Vertiv Holdings Co (“Vertiv”) (NYSE: VRT), a global provider of

critical digital infrastructure and continuity solutions, today

announced the pricing of the previously announced underwritten

secondary offering of 20,000,000 shares of Vertiv’s Class A common

stock by VPE Holdings, LLC (“Platinum”), an affiliate of Platinum

Equity, LLC, pursuant to an effective registration statement on

file with the Securities and Exchange Commission (the “SEC”). In

connection with the offering, Platinum has granted to the

underwriters a 30-day option to purchase up to 3,000,000 additional

shares of Vertiv’s Class A common stock.

The closing of the offering is expected to occur on or about

November 4, 2021 (the “Closing”), subject to customary closing

conditions. Following the Closing, Platinum will remain Vertiv’s

largest stockholder, owning at least 36,880,215 shares of Class A

common stock, representing an economic interest of approximately

9.8% in Vertiv. Vertiv is not selling any shares of Class A common

stock in the offering and will not receive any proceeds from the

offering. J.P. Morgan Securities LLC, Goldman Sachs & Co. LLC

and Citigroup are acting as joint book-running managers of, and as

the underwriters for, the offering.

Vertiv has filed a registration statement (including a

prospectus) with the SEC for the offering to which this

communication relates, and the offering may only be made by means

of such written prospectus. Before you invest, you should read the

prospectus included in the registration statement on file with the

SEC and other documents Vertiv has filed with the SEC for more

complete information about Vertiv and this offering. Copies of

these documents may be obtained for free by visiting EDGAR on the

SEC website at www.sec.gov. Alternatively, Vertiv, any underwriter,

or any dealer participating in the offering will arrange to send

these documents if contacted at: J.P. Morgan Securities LLC, c/o

Broadridge Financial Solutions, Attn: Prospectus Department, 1155

Long Island Avenue, Edgewood, NY 11717, or telephone:

1-866-803-9204, or by email at prospectus-eq_fi@jpmchase.com,

Goldman Sachs & Co. LLC, Prospectus Department, 200 West

Street, New York, New York 10282, telephone: 1-866-471-2526,

facsimile: 212-902-9316, or by emailing

prospectus-ny@ny.email.gs.com, or Citigroup, c/o Broadridge

Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717

(telephone: 1-800-831-9146).

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any securities in any state or

jurisdiction in which such an offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About Vertiv Holdings Co

Vertiv (NYSE: VRT) brings together hardware, software, analytics

and ongoing services to ensure its customers’ vital applications

run continuously, perform optimally and grow with their business

needs. Vertiv solves the most important challenges facing today’s

data centers, communication networks and commercial and industrial

facilities with a portfolio of power, cooling and IT infrastructure

solutions and services that extends from the cloud to the edge of

the network. Headquartered in Columbus, Ohio, USA, Vertiv employs

approximately 21,000 people and does business in more than 130

countries.

Category: Financial News

Cautionary Note Concerning

Forward-Looking Statements

This news release, and other statements that Vertiv may make in

connection therewith, may contain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act. This

includes, without limitation, statements regarding the financial

position, capital structure, indebtedness, business strategy and

plans and objectives of Vertiv management for future operations, as

well as statements regarding growth, anticipated demand for our

products and services and our business prospects during 2021, as

well as expected cost savings and synergies associated with the

acquisition of E&I. These statements constitute projections,

forecasts and forward-looking statements, and are not guarantees of

performance. Vertiv cautions that forward-looking statements are

subject to numerous assumptions, risks and uncertainties, which

change over time. Words such as “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,”

“might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “strive,” “would” and similar expressions may identify

forward-looking statements. Vertiv undertakes no obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

may be required under applicable securities laws.

The forward-looking statements contained or incorporated by

reference in this press release are based on current expectations

and beliefs concerning future developments and their potential

effects on Vertiv. There can be no assurance that future

developments affecting Vertiv will be those that Vertiv has

anticipated. Should one or more of these risks or uncertainties

materialize, or should any of the assumptions prove incorrect,

actual results may vary in material respects from those projected

in these forward-looking statements. Vertiv has previously

disclosed risk factors in its SEC reports. These risk factors and

those identified elsewhere in this press release, among others,

could cause actual results to differ materially from historical

performance.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211102005682/en/

For investor inquiries, please contact:

Lynne Maxeiner Vice President, Global Treasury & Investor

Relations Vertiv T +1 614-841-6776 E: lynne.maxeiner@vertiv.com

For media inquiries, please contact:

Scott Deitz FleishmanHillard for Vertiv T +1 336-908-7759 E:

scott.deitz@fleishman.com

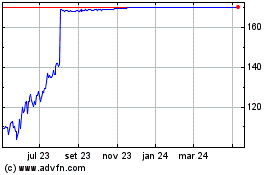

Veritiv (NYSE:VRTV)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Veritiv (NYSE:VRTV)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024