Regulatory News:

Pernod Ricard (Paris:RI):

Press release - Paris, 28 April 2022

9 Month Sales

Sales for the first 9 months of FY22 totalled €8,407m,

with an organic growth of +18%, with strong price/mix:

- Very dynamic Must-win domestic markets, with USA at

+13%, enhanced by phasing; India maintaining strong growth +19% and

China +12% following softer CNY impacted by Covid and a high

comparison basis

- Excellent growth in Europe with some deceleration in

March notably due to impacts of conflict in Ukraine

- Rest of World sees very strong growth in LATAM,

Africa-Middle East and Asia, notably Korea and Japan

- Travel Retail at +33% with increasing passenger traffic

outside of China.

By category:

- Strategic International Brands: excellent performance

+20% (Q3 +22%), driven by Jameson, Martell, Chivas Regal, Absolut,

Ballantine’s and The Glenlivet

- Strategic Local Brands: +14% (Q3 +15%), delivering

notably strong growth in Q3 of Blender’s Pride, Royal Stag and

Passport

- Specialty Brands: +28% (Q3 +45%), with very dynamic

performance across portfolio notably US Whiskeys, Malfy, Monkey 47,

Avion, Lillet, Redbreast and Del Maguey

- Strategic Wines: -3% (Q3 +3%), overall soft in

particular due to New Zealand lower harvest

Reported 9M Sales grew +21% with a favourable FX impact

of €191m. For full-year FY22, a positive FX impact on Profit

from Recurring Operations of c. €110m is expected1.

Sales for the third quarter of FY22 totalled €2,447m,

with an organic growth of +20% and a reported growth of

+25%.

Dividend

An interim dividend of €1.56 per share will be detached

on 6 July 2022 and paid on 8 July 2022. The final dividend

will be subject to the AGM decision on 10 November 2022.

Alexandre Ricard, Chairman and Chief Executive Officer,

stated,

“Our Q3 was very strong and continues the broad-based

performance we enjoyed in the first half, with all our regions and

Must-win markets showing very strong growth.

The global environment remains volatile with an increasingly

challenging and inflationary context. We expect a softer Q4

impacted by Covid disruptions in China, phasing normalization in

the US and conflict in Ukraine.

Overall we expect for FY22 a strong diversified Sales momentum

across the Regions due to On-trade rebound, Off-trade resilience

and a continuing recovery in Travel Retail.

We are increasing investments to fuel growth momentum.

Accordingly we are providing full year guidance for FY22 of an

organic growth in Profit from recurring Operations of c. +17% with

some operating margin expansion.”

All growth data specified in this press release refers to

organic growth, unless otherwise stated. Data may be subject to

rounding.

A detailed presentation can be downloaded from our website:

www.pernod-ricard.com

Definitions and reconciliation of non-IFRS measures to IFRS

measures

Pernod Ricard’s management process is based on the following

non-IFRS measures which are chosen for planning and reporting. The

Group’s management believes these measures provide valuable

additional information for users of the financial statements in

understanding the Group’s performance. These non-IFRS measures

should be considered as complementary to the comparable IFRS

measures and reported movements therein.

Organic growth

- Organic growth is calculated after

excluding the impacts of exchange rate movements, acquisitions and

disposals and changes in applicable accounting principles. -

Exchange rates impact is calculated by translating the current year

results at the prior year’s exchange rates. - For acquisitions in

the current year, the post-acquisition results are excluded from

the organic movement calculations. For acquisitions in the prior

year, post-acquisition results are included in the prior year but

are included in the organic movement calculation from the

anniversary of the acquisition date in the current year. - Where a

business, brand, brand distribution right or agency agreement was

disposed of, or terminated, in the prior year, the Group, in the

organic movement calculations, excludes the results for that

business from the prior year. For disposals or terminations in the

current year, the Group excludes the results for that business from

the prior year from the date of the disposal or termination. - This

measure enables to focus on the performance of the business which

is common to both years and which represents those measures that

local managers are most directly able to influence.

Profit from recurring

operations

Profit from recurring operations corresponds to the operating

profit excluding other non-current operating income and

expenses.

About Pernod Ricard

Pernod Ricard is the No.2 worldwide producer of wines and

spirits with consolidated sales amounting to €8,824 million in

fiscal year FY21. The Group, which owns 16 of the Top 100 Spirits

Brands, holds one of the most prestigious and comprehensive

portfolios in the industry with over 240 premium brands distributed

across more than 160 markets. Pernod Ricard’s portfolio includes

Absolut vodka, Ricard pastis, Ballantine’s, Chivas Regal, Royal

Salute, and The Glenlivet Scotch whiskies, Jameson Irish whiskey,

Martell cognac, Havana Club rum, Beefeater gin, Malibu liqueur,

Mumm and Perrier-Jouët champagnes, as well Jacob’s Creek, New

Zealand wines, Campo Viejo, Mumm sparkling and Kenwood wines.

Pernod Ricard’s strategy focuses on investing in long-term and

sustainable growth for all its stakeholders, remaining true to its

founding values: entrepreneurial spirit, mutual trust, and strong

sense of ethics. The Group’s decentralised organisation empowers

its 18,500 employees to be on-the-ground ambassadors of its vision

of “Créateurs de Convivialité”. Pernod Ricard 2030 Sustainability

and Responsibility roadmap “Good Times from a Good Place” is

integrated into all its activities from grain to glass, and Pernod

Ricard is recognised as a UN Global Compact LEAD participant for

its contribution to the United Nations Sustainable Development

Goals (SDGs). Pernod Ricard is listed on Euronext (Ticker: RI; ISIN

Code: FR0000120693) and is part of the CAC 40 and Eurostoxx 50

indices.

Appendices

9M FY22 Sales by Region

Net Sales(€ millions) H1 FY21 H1 FY22

Change Organic Growth Group Structure Forex

impact Americas

1,402

28.1

%

1,638

27.5

%

+235 +17% +196 +14% +17 +1% +22 +2% Asia / Rest of the World

2,127

42.7

%

2,524

42.4

%

+397 +19% +338 +16% +0 +0% +60 +3% Europe

1,456

29.2

%

1,797

30.2

%

+341 +23% +300 +21% +19 +1% +22 +2%

World

4,985

100.0

%

5,959

100.0

%

+974 +20% +834 +17% +36

+1% +104 +2% Net Sales(€

millions) Q3 FY21 Q3 FY22 Change

Organic Growth Group Structure Forex impact

Americas

592

30.3

%

787

32.2

%

+195 +33% +140 +24% +4 +1% +52 +9% Asia / Rest of World

878

44.9

%

1,057

43.2

%

+179 +20% +148 +17% +0 +0% +31 +4% Europe

486

24.8

%

603

24.7

%

+118 +24% +96 +20% +18 +4% +4 +1%

World

1,955

100.0

%

2,447

100.0

%

+492 +25% +384 +20% +22

+1% +86 +4% Net Sales(€

millions) 9M FY21 9M FY22 Change

Organic Growth Group Structure Forex impact

Americas

1,994

28.7

%

2,425

28.8

%

+431 +22% +336 +17% +21 +1% +74 +4% Asia / Rest of the World

3,005

43.3

%

3,581

42.6

%

+576 +19% +485 +16% +0 +0% +91 +3% Europe

1,942

28.0

%

2,401

28.6

%

+459 +24% +396 +20% +37 +2% +26 +1%

World

6,941

100.0

%

8,407

100.0

%

+1,466 +21% +1,217 +18% +58

+1% +191 +3%

Foreign exchange impact on 9M FY22 Sales

Forex impact 9M FY22(€ millions)

Average rates

evolution

On Net Sales

9M FY21

9M FY22

%

US dollar USD

1.19

1.15

(3.4

)%

+72 Pound sterling GBP

0.89

0.85

(5.3

)%

+18 Chinese yuan CNY

7.93

7.36

(7.3

)%

+85 Indian rupee INR

87.62

85.82

(2.1

)%

+19 Turkish Lira TRL

8.93

12.83

+43.8%

(42

)

Russian rouble RUB

88.98

86.10

(3.2

)%

+7 Canadian Dollar CAD

1.55

1.45

(6.3

)%

+13 Other +19

Total +191

Upcoming communications (Dates are indicative and liable

to change)

10 may 2022: North America conference call

8 June 2022: Capital Market Day in Paris

1 September 2022: FY22 Sales and Results

28th April calls details

Available in the media section of Pernod Ricard’s website

1 Based on YTD average rate & projected spot rate on April

15th 2022, particularly EUR/USD = 1.13

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220427006247/en/

Florence Tresarrieu / Global SVP Investors Relations and

Treasury +33 (0) 1 70 93 17 03 Edward Mayle / Investor Relations

Director +33 (0) 1 70 93 17 13 Charly Montet / Investor Relations

Manager +33 (0) 1 70 93 17 13 Emmanuel Vouin / Head of External

Engagement +33 (0) 1 70 93 16 34

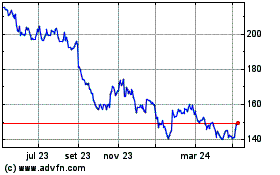

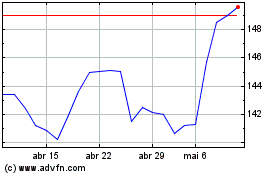

Pernod Ricard (EU:RI)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Pernod Ricard (EU:RI)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024