Intermediate declaration by the Board of Directors

Regulatory News:

(Paris:XFAB)

Highlights for Q2 2019:

- Revenue was USD 131.6 million, within the guidance of USD

128-135 million, down 15% year-on-year and flat

quarter-on-quarter

- EBITDA was USD 11.8 million, down 59% year-on-year and up

80% quarter-on-quarter EBITDA margin of 8.9%, on the upper end of

3-9% guidance

- EBIT was USD -5.6 million, down USD 19.1 million

year-on-year and up USD 4.7 million quarter-on-quarter

- Net loss was USD 8.1 million, down USD 9.6 million

year-on-year and up USD 2.3 million quarter-on-quarter

- Loss per share was USD 0.06

Outlook:

- Q3 2019 revenue is expected in the range of USD 128-135

million with an EBITDA margin in the range of 4% to 10%. Due to the

continuing uncertainties in the market, visibility on the fourth

quarter remains limited.

- Q3 2019 guidance is based on an average exchange rate of

1.14 USD/Euro.

Revenue breakdown per quarter:

in millions of USD

Q4 2017

Q1 2018

Q2 2018

Q3 2018

Q4 2018

Q1 2019

Q2 2019

Q2 y-o-y growth

Automotive

71.8

68.5

79.3

76.6

59.7

64.1

62.5

-21%

Industrial

20.7

23.2

25.0

23.8

24.3

24.1

23.3

-7%

Medical

6.9

4.8

5.6

6.3

7.3

6.8

6.3

14%

Subtotal core business

99.3

96.5

109.8

106.7

91.3

95.0

92.1

-16%

64.4%

67.2%

70.6%

70.5%

66.4%

72.5%

70.0%

CCC1

53.9

46.5

45.3

44.4

45.9

35.8

39.1

-14%

Others

1.0

0.5

0.3

0.3

0.3

0.2

0.3

n.m.

Total revenues

154.1

143.5

155.5

151.4

137.4

131.0

131.6

-15%

1 Consumer, Communications & Computer

Business development

In the second quarter, X-FAB recorded revenues of USD 131.6

million coming in within the guidance range of USD 128-135 million.

Year-on-year, revenues decreased by 15%, quarter-on-quarter

revenues were almost flat with a slight increase of 0.4%.

Production revenues in the second quarter were mainly impacted by

the weak automotive market.

Revenues in X-FAB’s core business, namely automotive, industrial

and medical, came in at USD 92.1 million, a decrease by 16%

compared to the same quarter last year. Quarter-on-quarter the core

business went down by 3%. Uncertainties in the market continued

throughout the second quarter, driven by a mix of economic factors

as well as political conflicts in the world. Combined with the

limited visibility going forward customers remained very cautious

in their ordering behavior and carried on reducing their

inventories. This is still reflected in a low level of bookings,

although up 10% from the first quarter.

In the second quarter, automotive revenues decreased 21%

year-on-year in line with the ongoing weakness of the automotive

market. While production revenues dropped, prototyping revenues in

the automotive segment recorded a growth of 14% compared to the

same quarter last year.

Revenues in the industrial market segment declined 7%

year-on-year; prototyping revenues for industrial applications went

down by 12% year-on-year. The global economic weakness has led to

cut-backs in investments for equipment, in particular in China,

causing customers in the industrial segment to reduce their

inventories.

The medical business of the second quarter recorded a 14% growth

compared to the same quarter last year. Prototyping revenues were

flat year-on-year, whereas production revenues in the medical

segment increased by 20%. Lab-on-a-chip applications remained to be

the strongest growth driver.

Consumer, communications & computer business (CCC) went down

by 14% year-on-year. This was mainly due to a decrease of the

legacy business in X-FAB France, which is however in line with the

plan. The portion of revenues of the French site that is based on

X-FAB technologies reached 20% and was mainly for the CCC end

market.

In the second quarter, X-FAB group prototyping revenue came in

at USD 18.5 million, which is an increase of 30% year-on-year

including an IP sale amounting to USD 3 million. Excluding this

one-off effect, prototyping revenue increased by more than 9%

predominantly driven by new contracts adding up to the pipeline of

new projects supporting future growth.

Operations update

In the second quarter, further progress was made with the

implementation of X-FAB’s automotive technologies at X-FAB France

with the first production of automotive wafers being started. As of

July 2019, X-FAB’s most popular 180nm technology platform (XH018)

is available for automotive applications for supply out of France

expanding the capacity for this technology and enabling dual

sourcing for security of supply.

Silicon carbide (SiC) revenue in the second quarter almost

tripled compared to the same quarter last year coming in at USD 6.4

million. SiC revenues in the first half of the year achieved the

same level as for the total of 2018, in line with the company’s

growth targets. SiC prototyping revenue increased 46% year-on-year

and 88% quarter-on-quarter. Production revenue went up by 15%

quarter-on-quarter with another customer moving from prototyping

stage into volume production. The customer and projects pipeline

remained strong, and the preparations for offering in-house epi

capabilities are on track. First epi prototyping is scheduled for

delivery in the fourth quarter of 2019. Epi is short for epitaxy

and refers to the process of depositing a thin epitaxial layer on a

SiC raw wafer. This is a significant value-add step in the overall

process of manufacturing silicon carbide semiconductors.

All manufacturing sites continued with their expansion and

optimization activities aiming to increase output and productivity.

This includes actions to drive automation as well as optimization

projects, therewith taking advantage of the currently lower

utilization levels since many of these activities are only possible

while the fabs are not fully loaded.

Capital expenditures of the second quarter amounted to USD 20.9

million up 18% compared to the same quarter last year. Major

projects were the capacity expansion at X-FAB Dresden, the new

office building at X-FAB Sarawak as well as the activities to get

the French site ready for automotive production. In a move to

reduce capex spending as part of the ongoing cost-saving program,

non-critical investments were put on hold. This will however only

materialize at a later stage. Capital expenditures for the second

quarter mainly refer to investment projects, which had been

initiated in 2018 already.

Profitability and FX volatility

After profitability was negatively impacted by a significant

decrease of unfinished and finished goods inventory amounting to

USD 9.2 million in the first quarter of the year, an increase of

unfinished and finished goods inventory by USD 2.1 million in the

second quarter positively contributed to profitability. These

quarterly fluctuations are part of normal business.

The actual exchange rate for the second quarter of 2019 was 1.12

with a corresponding EBITDA margin of 8.9%. At a constant

US-Dollar/Euro exchange rate of 1.19 experienced in the second

quarter of last year, the EBITDA margin in Q2 2019 would have been

at 7.6%.

In order to limit the impact of US-Dollar/Euro exchange rate

fluctuations on profitability, X-FAB aims at achieving a 25% share

of Euro-denominated sales by the end of 2019 and managed to raise

this level to 24% in the second quarter of 2019, coming from a low

of 11% in the fourth quarter of 2016.

Management comments & outlook

Commenting on the development of X-FAB’s business, Rudi De

Winter, CEO of X-FAB Group, said: “Market conditions remained weak

throughout the second quarter. Uncertainties continued with ongoing

destocking on customer side and restrained demand. Visibility is

therefore still limited. Nevertheless, I am extremely excited about

the great interest we keep seeing for our technologies. In the

automotive segment, thanks to the synergies between our silicon

carbide and high-voltage CMOS offering as well as the inductive

isolators, we are excellently prepared to support the

electrification of cars. In the medical segment, lab-on-a-chip

applications continued to grow, and we haven’t even seen the real

start of this business yet. I am also pleased with the very

positive response received during our recent China roadshow to

increase awareness for X-FAB in this market. I am confident that

X-FAB is well positioned for solid growth as soon as the market

recovers.”

Procedures of the independent auditor

The statutory auditor, KPMG Bedrijfsrevisoren – Réviseurs

d’Entreprises CVBA, represented by Herwig Carmans, has confirmed

that their review procedures, which have been substantially

completed, have not revealed any significant matters requiring

adjustment of the condensed consolidated financial information

included in this press release as of and for the six months ended

June 30, 2019.

X-FAB Quarterly Conference Call

X-FAB’s second quarter results will be discussed in a live

conference call on Tuesday, July 30th, 2019 at 6.30 pm CET. The

conference call will be in English. Please register in advance of

the conference using the following link:

http://emea.directeventreg.com/registration/7229215

Upon registering, you will be provided with participant dial-in

numbers, Direct Event passcode and a unique registrant ID. In the

10 minutes prior to the call, you will need to use the conference

access information provided in the email received at the point of

registering.

The conference call will be available for replay from July 30th

11.30 pm CET until August 6th 11.30 pm CET. The replay number will

be +44 (0) 3333009785, conference ID 7229215.

The third quarter 2019 results will be communicated on October

29th, 2019.

About X-FAB

X-FAB is the leading analog/mixed-signal and MEMS foundry group

manufacturing silicon wafers for automotive, industrial, consumer,

medical and other applications. Its customers worldwide benefit

from the highest quality standards, manufacturing excellence and

innovative solutions by using X-FAB’s modular CMOS processes in

geometries ranging from 1.0 to 0.13 µm, and its special silicon

carbide and MEMS long-lifetime processes. X-FAB’s analog-digital

integrated circuits (mixed-signal ICs), sensors and

micro-electro-mechanical systems (MEMS) are manufactured at six

production facilities in Germany, France, Malaysia and the U.S.

X-FAB employs about 4,000 people worldwide.

For more information, please visit www.xfab.com.

Forward-looking information

This press release may include forward-looking statements.

Forward-looking statements are statements regarding or based upon

our management’s current intentions, beliefs or expectations

relating to, among other things, X-FAB’s future results of

operations, financial condition, liquidity, prospects, growth,

strategies or developments in the industry in which we operate. By

their nature, forward-looking statements are subject to risks,

uncertainties and assumptions that could cause actual results or

future events to differ materially from those expressed or implied

thereby. These risks, uncertainties and assumptions could adversely

affect the outcome and financial effects of the plans and events

described herein.

Forward-looking statements contained in this press release

regarding trends or current activities should not be taken as a

report that such trends or activities will continue in the future.

We undertake no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, unless legally required. You should not place undue

reliance on any such forward-looking statements, which speak only

as of the date of this press release.

The information contained in this press release is subject to

change without notice. No re-report or warranty, express or

implied, is made as to the fairness, accuracy, reasonableness or

completeness of the information contained herein and no reliance

should be placed on it.

Condensed Consolidated Statement of Profit and Loss

in thousands of USD

Quarter

ended 30 Jun 2019

unaudited

Quarter

ended 30 Jun 2018

unaudited

Quarter

ended 31 Mar 2019

unaudited

Half-year

ended 30 Jun 2019

unaudited

Half-year

ended 30 Jun 2018

unaudited

Revenue

131,560

155,497

131,005

262,565

299,027

Revenues in USD in %

75

83

76

76

82

Revenues in EUR in %

24

17

23

24

18

Cost of sales

-115,988

-124,616

-126,477

-242,466

-243,844

Gross Profit

15,571

30,882

4,528

20,100

55,184

Gross Profit margin in %

11.8%

19.9%

3.5%

7.7%

18.5%

Research and development expenses

-8,221

-7,935

-5,407

-13,628

-16,126

Selling expenses

-2,011

-1,942

-1,992

-4,003

-4,148

General and administrative expenses

-7,778

-7,439

-7,785

-15,563

-15,403

Rental income and expenses from investment

properties

-361

439

174

-187

1,009

Other income and other expenses

-2,797

-461

220

-2,577

-1,126

Operating profit

-5,596

13,544

-10,262

-15,858

19,390

Finance income

3,405

-290

3,556

6,961

14,515

Finance costs

-4,964

-10,120

-2,622

-7,586

-19,091

Net financial result

-1,559

-10,410

934

-625

-4,576

Profit before tax

-7,155

3,133

-9,329

-16,483

14,814

Income tax

-926

-1,652

-1,036

-1,962

219

Profit for the period

-8,081

1,481

-10,365

-18,445

15,033

Operating profit (EBIT)

-5,596

13,544

-10,262

-15,858

19,390

Depreciation

17,365

15,087

16,784

34,149

29,413

EBITDA

11,769

28,631

6,522

18,291

48,803

EBITDA margin in %

8.9

18.4

5.0

7.0

16.3

Earnings per share at the end of

period

-0.06

0.01

-0.08

-0.14

0.12

Weighted average number of shares

130,631,921

130,631,921

130,631,921

130,631,921

130,631,921

EUR/USD average exchange rate

1.12324

1.19341

1.13635

1.12979

1.21187

Amounts in the financial tables provided in this press release

are rounded to the nearest thousand except when otherwise

indicated, rounding differences may occur.

Condensed Consolidated Statement of Financial

Position

in thousands of USD

Half-year ended 30 Jun 2019

unaudited

Half-year ended 30 Jun 2018

unaudited

Year ended 31 Dec 2018

audited

ASSETS

Non-current assets

Property, plant, and equipment

373,832

319,113

345,626

Investment properties

9,362

8,778

9,415

Intangible assets

8,462

8,317

9,023

Non-current investments

706

727

381

Other non-current assets

26,692

14,682

20,594

Deferred tax assets

34,328

35,665

34,234

Total non-current assets

453,381

387,282

419,272

Current assets

Inventories

157,959

118,943

147,150

Trade and other receivables

62,870

81,962

71,378

Other assets

31,057

19,846

26,699

Cash and cash equivalents

171,232

295,345

242,768

Total current assets

423,118

516,096

487,995

TOTAL ASSETS

876,499

903,378

907,268

EQUITY AND LIABILITIES

Equity

Share capital

432,745

432,745

432,745

Share premium

348,709

348,709

348,709

Retained earnings

-103,979

-91,794

-84,782

Cumulative translation adjustment

-483

-444

-539

Treasury shares

-770

-770

-770

Total equity attributable to equity

holders of the parent

676,222

688,446

695,363

Non-controlling interests

363

357

364

Total equity

676,585

688,803

695,726

Non-current liabilities

Non-current loans and borrowings

76,417

88,397

72,328

Other non-current liabilities and

provisions

7,441

8,370

7,446

Total non-current liabilities

83,858

96,767

79,774

Current liabilities

Trade payables

28,778

25,866

45,889

Current loans and borrowings

32,456

36,062

31,632

Other current liabilities and

provisions

54,822

55,879

54,246

Total current liabilities

116,056

117,808

131,767

TOTAL EQUITY AND LIABILITIES

876,499

903,378

907,268

Condensed Consolidated Statement of Cash Flow

in thousands of USD

Quarter

ended 30 Jun 2019

unaudited

Quarter

ended 30 Jun 2018

unaudited

Quarter

ended 31 Mar 2019

unaudited

Half-year

ended 30 Jun 2019

unaudited

Half-year

ended 30 Jun 2018

unaudited

Income before taxes

-7,155

3,133

-9,329

-16,483

14,814

Reconciliation of net income to cash

flow arising from operating activities:

19,807

22,493

13,833

33,639

31,897

Depreciation and amortization, before

effect of grants and subsidies

17,365

15,087

16,784

34,149

29,413

Recognized investment grants and subsidies

netted with depreciation and amortization

-742

-802

-745

-1,487

-1,639

Interest income and expenses (net)

424

60

419

842

654

Loss/(gain) on the sale of plant,

property, and equipment (net)

6

-2

0

6

671

Loss/(gain) on the change in fair value of

derivatives (net) and financial assets (net)

-182

2,107

-143

-325

3,206

Other non-cash transactions (net)

2,936

6,043

-2,482

454

-408

Changes in working capital:

-16,965

-3,167

-7,943

-24,908

-14,238

Decrease/(increase) of trade

receivables

-4,666

-1,167

13,406

8,740

863

Decrease/(increase) of other receivables

& prepaid expenses

-5,010

8,613

-6,082

-11,093

-163

Decrease/(increase) of inventories

-6,679

-5,516

-4,129

-10,808

-13,097

(Decrease)/increase of trade payables

-3,387

-2,242

-7,476

-10,863

-7,055

(Decrease)/increase of other

liabilities

2,777

-2,855

-3,662

-885

5,214

Income taxes (paid)/received

-417

-85

-92

-510

-148

Cash Flow from operating

activities

-4,730

22,374

-3,532

-8,262

32,325

Cash Flow from investing

activities:

Payments for property, plant, equipment

& intangible assets

-20,942

-17,730

-23,815

-44,756

-38,497

Payments for investments

-175

0

-175

-350

0

Acquisition of subsidiary, net of cash

acquired

0

0

0

0

0

Payments for loan investments to related

parties

-60

-61

-101

-161

-127

Proceeds from loan investments related

parties

40

44

94

133

96

Proceeds from sale of property, plant, and

equipment

40

2

0

40

18

Interest received

624

879

663

1,287

1,413

Cash Flow used in investing

activities

-20,473

-16,866

-23,334

-43,807

-37,098

Condensed Consolidated Statement of Cash Flow – con’t

in thousands of USD

Quarter

ended 30 Jun 2019

unaudited

Quarter

ended 30 Jun 2018

unaudited

Quarter

ended 31 Mar 2018

unaudited

Half-year

ended 30 Jun 2019

unaudited

Half-year

ended 30 Jun 2018

unaudited

Cash Flow from (used in) financing

activities:

Proceeds from loans and borrowings

0

0

0

0

0

Repayment of loans and borrowings

-7,083

-7,814

-7,500

-14,583

-16,562

Receipts from sale & leaseback

arrangements

0

0

0

0

0

Payments of lease installments

-2,156

-612

-618

-2,774

-1,314

Receipt of government grants and

subsidies

0

357

0

0

357

Interest paid

-401

-514

-409

-810

-1,133

Gross proceeds from capital increase

0

0

0

0

0

Direct cost related to capital

increase

0

0

0

0

0

Payment of preference dividend

0

0

0

0

0

Distribution to non-controlling

interests

0

0

-11

-11

-12

Cash Flow from (used in) financing

activities

-9,641

-8,583

-8,539

-18,180

-18,664

Effect of changes in foreign currency

exchange rates on cash

-1,200

-8,445

-88

-1,288

-454

Increase/(decrease) of cash and cash

equivalents

-34,844

-3,075

-35,405

-70,248

-23,437

Cash and cash equivalents at the beginning

of the period

207,276

306,865

242,768

242,768

319,235

Cash and cash equivalents at the end

of

the period

171,232

295,345

207,276

171,232

295,345

###

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190730005713/en/

X-FAB Press Contact Uta Steinbrecher Investor Relations

X-FAB Silicon Foundries +49-361-427-6489

uta.steinbrecher@xfab.com

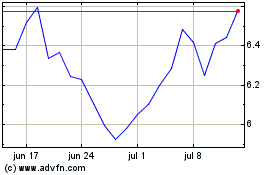

X-FAB Silicon Foundries (EU:XFAB)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

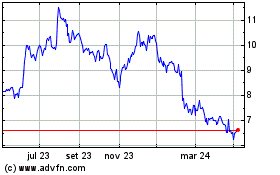

X-FAB Silicon Foundries (EU:XFAB)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024