Customer-Focused Connectivity Across Europe,

Innovative Technology, Experienced Local Teams

Mastercard (NYSE: MA) today announced it has entered into an

agreement to acquire Aiia, a leading European open banking

technology provider offering a direct connection to banks through a

single API, allowing its customers to develop and launch new

digital solutions that meet the needs of everyday life, work and

play.

Open banking is democratizing financial services by putting

consumers at the center of where and how their data is used to

provide the services they want and need. Fintechs and banks use

this consumer permissioned data to provide easier and more

inclusive access to credit, personal financial management, digital

wallets and payments services. Mastercard plays a central role in

this ecosystem as a trusted intermediary and secure data

network.

“The value of open banking comes through empowering consumers

and businesses to use their own data to obtain financial services

solutions simply, securely and quickly. The addition of Aiia

anchors our European open banking efforts and allows us to continue

to meet our customers where they are,” said Craig Vosburg, Chief

Product Officer, Mastercard. “As open banking continues to ignite

innovation, we’re committed to providing a unique set of technology

platforms, data connectivity and infrastructure combined with data

privacy and security principles. This will help fintechs and

financial institutions innovate, gather feedback and scale faster

and more effectively than ever to power smarter, more meaningful

experiences.”

Today, Aiia’s open banking platform and expertise, including

strong API connectivity and payment capabilities, has shown

significant growth coupled with a relentless focus on quality. Aiia

has brought to life a unique model for open banking in Europe,

driven by data privacy, security, quality and access. Its

customer-centric approach and ambition to create open banking that

simply works complements Mastercard’s existing distribution

channels, technology and data practices.

“For the past decade, we have worked to build Aiia into a

leading and quality-driven open banking platform, which has

onboarded hundreds of banks and fintechs onto safe and secure open

banking rails. We have worked closely alongside banks, customers

and local authorities to ensure that our APIs show the true effect

of open banking. We’re excited to become a part of Mastercard and

progress our journey of empowering people to bring their financial

data and accounts into play - safely and transparently,” said Rune

Mai, CEO & Founder, Aiia.

Solidifying a Foundation for Innovation

Mastercard was an early advocate of open banking across the

globe. The company has made bold moves to blend its proprietary

technology and multi-rail payments expertise with strong partners

offering complementary services. In 2019, Mastercard launched its

first open banking connectivity offering in the UK and Poland

through a partnership with Token.

With the acquisition of Finicity in 2020, Mastercard bolstered a

strong commitment to its customers by bringing together top-tier

technology platforms, dedicated resources and a global

infrastructure to catalyze innovation and continue to deliver

localized customer service. This commitment continued earlier in

2021 with Mastercard Payment Services, a broader set of

account-to-account payment and open banking capabilities gained in

the acquisition of the majority of Nets’ Corporate Services

business.

Aiia’s expertise in providing safe and secure data access

complements Mastercard’s data responsibility principles, continuing

to put the individual at the center of the process. This

relationship reinforces work led by Mastercard’s Finicity team to

extend data-related best practices across multiple industries. The

connectivity of Aiia in Europe will enable Mastercard to deliver

the credit decisioning and credit scoring applications of Finicity

to European clients. Similarly, the connectivity of Finicity in the

U.S. will help deliver the account information services and payment

applications of Aiia to U.S. clients – giving customers globally

easier, faster and safer access to open banking services.

“We have been very satisfied with our co-ownership and

partnership with Aiia, which has helped to create user-friendly

open banking solutions for the benefit of our customers. We are

pleased that Mastercard sees the potential in Aiia and are

convinced that they will be the right future owner to support the

development of the company and Aiia’s ambitions for European

expansion. We look forward to the continued collaboration with

Mastercard/Aiia on solutions that support open banking and that

provide real value for Danske Bank’s customers across the Nordic

markets,” said Glenn S�derholm, Head of Personal & Business

Customers, Danske Bank.

Benjamin K Golding, Group Executive Vice President, Payments

& Innovation, DNB also added, “DNB Ventures aims to contribute

growth and value in companies that with time can succeed within

areas relevant to DNB. We have been investors in Aiia since 2018

and DNB is also an important customer of the company. We are very

pleased with Aiia’s development, while with the company entering a

new phase it is natural for us as venture investors to exit, given

our focus on early-stage investments and value creation through

capital, knowledge and input to strategy and business development.

With Mastercard as owners, Aiia will benefit from a strong global

platform positioned for continued growth, and we are looking

forward to continuing our business relationship with

Mastercard/Aiia going forward.”

Aiia is a licensed Payment Initiation Service Provider (PISP)

and Account Information Service Provider (AISP) and operates under

the supervision of the Danish Financial Supervisory Authority

(FSA).

The transaction, which is anticipated to close by year’s end, is

subject to customary closing conditions. Terms of the agreement

were not disclosed.

About Mastercard

Mastercard is a global technology company in the payments

industry. Our mission is to connect and power an inclusive, digital

economy that benefits everyone, everywhere by making transactions

safe, simple, smart, and accessible. Using secure data and

networks, partnerships and passion, our innovations and solutions

help individuals, financial institutions, governments, and

businesses realize their greatest potential. Our decency quotient,

or DQ, drives our culture and everything we do inside and outside

of our company. With connections across more than 210 countries and

territories, we are building a sustainable world that unlocks

priceless possibilities for all. www.mastercard.com

About Aiia

Aiia is a leading open banking platform in Europe, with more

than a decade of experience in fintech and with hundreds of clients

servicing both businesses and consumers. The mission of Aiia is to

empower people to bring their financial data and accounts into play

safely and transparently. Aiia’s platform allows businesses and

financial institutions to integrate financial data and

account-to-account payments into their services for millions of

European citizens. Today, Aiia has connections to more than 2,700

banks across Europe, processes more than 10 million bank logins,

and more than a million account-to-account payments every month for

large banks and e-commerce payment gateways. Aiia provides open

banking services to a long list of banks, challenger banks,

fintechs, accounting system providers and payment companies. Aiia

won the award for Best Mobile Payment Solution at Finovate Awards

in 2020 for live open banking payment solutions built with its

customers.

Forward-Looking Statements

This press release contains forward-looking statements pursuant

to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. All statements other than statements of

historical facts may be forward-looking statements. When used in

this press release, the words “believe,” “expect,” “could,” “may,”

“would,” “will,” “trend” and similar words are intended to identify

forward-looking statements. Examples of forward-looking statements

include, but are not limited to, statements that relate to

Mastercard’s future prospects, developments, and business

strategies, as well as Mastercard’s acquisition and operation of

Aiia. We caution you to not place undue reliance on these

forward-looking statements, as they speak only as of the date they

are made. Except for the company’s ongoing obligations under the

U.S. federal securities laws, the company does not intend to update

or otherwise revise the forward-looking information to reflect

actual results of operations, changes in financial condition,

changes in estimates, expectations or assumptions, changes in

general economic or industry conditions or other circumstances

arising and/or existing since the preparation of this press release

or to reflect the occurrence of any unanticipated events.

Many factors and uncertainties relating to the proposed

transaction, our operations, and our business environment, all of

which are difficult to predict and many of which are outside of our

control, influence whether any forward-looking statements can or

will be achieved. Any one of these factors could cause our actual

results or the impact of the acquisition to differ materially from

those expressed or implied in writing in any forward-looking

statements made by Mastercard or on its behalf. Such factors

related to the completion and impact of the acquisition include,

but are not limited to, whether all necessary conditions will be

met, and whether the transaction will close on agreed terms and in

a timely manner.

For additional information on other factors related to

Mastercard’s overall business that could cause Mastercard’s actual

results to differ materially from expected results, please see the

company’s filings with the Securities and Exchange Commission,

including the company’s Annual Report on Form 10-K for the year

ended December 31, 2020, and any subsequent reports on Forms 10-Q

and 8-K.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210907005536/en/

Mastercard Investor Relations Contact Jud Staniar,

914-249-4565 investor.relations@mastercard.com

Mastercard Communications Contact Seth Eisen,

914-249-3153 Seth.Eisen@mastercard.com

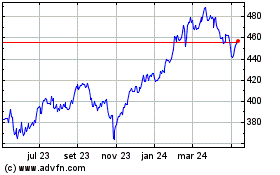

MasterCard (NYSE:MA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

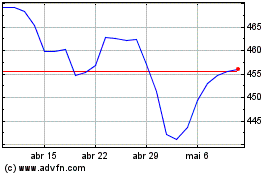

MasterCard (NYSE:MA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024