Quad Amends and Extends Bank Debt Agreement to November 2026

02 Novembro 2021 - 5:30PM

Business Wire

Quad/Graphics, Inc. (NYSE: QUAD) (“Quad/Graphics” or the

“Company”), announced today that it has completed the fifth

amendment to the Company’s April 28, 2014, bank debt agreement to:

(1) reduce the aggregate amount of the existing revolving credit

facility from $500 million to $432.5 million, and extend the

maturity of a portion of the revolving credit facility such that

$90.0 million under the revolving credit facility will be due on

the existing maturity date of January 31, 2024 (the “Existing

Maturity Date”) and $342.5 million under the revolving credit

facility will be due on November 2, 2026 (the “Extended Maturity

Date”); (2) extend the maturity of a portion of the existing term

loan facility such that $91.5 million of such term loan facility

will be due on the Existing Maturity Date and $483.9 million will

be due on the Extended Maturity Date; (3) make certain adjustments

to pricing, including an increase of .50% to the interest rate

margin applicable to the loans maturing on the Extended Maturity

Date; (4) modify certain financial and operational covenants; and

(5) modify the interest rate provisions relating to the phase-out

of LIBOR as a reference rate.

Dave Honan, Quad Executive Vice President and Chief Financial

Officer, said: “We are pleased to have completed the amendment of

our $1 billion bank debt agreement this week, which extends the

existing maturity to November 2026. We are proud of our strong and

trusted banking relationships, which provide us with increased

financial flexibility to continue to pay down debt while also

giving us the ability to make strategic investments to accelerate

our position as a marketing solutions partner.”

JPMorgan Chase Bank, N.A., BOFA Securities, Inc., BMO Capital

Markets Corp., Citizens Bank, N.A., Fifth Third Bank, PNC Capital

Markets LLC, and U.S. Bank National Association were the Lead

Arrangers of the bank debt agreement. Foley & Lardner LLP

served as legal counsel for the Company, and Sidley Austin LLP

served as legal counsel for the lenders.

Forward-Looking Statements This press release contains

certain “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements include statements regarding, among other things, our

current expectations about the Company’s future results, financial

condition, sales, earnings, free cash flow, margins, objectives,

goals, strategies, beliefs, intentions, plans, estimates,

prospects, projections and outlook of the Company and can generally

be identified by the use of words or phrases such as “may,” “will,”

“expect,” “intend,” “estimate,” “anticipate,” “plan,” “foresee,”

“project,” “believe,” “continue” or the negatives of these terms,

variations on them and other similar expressions. These

forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause actual results to

be materially different from those expressed in or implied by such

forward-looking statements. Forward-looking statements are based

largely on the Company’s expectations and judgments and are subject

to a number of risks and uncertainties, many of which are

unforeseeable and beyond our control.

The factors that could cause actual results to materially differ

include, among others: the negative impacts the coronavirus

(COVID-19) has had and will continue to have on the Company’s

business, financial condition, cash flows, results of operations

and supply chain, as well as the global economy in general

(including future uncertain impacts); the impact of decreasing

demand for printed materials and significant overcapacity in a

highly competitive environment creates downward pricing pressures

and potential underutilization of assets; the impact of digital

media and similar technological changes, including digital

substitution by consumers; the impact of increases in costs

(including labor and labor-related costs, energy costs, freight

rates and raw materials, including paper and the materials to

manufacture ink) and the impact of fluctuations in the availability

of raw materials, including paper and the materials to manufacture

ink; the impact of inflationary cost pressures and supply chain

shortages; the inability of the Company to reduce costs and improve

operating efficiency rapidly enough to meet market conditions; the

impact of the various restrictive covenants in the Company’s debt

facilities on the Company’s ability to operate its business, as

well as the uncertain negative impacts COVID-19 may have on the

Company’s ability to continue to be in compliance with these

restrictive covenants; the impact of increased business complexity

as a result of the Company’s transformation to a marketing

solutions partner; the impact negative publicity could have on our

business; the failure to successfully identify, manage, complete

and integrate acquisitions, investment opportunities or other

significant transactions, as well as the successful identification

and execution of strategic divestitures; the failure of clients to

perform under contracts or to renew contracts with clients on

favorable terms or at all; the impact of changing future economic

conditions; the fragility and decline in overall distribution

channels; the impact of changes in postal rates, service levels or

regulations, including delivery delays due to ongoing COVID-19

impacts on daily operational staffing at the United States Postal

Service; the failure to attract and retain qualified talent across

the enterprise; the impact of regulatory matters and legislative

developments or changes in laws, including changes in

cyber-security, privacy and environmental laws; significant capital

expenditures may be needed to maintain the Company’s platforms and

processes and to remain technologically and economically

competitive; the impact of risks associated with the operations

outside of the United States, including costs incurred or

reputational damage suffered due to improper conduct of its

employees, contractors or agents; the impact of an other than

temporary decline in operating results and enterprise value that

could lead to non-cash impairment charges due to the impairment of

property, plant and equipment and intangible assets; the impact on

the holders of Quad’s class A common stock of a limited active

market for such shares and the inability to independently elect

directors or control decisions due to the voting power of the class

B common stock; and the other risk factors identified in the

Company’s most recent Annual Report on Form 10-K, which may be

amended or supplemented by subsequent Quarterly Reports on Form

10-Q or other reports filed with the Securities and Exchange

Commission.

Except to the extent required by the federal securities laws,

the Company undertakes no obligation to publicly update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise.

About Quad Quad (NYSE: QUAD) is a worldwide marketing

solutions partner that leverages its 50-year heritage of platform

excellence, innovation, strong culture and social purpose to create

a better way for its clients, employees and communities. The

Company’s integrated marketing platform helps brands and marketers

reduce complexity, increase efficiency and enhance marketing spend

effectiveness. Quad provides its clients with unmatched scale for

client on-site services and expanded subject expertise in marketing

strategy, creative solutions, media deployment (which includes a

strong foundation in print) and marketing management services. With

a client-centric approach that drives the Company to continuously

evolve its offering, combined with leading-edge technology and

single-source simplicity, the Company has the resources and

knowledge to help a wide variety of clients in multiple vertical

industries, including retail, publishing, consumer technology,

consumer packaged goods, financial services, insurance, healthcare

and direct-to-consumer. Quad has multiple locations throughout

North America, South America and Europe, and strategic partnerships

in Asia and other parts of the world. For additional information,

visit www.QUAD.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211102006216/en/

Katie Krebsbach Investor Relations Manager, Quad 414-566-4247

kkrebsbach@quad.com

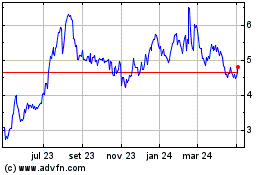

Quad Graphics (NYSE:QUAD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

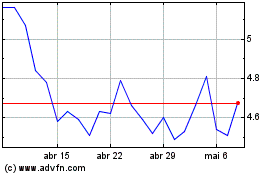

Quad Graphics (NYSE:QUAD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024