Rio Tinto declares interim ordinary dividend of $2.5 billion

29 Julho 2020 - 3:25AM

Business Wire

Rio Tinto Chief Executive J-S Jacques said “We have been agile

and adapted our way of working, to deliver another resilient

performance while navigating the new and ongoing challenges of

dealing with COVID-19. Despite the challenging backdrop, we

generated underlying EBITDA of $9.6 billion, with a margin of 47%,

driven by our strong and stable operations, with all of our assets

continuing to operate throughout the first half. As a result, we

have declared an interim dividend of $2.5 billion, equivalent to

155 US cents per share, and have reconfirmed our 2020 production

guidance across all commodities.

“Our world-class portfolio of high-quality assets and our strong

balance sheet consistently serve us well in all market conditions

and particularly in turbulent times. This, together with our

disciplined capital allocation, underpins our ability to sustain

production, increase our investment in the business, pay taxes and

royalties to governments and continue delivering superior returns

to shareholders.”

Six months ended 30 June

2020

2019

Change

Net cash generated from operating

activities (US$ millions)

5,628

6,389

(12)%

Capital expenditure1 (US$ millions)

2,693

2,391

13%

Free cash flow2 (US$ millions)

2,809

3,879

(28)%

Underlying EBITDA2 (US$ millions)

9,640

10,250

(6)%

Underlying earnings2 (US$ millions)

4,750

4,932

(4)%

Net earnings (US$ millions)

3,316

4,130

(20)%

Underlying earnings2 per share (US

cents)

293.7

301.5

(3)%

Ordinary dividend per share (US cents)

155.0

151.0

3%

Return on capital employed (ROCE)2

21 %

23%

At 30 June 2020

At 31 Dec 2019

Net debt2 (US$ millions)

(4,826)

(3,651)

- Sustained improvement in safety performance, with the all

injury frequency rate declining to 0.37 (0.42 in 2019), a reduction

in the severity rate and fewer process safety incidents.

- We remain committed to our relationship with communities,

following the Juukan Gorge events in the Pilbara. We are engaging

extensively with Traditional Owners, including the Puutu Kunti

Kurrama and Pinikura people, and indigenous leaders in the Pilbara

and across Australia. A board-led review of our heritage management

processes is underway. We will make our submission to the Inquiry

by the Joint Standing Committee on Northern Australia by 31

July.

- $5.6 billion operating cash flow was 12% lower than 2019 first

half, mainly due to lower prices and the effect of timing

differences. In June 2020 we made a final payment of $1.0 billion

in Australian income tax with respect to 2019 profits.

- $2.8 billion free cash flow2 was 28% lower than 2019 first

half, reflecting the lower operating cash flow and a 13% rise in

capital expenditure to $2.7 billion due to an increase in

development capital.

- $9.6 billion underlying EBITDA2 was 6% lower than 2019 first

half, primarily due to lower prices for aluminium and copper. Iron

ore prices were stable, reflected in our underlying EBITDA margin2

of 47%.

- $4.8 billion underlying earnings2 was 4% lower than 2019 first

half. Taking exclusions into account, net earnings of $3.3 billion

mainly reflected $1.0 billion3 of impairments, of four aluminium

smelters and the Diavik diamond mine, and exchange rate

movements.

- Maintained strength in our balance sheet with $4.8 billion of

net debt2, an increase of $1.2 billion, which mainly reflects $3.8

billion of cash returns paid to shareholders in 2020 first half,

partly offset by the free cash flow of $2.8 billion.

- $2.5 billion interim ordinary dividend declared today, with

interim pay-out ratio at 53% of first half underlying earnings,

equivalent to 155 US cents per share, 3% higher than 2019 first

half.

The financial results are prepared in accordance with IFRS and

are unaudited.

The full Rio Tinto 2020 interim results announcement is

available here

Footnotes 1. Capital expenditure is presented gross,

before taking into account any cash received from disposals of

property, plant and equipment (PP&E). 2. This financial

performance indicator is a non-GAAP alternative performance measure

("APM"). It is used internally by management to assess the

performance of the business and is therefore considered relevant to

readers of this document. It is presented here to give more clarity

around the underlying business performance of the Group’s

operations. APMs are reconciled to directly comparable IFRS

financial measures on pages 61 to 66. 3. Refer to page 40 for

pre-tax analysis of impairment charge.

LEI: 213800YOEO5OQ72G2R82 Classification: 1.2 Half year

financial reports and audit reports

This announcement is authorised for release to the market by Rio

Tinto's Group Company Secretary.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200728006096/en/

media.enquiries@riotinto.com www.riotinto.com

Follow @riotinto on Twitter

Media Relations, United Kingdom Illtud Harri M +44 7920

503 600

David Outhwaite T +44 20 7781 1623 M +44 7787 597 493

Media Relations, Americas Matthew Klar T +1 514 608

4429

Media Relations, Asia Grant Donald T +65 6679 9290 M +65

9722 6028

Media Relations, Australia Jonathan Rose T +61 3 9283

3088 M +61 447 028 913

Matt Chambers T +61 (0) 3 9283 3087 M +61 433 525 739

Jesse Riseborough T +61 8 6211 6013 M +61 436 653 412

Investor Relations, United Kingdom Menno Sanderse T +44

20 7781 1517 M +44 7825 195 178

David Ovington T +44 20 7781 2051 M +44 7920 010 978

Clare Peever M +44 7788 967877

Investor Relations, Australia Natalie Worley T +61 3 9283

3063 M +61 409 210 462

Amar Jambaa T +61 3 9283 3627 M +61 472 865 948

Group Company Secretary Steve Allen

Rio Tinto plc 6 St James’s Square London SW1Y 4AD United

Kingdom T +44 20 7781 2000 Registered in England No. 719885

Joint Company Secretary Tim Paine

Rio Tinto Limited Level 7, 360 Collins Street Melbourne

3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004

458 404

Category: General

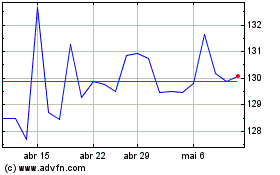

Rio Tinto (ASX:RIO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

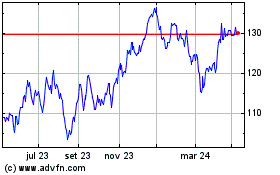

Rio Tinto (ASX:RIO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024