- Excellent sales momentum in Q3: +8.4% on a like-for-like

basis (LFL), best performance in at least 20 years

- Successful roll-out of actions focused on customer

satisfaction: NPS® acceleration of +4 points since end-June(1),

including +7 points in France

- In Brazil (+26.0% LFL): Record growth thanks to an unmatched

ecosystem

- Carrefour Retail (+26.6% LFL)

fully benefited from the repositioning launched in 2018

- Customers favor Atacadão

(+25.8% LFL), the market’s most competitive commercial

model

- In France (+3.8% LFL): Positive customer response to

initiatives to improve their satisfaction

- The transformation is

accelerating in hypermarkets (+2.5% LFL)

- Supermarkets (+4.9% LFL) and

convenience (+5.3% LFL) continued on a positive

trajectory

- In Spain (+6.3% LFL): Another strong performance, reflecting

Carrefour’s attractiveness

- Strong growth in food e-commerce: Above +65% in Q3

- Constant commitment by Carrefour since the beginning of the

pandemic, with rigorous application of measures to protect the

health of customers and employees. Ongoing evaluation of sanitary

measures. Certification by third parties

Regulatory News:

Carrefour (Paris:CA):

Alexandre Bompard, Chairman and Chief Executive Officer,

declared: “Amid the

continuing crisis linked to the COVID-19 pandemic, we remain

extremely vigilant regarding the safety of our teams and our

customers, and we are constantly adapting our governance as well as

our commercial and operational models to the evolution of the

health situation, in all our countries.

Carrefour's sales in the third

quarter reflect the excellent momentum underway in the Group,

confirming the success of the Carrefour 2022 transformation plan.

Our initiatives in favor of customer satisfaction are bearing

fruit: They are reflected in a marked improvement in the NPS®,

record like-for-like growth and outperformance in the organic and

e-commerce segments. The exceptional growth in Brazil, solid

activity in Spain and better momentum in France attest to the

strength of our multi-format and omnichannel model. We remain

mobilized to keep gaining commercial ground.”

THIRD-QUARTER 2020 KEY FIGURES

Third-quarter 2020

Sales inc. VAT (€m)

LFL (2)

Total variation (3)

At current exchange rates

At constant exchange rates

France

9,676

+3.8%

-0.9%

-0.9%

Europe

5,813

+1.9%

-0.3%

+0.2%

Latin America (pre-IAS 29)

3,614

+28.4%

-10.2%

+29.5%

Asia

587

+0.6%

+2.3%

+1.4%

Group (pre-IAS 29)

19,690

+8.4%

-2.5%

+5.5%

IAS 29 (4)

-49

Group (post-IAS 29)

19,641

Notes: (1) end-September vs. end-June 2020; (2) excluding petrol

and calendar effects and at constant exchange rates; (3) variations

presented relative to 2019 sales restated for IFRS 5; (4)

hyperinflation and foreign exchange in Argentina

THIRD-QUARTER 2020 SALES INC. VAT

Thanks to the transformation of its commercial model over more

than two years, Carrefour is now able to capture buoyant market

growth in its main countries. The market has benefited from a shift

from out-of-home consumption towards consumption at home,

particularly in view of the increase in home working.

Third-quarter gross sales up 8.4% on a like-for-like

basis. The Group's gross sales came to €19,690m pre-IAS 29, an

increase of +5.5% at constant exchange rates. This increase

includes an unfavorable petrol effect of -2.9%. After taking into

account an unfavorable exchange rate effect of -8.0%, mainly due to

the depreciation of the Brazilian Real and the Argentine Peso, the

total variation in sales at current exchange rates amounts to -2.5

%. The impact of the application of IAS 29 is -€49m.

In France, Q3 sales were up +3.8% LFL (+2.9% LFL in food

and +9.9% LFL in non-food). Customers reacted quickly and

positively to all initiatives aiming at improving purchasing

experience and customer satisfaction. NPS® increased rapidly in all

formats and growth accelerated.

- Hypermarkets (+2.5% LFL)

accentuated the good momentum that began post-confinement. Constant

focus on execution and customer satisfaction bore fruit. The

transformation is gaining traction. NPS® is clearly improving

- Supermarkets (+4.9% LFL) continued

to post a solid performance, benefiting from the repositioning

initiated in 2018

- Convenience (+5.3% LFL) remained

very dynamic, although it felt the impact of lower summer tourism.

Carrefour continues to expand this growth format with +56 openings

in the third quarter

- Promocash’s activities remained penalized by the decrease in

B2B sales

In Europe, LFL growth reached +1.9% in the quarter.

- In Spain (+6.3% LFL), the Group confirmed its excellent

momentum in a buoyant market. Carrefour stands out thanks to an

attractive commercial model (fresh and Carrefour-branded products,

price positioning) and a continuous improvement of customer

satisfaction

- In Italy (-8.0% LFL), Carrefour was penalized by its

exposure to tourist areas in the North, which were particularly

affected during the summer season. The new country CEO, who arrived

in early September, is tasked with placing seamless execution and

customer satisfaction at the heart of the strategy

- In Belgium(+5.4% LFL), Carrefour continued its market

share gains initiated at the start of the year. The Group continued

its price investments with the "Healthy Prices" campaign launched

in early September

- In Poland(-1.4% LFL), large hypermarkets continued to be

impacted by the drop in traffic in large shopping centers.

Supermarket and proximity formats returned to growth

- In Romania (+0.0% LFL), the market was impacted by

travel restrictions which limited the return home of foreign

workers during the summer

Commercial momentum accelerated in Latin America (+28.4%

LFL).

- In Brazil, Carrefour benefited from a virtuous circle

with dynamic traffic, market share gains and an increase in share

of wallet among its customers. Q3 sales increased by +27.3% at

constant exchange rates, with like-for-like growth of +26.0%, a

contribution from openings of +4.0% and an unfavorable petrol

impact of -2.6%. The currency effect was an unfavorable -37.9%.

- Carrefour Retail (+26.6% LFL)

posted record growth, with hypermarkets growing twice as fast as

the market. Food (+15.4% LFL) was supported by the good momentum of

Carrefour-branded products, while non-food (+43.6% LFL) benefited

from the repositioning of the offer

- Atacadão (+25.8% LFL) recorded

exceptional growth of +31.3% at constant exchange rates. Given the

easing of restrictive measures, Q3 notably benefited from a

resumption of B2B sales. The banner strengthened its price

competitiveness and continues to expand, with the opening of 2

stores in Q3

- In Argentina (+41.4% LFL), good commercial momentum

continued against a backdrop of slowing food inflation and a less

buoyant market. Carrefour continued to gain market share thanks to

its offensive commercial positioning and proximity with its

customers

In Taiwan (Asia), sales rose +1.4% at constant exchange

rates and +0.6% LFL in Q3. Carrefour achieved a solid commercial

performance in an uncertain geopolitical environment.

A SUSTAINABLE GROWTH MODEL

The initiatives of the Carrefour 2022 transformation plan

confirm their relevance quarter after quarter. A winning commercial

model is gradually being put in place. It is based on a culture of

customer service, seamless operational and commercial execution,

enhanced price competitiveness, an efficient omnichannel offer and

a dynamic assortment matching customer expectations.

Thus, countries or regions which two years ago faced major

challenges have now reached a winning position. This is notably the

case of Brazil and Spain, where the pace of growth continues to be

higher than the market’s. France, for its part, is showing signs of

acceleration.

Priority to customer

satisfaction: NPS® up +4 points since end-June, of which +7

points in France

In 2020, Carrefour adopted a customer orientation that is

unprecedented in its history, with an emphasis on winning back

traffic and accelerating LFL growth, in particular through the

deployment of the 5/5/5 method. This method is based on the

individual and collective commitment of employees, at headquarters

and in stores, around a common priority - customer satisfaction -

through 15 commitments divided into three categories (trust,

service, experience). Since 2018, it has contributed to the

commercial success of Argentina, Spain, Taiwan and Poland. The

5/5/5 is now generalized in all Group countries.

The improvement in customer satisfaction is reflected in an

increase of +4 points in Group NPS® since end-June, after an

increase of +3 points in the first six months of the year.

In France, Carrefour rapidly deployed the 5/5/5 since the

beginning of the summer. The NPS® increased by +7 points in the

last three months. All formats improved, particularly hypermarkets.

This improvement reflects the first benefits of the method and

supports the acceleration of LFL growth (+3.8%).

Price competitiveness: Continued

price investments

Since 2018, Carrefour has made significant investments in the

competitiveness of its offer. Good levels of price competitiveness

have been achieved in many countries, notably in Latin America,

Spain and Eastern Europe. These investments contributed to the

strong commercial momentum in the quarter.

In Q3, the Group continued to invest in

prices in most countries, in particular:

- In France: Carrefour continues to defend purchasing power. On

top of past initiatives, the Group notably improved its price

positioning in fruits and vegetables during the summer

- In Brazil: Atacadão has reinforced its price leadership versus

its direct competitors since June

- In Belgium: Launch of the “Healthy prices” campaign on

Carrefour-branded products

The Group intends to continue strengthening its competitiveness,

particularly in France.

Particular attention is paid to Carrefour-branded products, which contribute to

purchasing power and price perception. The penetration of

Carrefour-branded products increased by +2 points at the end of

September 2020 (vs. end of September 2019) to 29% of sales.

Strong growth in

food-e-commerce: Up more than +65% in Q3

Food e-commerce has significantly accelerated in recent months

and grew by more than +65% at Group level in the third quarter.

- In Brazil, food e-commerce grew by more than +200%. Carrefour

is building a leadership position on this market

- In France, growth was above +45%. Carrefour notably

strengthened its leadership in the home delivery segment

- In Spain, Carrefour posted c.+60% growth and gained market

share

In order to meet the increase in demand, Carrefour continues to

increase order preparation and delivery capacities in all

geographies:

- Deployment of the network of drives: 2,102 at the end of September (i.e. +406

since the beginning of the year)

- Development of home delivery in

all Group countries, including full coverage in Spain and the

opening of new cities in France (86, of which +7 in Q3)

- Strengthening of express delivery,

directly (France, Poland with Carrefour Sprint, Belgium and Romania

with Bringo) or with partners (Glovo, Uber Eats, Rappi, Cornershop,

etc.) in all Group countries

- Acceleration in the automation and

mechanization of order preparation, in warehouses and

stores, with partners such as Dematic and Exotec in France

- Signing of an exclusive partnership in Belgium with Food-X

technologies Inc., in order to increase the productivity and

profitability of its e-commerce operations

Carrefour continues to work on improving its productivity. The

high growth allows better absorption of fixed costs. Thus,

e-commerce has already contributed to the growth in recurring

operating income during the first half of the year.

Organic and healthy products:

Carrefour further reinforces its leadership

Carrefour continues to outperform the organic product market1,

with sales growth of + 20% over the first nine months.

On September 21, Carrefour strengthened its support for French

organic products by forging new partnerships with 6 French

cooperatives and 3 industrialists for its Carrefour Bio brand.

On October 13, Carrefour announced the acquisition of Bioazur by

its subsidiary So.bio. Bioazur is a network of 5 stores

specializing in the distribution of organic products, in the South

West of France. The So.bio network is now deployed in 23 points of

sale compared to 8 at the time of acquisition and should exceed 30

points of sale by the end of 2020.

On October 19, Carrefour launched the personalized INNIT

nutritional score. After the food blockchain and the affixing of

Nutriscore, this new service is one more step in the Act for Food

program to allow consumers to be better informed and make smarter

choices for a healthy diet.

Financial discipline: Cost

reduction momentum, contained investments and solid balance

sheet

Since the launch of the Carrefour 2022 plan, the Group has

developed a culture of financial discipline:

- Cost reduction momentum continued in the third quarter. At the

end of June 2020, the Group had made savings of €2,440m since the

start of the plan. The savings target was thus raised to €3.0bn by

the end of 2020. This momentum will continue beyond 2020

- Carrefour is also vigilant with regard to the selectivity and

productivity of its investments, whose budget should be contained

below €1.5bn in 2020

Since 2018, Carrefour has demonstrated great financial

discipline and has strengthened its balance sheet and liquidity. It

has one of the strongest balance sheets in the industry. This is an

important asset in the current context, marked by rapid changes in

food distribution and the COVID-19 pandemic.

- Moody’s reaffirmed the Baa1 rating with negative outlook on

September 29

- In addition, the Group was rated BBB stable outlook by Standard

& Poor’s at the end of September

Targeted acquisitions: new

growth and value creation engine

Bolstered by its balance sheet, its further strengthened

know-how and its solid market positions, Carrefour is positioned as

a natural consolidator in the regions in which it is present. The

Group is more attentive than ever to opportunities for

moderate-sized acquisition opportunities, offering perfect

complementarity with its existing activities. The acquisitions of

Makro in Brazil, Wellcome in Taiwan and more recently Supersol in

Spain, carried out under attractive financial conditions, are

perfect illustrations of this strategy.

- At the end of August, Carrefour signed an agreement to acquire

172 stores under the Supersol banner in Spain, thus strengthening

its number 2 position in the country. This new acquisition allows

Carrefour to accelerate its development in its growth formats. The

transaction is subject to customary conditions and closing is

expected in early 2021

- Grupo Carrefour Brasil received on September 16 the agreement

of the local competition authority (CADE) for the acquisition of 30

Makro stores in Brazil. The transaction is expected to close in Q4

2020

- The decision of the competition authorities on the acquisition

of Wellcome in Taiwan is expected in Q4 2020

While remaining very selective, this policy of targeted

acquisitions can, over time, be an opportunity for additional

profitable growth.

CARREFOUR, A COMMITTED COMPANY

Carrefour continues to build a model that creates sustainable

value for all of its stakeholders.

Leader in the food transition for

all: On track to achieve the 2020 objectives of the "CSR and

Food Transition" index

Our progress on the main indicators of the "CSR and Food

Transition" index reinforces our confidence in reaching the 2020

objectives. Carrefour has made particular progress on the following

indicators:

- Reduction of packaging: 5,660 tons of packaging saved since

2017 against a target of 10,000 tons by 2025, of which 1,565 since

beginning 2020

- Carrefour Quality Line: Carrefour continues to grow with 7.3%

penetration in fresh products at the end of September 2020, against

6.6% at the end of December 2019

- Reduction of food waste: Carrefour confirms its objective of

reducing food waste by 50% by 2025 (vs 2016), with an 8% reduction

in H1 2020 (vs H1 2019)

- Recovery of in-store waste: The rate of waste recovered in our

stores increased by 4.4 points in Q3 2020 and reached 70.9% of

waste recovery compared to 66.5% at the end of 2019

Exceptional mobilization in the face of

the crisis: Certification of strong protection

measures

Faced with the COVID-19 pandemic, Carrefour teams have

demonstrated exceptional responsiveness to ensure the continuity of

food distribution, then meet new consumer expectations in a complex

and rapidly-changing environment.

The Group immediately implemented strong measures to protect the

health of employees and customers. Carrefour continues to adapt to

the new sanitary provisions and rules recommended by public

authorities in each country.

- In Spain, Carrefour was the first company to obtain AENOR

certification in June. The Group was distinguished for the

effectiveness of its security measures aimed at offering safe

shopping spaces to its customers

- In September, Carrefour Brazil became the first company in the

retail sector in Brazil to be recognized with the international My

Care label, developed by DNV GL, which attests to the effectiveness

and safety of the measures adopted by the company for the

protection of its customers and employees in all stores

- In France, Carrefour launched in September a labeling program

for the COVID-19 health measures implemented in its stores and

within its supply chain, a program verified by AFNOR Certification.

AFNOR Certification teams are currently auditing Carrefour

hypermarkets, Carrefour Market and the warehouses. The labeling

phase will end in mid-November 2020

PROSPECTS AND OBJECTIVES

Carrefour remains attentive to the evolution of the COVID-19

pandemic and its impact.

At this stage, Carrefour anticipates for 2020 sustained

commercial momentum and an improvement in the operating leverage of

retail activities. They benefit from the success of the Carrefour

2022 plan in a resilient market context. Carrefour's omnichannel

and multi-format positioning and its commitment to the food

transition are perfectly in line with current consumer trends.

Due to the crisis, financial services, other services and B2B

sales in Europe should however weigh on full-year 2020 results.

The Group reiterates the orientations of the Carrefour 2022

strategic plan and confirms all of its objectives.

Operational objectives :

- Improvement in the Group NPS® of +15 points over 2020-22

period, i.e. +23 points since the start of the plan

- Reduction of 350,000 sq. m of hypermarket sales area worldwide

by 2022

- -15% reduction in assortments by 2020

- Carrefour-branded products accounting for one-third of food

sales in 2022

- 2,700 convenience store openings by 2022

End-2019

End-September 2020

Objective

Operational objectives

Improvement in the Group NPS®

+8 points

+15 points

+23 points by 2022

Reduction of hypermarket sales

area

115,000 sq. m

133,000 sq. m

350,000 sq. m by 2022

Reduction in assortments

-10%

-12%

-15% by 2020

Sales of Carrefour-branded

products

27% of sales +2 points yoy

29% of sales +2 points yoy

1/3 of sales by 2022

Convenience store openings

+1,042

+1,697

+2,700 by 2022

Financial objectives :

- €4.2bn in food e-commerce sales in 2022

- €4.8bn in sales of organic products in 2022

- Three-year cost-reduction plan raised to €3.0bn on an annual

basis by end 2020. Continued cost-reduction momentum beyond

2020

- €300m in additional disposals of non-strategic real estate

assets by 2022

AGENDA

- Fourth-quarter 2020 sales and full year 2020 results: February

18, 2021

APPENDIX

THIRD-QUARTER 2020 SALES INC. VAT

The Group's sales amounted to €19,690m pre-IAS 29. Foreign

exchange had an unfavorable impact in the third quarter of -8.0%,

largely due to the depreciation of the Brazilian Real and the

Argentine Peso. Petrol had an unfavorable impact of -2.9%. The

calendar effect was an unfavorable -0.2%. Openings contributed for

+1.1%. The impact of the application of IAS 29 was -€49m.

Sales inc. VAT (€m)

Variation ex petrol ex

calendar

Total variation inc.

petrol

LFL

Organic

at current exchange

rates

at constant exchange

rates

France

9,676

+3.8%

+3.2%

-0.9%

-0.9%

Hypermarkets

4,876

+2.5%

+2.1%

-1.3%

-1.3%

Supermarkets

3,226

+4.9%

+3.8%

+0.2%

+0.2%

Convenience /other formats

1,575

+5.4%

+5.3%

-2.0%

-2.0%

Other European countries

5,813

+1.9%

+1.9%

-0.3%

+0.2%

Spain

2,581

+6.3%

+6.3%

+2.7%

+2.7%

Italy

1,101

-8.0%

-9.5%

-9.8%

-9.8%

Belgium

1,064

+5.4%

+5.6%

+4.8%

+4.8%

Poland

498

-1.4%

-1.6%

-4.7%

-2.0%

Romania

570

+0.0%

+3.9%

+1.5%

+3.9%

Latin America (pre-IAS 29)

3,614

+28.4%

+31.8%

-10.2%

+29.5%

Brazil

3,070

+26.0%

+30.0%

-10.7%

+27.3%

Argentina (pre-IAS 29)

544

+41.4%

+41.5%

-7.8%

+42.0%

Asia

587

+0.6%

+3.5%

+2.3%

+1.4%

Taiwan

587

+0.6%

+3.5%

+2.3%

+1.4%

Group total (pre-IAS 29)

19,690

+8.4%

+8.9%

-2.5%

+5.5%

IAS 29(1)

-49

Group total (post-IAS 29)

19,641

Note : (1) hyperinflation and currencies

NINE-MONTH 2020 SALES INC. VAT

The Group's sales amounted to €57,845m pre-IAS 29. Foreign

exchange had an unfavorable impact of -6.3% in the first nine

months of the year, largely due to the depreciation of the

Argentine Peso and the Brazilian Real. Petrol had an unfavorable

impact of -3.5%. The calendar effect was a favorable +0.1%.

Openings contributed for +1.2%. The impact of the application of

IAS 29 was -€125m.

Sales inc. VAT (€m)

Variation ex petrol ex

calendar

Total variation inc.

petrol

LFL

Organic

LFL

Organic

France

27,864

+2.9%

+2.2%

-2.3%

-2.3%

Hypermarkets

13,827

-0.1%

-0.6%

-5.0%

-5.0%

Supermarkets

9,461

+5.7%

+4.2%

-0.2%

-0.2%

Convenience /other formats

4,576

+6.2%

+6.6%

+2.0%

+2.0%

Other European countries

17,177

+4.2%

+4.0%

+1.6%

+2.0%

Spain

7,217

+7.5%

+7.5%

+3.2%

+3.2%

Italy

3,477

-4.4%

-5.9%

-6.8%

-6.8%

Belgium

3,310

+9.2%

+9.2%

+9.3%

+9.3%

Poland

1,503

+0.9%

+0.5%

-3.1%

-0.4%

Romania

1,671

+2.3%

+5.3%

+3.6%

+5.6%

Latin America (pre-IAS 29)

11,077

+22.2%

+25.4%

-7.5%

+23.7%

Brazil

9,294

+16.4%

+20.3%

-9.0%

+18.4%

Argentina (pre-IAS 29)

1,783

+53.9%

+53.3%

+1.4%

+53.7%

Asia

1,727

+1.6%

+5.7%

+8.6%

+4.3%

Taiwan

1,727

+1.6%

+5.7%

+8.6%

+4.3%

Group total (pre-IAS 29)

57,845

+7.5%

+7.8%

-1.9%

+4.4%

IAS 29(1)

-125

Group total (post-IAS 29)

57,720

Note : (1) hyperinflation and currencies

Application of IAS 29 - Accounting treatment of

hyperinflation for Argentina

The impact on Q3 2020 sales is presented in the table below:

Sales incl. VAT (€m)

2019 pre-IAS 29(1)

LFL(2)

Calendar

Openings

Scope and others(3)

Petrol

2020 at constant rates pre-IAS

29

Forex

2020 at current rates pre-IAS

29

IAS 29(4)

2020 at current rates post-IAS

29

Q1

18,819

+7.8%

+0.9%

+1.3%

-0.8%

-1.5%

+7.5%

-4.2%

19,445

-10

19,435

Q2

19,974

+6.3%

-0.4%

+1.2%

-1.0%

-5.8%

+0.3%

-6.7%

18,710

-66

18,644

H1

38,793

+7.0%

+0.2%

+1.3%

-0.9%

-3.7%

+3.8%

-5.5%

38,155

-76

38,079

Q3

20,199

+8.4%

-0.2%

+1.1%

-0.9%

-2.9%

+5.5%

-8.0%

19,690

-49

19,641

9M

58,992

+7.5%

+0.1%

+1.2%

-0.9%

-3.5%

+4.4%

-6.3%

57,845

-125

57,720

Notes: (1) restated for IFRS 5; (2) excluding petrol and

calendar effects and at constant exchange rates; (3) including

transfers; (4) hyperinflation and currencies

EXPANSION UNDER BANNERS – THIRD-QUARTER 2020

Thousands of sq. m

Dec 31. 2019

June 30 2020

Openings/ Store

enlargements

Acquisitions

Closures/ Store

reductions

Total Q3 2020 change

Sept. 30 2020

France

5,475

5,466

+14

+2

-14

+2

5,469

Europe (ex France)

5,596

6,082

+57

-

-33

+24

6,106

Latin America

2,616

2,640

+10

-

-2

+8

2,648

Asia

1,050

1,045

-

-

-13

-13

1,032

Others2

1,379

1,403

+19

-

-

+19

1,422

Group

16,116

16,637

+101

+2

-62

+40

16,677

STORE NETWORK UNDER BANNERS – THIRD-QUARTER 2020

N° of stores

Dec. 31 2019

June 30 2020

Openings

Acquisitions

Closures/ Disposals

Transfers

Total Q3 2020 change

Sept. 30 2020

Hypermarkets

1,207

1,207

+2

-

-3

-1

-2

1,205

France

248

248

-

-

-

-

-

248

Europe (ex France)

455

455

+1

-

-1

-1

-1

454

Latin America

188

185

-

-

-

-

-

185

Asia

175

174

-

-

-2

-

-2

172

Others2

141

145

+1

-

-

-

+1

146

Supermarkets

3,344

3,375

+50

+1

-14

+1

+38

3,413

France

1,071

1,073

+4

+1

-4

-

+1

1,074

Europe (ex France)

1,798

1,823

+35

-

-9

+1

+27

1,850

Latin America

150

151

-

-

-1

-

-1

150

Asia

9

9

-

-

-

-

-

9

Others2

316

319

+11

-

-

-

+11

330

Convenience stores

7,261

7,665

+134

+8

-78

-

+64

7,729

France

3,959

3,933

+56

+8

-27

-

+37

3,970

Europe (ex France)

2,646

3,078

+76

-

-41

-

+35

3,113

Latin America

530

528

+2

-

-6

-

-4

524

Asia

68

69

-

-

-4

-

-4

65

Others2

58

57

-

-

-

-

-

57

Cash & carry

413

422

+6

-

-

+6

428

France

146

146

+1

-

-

-

+1

147

Europe (ex France)

60

62

+3

-

-

-

+3

65

Latin America

193

200

+2

-

-

-

+2

202

Asia

-

-

-

-

-

-

-

-

Others2

14

14

-

-

-

-

-

14

Group

12,225

12,669

+192

+9

-95

-

+106

12,775

France

5,424

5,400

+61

+9

-31

-

+39

5,439

Europe (ex France)

4,959

5,418

+115

-

-51

-

+64

5,482

Latin America

1,061

1,064

+4

-

-7

-

-3

1,061

Asia

252

252

-

-

-6

-

-6

246

Others2

529

535

+12

-

-

-

+12

547

DEFINITIONS

Free cash-flow

Free cash flow corresponds to cash flow from operating

activities before net finance costs and net interests related to

lease commitment, after the change in working capital, less net

cash from/(used in) investing activities.

Net free cash-flow

Net free cash flow corresponds to free cash flow after net

finance costs and net lease payments.

Like for like sales growth (LFL)

Sales generated by stores opened for at least twelve months,

excluding temporary store closures, at constant exchange rates,

excluding petrol and calendar effects and excluding IAS 29

impact.

Organic sales growth

Like for like sales growth plus net openings over the past

twelve months, including temporary store closures, at constant

exchange rates.

Gross margin

Gross margin corresponds to the sum of net sales and other

income, reduced by loyalty program costs and cost of goods sold.

Cost of sales comprise purchase costs, changes in inventory, the

cost of products sold by the financial services companies,

discounting revenue and exchange rate gains and losses on goods

purchased.

Recurring Operating Income (ROI)

Recurring Operating Income corresponds to the gross margin

lowered by sales, general and administrative expenses, depreciation

and amortization.

Recurring Operating Income Before Depreciation and

Amortization (EBITDA)

Recurring Operating Income Before Depreciation and Amortization

(EBITDA) also excludes depreciation and amortization from supply

chain activities which is booked in cost of goods sold.

Operating Income (EBIT)

Operating Income (EBIT) corresponds to the recurring operating

income after income from associates and joint ventures and

non-recurring income and expenses. This latter classification is

applied to certain material items of income and expense that are

unusual in terms of their nature and frequency, such as impairment

of non-current assets, gains and losses on sales of non-current

assets, restructuring costs and provisions recorded to reflect

revised estimates of risks provided for in prior periods, based on

information that came to the Group’s attention during the reporting

year.

® Net Promoter, Net Promoter System, Net Promoter Score, NPS and

the NPS-related emoticons are registered trademarks of Bain &

Company, Inc., Fred Reichheld and Satmetrix Systems, Inc

DISCLAIMER

This press release contains both historical and forward-looking

statements. These forward-looking statements are based on Carrefour

management's current views and assumptions. Such statements are not

guarantees of future performance of the Group. Actual results or

performances may differ materially from those in such forward

looking statements as a result of a number of risks and

uncertainties, including but not limited to the risks described in

the documents filed with the Autorité des Marchés Financiers as

part of the regulated information disclosure requirements and

available on Carrefour's website (www.carrefour.com), and in

particular the Annual Report (Document de Référence). These

documents are also available in English on the company's website.

Investors may obtain a copy of these documents from Carrefour free

of charge. Carrefour does not assume any obligation to update or

revise any of these forward-looking statements in the future.

1 Source: Nielsen for France and Belgium 2 Africa, Middle East

and Dominican Republic.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201027006302/en/

Investor Relations Selma Bekhechi, Anthony Guglielmo and

Antoine Parison Tel : +33 (0)1 64 50 82 57 Shareholder

Relations Tel : 0 805 902 902 (toll-free in France) Group

Communication Tel : +33 (0)1 58 47 88 80

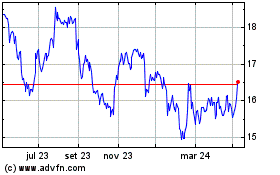

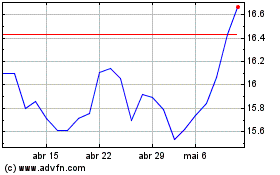

Carrefour (EU:CA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Carrefour (EU:CA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024