND

MAJOR MILESTONES IN THE "ENGINE CONTROL" PROGRAM, SUPPORTING

PROFITABLE GROWTH TARGETS OF THE 4G PLAN FOR 2026

INVESTOR WEBINAR – TUESDAY, JANUARY 28,

10:00 AM

(Non-audited data)

- Quarterly revenue of EUR 2,759 thousand, bringing the

Group's annual sales to EUR 12,660 thousand

- Proven resilient profitability model despite challenging

sector conditions

- Quarterly adjusted EBITDA1 of EUR 369 thousand (13.4% of

revenue), resulting in an adjusted EBITDA1 of EUR 2,148

thousand for FY 2024 (17.0% of revenue)

- Quarterly consolidated net profit of EUR 204 thousand (7.4%

of revenue), leading to a net profit of EUR 1,374 thousand for FY

2024 (10.9% of revenue)

- Strong visibility in the aerospace sector for 2025

- Investor webinar: Tuesday, January 28, 10:00 AM

Registration link:

https://app.livestorm.co/euroland-corporate/memscap-webinaire-actionnaires?s=b2cb247c-2eb4-4e18-a70f-7ac75d5a449f

Regulatory News:

MEMSCAP (Euronext Paris: MEMS), leading provider of

high-accuracy, high-stability pressure sensor solutions for the

aerospace and medical markets using MEMS technology (Micro Electro

Mechanical Systems), today announced its earnings for the fourth

quarter of 2024 ending December 31, 2024.

Analysis of consolidated revenue

The distribution of consolidated revenue from continuing

operations (non-audited) by market segment for the fourth quarter

of 2024 and for FY 2024 is as follows:

Market segments / Revenue (In

thousands of euros) – Non-audited

Q4 2023 (3 months)

Q4 2023 (%)

Jan.-Dec. 2023

(12 months)

Jan.-Dec. 2023 (%)

Q4 2024 (3 months)

Q4 2024 (%)

Jan.-Dec. 2024

(12 months)

Jan.-Dec. 2024 (%)

Aerospace

2,323

58%

8,801

63%

1,727

63%

8,195

65%

Medical

1,066

27%

3,589

26%

714

26%

3,147

25%

Optical communications

548

14%

1,555

11%

297

11%

1,237

10%

Others (Royalties from licensed

trademarks)

36

1%

128

1%

20

1%

81

1%

Total revenue from continuing

operations

3,973

100%

14,073

100%

2,759

100%

12,660

100%

(Any apparent discrepancies in totals are due to rounding.)

The fourth quarter of 2024 unfolded in a deteriorated sectoral

environment, with the aerospace industry facing significant

tensions within supply chains. In the Group's primary market sector

(65% of consolidated sales for the 2024 fiscal year), demand

remained particularly strong in both civil and military domains.

However, supply chains are struggling to meet this demand, with

some players experiencing disruptions and delays impacting the

entire industry. After a growth-oriented first half, these

disruptions nevertheless affected the Group's sales during the

second half.

While the Group's major clients remained aligned with stated

objectives, achieving significant growth over the fiscal year,

these turbulences heavily impacted four smaller clients.

Consolidated revenue from continuing operations for the fourth

quarter of 2024 amounted to EUR 2,759 thousand (EUR 3,973 thousand

for the fourth quarter of 2023).

The Group's 12-month consolidated sales amounted to EUR 12,660

thousand, representing a 10.0% decline compared to fiscal year

2023, despite the previous year's growth reaching +51%, resulting

in a particularly demanding base effect.

The aerospace industry is expected to return to a normative

situation during the 2025 fiscal year.

Analysis of consolidated income statement

MEMSCAP’s consolidated earnings (non-audited) for the fourth

quarter of 2024 and for FY 2024 are given within the following

table:

In thousands of euros –

Non-audited

Q4 2023 (3 months)

Jan.-Dec. 2023 (12 months)

Q4 2024 (3 months)

Jan.-Dec. 2024 (12 months)

Revenue from continuing

operations

3,973

14,073

2,759

12,660

Cost of revenue

(2,279)

(8,033)

(1,811)

(7,639)

Gross margin

1,694

6,040

948

5,022

% of revenue

42.6%

42.9%

34.4%

39.7%

Operating expenses*

(876)

(3,563)

(885)

(3,849)

Operating profit /

(loss)

818

2,477

64

1,172

Financial profit / (loss)

(132)

(304)

142

226

Income tax expense

16

(33)

(1)

(24)

Net profit / (loss)

702

2,140

204

1,374

* Net of research & development grants. (Any apparent

discrepancies in totals are due to rounding.)

Due to an unfavourable volume effect, the gross margin for the

fourth quarter of 2024 stood at EUR 948 thousand, bringing the

annual gross margin rate to 39.7% of consolidated revenue compared

to 42.9% in the previous fiscal year.

Operating expenses, net of research and development grants,

amounted to EUR 885 thousand for the fourth quarter of 2024,

resulting in a total annual amount of EUR 3,849 thousand compared

to EUR 3,563 thousand for fiscal year 2023.

As a result, the operating profit from continuing operations

stood at EUR 64 thousand (2.3% of consolidated revenue) for the

fourth quarter of 2024, leading to an operating profit of EUR 1,172

thousand (9.3% of consolidated revenue) for fiscal year 2024,

compared to EUR 2,477 thousand (17.6% of consolidated revenue) for

fiscal year 2023.

Benefiting from a favourable exchange rate effect, net financial

income for the fourth quarter of 2024 amounted to EUR 142 thousand.

The financial income for fiscal year 2024 thus showed a net gain of

EUR 226 thousand, compared to a net loss of EUR 304 thousand for

fiscal year 2023.

The tax expense recognized for fiscal years 2024 and 2023

corresponded to changes in deferred tax assets. This expense had no

impact on the Group's cash flow.

The consolidated net profit after tax amounted to EUR 204

thousand (7.4% of consolidated revenue) in the fourth quarter of

2024, bringing the net profit for fiscal year 2024 to EUR 1,374

thousand (10.9% of consolidated revenue), compared to a net profit

of EUR 2,140 thousand (15.2% of consolidated revenue) for fiscal

year 2023.

MEMSCAP reported an adjusted EBITDA¹ of EUR 369 thousand for the

fourth quarter of 2024 (13.4% of consolidated revenue) and EUR

2,148 thousand for fiscal year 2024, representing 17.0% of

consolidated revenue (EUR 3,263 thousand for fiscal year 2023,

23.2% of consolidated revenue). It is noted that research and

development costs were fully recognized as expenses during this

12-month period and were not capitalized in the Group's balance

sheet.

1 Adjusted EBITDA means operating profit before depreciation,

amortisation, and share-based payment charge (IFRS 2) and including

foreign exchange gains/losses related to ordinary activities.

Perspectives

Despite a temporarily deteriorated sectoral environment, the

fourth quarter and fiscal year 2024 demonstrated the robustness of

MEMSCAP's business model, whose foundations ensure a significant

and sustainable level of profitability.

Additionally, the Group holds a strong order backlog in the

aerospace sector for fiscal year 2025.

The successful validation of technical tests and major

milestones in the "Engine Control" development and

industrialization program reinforces the profitable growth

objectives outlined in the 4G Plan by 2026.

Shareholders and investors video conference - Tuesday,

January 28, 2025 at 10:00 a.m. Thank you for registering and

sending your questions in advance using the following link:

https://memscap.com/fr/visio/

About MEMSCAP

MEMSCAP is a leading provider MEMS based pressure sensors,

best-in-class in term of precision and stability (very low drift)

for two market segments: aerospace and medical.

MEMSCAP also provides variable optical attenuators (VOA) for the

optical communications market.

For more information, visit our website at: www.memscap.com

MEMSCAP is listed on Euronext Paris (Euronext Paris - Memscap -

ISIN code: FR0010298620 - Ticker symbol: MEMS)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250127664670/en/

Yann Cousinet Chief Financial Officer Ph.: +33 (0) 4 76 92 85 00

yann.cousinet@memscap.com

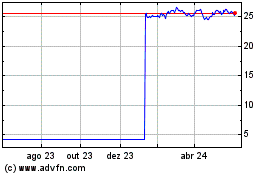

Matthews Emerging Market... (NASDAQ:MEMS)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

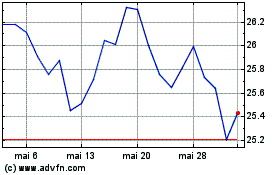

Matthews Emerging Market... (NASDAQ:MEMS)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025