Egan-Jones Joins ISS in Recommending Kohl's Shareholders Vote for Boardroom Change on Macellum's WHITE Proxy Card

09 Maio 2022 - 3:34PM

Business Wire

Independent Proxy Advisory Firm Egan-Jones

Recommends Shareholders Vote to Elect Four Macellum Nominees:

Francis Ken Duane, Jonathan Duskin, Jeffrey Kantor and Pamela

Edwards

Follows Leading Independent Proxy Firm ISS

Also Finding Macellum Has Made a Compelling Case for Change and

Recommending for Multiple Macellum Nominees

As a Reminder, ISS Noted “Some Shareholders

May Consider the Addition of Macellum’s CEO, Jonathan Duskin, to

the Board as a Net Positive Given his Direct Ownership Stake and

Substantial Experience in the Retail Sector"

Macellum Urges

Shareholders to See Through Any Spin About “Unintended

Consequences” and Recognize That the Only Way to Guarantee

Incremental Boardroom Change is Effectuated is by Voting on the

WHITE Proxy Card

Macellum Advisors GP, LLC (together with its affiliates,

“Macellum” or “we”), a long-term holder of nearly 5% of the

outstanding common shares of Kohl’s Corporation (NYSE: KSS)

(“Kohl’s” or the “Company”), today announced that Egan-Jones Proxy

Services (“Egan-Jones”), an independent proxy advisory firm, has

recommended that the Company’s shareholders vote for boardroom

change on the WHITE proxy card.

In particular, Egan-Jones supports the addition of four Macellum

nominees – Francis Ken Duane, Jonathan Duskin, Jeffrey Kantor and

Pamela Edwards – to the Company’s Board of Directors (the

"Board").

Last week, Institutional Shareholder Services Inc. (“ISS”), a

leading independent proxy advisory firm, also recommended that the

Company’s shareholders vote for boardroom change on Macellum’s

WHITE proxy card. ISS supports

the addition of two Macellum nominees – Jeffrey Kantor and Pamela

Edwards – to Kohl's' Board. ISS also stated that “some shareholders

may consider the addition of Macellum’s CEO, Jonathan Duskin, to

the Board as a net positive.” 1

In its report, Egan-Jones validates a case for boardroom change

by noting the following:2

- “Despite the addition of the dissident shareholders’ two

nominees in the previous campaign, in our view, Kohl’s board has

failed to be aggressive in improving its status quo of

underperformance.”

- “In our view, the board’s lack of commitment to value creation

hinders the opportunities for growth and consideration of strategic

alternatives that could be in the best interests of the Company and

its shareholders.”

- “In our view, Kohl’s entrenched board must be liable to the

Company’s history of underperformance.”

- “Despite the clothing industry’s growth from 2011-2021, Kohl’s

remained to have an upsetting financial performance compared to its

peers. Kohl’s EBIT from 2011 to 2021 has declined 22% and EBIT has

underperformed its Retail Peer average by 128%.”

- “We believe that the incumbent board has failed to ensure that

the interests of the key individuals are aligned with the business

strategy and risk tolerance, objectives, values and long-term

interests of the Company and will be consistent with the

"pay-for-performance" principle.”

- “Given the right mix of experience in retail, mergers and

acquisitions and corporate governance, we believe that the election

of Jeff Kantor, Pamela Edwards, Jonathan Duskin and Francis Ken

Duane is in the best interests of the Company and its

shareholders.”

- “In our view, there is an urgent need for change in the board

room to cease the trend of underperformance and instead, focus on

unlocking shareholder value.”

***

VOTE THE WHITE

PROXY CARD TO ELECT MACELLUM’S ALIGNED AND EXPERIENCED

SLATE.

LEARN MORE ABOUT MACELLUM’S SLATE HERE:

WWW.KEEPKOHLSACCOUNTABLE.COM/NOMINEES

CONTACT INFO@SARATOGAPROXY.COM WITH

QUESTIONS ABOUT YOUR PROXY AND HOW TO VOTE.

***

About Macellum

Macellum Capital Management is an activist investment firm, with

deep expertise in the retail and consumer sectors, founded in 2009

by Jonathan Duskin. Macellum invests in undervalued companies that

it believes can appreciate significantly in value as a result of a

change in corporate strategy or improvements in operations, capital

allocation or corporate governance. Macellum’s investment team,

advisors and network of industry experts draw upon their extensive

strategic, operating and boardroom experience to assist companies

in designing and implementing initiatives to improve long-term

shareholder value. Macellum prefers to constructively engage with

management to improve its governance and performance for the

benefit of all stockholders. However, when management is

entrenched, Macellum has run successful proxy contests to

effectuate meaningful change. Macellum has run successful election

contests to effectuate meaningful change at many companies,

including at The Children’s Place Inc., Citi Trends, Inc., Bed Bath

and Beyond and Big Lots, Inc. Learn more at

www.macellumcapitalmanagement.com.

1 Permission to quote ISS was neither sought nor obtained. 2

Permission to quote Egan-Jones was neither sought nor obtained.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220509006073/en/

For Investors: Saratoga Proxy Consulting John Ferguson / Joe

Mills, 212-257-1311 info@saratogaproxy.com For Media: Longacre

Square Partners Greg Marose / Bela Kirpalani, 646-386-0091

macellum@longacresquare.com

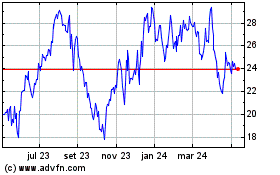

Kohls (NYSE:KSS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

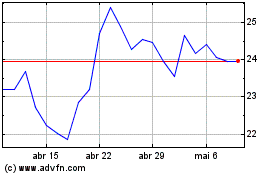

Kohls (NYSE:KSS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024