Citi Launches New Report on Global Supply Chain Disruptions

15 Dezembro 2021 - 7:00AM

Business Wire

Latest Report analyses the impact supply chain

disruptions has had across multiple sectors

Citi has today launched its latest Global Perspectives &

Solutions (Citi GPS) report titled: Global Supply Chains: The

Complicated Road Back to “Normal.”

The report details the challenges that have emerged for supply

chains as a result of the COVID-19 pandemic and highlights the

hardest hit sectors and what their road to recovery looks like.

The report identifies a number of macroeconomic factors that

came into play during the pandemic to disrupt supply chains

including supply-chain management practices, shifts in consumption

towards goods, monetary and fiscal stimulus by the public sector

spurring aggregate demand, the emergence of the Delta variant, and

commodity shocks that have amplified other supply-side pressures.

It also acknowledges the speed at which these disruptions have

cascaded around the world.

Nathan Sheets, Citi’s Global Chief Economist, commented: “The

pandemic brought a sustained substitution in consumer spending

towards goods. Coupled with the sizable macroeconomic stimulus,

this has driven the demand for goods well above supply in many

sectors. The recovery from the pandemic, as well as the actions

taken to support the economy, have created a situation where the

demand for goods has run well ahead of their supply. The resulting

supply-side disruptions are, at least in part, the result of firms

desperately trying to catch up.”

The report goes on to say that supply-chain pressures are at a

point where they have stopped getting worse; however, there is

currently no sign of any substantial improvements. It argues that

the global inventory system was not designed to absorb the highly

uneven stops and starts in demand and production that the pandemic

has caused, and notes that the ongoing global vaccination campaign

is a critical contributor to an eventual easing of supply-chain

pressures.

Shahmir Khaliq, Global Head of Citi’s Treasury and Trade

Solutions, commented: “The supply chain disruptions globally are

the byproduct of multiple events including national lockdowns, port

congestion, and labor and energy shortages, layered on top of

rising geopolitical tensions. As different parts of the world

reopen their borders, lift restrictions, and resume manufacturing

operations, we see an imbalance of supply and demand in the market.

Suppliers and sellers are struggling to keep up with the demand

from reopened economies.”

The report advises that corporates will need to review their

supply chains based on lessons learned from the pandemic. Doing

this will likely lead to a further embrace of digitization and

electronic tracking of inventories and logistics, greater emphasis

on long-term alliances and partnerships with suppliers, inventory

management strategies that shift towards holding larger inventory

buffers, simplifying supply chains and bringing them closer to

home, as well as a reduction in global integration, as nations try

to protect their national economies from the next shock.

Shahmir Khaliq continues: “Even before the pandemic, we had

witnessed a major acceleration in the adoption of technology,

including digitization, data analysis, and tools like application

programming interfaces (APIs). COVID-19 has emphasized the benefits

of this adoption on many levels. Citi has continued to push

innovation, investing in digital solutions to enhance the client

onboarding and implementation experience, develop new self-service

capabilities, and leverage data to empower clients.”

The digital copy of the report is available here

-ENDS-

About Citi

Citi, the leading global bank, has approximately 200 million

customer accounts and does business in more than 160 countries and

jurisdictions. Citi provides consumers, corporations, governments

and institutions with a broad range of financial products and

services, including consumer banking and credit, corporate and

investment banking, securities brokerage, transaction services, and

wealth management.

Additional information may be found at www.citigroup.com |

Twitter: @Citi | YouTube: www.youtube.com/citi | Blog:

blog.citigroup.com | Facebook: www.facebook.com/citi | LinkedIn:

www.linkedin.com/company/citi

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211215005402/en/

Belinda Marks Belinda.marks@citi.com Gabe Morales

gabriel.morales@citi.com Nina Das nina.das@citi.com Francesco

Meucci Francesco.meucci@citi.com

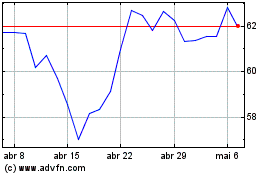

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

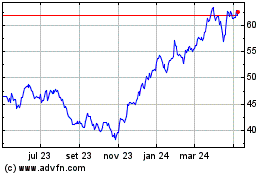

Citigroup (NYSE:C)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024