false

0000024741

CORNING INC /NY

0000024741

2024-09-19

2024-09-19

0000024741

GLW:CommonStock0.50ParValuePerShareMember

2024-09-19

2024-09-19

0000024741

GLW:ThreePointEightSeventyFivePercentageNotesDue2026Member

2024-09-19

2024-09-19

0000024741

GLW:FourPointOneTwentyFivePercentageNotesDue2031Member

2024-09-19

2024-09-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

| Date of Report: (Date of earliest event reported) |

September 19, 2024 |

CORNING INCORPORATED

(Exact name of registrant as specified in its charter)

New York

(State or other jurisdiction of incorporation) |

1-3247

(Commission File Number) |

16-0393470

(I.R.S. Employer Identification No.) |

| |

|

|

One Riverfront Plaza, Corning, New York

(Address of principal executive offices) |

|

14831

(Zip Code) |

(607) 974-9000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.50 par value per share |

|

GLW |

|

New York Stock Exchange |

| 3.875% Notes due 2026 |

|

GLW26 |

|

New York Stock Exchange |

| 4.125% Notes due 2031 |

|

GLW31 |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 ((§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of

1934 (§240.12b-2 of this chapter).

| Emerging growth company |

☐ |

|

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 | Regulation FD Disclosure |

On September 19, 2024,

Corning Incorporated (the “Company”) issued a press release providing updates on key business milestones in its

“Springboard” plan and sharing an operating margin target of 20% by the end of 2026. Management announced that it is

implementing price increases in the Company’s Display Technologies segment, and expects to deliver segment net income of $900

million to $950 million in 2025 and to maintain net income margin of 25% in the segment. Management also stated that, in the Optical

Communications segment, Enterprise sales are expected to grow by more than 40% year-over-year in the third quarter of 2024. In addition,

management reaffirmed the Company’s estimated core sales and EPS guidance for the third quarter of 2024, which was previously

issued on July 30, 2024, based on preliminary financial results. The full text of the press release is furnished as Exhibit 99.1 hereto and incorporated herein by reference.

These preliminary financial results are

based on the Company’s current estimate of its results for the quarter ended September 30, 2024, and remain subject to change based

on the completion of closing and review procedures and the execution of the Company’s internal control over financial reporting.

Pursuant to General Instruction B.2 of Current

Report on Form 8-K, the information contained in, or incorporated into, Item 7.01, including the press release attached as Exhibit 99.1,

is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference into any registration statement or other filing under the Securities Act of 1933, as amended, or the Exchange Act, except

as shall be expressly set forth by specific reference to such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

The following exhibits are included with

this Current Report on Form 8-K:

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

CORNING INCORPORATED |

| |

|

|

|

| |

By: |

/s/ Linda E. Jolly |

|

| |

Name: |

Linda E. Jolly |

|

| |

Title: |

Vice President and Corporate Secretary |

|

Date: September 19, 2024

Exhibit 99.1

|

Corning

Incorporated

www.corning.com |

|

News Release

FOR RELEASE – Sept. 19, 2024

Corning Provides Update on Key Milestones in

‘Springboard’

Plan to Add More Than $3 Billion in Annualized

Sales, and Shares Operating-Margin Target of 20% by End of 2026

Management implementing

price increases in Display Technologies and expects to

deliver segment net income of $900 million to $950 million in 2025, and to maintain

net income margin of 25%

In Optical Communications,

Enterprise sales are expected to grow by more than 40%

year over year in the third quarter, driven by the continued strong adoption of

new

optical-connectivity products for generative AI used inside data centers

Company showcases

new set of products to interconnect AI-enabled data centers,

which support Lumen’s build of a new network and mark the first outside-plant

deployment of Corning’s new gen AI fiber-and-cable system

CORNING, N.Y. — Corning

Incorporated (NYSE: GLW) will host a meeting today at its optical fiber facility in Concord, North Carolina, with investors

and industry analysts to provide significant updates to its “Springboard” plan to add more than $3 billion in annualized

sales with strong incremental profit and cash flow in the next three years.

Wendell P. Weeks, chairman and chief

executive officer, said, “I’m very pleased with the progress we have made on our ‘Springboard’ plan to

add more than $3 billion in annualized sales by 2026. The plan leads to an improving return profile, with profits growing

significantly faster than sales. Today, we are sharing our Springboard operating-margin target of 20% by the end of

2026.”

Weeks continued, “We are implementing price increases in Display

Technologies and expect to deliver segment net income of $900 million to $950 million in 2025, and to maintain net income margin of 25%.

Additionally, our positive momentum in Optical Communications continues – Enterprise sales are expected to grow by more than 40% year over year

in the third quarter, driven by the continued strong adoption of our generative AI products.”

Ed Schlesinger, executive vice president and

chief financial officer, said, “Our second-quarter results and third-quarter guidance put us well ahead of our ‘Springboard’

plan run rate. In the third quarter, we continue to expect sales of $3.7 billion and EPS of $0.50 to $0.54.”

Today, Corning management will lead investors through a tour of the company’s

– and the world’s – largest and lowest cost optical-fiber production facility. During the visit, leadership

© 2024 Corning Incorporated. All Rights Reserved.

Page 2

will highlight the company’s unique competitive advantage and industry

and technology leadership – which enables Corning to capture the significant growth opportunity outlined in its Springboard plan.

About Today’s Meeting

A live webcast will be available during the event at https://edge.media-server.com/mmc/p/dhxwdnvn/.

The presentation used during the event and a replay of the event will also be available on Corning’s Investor Relations website, https://investor.corning.com/investor-relations/default.aspx.

Presentation of Information in this News Release

This news release includes non-GAAP financial measures. Non-GAAP financial

measures are not in accordance with, or an alternative to, GAAP. Corning’s non-GAAP financial measures exclude the impact of items

that are driven by general economic conditions and events that do not reflect the underlying fundamentals and trends in the company’s

operations. The company believes presenting non-GAAP financial measures assists in analyzing financial performance without the impact

of items that may obscure trends in the company’s underlying performance. Definitions of these non-GAAP financial measures and reconciliations

of these non-GAAP financial measures to the most directly comparable GAAP financial measures can be found on the company’s website

by going to the Investor Relations page and clicking “Quarterly Results” under the “Financials and Filings” tab.

With respect to the outlook for future periods, it is not possible to provide

reconciliations for these non-GAAP measures because management does not forecast the movement of foreign currencies against the U.S. dollar,

or other items that do not reflect ongoing operations, nor does it forecast items that have not yet occurred or are out of management’s

control. As a result, management is unable to provide outlook information on a GAAP basis.

Caution Concerning Forward-Looking Statements

The statements contained in this release and related comments by management

that are not historical facts or information and contain words such as “will,” “believe,” “anticipate,”

“expect,” “intend,” “plan,” “seek,” “see,” “would,” “target,”

“estimate,” “forecast” or similar expressions are forward-looking statements. These forward-looking statements

are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and include estimates and assumptions

related to economic, competitive and legislative developments. Such statements relate to future events that by their nature address matters

that are, to different degrees, uncertain. These forward-looking statements relate to, among other things, the company’s future

operating performance, the company’s share of new and existing markets, the company’s revenue and earnings growth rates, the

company’s ability to innovate and commercialize new products, the company’s expected capital expenditure and the company’s

implementation of cost-reduction initiatives and measures to improve pricing, including the optimization of the company’s manufacturing

capacity.

© 2024 Corning Incorporated. All Rights Reserved.

Page 3

Although the company believes that these forward-looking statements are

based upon reasonable assumptions regarding, among other things, current estimates and forecasts, general economic conditions, its knowledge

of its business and key performance indicators that impact the company, there can be no assurance that these forward-looking statements

will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The

company undertakes no obligation to update forward-looking statements if circumstances or management’s estimates or opinions should

change except as required by applicable securities laws.

Some of the risks, uncertainties and other factors that could cause actual

results to differ materially from those expressed in or implied by the forward-looking statements include, but are not limited to: global

economic trends, competition and geopolitical risks, or an escalation of sanctions, tariffs or other trade tensions between the U.S. and

China or other countries, and related impacts on our businesses’ global supply chains and strategies; changes in macroeconomic and

market conditions and market volatility, including developments and volatility arising from health crisis events, inflation, interest

rates, the value of securities and other financial assets, precious metals, oil, natural gas, raw materials and other commodity prices

and exchange rates (particularly between the U.S. dollar and the Japanese yen, New Taiwan dollar, euro, Chinese yuan and South Korean

won), the availability of government incentives, decreases or sudden increases of consumer demand, and the impact of such changes and

volatility on our financial position and businesses; the duration and severity of health crisis events, such as an epidemic or pandemic,

and its impact across our businesses on demand, personnel, operations, our global supply chains and stock price; possible disruption in

commercial activities or our supply chain due to terrorist activity, cyber-attack, armed conflict, political or financial instability,

natural disasters, international trade disputes or major health concerns; loss of intellectual property due to theft, cyber-attack, or

disruption to our information technology infrastructure; ability to enforce patents and protect intellectual property and trade secrets;

disruption to Corning’s, our suppliers’ and manufacturers’ supply chain, equipment, facilities, IT systems or operations;

product demand and industry capacity; competitive products and pricing; availability and costs of critical components, materials, equipment,

natural resources and utilities; new product development and commercialization; order activity and demand from major customers; the amount

and timing of our cash flows and earnings and other conditions, which may affect our ability to pay our quarterly dividend at the planned

level or to repurchase shares at planned levels; the amount and timing of any future dividends; the effects of acquisitions, dispositions

and other similar transactions; the effect of regulatory and legal developments; ability to pace capital spending to anticipated levels

of customer demand; our ability to increase margins through implementation of operational changes, pricing actions and cost reduction

measures; rate of technology change; adverse litigation; product and component performance issues; retention of key personnel; customer

ability to maintain profitable operations and obtain financing to fund ongoing operations and manufacturing expansions and pay receivables

when due; loss of significant customers; changes in tax laws, regulations and international tax standards; the impacts of audits by taxing

authorities; the potential impact of legislation, government regulations, and other government action and investigations; and other risks

detailed in Corning’s SEC filings.

© 2024 Corning Incorporated. All Rights Reserved.

Page 4

For a complete listing of risks and other factors,

please reference the risk factors and forward-looking statements described in our annual reports on Form 10-K and quarterly reports on

Form 10-Q.

Web Disclosure

In accordance with guidance provided by the SEC regarding the use of company

websites and social media channels to disclose material information, Corning Incorporated (“Corning”) wishes to notify investors,

media, and other interested parties that it uses its website (https://www.corning.com/worldwide/en/about-us/news-events.html) to publish

important information about the company, including information that may be deemed material to investors, or supplemental to information

contained in this or other press releases. The list of websites and social media channels that the company uses may be updated on Corning’s

media and website from time to time. Corning encourages investors, media, and other interested parties to review the information Corning

may publish through its website and social media channels as described above, in addition to the company’s SEC filings, press releases,

conference calls, and webcasts.

About Corning Incorporated

Corning (www.corning.com)

is one of the world’s leading innovators in materials science, with a 170-year track record of life-changing inventions. Corning

applies its unparalleled expertise in glass science, ceramic science, and optical physics along with its deep manufacturing and engineering

capabilities to develop category-defining products that transform industries and enhance people’s lives. Corning succeeds through

sustained investment in RD&E, a unique combination of material and process innovation, and deep, trust-based relationships with customers

who are global leaders in their industries. Corning’s capabilities are versatile and synergistic, which allows the company to evolve

to meet changing market needs, while also helping its customers capture new opportunities in dynamic industries. Today, Corning’s

markets include optical communications, mobile consumer electronics, display, automotive, solar, semiconductors, and life sciences.

Media Relations Contact:

Michael A. West Jr.

(607) 684-1167

westm4@corning.com

Investor Relations Contact:

Ann H.S. Nicholson

(607) 974-6716

nicholsoas@corning.com

© 2024 Corning Incorporated.

All Rights Reserved.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=GLW_CommonStock0.50ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=GLW_ThreePointEightSeventyFivePercentageNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=GLW_FourPointOneTwentyFivePercentageNotesDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

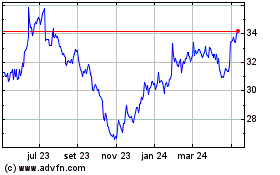

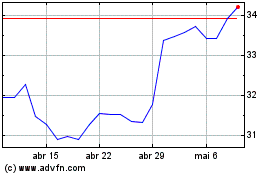

Corning (NYSE:GLW)

Gráfico Histórico do Ativo

De Ago 2024 até Set 2024

Corning (NYSE:GLW)

Gráfico Histórico do Ativo

De Set 2023 até Set 2024