GMV grew by 58%, leading to a

102% increase in Marketplace revenue

Jumia continued to deliver cost efficiency

improvements

JumiaPay entered into a strategic partnership

with Mastercard who also made a €50 million

investment in Jumia

Jumia Technologies AG (NYSE:JMIA) (“Jumia” or the Company)

announced today its financial results for the quarter ended March

31, 2019.

“Jumia delivered excellent results during the first quarter of

2019: strong GMV growth of 58% leading to 102% growth in

marketplace revenue, year-on-year improvement of 356 basis points

of Operating loss as a percentage of GMV and further development of

JumiaPay, highlighted by the investment by and partnership with

Mastercard,” said Sacha Poignonnec and Jeremy Hodara, co-CEOs of

Jumia. “We believe that Jumia is increasingly relevant for

consumers and sellers in Africa. Looking ahead, we remain focused

on our core operations, driving consumer adoption and engagement on

our marketplace, increasing the penetration of JumiaPay, while

continuing to improve our financial profile and making a

sustainable impact on the continent.”

Business highlights

- The €50 million investment by

Mastercard into Jumia, in a concurrent private placement with our

Initial Public Offering, marked another milestone in the

development of JumiaPay and a validation of its potential. We are

partnering with Mastercard on a number of initiatives, including

the development and marketing of co-branded products (i.e., cards,

virtual cards and quick response codes).

- In the first quarter of 2019, our

marketplace continued to gain depth and diversity as we focused on

attracting quality sellers to our platform and providing our

consumers with an expanding range of products and services. An

example of this strategy is the partnership we announced this

quarter with the technology leader Xiaomi. As part of this

partnership, we are opening the Mi official store on our platform

with the ability to offer a number of Xiaomi products on an

exclusive basis. This demonstrates the attractiveness of Jumia as a

destination of choice for high profile international brands, giving

them access to millions of potential consumers in Africa with one

partnership.

Financial highlights

- Gross Merchandise Volume (“GMV”) grew

this quarter by 58% on a yearly basis, on the back of strong

marketplace growth, leading to a 102% increase this quarter in

Marketplace revenue on a yearly basis. Our strong GMV growth

combined with the attractive value proposition we offer both

sellers and consumers are a key engine of monetization, which we

derive from diversified revenue streams such as Commissions,

Fulfillment, Value Added Services, Marketing and Advertising

services.

- Gross Profit margin as a percentage of

GMV increased from 5.6% in the first quarter of 2018 to 6.5% this

quarter, as a result of the increased GMV monetization rate. Our

Gross Profit also exceeded Fulfillment expense this quarter.

- We continue to have a strong focus on

cost efficiency. Leveraging our strong brand awareness and highly

localized marketing approach, we have been able to gain 205bps of

marketing efficiency this quarter, bringing the Sales &

Advertising expense from 7.2% of GMV in the first quarter of 2018

to 5.1% in the first quarter of 2019.

- Adjusted EBITDA loss as a percentage of

GMV improved from negative 19.8% in the first quarter of 2018 to

negative 16.4% in the first quarter of 2019.

Selected Operational KPIs

2018 2019 First

Quarter Second Quarter

Third Quarter Fourth Quarter First

Quarter

GMV1

(€

million) 152 166 198

311 240

LTM Active Consumers2

(million)

3.0 3.2 3.5

4.0 4.3

1 GMV corresponds to the total value of orders including

shipping fees, value added tax, and before deductions of any

discounts or vouchers, irrespective of cancellations or returns.2

Active Consumers means unique consumers who placed an order on our

marketplace within the 12-month period preceding the relevant date,

irrespective of cancellations or returns

- GMV increased by 57.6% from €152

million in the first quarter of 2018 to €240 million in the first

quarter of 2019, on the back of strong growth of both Active

Consumers and spend per Active Consumer.

- The number of Active Consumers at March

31st, 2019 was 4.3 million, up from 3.0 million a year ago. We

believe that a major driver of our Active Consumers growth is the

continued expansion of our product offering and the growing

relevance of our platform, which drives consumer adoption and

engagement.

Selected Financial Information

1. Revenue

The following table shows a breakdown of revenue, for the first

quarters of 2018 and 2019.

For the three months ended March

31st YoY (€ million)

2018

2019 Change

Marketplace revenue

7.9 16.0

102.3% Commissions 2.8 5.5 95.5% Fulfillment

2.3 5.0 116.1% Marketing 0.3 0.9 200.7% Value Added Services 2.5

4.6 85.8%

First Party revenue 19.8

15.6 (21.2%) Platform

revenue 27.7 31.7

14.1% Non-Platform revenue 0.6

0.2 (68.1%)

Revenue

28.3 31.8

12.3%

- First Party/

Marketplace mix. Our primary sources of revenue are

commissions and fees generated from third-party sales (“Marketplace

revenue” or “Revenue related to third-party sales”) and revenue

from sales of goods we undertake ourselves (“First Party revenue”

or ““Revenue related to first-party sales”). Shifts in the mix

between first party and marketplace activities trigger substantial

variations in our Revenue as we record the full sales price net of

returns as First Party revenue and only commissions and fees in the

case of Marketplace revenue. Accordingly, we steer our operations

not on the basis of our total revenue, but rather on the basis of

Gross profit, as changes between third-party and first-party sales

mix are largely eliminated at the Gross profit level. Over time, it

is our goal to reduce the proportion of first party activity in

favor of third-party activity at group level. This strategy may

however vary from quarter to quarter and from country to

country.

- Marketplace

revenue increased by 102.3% in the first quarter of 2019

compared to the first quarter of 2018, on the back of strong

revenue growth across all components of Marketplace revenue,

demonstrating our ability to monetize the platform as we continue

to grow overall GMV.

- Commissions, which are charged to our

sellers, grew by 95.5%

- Fulfillment, which are delivery fees

charged to consumers, grew by 116.1%

- Value Added Services, which include

revenue from services charged to our sellers such as logistics

services, packaging, or content creation, grew by 85.8%

- Marketing and advertising, which

include performance marketing campaigns, or the placement of

banners on our platform, grew by 200.7%

- First Party

revenue decreased by 21.2% as we conducted fewer sales of

goods on a first party basis. We undertake our first party activity

in an opportunistic manner to complement the breadth of product

assortment on our platform, usually in areas where we see unmet

consumer demand.

2. Gross Profit

For the three months ended March 31st YoY (€ million)

2018 2019 Change

Gross

profit 8.6 15.7

82.3% As % of GMV 5.6% 6.5%

Gross profit increased by 82.3% from €8.6 million in the first

quarter of 2018 to €15.7 million in the first quarter of 2019,

primarily due to an increase in Marketplace revenue.

Gross profit margin as a percentage of GMVincreased from 5.6% in

the first quarter of 2018 to 6.5% in the first quarter of 2019 as a

result of increased platform monetization.

3. Fulfillment Expense

For the three months ended March

31st YoY (€ million)

2018

2019 Change

Fulfillment expense

(9.6) (15.2)

59.4% As % of GMV 6.3% 6.3%

Fulfillment expense includes expenses related to services of

third-party logistics providers, expenses related to our network of

warehouses and pick-up stations, including employee benefit

expenses. Fulfillment expense is influenced by a number of factors

including:

- The origin of the goods, for example

the cost of shipping a product from a cross-border seller based

overseas is higher than shipping from a local seller

- The destination of the package and type

of delivery, for example main city vs. secondary city vs. rural

area, and home delivery vs. pick-up station

- The type of goods, for example the cost

of delivery is higher for a large home appliance than a fashion

accessory

Despite an increase this quarter in the freight and shipping

expense portion of Fulfillment expense, as a result of higher

proportion of cross-border sales, our Gross Profit exceeded

Fulfillment expense this quarter.

4. Sales & Advertising Expense

For the three months ended March

31st YoY (€ million)

2018

2019 Change

Sales & Advertising expense

10.9 12.3

12.5% As % of GMV 7.2% 5.1%

Our Sales and Advertising expense increased by 12.5% to €12.3

million in the first quarter of 2019 from €10.9 million in the

first quarter of 2018, while we were able to increase our GMV by

57.6% over the same period. As a result, Sales and Advertising

expense as a percentage of GMV, decreased from 7.2% in the first

quarter of 2018 to 5.1% in the first quarter of 2019, demonstrating

the relevance of our marketing strategy as well as the continuous

user adoption of our platform.

5. General and Administrative Expense, Technology and

Content Expense

For the three months ended March

31st YoY (€ million)

2018

2019 Change General and Administrative

("G&A") expense 17.4 27.8 59.9% Share-Based Compensation

("SBC") expense (3.6) (4.3)

18.2%

G&A expense, excluding SBC

13.7 23.5 71.0% As

% of GMV 9.0% 9.8%

Technology & Content expense 5.1

5.9 15.3% As % of GMV

3.3% 2.4%

G&A, Technology & Content expense, excluding SBC

18.8 29.3

55.9% As % of GMV 12.3% 12.2%

General and Administrative expense contains wages and benefits,

including share-based payment expense of management, as well as

seller management, commercial development, accounting and legal

staff, consulting expense, audit expense, office rent and related

utilities, insurance and other overhead expense.

General and Administrative expense excluding SBC increased by

71.0% from €13.7 million in the first quarter of 2018 to €23.5

million in the first quarter of 2019. As a percentage of GMV,

General & Administrative expense excluding SBC, increased from

9.0% in the first quarter of 2018 to 9.8% in the first quarter of

2019, as the improvements due to operating leverage were more than

offset by non-recurring expenses concomitant with the IPO.

Technology and Content expense increased by 15.3% from €5.1

million in the first quarter of 2018 to €5.9 million in the first

quarter of 2019. As a percentage of GMV, Technology and content

expense, decreased from 3.3% in the first quarter of 2018 to 2.4%

in the first quarter of 2019, as a result of operating

leverage.

6. Operating Loss and Adjusted EBITDA

For the three months ended March 31st (€

million)

2018 2019

Operating loss (34.3) (45.5) Depreciation and amortization 0.5 1.7

Share-Based Compensation ("SBC") expense 3.6

4.3

Adjusted EBITDA (30.2)

(39.5) As % of GMV (19.8%) (16.4%)

Adjusted EBITDA loss, as a percentage of GMV improved from

negative 19.8% in the first quarter of 2018 to negative 16.4% in

the first quarter of 2019 as a result of a higher gross profit

margin as a percentage of GMV, marketing efficiencies and

operating leverage improving Technology & Content expense as a

percentage of GMV.

On January 1, 2019, we adopted IFRS 16 accounting guidance

amending the accounting for leases. This led to a reduction of

G&A by approximately €1.1 million in the first quarter of 2019

and an increase in Depreciation and amortization by approximately

€1.3 million, resulting in a positive impact on Adjusted EBITDA of

€1.1 million in the first quarter of 2019 and a negative impact on

Operating loss of €0.2 million. Prior period amounts were not

retrospectively adjusted.

7. Net IPO Proceeds

As of March 31st, 2019, we had €132.2 million of Cash and cash

equivalent on the balance sheet.

After the balance sheet date, we completed our Initial Public

Offering. The net proceeds from our Initial Public Offering, the

investment by Mastercard, the issuance of anti-dilution shares to

certain of our existing shareholders and the exercise by the

underwriters of their option to purchase additional ADRs added

$280.2 million to our cash and cash equivalents in April 2019.

Conference Call and Webcast information

Jumia will host a conference call today, May 13, 2019 at

8:30 a.m. U.S. Eastern Time to discuss Jumia’s results. Details of

the conference call are as follows:

Participant Dial in (Toll Free): 1-888-317-6016

Participant International Dial in: 1-412-317-6016

Canada Toll Free: 1-855-669-9657

A live webcast of the earnings conference call can be accessed

on the Jumia Investor Relations website:

https://investor.jumia.com/

An archived webcast will be available following the call.

(UNAUDITED)

Consolidated statement of comprehensive

income for the quarters ended March 31, 2019 and

2018

For the three months ended March

31 March 31 In millions of EUR

2019 2018

Revenue 31.8 28.3 Cost of revenue

16.2 19.8

Gross profit

15.7 8.6 Fulfillment expense 15.2 9.6 Sales

and advertising expense 12.3 10.9 Technology and content expense

5.9 5.1 General and administrative expense 27.8 17.4 Other

operating income 0.1 0.1 Other operating expense

0.0 0.0

Operating loss

(45.5) (34.3) Finance income 0.6 0.6 Finance

costs 0.8 0.3

Loss

before Income tax (45.7) (34.0) Income tax

expense 0.1 0.1

Loss for the period

(45.8)

(34.1) Attributable to: Equity holders of the

Company (45.7) (33.6) Non-controlling interests

(0.1) (0.5)

Loss for the period

(45.8)

(34.1) Other comprehensive income/loss to be

classified to profit or loss in subsequent periods Exchange

differences on translation of foreign operations - net of tax

(11.9) 6.6 Other comprehensive income / (loss) on net investment in

foreign operations - net of tax 12.2

(6.6) Other comprehensive loss

0.4 (0.1)

Total comprehensive loss for the

period

(45.4)

(34.2) Attributable to: Equity holders of the

Company (45.4) (33.7) Non-controlling interests

(0.1) (0.4)

Total comprehensive loss for the

period

(45.4)

(34.2)

(UNAUDITED)

Consolidated Statement of financial

position as of March 31, 2019 and 2018

As of March

31 December 31 In millions of EUR

2019 2018

Assets Non-current assets Property and

equipment 15.5 5.0 Intangible assets 0.1 0.2 Deferred tax assets

0.2 0.2 Other non-current assets 1.4

1.3

Total Non-current assets

17.2 6.6

Current assets Inventories 11.0 9.4 Trade and other

receivables 13.3 13.0 Other taxes receivable 5.5 4.9 Prepaid

expense and other current assets 12.6 7.4 Cash and cash equivalents

132.2 100.6

Total

Current assets 174.7

135.4 Total Assets

191.9 142.0 Equity and

Liabilities Equity Share capital 0.1 0.0 Share

premium 0.8 0.8 Other reserves 0.1 0.1 Accumulated losses

(0.9) (0.9)

Equity

attributable to the equity holders of the Company 81.1

50.0 Non-controlling interests

(0.2) (0.1) Total Equity

80.9 49.8

Liabilities Non-current liabilities 0.0 0.0

Non-current borrowings 6.0

0.0

Total Non-current liabilities

6.0 0.0

Current

liabilities Borrowings 3.4 0.0 Trade and other payables 58.6

47.7 Income tax payables 0.1 0.1 Other taxes payable 7.6 7.4

Provisions for liabilities and other charges 31.3 30.4 Deferred

income 3.9 6.5

Total

Current liabilities 104.9

92.2 Total Liabilities

110.9 92.2 Total

Equity and Liablities 191.9

142.0

(UNAUDITED)

Consolidated statement of cash flows

for the quarters ended March 31, 2019 and 2018

For the three months ended March

31 March 31 In millions of EUR

2019 2018

Loss before Income tax (45.7) (34.0)

Depreciation and amortization 1.7 0.5 Impairment losses on

loans, receivables and other assets 0.5 0.3 Impairment losses on

obsolete inventories 0.2 (0.0) Share-based payment expense 4.3 3.6

Loss/(Gain) on disposal of property, equipments and intangible

assets 0.0 0.0 (Gain) /Loss on disposal of financial assets 0.0 0.0

Net accrued interest and similar (income)/expense 0.2 (0.0) Net

unrealized foreign exchange (gain)/loss (0.1) (0.4)

(Increase)/Decrease in trade and other receivables, prepayments and

VAT receivables (7.3) 0.6 (Increase)/Decrease in inventories (1.7)

0.8 Increase/(Decrease) in trade and other payables, prepayments

and VAT payables 8.0 (4.7) Change in provision for other

liabilities and charges 0.6 (0.0) Income taxes paid

(0.1) 0.1

Net cash flows used in

operating activities (39.3)

(33.1) Cash flows from investing

activities Purchase of property and equipment (0.7) (0.5)

Proceeds from sale of property and equipment 0.0 0.0 Purchase of

intangible assets 0.0 (0.0) Consolidated securities investment

(0.0) 0.0 Purchase of financial assets (0.0) 0.0 Movement in other

non-current assets 0.1

(0.3)

Net cash flows used in investing activities

(0.7) (0.8)

Cash flows from financing activities Proceeds from

borrowings 0.0 0.0 Financial interest paid (0.3) 0.0 Payment of

lease liabilities (0.8) 0.0 Capital contributions 75.0 24.0

Expenses reclassed to Equity (2.7)

0.0

Net cash flows from financing activities

71.2 24.0

Net increase in cash and cash equivalents

31.2 (9.9) Effect of exchange rate

changes on cash and cash equivalents 0.4

(0.4)

Cash and cash equivalents at the

beginning of the period

100.6 29.7

Cash and cash equivalents at the end of

the period

132.2 19.4

Non-IFRS and Other Financial and

Operating Metrics

This release includes certain financial measures and metrics not

based on IFRS, including Adjusted EBITDA, as well as operating

metrics, including GMV and Active Consumers. We define GMV, Active

Consumers and Adjusted EBITDA as follows:

GMV corresponds to the total value

of orders including shipping fees, value added tax, and before

deductions of any discounts or vouchers, irrespective of

cancellations or returns.

Active Consumers means unique

consumers who placed an order on our marketplace within the

12-month period preceding the relevant date, irrespective of

cancellations or returns.

Adjusted EBITDA corresponds to loss

for the year, adjusted for income tax expense, finance income,

finance costs, depreciation and amortization and share-based

payment expense.

Adjusted EBITDA is a supplemental non-IFRS measure of our

operating performance that is not required by, or presented in

accordance with, IFRS. Adjusted EBITDA is not a measurement of our

financial performance under IFRS and should not be considered as an

alternative to loss for the year, loss before income tax or any

other performance measure derived in accordance with IFRS. We

caution investors that amounts presented in accordance with our

definition of Adjusted EBITDA may not be comparable to similar

measures disclosed by other companies, because not all companies

and analysts calculate Adjusted EBITDA in the same manner. We

present Adjusted EBITDA because we consider it to be an important

supplemental measure of our operating performance. Management

believes that investors’ understanding of our performance is

enhanced by including non-IFRS financial measures as a reasonable

basis for comparing our ongoing results of operations. By providing

this non-IFRS financial measure, together with a reconciliation to

the nearest IFRS financial measure, we believe we are enhancing

investors’ understanding of our business and our results of

operations, as well as assisting investors in evaluating how well

we are executing our strategic initiatives.

Management uses Adjusted EBITDA:

- as a measurement of operating

performance because it assists us in comparing our operating

performance on a consistent basis, as it removes the impact of

items not directly resulting from our core operations;

- for planning purposes, including the

preparation of our internal annual operating budget and financial

projections;

- to evaluate the performance and

effectiveness of our strategic initiatives; and

- to evaluate our capacity to expand our

business.

Items excluded from this non-IFRS measure are significant

components in understanding and assessing financial performance.

Adjusted EBITDA has limitations as an analytical tool and should

not be considered in isolation, or as an alternative to, or a

substitute for analysis of our results reported in accordance with

IFRS, including loss for the year. Some of the limitations are:

- Adjusted EBITDA does not reflect our

share-based payments, income tax expense or the amounts necessary

to pay our taxes;

- although depreciation and amortization

are eliminated in the calculation of Adjusted EBITDA, the assets

being depreciated and amortized will often have to be replaced in

the future and such measures do not reflect any costs for such

replacements; and

- other companies may calculate Adjusted

EBITDA differently than we do, limiting its usefulness as a

comparative measure.

Due to these limitations, Adjusted EBITDA should not be

considered as a measure of discretionary cash available to us to

invest in the growth of our business. We compensate for these and

other limitations by providing a reconciliation of Adjusted EBITDA

to the most directly comparable IFRS financial measure, loss for

the year.

The following tables provide a reconciliation of loss for the

year to Adjusted EBITDA for the periods indicated:

For the three months ended March 31st (€

million)

2018 2019

Loss for the period

(34.1) (45.8) Income tax expense

0.1 0.1 Finance costs 0.3 0.8 Finance income (0.6)

(0.6) Depreciation and amortization 0.5 1.7 Share-based payment

exercise 3.6 4.3

Adjusted EBITDA

(30.2) (39.5)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190513005383/en/

Safae DamirHead of Investor

Relationsinvestor-relations@jumia.comAbdesslam BenzitouniHead of PR

and Communicationspress@jumia.com

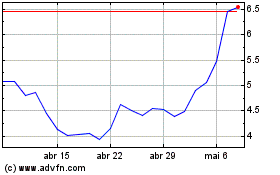

Jumia Technologies (NYSE:JMIA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Jumia Technologies (NYSE:JMIA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024