Rio Tinto releases second quarter production results

16 Julho 2020 - 7:26PM

Business Wire

Rio Tinto Chief Executive J-S Jacques said “We delivered a

strong performance, particularly in iron ore and bauxite,

demonstrating the underlying resilience of our business and ability

to adapt in difficult conditions. Our iron ore assets are

performing well in a strong pricing environment and we are on track

to meet our 2020 iron ore guidance. Despite various COVID-19

related challenges, all our assets have continued to operate, with

our first priority to protect the health and safety of all our

employees and communities.

“Our focus is to maintain a business as usual approach with many

safeguards at a very unusual time. Our operational teams are

continuing to run our assets safely so we can continue to

contribute to local and national economies and serve our customers.

We remain even more committed to our relationship with communities,

following the Juukan Gorge events in the Pilbara, and we are

engaging extensively with Traditional Owners around our operations

and across Australia.

“We are executing our value over volume strategy to drive

performance, productivity and free cash flow per share. We will

remain agile and ready to adapt to the changing operating and macro

environment.”

Production*

Q2

2020

vs Q2 2019

vs Q1 2020

H1

2020

vs H1 2019

Pilbara iron ore shipments (100%

basis)

Mt

86.7

+1%

+19%

159.6

+3%

Pilbara iron ore production (100%

basis)

Mt

83.2

+4%

+7%

161.1

+3%

Bauxite

Mt

14.6

+9%

+5%

28.4

+8%

Aluminium

kt

785

-2%

0%

1,568

-2%

Mined Copper

kt

132.8

-3%

0%

265.7

-5%

Titanium dioxide slag

kt

262

-13%

-10%

555

-7%

IOC iron ore pellets and concentrate

Mt

2.8

+9%

+8%

5.3

+6%

*Rio Tinto share unless otherwise

stated

Q2 Operational update

- We continue to prioritise the health and safety of our

employees and communities during this turbulent period. We achieved

an all injury frequency rate of 0.37 for the first half of 2020,

trending positively compared with a rate of 0.42 in 2019. We have

now fully embedded our rigorous COVID-19 health and hygiene

controls as we adapt to the new operating conditions. Our

operational sites and offices are moving ahead with the

implementation of fit for purpose COVID-19 screening as an

additional measure to protect our people and communities.

- We remain even more committed to our relationship with

communities, following the Juukan Gorge events in the Pilbara. We

are engaging extensively with Traditional Owners, including the

Puutu Kunti Kurrama and Pinikura people, and indigenous leaders in

the Pilbara and across Australia. On 19 June 2020, we announced a

board-led review of our heritage management processes within Iron

Ore to be completed by October 2020. We will also contribute to the

Inquiry by the Joint Standing Committee on Northern Australia that

will report to the Senate and we will continue to support the West

Australian government’s planned reform of the Aboriginal Heritage

Act 1972 (WA).

- Overall, we achieved a robust production performance with

volumes up 1% compared with the second quarter of 2019 on a copper

equivalent basis despite significant global challenges,

restrictions related to COVID-19 and the impact of the earthquake

at Kennecott, Utah.

- Pilbara iron ore shipments of 86.7 million tonnes (100% basis)

were 1% higher than the second quarter of 2019 despite the impact

of COVID-19 related operational controls. With 1.7 million tonnes

of port sales in the second quarter, we continue to grow our

portside business steadily, looking to better serve our existing

customers and open opportunities to sell to new customers who do

not participate in the seaborne market.

- Bauxite production of 14.6 million tonnes, 9% higher than the

second quarter of 2019, continued the first quarter trend following

the successful ramp-up of Amrun in 2019, and higher production at

the non-managed CBG joint venture in Guinea reflecting good

progress on the ramp-up of the expansion.

- Aluminium production of 0.8 million tonnes in the second

quarter was 2% lower than the second quarter of 2019 primarily due

to pot relining at Kitimat, the decision to operate the ISAL

smelter at 85% capacity, and the curtailment of the fourth pot line

at our New Zealand Aluminium Smelter (NZAS) in April 2020 due to

COVID-19 impacts.

- On 9 July 2020, we announced the wind-down of operations and

eventual closure of NZAS following the conclusion of the strategic

review.

- Second quarter mined copper was 3% lower than the same period

of 2019 due to lower head grade at Kennecott. Second quarter

refined copper was 67% lower than the same period of 2019 due to

the impact from the 5.7 magnitude earthquake in the first quarter

resulting in an unplanned flash converting furnace rebuild at

Kennecott, in addition to the planned 45-day smelter shutdown in

May/June.

- On 29 June 2020, we announced an agreement with Turquoise Hill

Resources and the Government of Mongolia on the preferred domestic

power solution for Oyu Tolgoi that paves the way for the Government

to fund and construct a State Owned Power Plant at Tavan Tolgoi.

Parties will work towards finalising a Power Purchase Agreement by

March 2021.

- The new Oyu Tolgoi mine design announced on 3 July 2020,

confirms that the caving method of mining remains valid. We are

targeting first sustainable production between October 2022 to June

2023 and development capital of $6.6 to $7.1 billion based on the

updated mine design of Panel 0. Material contained in pillars

retained on either side of Panel 0 have been reclassified from Ore

Reserves to Mineral Resources. Part of the material contained in

these pillars is expected to be recoverable at a later stage

following additional studies which are currently underway.

- Titanium dioxide slag production of 262 thousand tonnes was 13%

lower than the second quarter of 2019 partly due to COVID-19

restrictions in Quebec and South Africa.

- Production of pellets and concentrate at the Iron Ore Company

of Canada (IOC) was 9% higher than the same period of 2019 with

continued focus on concentrate feed to match market demand.

- Governments are gradually lifting restrictions on the movement

of goods and people as part of their COVID-19 recovery plans.

However, some restrictions remain in place or are being

reintroduced. As a result, there continues to be an impact on

projects in general although to a lesser degree than earlier in the

year.

- Capital expenditure is expected to be around $6 billion in 2020

(previously $5 to $6 billion) due to an appreciation in our major

operating currencies against the US dollar since the first quarter

and a reduced impact of COVID-19 on both sustaining and development

expenditure. Capital expenditure for 2021 and 2022 is expected to

be around $7 billion per year (previously $6.5 billion). This

includes spend from 2020 that has been re-phased as a result of

COVID-19 restrictions. Further details can be found in the

Investments, growth and development projects section below.

- We made a final payment of US$1.0 billion in Australian income

tax in June 2020 with respect to 2019 profits.

COVID-19

Our markets

In China, conditions have improved through the second quarter

and appear to be stabilising. While employment and trade

uncertainties remain, the construction and infrastructure sectors

are performing well; house prices and stock markets are also

recovering, lending support to consumer confidence. The United

States and Europe have started to re-open and recover. A second

wave of infections remains a key threat for advanced economies.

- China’s demand for iron ore continues while the recovery in

Japan and Europe is yet to begin meaningfully and is likely to be

subdued when it does.

- The automotive sector is showing initial signs of recovery from

a very low base, supporting demand for aluminium value-added

products (VAP).

- There has been limited impact on bauxite demand to date.

- China’s copper concentrate market remains favourable; however,

the US market is weaker. COVID-19 related supply disruptions are

between 3 to 4% of annual copper supply currently, in addition to

normal industry supply disruptions, and could increase

further.

Our assets

During the COVID-19 pandemic, we have implemented strict

protocols globally across the business. These measures are in line

with government guidance and directives, and advice from leading

medical experts and international health organisations on best

practice to keep our employees, contractors and partners healthy

and safe. These range from physical distancing to travel

restrictions, roster changes and team splits, to flexible working

arrangements, rapid screening and personal hygiene controls.

While uncertainties continue to exist in our business

environment, we are focused on our underlying resilience and

ability to adapt in a fast-moving environment. Key updates are

outlined below and full details of initiatives taken to date can be

found on our website.

Operations and Workforce

- With the de-escalation of health restrictions in Western

Australia, we are progressing the return to normal rosters at our

Iron Ore operations, construction and exploration projects. We

expect this transition to be completed by August 2020.

- Our office-based employees are beginning to return to offices

in regions where permitted. In most cases, employees are returning

to offices in alternate teams to reduce the risk of widespread

transmission and ensure business continuity.

- We have introduced screening programmes across sites as a

control to stop the spread of COVID-19. For the Pilbara

fly-in-fly-out workforce, we have conducted more than 50,000 checks

through facilities we established at Perth and regional airports as

an enhanced control for employees boarding flights to site.

- At our copper assets in Mongolia and the US, our teams have

used virtual technology to overcome some challenges related to

COVID-19 travel restrictions. At our Oyu Tolgoi underground project

in Mongolia, the use of virtual reality glasses has helped gain

access to global experts to support project progression during

construction and commissioning stages.

- At Richards Bay Minerals (RBM), furnaces are gradually ramping

up production following easing of restrictions in South Africa.

However, we are managing the situation carefully in the challenging

South African environment.

Products

- In the second quarter, we continued to focus on the

optimisation of IOC product mix to match market demand, moving from

pellet to concentrate.

- In aluminium, in response to market conditions we have reduced

the proportion of primary metal being produced as VAP, which

represented 40% of primary metal sold in the first half of 2020

(first half 2019: 54%).

Production Guidance

Rio Tinto share, unless otherwise

stated

2019 Actuals

H1 2020 (YTD)

2020

Pilbara iron ore (shipments,

100% basis) (Mt)

327

159.6

324 to 334

Bauxite (Mt)

55

28.4

55 to 58

Alumina (Mt)

7.7

4.0

7.8 to 8.2

Aluminium (Mt)

3.2

1.6

3.1 to 3.3

Mined copper (kt)

577

265.7

475 to 520

Refined copper (kt)

260

74.1

165 to 205

Diamonds (M carats)

17

7.7

12 to 14

Titanium dioxide slag (Mt)

1.2

0.6

Lower end of 1.2 to

1.4

IOC iron ore pellets and concentrate

(Mt)

10.5

5.3

10.5 to 12.0

Boric oxide equivalent (Mt)

0.5

0.26

~0.5

- Production guidance remains unchanged across all commodities

from the First Quarter Operations Review.

- We will continue to monitor and adjust production levels and

product mix to meet customer requirements in 2020, in line with our

value over volume strategy, government imposed restrictions related

to COVID-19, and any other potential COVID-19 related

disruptions.

The full second quarter production results are available

here

This announcement is authorised for release to the market by Rio

Tinto’s Group Company Secretary.

LEI: 213800YOEO5OQ72G2R82

Classification: 3.1 Additional regulated information required to

be disclosed under the laws of a Member State

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200716006077/en/

media.enquiries@riotinto.com riotinto.com

Follow @RioTinto on Twitter Media Relations, United

Kingdom Illtud Harri M +44 7920 503 600

David Outhwaite T +44 20 7781 1623 M +44 7787 597 493

Media Relations, Americas Matthew Klar T +1 514 608

4429

Media Relations, Asia Grant Donald T +65 6679 9290 M +65

9722 6028

Media Relations, Australia Jonathan Rose T +61 3 9283

3088 M +61 447 028 913

Matt Chambers T +61 3 9283 3087 M +61 433 525 739

Jesse Riseborough T +61 8 6211 6013 M +61 436 653 412

Investor Relations, United Kingdom Menno Sanderse T +44

20 7781 1517 M +44 7825 195 178

David Ovington T +44 20 7781 2051 M +44 7920 010 978

Clare Peever M: +44 7788 967 877

Investor Relations, Australia Natalie Worley T +61 3 9283

3063 M +61 409 210 462

Amar Jambaa T +61 3 9283 3627 M +61 472 865 948

Group Company Secretary Steve Allen

Rio Tinto plc 6 St James’s Square London SW1Y

4AD United Kingdom T +44 20 7781 2000

Registered in England No. 719885

Joint Company Secretary Tim Paine

Rio Tinto Limited Level 7, 360 Collins Street

Melbourne 3000 Australia T +61 3 9283 3333

Registered in Australia ABN 96 004 458 404

Category: General

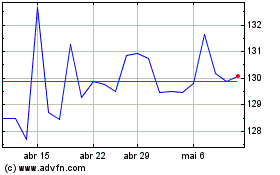

Rio Tinto (ASX:RIO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

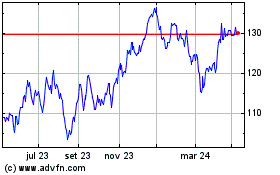

Rio Tinto (ASX:RIO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024