Ace Capital Partners Launches Spain-focused Aerospace & Defence Private Equity Fund With SEPI, Airbus, Indra & Tikehau Capita...

09 Junho 2021 - 6:36AM

Business Wire

- SEPI, Airbus, Indra and Tikehau Capital will invest in a

newly-launched private equity aerospace and defence Spanish fund

managed by Ace: “Ace Aerofondo IV F.C.R.”, as Strategic

Partners

- The initiative is sponsored by SEPI, the investment arm of the

Spanish government, Airbus, the leading global player in aerospace

and defence and Indra, key technological partner in defence

- Ace will draw on the expertise and knowledge of Airbus, Indra

and SEPI through the creation of a Strategic Committee - to provide

Ace with intelligence on sector trends, opportunities and

risks

Regulatory News:

Ace Capital Partners, a private equity firm

specialised in strategic industries and technologies and subsidiary

of Tikehau Capital (Paris:TKO), announces today the launch of Ace

Aerofondo IV F.C.R., with SEPI, Airbus, Indra and Tikehau Capital

as investors. This new private equity fund will invest in lower and

upper midmarket companies active in the Spanish aerospace and

defence sector.

Ace Capital Partners will act as manager of the fund, which will

invest in both Support Capital (niche players with the ability to

grow organically) and Platform Capital (consolidation platforms to

become leaders in their markets through external growth)

strategies. Ace is currently investing its 4th vintage of aerospace

and defence funds, with a focus on Western Europe and with France

and Spain as its core markets. Ace invests in strategic industries

and technologies, applying a sector-focused approach and providing

strategic and operational support to its portfolio companies. Ace

seeks to grow intrinsic value of its investments through engagement

over the long term. Ace Aerofondo IV will replicate this approach

as it benefits from the recovery of the aerospace and defence

sector in the wake of the Covid-19 crisis.

A first closing for €100 million of initial commitments will

take place in June 2021. Tikehau Capital and SEPI have both

invested €33.3 million along with the two other Strategic Partners,

Airbus and Indra, which have invested €28.3 million and €5.0

million respectively. The target size is €150-200 million. The fund

follows the longstanding model of Tikehau Capital, whereby the

group invests its own capital in the funds managed by its group

entities, to ensure a full alignment of interests between the firm

and its investors.

Marwan Lahoud, Executive Chairman of Ace Capital

Partners, declared: “The aerospace sector will recover from

this crisis. We remain unwavering in our commitment to the sector

as it navigates the post-Covid era and we are pleased to manage

this fund which is perfectly in line with our objective to protect,

strengthen and secure this key industry for Spain, with SEPI,

Airbus and Indra as sponsors as well as Tikehau Capital.”

Carmen Alonso, head of Iberia and UK for Tikehau Capital

added: “Tikehau Capital is committed to helping the aerospace

sector in Spain. We are delighted to partner with SEPI, Airbus and

Indra to contribute to the recovery of the sector and ensure the

technological competitiveness and strategic importance of the

Spanish aerospace and defence sector.”

***

About Ace Capital

Partners

Ace Capital Partners, a subsidiary of Tikehau Capital, is a

private equity firm specialised in strategic industries and

technologies, with more than €1 billion in assets under management.

Founded in 2000, Ace invests with a vertical approach in strategic

industries (e.g. Aerospace, Defense and technologies (e.g.

Cybersecurity). Ace has built its model on strategic partnerships

with large corporates (including Airbus, Safran, Dassault Aviation,

Thales, EDF, Naval Group, and Sopra Steria), which invest in its

funds and maintain an ongoing dialogue with the firm, enabling Ace

to take a differentiated approach to investing.

Ace is present in Paris, Toulouse and Montreal and benefits from

the worldwide presence of Tikehau Capital. www.ace-cp.com

About Tikehau Capital

Tikehau Capital is a global alternative asset management group

with €29.4 billion of assets under management (at 31 March 2021).

Tikehau Capital has developed a wide range of expertise across four

asset classes (private debt, real assets, private equity and

capital markets strategies) as well as multi-asset and special

opportunities strategies. Tikehau Capital is a founder-led team

with a differentiated business model, a strong balance sheet,

proprietary global deal flow and a track record of backing high

quality companies and executives. Deeply rooted in the real

economy, Tikehau Capital provides bespoke and innovative

alternative financing solutions to companies it invests in and

seeks to create long-term value for its investors. Leveraging its

strong equity base (€2.8 billion of shareholders’ equity at 31

December 2020), the firm invests its own capital alongside its

investor-clients within each of its strategies. Controlled by its

managers alongside leading institutional partners, Tikehau Capital

is guided by a strong entrepreneurial spirit and DNA, shared by its

607 employees (at 31 March 2021) across its 12 offices in Europe,

Asia and North America.

Tikehau Capital is listed in compartment A of the regulated

Euronext Paris market (ISIN code: FR0013230612; Ticker:

TKO.FP).

For more information, please visit: www.tikehaucapital.com

Disclaimer: This document

does not constitute an offer of securities for sale or investment

advisory services. It contains general information only and is not

intended to provide general or specific investment advice. Past

performance is not a reliable indicator of future earnings and

profit, and targets are not guaranteed. Certain statements and

forecasted data are based on current forecasts, prevailing market

and economic conditions, estimates, projections and opinions of

Tikehau Capital and/or its affiliates. Due to various risks and

uncertainties. actual results may differ materially from those

reflected or expected in such forward-looking statements or in any

of the case studies or forecasts. All references to Tikehau

Capital’s advisory activities in the US or with respect to US

persons relate to Tikehau Capital North America.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210609005411/en/

Press Contacts Ace Capital

Partners: Audrey Hood - +33 1 73 31 30 10 - ahood@ace-cp.com

Tikehau Capital: Valérie Sueur – +33 1 40 06 39 30 –

press@tikehaucapital.com UK – Prosek Partners: Henrietta Dehn – +44

7717 281 665 - hdehn@prosek.com

Shareholder and Investor contacts –

Tikehau Capital: Louis Igonet – +33 1 40 06 11 11

shareholders@tikehaucapital.com

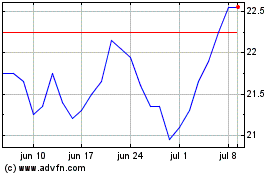

Tikehau Capital (EU:TKO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

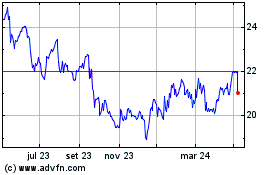

Tikehau Capital (EU:TKO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024