Demonstrates Execution of Complementary Product

Growth and Profit Expansion Priorities

Enhances GMS’s Offerings to Professional

Drywall Contractors

GMS Inc. (NYSE: GMS) (“GMS” or the “Company”), a leading

North American specialty distributor of interior building products,

today announced that it has entered into a definitive agreement to

acquire AMES Taping Tools Holding LLC (“AMES”). AMES is the

nation’s foremost provider of automatic taping and finishing

(“ATF”) tools and related products to the professional drywall

finishing industry. The transaction is expected to close in the

Company’s fiscal third quarter 2022 with a purchase price of $212.5

million in cash.

AMES provides a distinctive complement to GMS’s current

offerings, significantly expanding the Company’s presence in the

attractive tools and fasteners market. AMES’s portfolio includes

the industry-leading finishing tool brand, TapeTech®, and the top

specialty interior finishing e-commerce platform, All-Wall®. For

the twelve months ended September 30, 2021, AMES achieved net sales

of approximately $100 million.

“We are pleased to welcome the AMES team to GMS and provide a

full suite of offerings for interior contractors and drywall

finishers,” said John C. Turner, Jr., President and Chief Executive

Officer of GMS. “AMES has highly-respected brands and an

entrepreneurial culture with an attractive growth plan, which all

align well with our strategic priorities and provide an excellent

opportunity for GMS to expand our presence in the growing ATF tools

market. With its multichannel distribution model and strong

customer relationships, AMES is expected to generate accretive

EBITDA margins for GMS. We believe this transaction will add

immediate benefits as part of one of our strategic growth

priorities to diversify our core product offerings, and will

further position GMS to drive long-term growth and shareholder

value.”

Jay Davisson, President and CEO of AMES added, “We are excited

about the opportunity to join the GMS team. Like GMS, customer

service has been a cornerstone of the AMES business since our

founding over 80 years ago. Building on our strong, existing

relationships, we are excited to bring our customer-first culture

and deep industry matter expertise to GMS to create a best-in-class

product and service experience for our customers and growth

opportunities for employees.”

AMES services customers through its multichannel distribution

model including:

1. AMES

Stores – supplies, supports and services residential and

commercial interior finishing applications through a network of

more than 85 store locations that sell drywall finishing products

and provide drywall contractors with the option to purchase or rent

ATF tools from a 100,000-tool fleet shared by AMES stores

platform-wide.

2. Dealer

Distribution – sales of market-leading TapeTech®

Automatic Taping and Finishing Tools and related TapeTech® branded

products through dealers and distributors, including a significant

relationship with GMS’s subsidiary, Tool Source Warehouse.

3. All-Wall®

E-Commerce Platform – Leading E-Commerce retailer of

specialty interior finishing tools and related products.

Transaction Details, Leadership and Closing

GMS expects to fund this transaction with cash on hand and

borrowings under the Company's ABL credit facility. In connection

with this transaction, GMS will be exercising the $100 million

accordion within the Company's ABL agreement, increasing the ABL

borrowing limit from $445 million to $545 million.

Following the closing of the transaction, AMES’s current

management team, including President & CEO Jay Davisson, will

continue to lead the business, which will continue to operate under

the “AMES” brand – as it has for over 80 years.

GMS expects to leverage its existing relationship with AMES and

the sourcing arrangements at GMS’s subsidiary, Tool Source

Warehouse, to expand and enhance AMES’s distribution model, better

capitalize on available growth opportunities and provide an even

higher level of service to customers.

This transaction is expected to close in GMS’s fiscal third

quarter of 2022, subject to the satisfaction of customary closing

conditions, including clearance under the Hart-Scott-Rodino

Antitrust Improvements Act of 1976.

About GMS

Celebrating the 50th anniversary of its founding in 1971, GMS

operates a network of more than 280 distribution centers across the

United States and Canada. GMS’s extensive product offering of

wallboard, suspended ceilings, steel framing and complementary

construction products is designed to provide a comprehensive

one-stop-shop for our core customer, the interior contractor who

installs these products in commercial and residential buildings.

For more information about GMS, please visit www.gms.com.

Forward-Looking Statements and Information:

This press release includes "forward-looking statements" within

the meaning of the Private Securities Litigation Reform Act of

1995. You can generally identify forward-looking statements by our

use of forward-looking terminology such as "anticipate," "believe,"

"continue," "could," "estimate," "expect," "intend," "may,"

"might," "plan," "potential," "predict," "seek," or "should," or

the negative thereof or other variations thereon or comparable

terminology. Forward-looking statements relating to the acquisition

include, but are not limited to: statements about the benefits of

the acquisition, including anticipated growth of AMES’ business,

certain synergies and future financial and operating results;

potential financing for the acquisition; GMS’ plans, objectives,

expectations, projections and intentions, the expected timing of

completion of the acquisition; and other statements relating to the

transaction that are not historical facts. We have based these

forward-looking statements on our current expectations,

assumptions, estimates and projections. While we believe these

expectations, assumptions, estimates, and projections are

reasonable, such forward-looking statements are only predictions

and involve known and unknown risks and uncertainties, many of

which are beyond our control. Forward-looking statements involve

risks and uncertainties, including those factors described in the

"Risk Factors" section in our filings with the SEC. We undertake no

obligation to update any of the forward-looking statements made

herein, whether as a result of new information, future events,

changes in expectation or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211103006254/en/

Investors: Carey Phelps ir@gms.com 770-723-3369

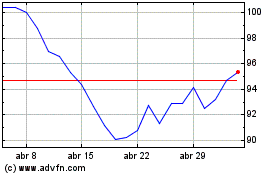

GMS (NYSE:GMS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

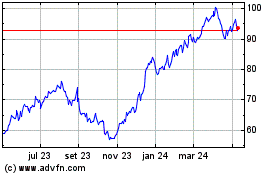

GMS (NYSE:GMS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024