Daily Active Users increased 2% sequentially to

190 million

First quarter revenue increased 39% to $320

million

Year over year revenue growth accelerated to

39%, from 36% in the prior quarter

Snap Inc. (NYSE: SNAP) today announced financial results for the

quarter ended March 31, 2019.

Financial Highlights

- Operating cash flow improved by $166

million to $(66) million in Q1 2019, compared to the prior

year.

- Free Cash Flow improved by $190 million

to $(78) million in Q1 2019, compared to the prior year.

- Common shares outstanding plus shares

underlying stock-based awards totaled 1,544 million at March 31,

2019, compared with 1,457 million one year ago.

- Revenue increased 39% to $320 million

in Q1 2019, compared to the prior year.

- Operating loss improved $76 million to

$(316) million in Q1 2019, compared to the prior year.

- Net loss improved $75 million to $(310)

million in Q1 2019, compared to the prior year.

- Adjusted EBITDA loss improved $94

million to $(123) million in Q1 2019, compared to the prior

year.

“In the first quarter we delivered strong results across our

business with growth in daily active users and revenue,” said Evan

Spiegel, CEO. “Our new Android application is available to

everyone, with promising early results. This month we announced

several new products that we believe will drive further engagement

and monetization. As we look towards the future, we see many

opportunities to increase our investments, and will continue to

manage our business for long-term growth.”

Three Months Ended March 31,

Percent

2019 2018 Change

(Unaudited)

(in thousands, except per share amounts) Cash

used in operating activities $ (66,178 ) $ (231,981 ) (71 )%

Free Cash Flow $ (77,992 ) $ (268,296 ) 71 % Common shares

outstanding plus shares underlying stock-based awards 1,543,986

1,456,613 6 % Operating loss $ (316,061 ) $ (392,530 ) (19 )%

Revenue $ 320,426 $ 230,666 39 % Net loss $ (310,407 ) $ (385,785 )

(20 )% Adjusted EBITDA $ (123,449 ) $ (217,867 ) 43 % Diluted net

loss per share attributable to common shareholders $ (0.23 ) $

(0.30 ) (24 )% Non-GAAP diluted net loss per share $ (0.10 ) $

(0.17 ) (44 )%

Q1 2019 Summary & Key Highlights

We started the year increasing Daily Active Users and

enhancing engagement across key metrics:

- DAUs were 190 million in Q1 2019,

compared to 186 million in Q4 2018 and 191 million in Q1 2018.

- As of March, Snapchat reaches 90% of

all 13-24 year-olds and 75% of all 13-34 year-olds in the U.S.

We fully rolled out the new build of our Android

application:

- As of the end of Q1, our new Android

application is available to everyone.

- The new app is 25% smaller, opens 20%

faster on average, and is modularized for more efficient ongoing

innovation.

- On lower-performing devices, this

resulted in a 6% increase in the number of users sending Snaps

within the first week of upgrading to the new Android build.

On April 4th, we hosted the first ever Snap Partner Summit to

celebrate our partners and to come together in person to share some

of the latest innovations we brought to our platform. These

include:

- Games – We unveiled Snap Games –

an all-new live, multi-player gaming experience featuring our

original game Bitmoji Party and select third-party games.

- Augmented Reality – We

introduced a number of augmented reality (AR) innovations,

including Landmarkers, AR Bar, and Scan.

- Snap Kit – We added new features

to Snap Kit, enabling our app partners to utilize the best features

in Snapchat, including App Stories, Creative Kit Web, and Snap

Audience Network.

- Discover – We announced a new

slate of ten Snap Original Shows, our premium, mobile shows created

exclusively for Snapchat’s audience, which will begin airing in May

2019, and renewed three of our most popular Snap Original Shows,

including “The Dead Girls Detective Agency,” “Endless Summer,” and

“Deep Creek.”

We’ve enhanced Discover’s high quality, made-for-mobile video

offering across the Snapchat platform:

- In Q1 2019, nearly half of our daily

Discover viewers watched Discover every day of the week.

- We now offer more than 450 premium

content channels worldwide.

- In the past six months, we’ve more than

doubled the number of localized media partners outside of the

U.S.

- In Q1 2019 alone, we launched over 50

new Shows and Publisher Stories in international markets.

- In March, our partners increased their

total mobile monthly audience in the U.S. by an average of more

than 30% just by publishing to Discover, as measured by

ComScore.

We have made major strides in building our platform

capabilities to drive improved outcomes for advertisers:

- We made several updates to our

self-serve tool, Ads Manager, including enhancing advanced features

such as target cost bidding, new bulk uploading capabilities, bulk

editing and cloning, and the expansion of location categories to

the UK, Canada, and France.

- We continue to invest in brand-focused

buying tools; our Reach & Frequency product now allows for

one-day buys (the previous minimum was three) and has been expanded

to the UK, Canada, and France.

- Toyota ran a sophisticated campaign

across our various video and AR products to promote the Corolla

Hatchback among Millennials. Snapchatters engaged with the ads,

watching more than 90% of their Commercials on average, and playing

with their Lenses for more than 10 seconds each on average.

Financial Guidance

The following forward-looking statements reflect our

expectations for the second quarter of 2019 as of April 23, 2019,

and are subject to substantial uncertainty. This guidance assumes,

among other things, that no business acquisitions, investments,

restructurings, or legal settlements are concluded in the quarter.

Our results are based on assumptions that we believe to be

reasonable as of this date, but may be materially affected by many

factors, as discussed below in “Forward-Looking Statements.”

Q2 2019 Outlook

- Revenue is expected to be between $335

million and $360 million, or grow between 28% and 37% compared to

Q2 2018.

- Adjusted EBITDA is expected to be

between $(150) million and $(125) million, compared to $(169)

million in Q2 2018.

Conference Call Information

Snap Inc. will host a conference call to discuss the results at

2:00 p.m. Pacific / 5:00 p.m. Eastern today. The live audio webcast

along with supplemental information will be accessible at

investor.snap.com. A recording of the webcast will also be

available following the conference call.

Snap Inc. uses the investor.snap.com and snap.com/news websites

as means of disclosing material non-public information and for

complying with its disclosure obligation under Regulation FD.

Definitions

Free Cash Flow is defined as net cash provided by (used in)

operating activities, reduced by purchases of property and

equipment.

Common shares outstanding plus shares underlying stock-based

awards includes common shares outstanding, restricted stock units,

restricted stock awards, and outstanding stock options.

Adjusted EBITDA is defined as net income (loss), excluding

interest income; interest expense; other income (expense) net;

income tax benefit (expense); depreciation and amortization;

stock-based compensation expense and related payroll tax expense;

and certain other non-cash or non-recurring items impacting net

income (loss) from time to time.

A Daily Active User (DAU) is defined as a registered Snapchat

user who opens the Snapchat application at least once during a

defined 24-hour period. We calculate average DAUs for a particular

quarter by adding the number of DAUs on each day of that quarter

and dividing that sum by the number of days in that quarter.

Average revenue per user (ARPU) is defined as quarterly revenue

divided by the average DAUs.

A Monthly Active User (MAU) is defined as a registered Snapchat

user who opens the Snapchat application at least once during the

30-day period ending on the calendar month-end. We calculate

average Monthly Active Users for a particular quarter by

calculating the average of the MAUs as of each calendar month-end

in that quarter.

Addressable reach is defined as the approximate number of

Snapchat users that an ad could reach over a 28-day period in a

given locality. When we calculate the percentage of a demographic

group that can be reached, we do so by dividing addressable reach

by relevant census figures. Addressable reach and age data are

subject to limitations. For more information, see Snap’s SEC

filings and businesshelp.snapchat.com.

Note: For adjustments and additional information regarding the

non-GAAP financial measures and other items discussed, please see

“Non-GAAP Financial Measures,” “Reconciliation of GAAP to Non-GAAP

Financial Measures,” and “Supplemental Financial Information and

Business Metrics.”

About Snap Inc.

Snap Inc. is a camera company. We believe that reinventing the

camera represents our greatest opportunity to improve the way

people live and communicate. We contribute to human progress by

empowering people to express themselves, live in the moment, learn

about the world, and have fun together. For more information, visit

snap.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, or the Securities Act, and Section 21E of the Securities

Exchange Act of 1934, as amended, or the Exchange Act, about us and

our industry that involve substantial risks and uncertainties. All

statements other than statements of historical facts contained in

this press release, including statements regarding guidance, our

future results of operations or financial condition, business

strategy and plans, user growth and engagement, product

initiatives, and objectives of management for future operations,

are forward-looking statements. In some cases, you can identify

forward-looking statements because they contain words such as

“anticipate,” “believe,” “contemplate,” “continue,” “could,”

“estimate,” “expect,” “going to,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,” or

“would” or the negative of these words or other similar terms or

expressions. We caution you that the foregoing may not include all

of the forward-looking statements made in this press release.

You should not rely on forward-looking statements as predictions

of future events. We have based the forward-looking statements

contained in this press release primarily on our current

expectations and projections about future events and trends that we

believe may affect our business, financial condition, results of

operations, and prospects. These forward-looking statements are

subject to risks and uncertainties related to: our financial

performance; our lack of profitability to date; our ability to

generate and sustain positive cash flow; our ability to attract and

retain users, publishers, and advertisers; competition and new

market entrants; managing our international expansion and our

growth and future expenses; compliance with new laws and

regulations; our ability to maintain, protect, and enhance our

intellectual property; our ability to attract and retain qualified

and key personnel; and future acquisitions or investments, as well

as risks, uncertainties, and other factors described in “Risk

Factors” and elsewhere in our annual report on Form 10-K for the

fiscal year ended December 31, 2018 filed with the SEC, which is

available on the SEC’s website at www.sec.gov. Additional

information will be made available in Snap Inc.’s quarterly report

on Form 10-Q for the quarter ended March 31, 2019 and other filings

that we make from time to time with the SEC. In addition, any

forward-looking statements contained in this press release are

based on assumptions that we believe to be reasonable as of this

date. We undertake no obligation to update any forward-looking

statements to reflect events or circumstances after the date of

this press release or to reflect new information or the occurrence

of unanticipated events, except as required by law.

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are

prepared and presented in accordance with GAAP, we use certain

non-GAAP financial measures, as described below, to understand and

evaluate our core operating performance. These non-GAAP financial

measures, which may be different than similarly titled measures

used by other companies, are presented to enhance investors’

overall understanding of our financial performance and should not

be considered a substitute for, or superior to, the financial

information prepared and presented in accordance with GAAP.

We use the non-GAAP financial measure of Free Cash Flow, which

is defined as net cash provided by (used in) operating activities,

reduced by purchases of property and equipment. We believe Free

Cash Flow is an important liquidity measure of the cash that is

available, after capital expenditures, for operational expenses and

investment in our business and is a key financial indicator used by

management. Additionally, we believe that Free Cash Flow is an

important measure since we use third-party infrastructure partners

to host our services and therefore we do not incur significant

capital expenditures to support revenue generating activities. Free

Cash Flow is useful to investors as a liquidity measure because it

measures our ability to generate or use cash. Once our business

needs and obligations are met, cash can be used to maintain a

strong balance sheet and invest in future growth.

We use the non-GAAP financial measure of Adjusted EBITDA, which

is defined as net income (loss); excluding interest income;

interest expense; other income (expense), net; income tax benefit

(expense); depreciation and amortization; stock-based compensation

expense and related payroll tax expense; and certain other non-cash

or non-recurring items impacting net income (loss) from time to

time. We believe that Adjusted EBITDA helps identify underlying

trends in our business that could otherwise be masked by the effect

of the expenses that we exclude in Adjusted EBITDA.

We use the non-GAAP financial measure of non-GAAP net loss,

which is defined as net income (loss); excluding amortization of

intangible assets; stock-based compensation expense and related

payroll tax expense; certain other non-cash or non-recurring items

impacting net income (loss) from time to time; and related income

tax adjustments. Non-GAAP net loss and weighted average diluted

shares are then used to calculate non-GAAP diluted net loss per

share. Similar to Adjusted EBITDA, we believe these measures help

identify underlying trends in our business that could otherwise be

masked by the effect of the expenses we exclude in the measure.

We believe that these non-GAAP financial measures provide useful

information about our financial performance, enhance the overall

understanding of our past performance and future prospects, and

allow for greater transparency with respect to key metrics used by

our management for financial and operational decision-making. We

are presenting these non-GAAP measures to assist investors in

seeing our financial performance through the eyes of management,

and because we believe that these measures provide an additional

tool for investors to use in comparing our core financial

performance over multiple periods with other companies in our

industry.

For a reconciliation of these non-GAAP financial measures to the

most directly comparable GAAP financial measure, please see

“Reconciliation of GAAP to Non-GAAP Financial Measures.”

Snap Inc., “Snapchat,” and our other registered and common law

trade names, trademarks, and service marks are the property of Snap

Inc. or our subsidiaries.

SNAP INC.

CONSOLIDATED STATEMENTS OF CASH

FLOWS

(in thousands, unaudited)

Three Months Ended March 31, 2019

2018 Cash flows from operating activities Net loss $

(310,407 ) $ (385,785 ) Adjustments to reconcile net loss to net

cash used in operating activities: Depreciation and amortization

23,319 21,553 Stock-based compensation 162,556 133,258 Deferred

income taxes (266 ) 236 Other (1,917 ) (3,392 ) Change in operating

assets and liabilities, net of effect of acquisitions: Accounts

receivable, net of allowance 71,870 48,697 Prepaid expenses and

other current assets 271 (10,439 ) Operating lease right-of-use

asset 9,812 — Other assets (368 ) 4,204 Accounts payable 3,090

(37,069 ) Accrued expenses and other current liabilities (14,323 )

(10,149 ) Operating lease liabilities (10,470 ) — Other liabilities

655 6,905 Net cash used in operating activities

(66,178 ) (231,981 )

Cash flows from investing

activities Purchases of property and equipment (11,814 )

(36,315 ) Sales of property and equipment 29 — Purchases of

intangible assets — (60 ) Non-marketable investments (2,250 ) —

Purchases of marketable securities (525,520 ) (477,213 ) Sales of

marketable securities — 45,007 Maturities of marketable securities

458,627 787,828 Net cash provided by (used in)

investing activities (80,928 ) 319,247

Cash flows

from financing activities Proceeds from the exercise of stock

options 5,596 45,809 Stock repurchases from employees for tax

withholdings — (551 ) Net cash provided by financing

activities 5,596 45,258 Change in cash, cash

equivalents, and restricted cash (141,510 ) 132,524 Cash, cash

equivalents, and restricted cash, beginning of period

388,974 337,007 Cash, cash equivalents, and restricted cash,

end of period $ 247,464 $ 469,531

Supplemental disclosures

Cash paid for income taxes $ 320 $ 991

SNAP INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per share amounts,

unaudited)

Three Months Ended March 31, 2019

2018 Revenue $ 320,426 $ 230,666 Costs and expenses:

Cost of revenue 203,767 196,798 Research and development 216,185

200,986 Sales and marketing 97,882 102,113 General and

administrative 118,653 123,299 Total costs and

expenses 636,487 623,196 Operating loss (316,061 )

(392,530 ) Interest income 7,816 6,104 Interest expense (756 ) (934

) Other income (expense), net (1,127 ) 3,153 Loss

before income taxes (310,128 ) (384,207 ) Income tax benefit

(expense) (279 ) (1,578 ) Net loss $ (310,407 ) $

(385,785 ) Net loss per share attributable to Class A, Class B, and

Class C common stockholders: Basic $ (0.23 ) $ (0.30 ) Diluted $

(0.23 ) $ (0.30 ) Weighted average shares used in computation of

net loss per share: Basic 1,340,615 1,270,998 Diluted

1,340,615 1,270,998

SNAP INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except par value)

March 31,

2019

December 31, 2018

(unaudited) Assets Current assets Cash and cash

equivalents $ 245,639 $ 387,149 Marketable securities 963,093

891,914 Accounts receivable, net of allowance 282,407 354,965

Prepaid expenses and other current assets 41,701

41,900 Total current assets 1,532,840 1,675,928 Property and

equipment, net 195,302 212,560 Operating lease right-of-use assets

284,486 — Intangible assets, net 115,386 126,054 Goodwill 629,596

632,370 Other assets 68,133 67,194 Total assets $

2,825,743 $ 2,714,106

Liabilities and Stockholders’ Equity

Current liabilities Accounts payable $ 31,827 $ 30,876 Operating

lease liabilities 46,078 — Accrued expenses and other current

liabilities 244,999 261,815 Total current liabilities

322,904 292,691 Operating lease liabilities, noncurrent 329,293 —

Other liabilities 7,669 110,416 Total liabilities

659,866 403,107 Commitments and contingencies

Stockholders’ equity Class A non-voting common stock, $0.00001 par

value. 3,000,000 shares

authorized, 999,304 shares issued and

outstanding at December 31, 2018, and

3,000,000 shares authorized, 1,057,135

shares issued and outstanding

at March 31, 2019.

11 10 Class B voting common stock, $0.00001 par value. 700,000

shares authorized,

93,846 shares issued and outstanding at

December 31, 2018, and 700,000 shares

authorized, 51,510 shares issued and

outstanding at March 31, 2019.

1 1 Class C voting common stock, $0.00001 par value. 260,888 shares

authorized,

224,611 shares issued and outstanding at

December 31, 2018, and 260,888 shares

authorized, 226,287 shares issued and

outstanding at March 31, 2019.

2 2 Additional paid-in capital 8,388,608 8,220,417 Accumulated

other comprehensive income (68 ) 3,147 Accumulated deficit

(6,222,677 ) (5,912,578 ) Total stockholders’ equity

2,165,877 2,310,999 Total liabilities and stockholders’

equity $ 2,825,743 $ 2,714,106

SNAP INC.

RECONCILIATION OF GAAP TO NON-GAAP

FINANCIAL MEASURES

(in thousands, unaudited)

Three Months Ended March 31, 2019

2018 Free Cash Flow reconciliation: Net cash used in

operating activities $ (66,178 ) $ (231,981 ) Less: Purchases of

property and equipment (11,814 ) (36,315 ) Free Cash

Flow $ (77,992 ) $ (268,296 )

Three Months Ended March

31, 2019 2018 Adjusted EBITDA

reconciliation: Net loss $ (310,407 ) $ (385,785 ) Add

(deduct): Interest income (7,816 ) (6,104 ) Interest expense 756

934 Other (income) expense, net 1,127 (3,153 ) Income tax (benefit)

expense 279 1,578 Depreciation and amortization 23,319 21,553

Stock-based compensation expense 162,556 133,258 Payroll tax

expense related to stock-based compensation 6,737 9,968 Reduction

in force charges(1) — 9,884 Adjusted EBITDA $

(123,449 ) $ (217,867 )

(1) Reduction in force charges in the first quarter of 2018 were

related to a reduction in force plan impacting approximately 7% of

our global headcount, primarily in engineering and sales. The

charges are composed primarily of severance expense and related

payroll tax expense. These charges are non-recurring and not

reflective of underlying trends in our business. Additionally, we

recognized a stock-based compensation forfeiture benefit of $31.5

million, which is included in the stock-based compensation expense

line item above.

SNAP INC.

RECONCILIATION OF GAAP TO NON-GAAP

FINANCIAL MEASURES (continued)

(in thousands, except per share amounts,

unaudited)

Total depreciation and amortization

expense by function:

Three Months Ended March 31, 2019

2018 Depreciation and amortization expense: Cost of revenue

$ 6,146 $ 5,202 Research and development 8,650 8,791 Sales and

marketing 4,015 3,569 General and administrative 4,508

3,991 Total $ 23,319 $ 21,553

Total stock-based compensation expense by

function:

Three Months Ended March 31, 2019 2018

Stock-based compensation expense: Cost of revenue $ 1,849 $ 276

Research and development 112,242 77,815 Sales and marketing 17,760

16,185 General and administrative 30,705 38,982 Total

$ 162,556 $ 133,258

Three Months Ended March

31, 2019 2018 Non-GAAP net loss

reconciliation: Net loss $ (310,407 ) $ (385,785 ) Amortization

of intangible assets 10,369 10,824 Stock-based compensation expense

162,556 133,258 Payroll tax expense related to stock-based

compensation 6,737 9,968 Reduction in force charges — 9,884 Income

tax adjustments (115 ) 220 Non-GAAP net loss $

(130,860 ) $ (221,631 ) Weighted-average common shares -

Diluted 1,340,615 1,270,998

Non-GAAP diluted net loss per

share reconciliation: Diluted net loss per share $ (0.23 ) $

(0.30 ) Non-GAAP adjustment to net loss 0.13 0.13

Non-GAAP diluted net loss per share $ (0.10 ) $ (0.17 )

SNAP INC.

SUPPLEMENTAL FINANCIAL INFORMATION AND

BUSINESS METRICS

(dollars and shares in thousands, except

as noted below, unaudited)

Q4 2017 Q1

2018 Q2 2018 Q3 2018 Q4 2018 Q1

2019 Cash Flows and Shares Net cash used in operating

activities $ (176,083 ) $ (231,981 ) $ (199,346 ) $ (132,543 ) $

(126,054 ) $ (66,178 ) Net cash used in operating activities - YoY

(year-over-year) (5 )% (50 )% 5 % 32 % 28 % 71 % Net cash used in

operating activities - TTM (trailing twelve months) $ (734,667 ) $

(811,651 ) $ (801,423 ) $ (739,953 ) $ (689,924 ) $ (524,121 )

Purchases of property and equipment $ (21,212 ) $ (36,315 ) $

(34,901 ) $ (26,285 ) $ (22,741 ) $ (11,814 ) Purchases of property

and equipment - YoY 4 % 102 % 80 % 1 % 7 % (67 )% Purchases of

property and equipment - TTM $ (84,518 ) $ (102,840 ) $ (118,376 )

$ (118,713 ) $ (120,242 ) $ (95,741 ) Free Cash Flow $ (197,295 ) $

(268,296 ) $ (234,247 ) $ (158,828 ) $ (148,795 ) $ (77,992 ) Free

Cash Flow - YoY (5 )% (55 )% (2 )% 28 % 25 % 71 % Free Cash Flow -

TTM $ (819,185 ) $ (914,491 ) $ (919,799 ) $ (858,666 ) $ (810,166

) $ (619,862 ) Common shares outstanding 1,222,202 1,254,439

1,273,163 1,291,217 1,317,760 1,334,931 Common shares outstanding -

YoY NM 6 % 8 % 7 % 8 % 6 % Shares underlying stock-based awards

230,802 202,175 205,595 184,802 188,863 209,055 Shares underlying

stock-based awards - YoY NM (20 )% (19 )% (23 )% (18 )% 3 % Total

common shares outstanding plus shares underlying stock-based awards

1,453,004 1,456,613 1,478,758 1,476,019 1,506,623 1,543,986 Total

common shares outstanding plus shares underlying stock-based awards

- YoY NM 2 % 3 % 2 % 4 % 6 %

Results of Operations

Revenue $ 285,693 $ 230,666 $ 262,263 $ 297,695 $ 389,822 $ 320,426

Revenue - YoY 72 % 54 % 44 % 43 % 36 % 39 % Revenue - TTM $ 824,949

$ 905,967 $ 986,559 $ 1,076,317 $ 1,180,446 $ 1,270,206 Revenue by

region(1) North America $ 219,394 $ 170,488 $ 177,410 $ 207,477 $

268,858 $ 225,705 North America - YoY 51 % 32 % 20 % 24 % 23 % 32 %

North America - TTM $ 663,057 $ 704,827 $ 734,599 $ 774,769 $

824,233 $ 879,450 Europe $ 39,976 $ 32,721 $ 40,241 $ 50,478 $

62,470 $ 47,448 Europe - YoY 173 % 150 % 82 % 85 % 56 % 45 % Europe

- TTM $ 102,392 $ 122,011 $ 140,200 $ 163,416 $ 185,910 $ 200,637

Rest of World $ 26,323 $ 27,458 $ 44,612 $ 39,740 $ 58,495 $ 47,273

Rest of World - YoY NM 251 % 272 % 197 % 122 % 72 % Rest of World -

TTM $ 59,501 $ 79,130 $ 111,761 $ 138,133 $ 170,305 $ 190,120

Operating loss $ (360,964 ) $ (392,530 ) $ (357,842 ) $ (323,371 )

$ (194,707 ) $ (316,061 ) Operating loss - YoY (113 )% 82 % 20 % 30

% 46 % 19 % Operating loss - Margin (126 )% (170 )% (136 )% (109 )%

(50 )% (99 )% Operating loss - TTM $ (3,485,576 ) $ (1,664,339 ) $

(1,573,163 ) $ (1,434,707 ) $ (1,268,450 ) $ (1,191,981 ) Net loss

$ (349,977 ) $ (385,785 ) $ (353,310 ) $ (325,148 ) $ (191,668 ) $

(310,407 ) Net loss - YoY 106 % (83 )% (20 )% (27 )% (45 )% (20 )%

Net loss - TTM $ (3,445,066 ) $ (1,622,014 ) $ (1,532,231 ) $

(1,414,220 ) $ (1,255,911 ) $ (1,180,533 ) Adjusted EBITDA $

(158,922 ) $ (217,867 ) $ (169,032 ) $ (138,377 ) (50,363 )

(123,449 ) Adjusted EBITDA - YoY (4 )% (16 )% 13 % 23 % 68 % 43 %

Adjusted EBITDA - Margin (56 )% (94 )% (64 )% (46 )% (13 )% (39 )%

Adjusted EBITDA - TTM $ (720,056 ) $ (749,680 ) $ (724,722 ) $

(684,198 ) $ (575,637 ) $ (481,221 )

(1) Total revenue for geographic reporting is apportioned to

each region based on our determination of the geographic location

in which advertising impressions are delivered, as this

approximates revenue based on user activity. This allocation is

consistent with how we determine ARPU.

SNAP INC.

SUPPLEMENTAL FINANCIAL INFORMATION AND

BUSINESS METRICS (continued)

(dollars and shares in thousands, except

as noted below, unaudited)

Q4 2017 Q1

2018 Q2 2018 Q3 2018 Q4 2018 Q1

2019 Other DAU (in millions) 187 191 188 186 186 190 DAU

- YoY 18 % 15 % 8 % 5 % (0 )% (0 )% DAU by region (in millions)

North America 80 81 80 79 79 80 North America - YoY 18 % 14 % 7 % 3

% (1 )% (1 )% Europe 60 62 61 59 60 61 Europe - YoY 17 % 13 % 7 % 4

% (1 )% (2 )% Rest of World 47 48 47 47 47 49 Rest of World - YoY

21 % 18 % 12 % 8 % 1 % 2 % ARPU $ 1.53 $ 1.21 $ 1.40 $ 1.60 $ 2.09

$ 1.68 ARPU - YoY 46 % 34 % 34 % 37 % 37 % 39 % ARPU by region

North America $ 2.75 $ 2.10 $ 2.21 $ 2.62 $ 3.38 $ 2.81 North

America - YoY 28 % 16 % 12 % 20 % 23 % 34 % Europe $ 0.66 $ 0.53 $

0.66 $ 0.85 $ 1.04 $ 0.77 Europe - YoY 133 % 120 % 70 % 78 % 57 %

47 % Rest of World $ 0.56 $ 0.58 $ 0.96 $ 0.84 $ 1.24 $ 0.97 Rest

of World - YoY 284 % 198 % 233 % 175 % 120 % 68 % Employees

(full-time; excludes part-time, contractors, and temporary

personnel) 3,069 2,989 2,879 2,903 2,884 2,818 Employees - YoY 65 %

27 % 10 % (2 )% (6 )% (6 )%

Depreciation and amortization

expense Cost of revenue $ 5,179 $ 5,202 $ 5,610 $ 5,582 $ 9,888

$ 6,146 Research and development 6,937 8,791 9,489 10,174 4,547

8,650 Sales and marketing 3,441 3,569 3,991 4,054 3,475 4,015

General and administrative 3,229 3,991 3,424

5,088 4,772 4,508 Total $ 18,786 $ 21,553 $

22,514 $ 24,898 $ 22,682 $ 23,319 Depreciation and amortization

expense - YoY 77 % 73 % 79 % 43 % 21 % 8 %

Stock-based

compensation expense Cost of revenue $ 2,189 $ 276 $ 1,467 $

1,368 $ 1,283 $ 1,849 Research and development 129,199 77,815

92,303 95,329 75,086 112,242 Sales and marketing 28,936 16,185

21,996 25,082 20,795 17,760 General and administrative

20,720 38,982 40,605 5,030 24,608

30,705 Total $ 181,044 $ 133,258 $ 156,371 $ 126,809 $

121,772 $ 162,556 Stock-based compensation expense - YoY NM (93 )%

(36 )% (43 )% (33 )% 22 %

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190423005881/en/

Investors and Analysts:ir@snap.com

Press:press@snap.com

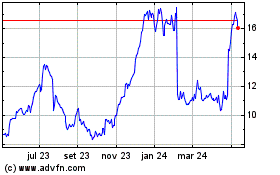

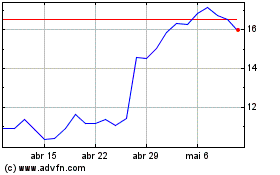

Snap (NYSE:SNAP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Snap (NYSE:SNAP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024