Earthstone Energy, Inc. Announces Termination of Sabalo Acquisition and Cancellation of Special Meeting of Stockholders

21 Dezembro 2018 - 10:40PM

Business Wire

Earthstone Energy, Inc. (NYSE: ESTE) (“Earthstone” or the

“Company”), today announced that due to the recent significant

decline in commodity prices and the related adverse effect on the

debt and equity markets, the Company and Sabalo Holdings, LLC

(“Sabalo Holdings”) have entered into an agreement to terminate the

pending acquisition by the Company of Sabalo Energy, LLC under a

Contribution Agreement dated as of October 17, 2018, effective

immediately. In addition, the special meeting of Earthstone

stockholders scheduled for January 3, 2019 to approve the

acquisition has been cancelled. As part of the mutual termination

agreement, Earthstone will reimburse Sabalo Holdings for

transaction related expenses up to approximately $3.1 million,

including costs incurred related to the acquisition of well-bore

interests held by Shad Permian, LLC.

Management Comments

Frank A. Lodzinski, Chief Executive Officer of Earthstone,

commented, “Despite the high quality of the Sabalo assets and the

outstanding opportunity the transaction provided Earthstone, the

drastic change in commodity prices and in the debt and equity

markets has negatively affected the significant merits of the

acquisition. Accordingly, we have mutually agreed to terminate the

Contribution Agreement. While we are disappointed with this result,

we greatly appreciate the hard work of the Sabalo management team,

our officers and employees and our financial partners, as we all

worked tirelessly to close this deal.”

Mr. Lodzinski further commented, “We are pleased with our

achievements in 2018. As always, our highest priority is to protect

our shareholders’ interests and we believe that Earthstone is

well-positioned to continue to focus on shareholder returns and

successfully withstand even a prolonged downturn in commodity

prices and capital markets, given our operating strengths, low

leverage, disciplined capital approach, and favorable hedge

position. We will continue to concentrate on maintaining a strong

balance sheet, operating efficiently, making accretive acquisitions

that add production and enhance our acreage positions and pursuing

larger transactions that are beneficial to our shareholders.

Finally, in January, we expect to provide an operations update,

announce our capital program and provide guidance for 2019.”

About Earthstone Energy,

Inc.

Earthstone Energy, Inc. is a growth-oriented, independent energy

company engaged in the acquisition, development and operation of

oil and natural gas properties, primarily in the Midland Basin of

west Texas. Earthstone is listed on the New York Stock Exchange

under the symbol “ESTE.” For more information, visit the Company’s

website at www.earthstoneenergy.com.

Forward-Looking

Statements

This release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended

(the “Securities Act”), and Section 21E of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”). Statements that are

not strictly historical statements constitute forward-looking

statements and may often, but not always, be identified by the use

of such words such as “expects,” “believes,” “intends,”

“anticipates,” “plans,” “estimates,” “forecast,” “guidance,”

“potential,” “possible,” or “probable” or statements that certain

actions, events or results “may,” “will,” “should,” or “could” be

taken, occur or be achieved. The forward-looking statements include

statements about the expected future reserves, production,

financial position, business strategy, revenues, earnings, costs,

capital expenditures and debt levels of the Company, and plans and

objectives of management for future operations. Forward-looking

statements are based on current expectations and assumptions and

analyses made by Earthstone and its management in light of

experience and perception of historical trends, current conditions

and expected future developments, as well as other factors

appropriate under the circumstances. However, whether actual

results and developments will conform to expectations is subject to

a number of material risks and uncertainties, including but not

limited to: declines in oil, natural gas liquids or natural gas

prices; the level of success in exploration, development and

production activities; adverse weather conditions that may

negatively impact development or production activities; the timing

of exploration and development expenditures; inaccuracies of

reserve estimates or assumptions underlying them; revisions to

reserve estimates as a result of changes in commodity prices;

impacts to financial statements as a result of impairment

write-downs; risks related to level of indebtedness and periodic

redeterminations of the borrowing base under Earthstone’s credit

agreement; Earthstone’s ability to generate sufficient cash flows

from operations to meet the internally funded portion of its

capital expenditures budget; Earthstone’s ability to obtain

external capital to finance exploration and development operations

and acquisitions; the ability to successfully complete any

potential asset dispositions and the risks related thereto; the

impacts of hedging on results of operations; uninsured or

underinsured losses resulting from oil and natural gas operations;

Earthstone’s ability to replace oil and natural gas reserves; and

any loss of senior management or technical personnel. Earthstone’s

annual report on Form 10-K for the year ended December 31, 2017,

quarterly reports on Form 10-Q, recent current reports on Form 8-K,

and other SEC filings discuss some of the important risk factors

identified that may affect Earthstone’s business, results of

operations, and financial condition. Earthstone undertakes no

obligation to revise or update publicly any forward-looking

statements except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181221005612/en/

Mark Lumpkin, Jr.Executive Vice President – Chief Financial

OfficerEarthstone Energy, Inc.1400 Woodloch Forest Drive, Suite

300The Woodlands, TX 77380281-298-4246mark.lumpkin@earthstoneenergy.com

Scott ThelanderDirector of FinanceEarthstone Energy, Inc.1400

Woodloch Forest Drive, Suite 300The Woodlands, TX

77380281-298-4246scott@earthstoneenergy.com

Earthstone Energy (NYSE:ESTE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

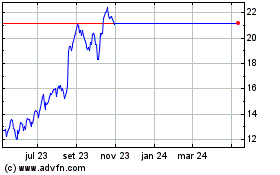

Earthstone Energy (NYSE:ESTE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024