Record Levels of Net Sales, Net Income and

Adjusted EBITDA

Announces Expanded Share Repurchase

Authorization

GMS Inc. (NYSE: GMS), a leading North American specialty

building products distributor, today reported financial results for

the fourth quarter and fiscal year ended April 30, 2022.

Fourth Quarter Fiscal 2022 Highlights

(Comparisons are to the fourth quarter of fiscal 2021 unless

otherwise noted)

- Net sales of $1,288.7 million increased 38.2%; organic net

sales increased 28.9%.

- Net income of $76.5 million, or $1.75 per diluted share, was

more than double the net income of $33.7 million, or $0.77 per

diluted share, recorded a year ago; Adjusted net income of $91.3

million, or $2.09 per diluted share, compared to $46.9 million, or

$1.07 per diluted share.

- Adjusted EBITDA of $154.2 million increased $63.0 million, or

69.1%; Adjusted EBITDA margin improved 220 basis points to 12.0%

from 9.8%.

- Cash provided by operating activities of $199.5 million,

compared to $84.8 million. Free cash flow of $191.6 million,

compared with $72.8 million.

- Net debt leverage was 1.8 times as of the end of the fourth

quarter of fiscal 2022, down from 2.3 at the end of the third

quarter and down from 2.5 times at the end of the fourth quarter of

fiscal 2021.

Full Year Fiscal 2022 Highlights

(Comparisons are to the full year of fiscal 2021, unless

otherwise noted.)

- Net sales of $4,634.9 million increased 40.5%; organic net

sales increased 30.9%.

- Net income of $273.4 million, or $6.23 per diluted share,

compared to net income of $105.6 million or $2.44 per diluted

share; Adjusted net income of $328.8 million, or $7.49 per diluted

share, compared to $153.3 million, or $3.54 per diluted share.

- Adjusted EBITDA of $566.9 million increased $247.6 million, or

77.5%; Adjusted EBITDA margin improved 250 basis points to 12.2%

from 9.7%.

- The Company completed five business acquisitions, including the

acquisition of Westside Building Material, one of the largest

independent distributors of interior building products in the US

with nine locations across California and one in Nevada, as well as

the acquisition of Ames Taping Tools Holding, LLC, the leading

provider of automatic taping and finishing tools and related

products to the professional drywall finishing industry. During

fiscal 2022, the Company also opened 13 greenfield locations and

five new AMES store locations under GMS ownership.

“GMS achieved outstanding results for the fourth quarter and

full year fiscal 2022,” said John C. Turner, Jr., President and

Chief Executive Officer of GMS. “Our scale, balanced mix of

products and customers, commitment to delivering best-in-class

service and continued execution of our growth strategy, coupled

with strong residential demand and an inflationary pricing

environment, enabled us to deliver record levels of net sales, net

income and Adjusted EBITDA. We remain optimistic about the year

ahead, which, despite rising rates, is supported by a continuing

fundamental underbuild of residential housing stock as well as

signs of an improving commercial market.”

Turner continued, “We are also very pleased to announce that our

Board of Directors has approved the repurchase of up to $200

million of the Company’s common stock. This expanded authorization

demonstrates our Board’s continued confidence in the strength and

future prospects of our business. We remain focused on the

execution of our strategic priorities, including expanding our

platform through both acquisitions and greenfield opportunities, as

well as enhancing our product and service offerings and delivering

improved profitability as we leverage technology and best practices

to achieve advancements in productivity. Looking ahead, we are

committed to driving long-term shareholder value with a disciplined

capital allocation strategy that balances investing in our organic

growth initiatives, pursuing accretive M&A transactions and

opportunistically leveraging favorable market conditions for share

repurchases as they arise.

Fourth Quarter Fiscal 2022 Results

Net sales for the fourth quarter of fiscal 2022 of $1.29 billion

increased 38.2% as compared with the prior year quarter, primarily

due to inflationary pricing, healthy residential end market demand,

strong performance from our complementary products and the

acquisitions of Westside Building Material and AMES Taping Tools.

Organic net sales increased 28.9%.

Excluding the impact from one less selling day in the fourth

quarter of fiscal 2022 compared to the same period a year ago, net

sales and organic net sales were up 40.4% and 30.9%,

respectively.

Fourth quarter year-over-year sales increases by product

category were as follows:

- Wallboard sales of $491.1 million increased 30.3% (up 26.5% on

an organic basis).

- Ceilings sales of $148.9 million increased 22.7% (up 17.0% on

an organic basis).

- Steel framing sales of $276.9 million increased 93.3% (up 81.6%

on an organic basis).

- Complementary product sales of $371.8 million increased 27.9%

(up 11.1% on an organic basis).

Gross profit of $412.8 million increased 40.5% compared to the

fourth quarter of fiscal 2021, and gross margin improved 50 basis

points to 32.0%, both primarily due to the successful pass through

of product price inflation, continued strength in residential

market demand and incremental gross profit dollars along with

accretive gross margins from acquisitions.

Selling, general and administrative (“SG&A”) expense as a

percentage of net sales improved 170 basis points to 20.5% for the

quarter compared to 22.2% in the fourth quarter of fiscal 2021.

Adjusted SG&A expense as a percentage of net sales of 20.2%

improved 170 basis points from 21.9% in the prior year quarter as

product price inflation outpaced increases in operating costs.

Net income increased 126.7% to $76.5 million, or $1.75 per

diluted share, compared to net income of $33.7 million, or $0.77

per diluted share, in the fourth quarter of fiscal 2021. Adjusted

net income was $91.3 million, or $2.09 per diluted share, compared

to $46.9 million, or $1.07 per diluted share, in the fourth quarter

of the prior fiscal year.

Adjusted EBITDA increased $63.0 million, or 69.1%, to $154.2

million compared to the prior year quarter. Adjusted EBITDA margin

of 12.0% improved 220 basis points from 9.8% for the fourth quarter

of fiscal 2021.

Balance Sheet, Liquidity and Cash Flow

As of April 30, 2022, the Company had cash on hand of $101.9

million, total debt of $1.2 billion and $330.7 million of available

liquidity under its revolving credit facilities. Net debt leverage

was 1.8 times as of the end of the quarter, down from 2.5 times at

the end of the fourth quarter of fiscal 2021.

The Company generated cash from operating activities and free

cash flow of $199.5 million and $191.6 million, respectively, for

the quarter ended April 30, 2022. For the quarter ended April 30,

2021, the Company generated cash from operating activities and free

cash flow of $84.8 million and $72.8 million, respectively.

Expanded Share Repurchase Authorization

The Company’s Board of Directors has approved an expanded share

repurchase program under which the Company is authorized to

repurchase up to $200 million of its outstanding common stock. This

expanded program replaces the Company’s previous share repurchase

authorization of $75 million, which commenced in 2018, and reflects

the Board’s confidence in the business going forward. The

repurchases will be made from time to time on the open market at

prevailing market prices or in negotiated transactions off the

market.

Conference Call and Webcast

GMS will host a conference call and webcast to discuss its

results for the fourth quarter of fiscal year 2022, which ended on

April 30, 2022, and other information related to its business at

8:30 a.m. Eastern Time on Thursday, June 23, 2022. Investors who

wish to participate in the call should dial 877-407-3982 (domestic)

or 201-493-6780 (international) at least 5 minutes prior to the

start of the call. The live webcast will be available on the

Investors section of the Company’s website at www.gms.com. There

will be a slide presentation of the results available on that page

of the website as well. Replays of the call will be available

through July 23, 2022 and can be accessed at 844-512-2921

(domestic) or 412-317-6671 (international) and entering the pass

code 13728027.

About GMS Inc.

Founded in 1971, GMS operates a network of nearly 300

distribution centers with extensive product offerings of wallboard,

ceilings, steel framing and complementary construction products. In

addition, GMS operates nearly 100 tool sales, rental and service

centers, providing a comprehensive selection of building products

and solutions for its residential and commercial contractor

customer base across the United States and Canada. The Company’s

unique operating model combines the benefits of a national platform

and strategy with a local go-to-market focus, enabling GMS to

generate significant economies of scale while maintaining high

levels of customer service.

Use of Non-GAAP Financial Measures

GMS reports its financial results in accordance with GAAP.

However, it presents Adjusted net income, free cash flow, Adjusted

SG&A, Adjusted EBITDA, and Adjusted EBITDA margin, which are

not recognized financial measures under GAAP. GMS believes that

Adjusted net income, free cash flow, Adjusted SG&A, Adjusted

EBITDA, and Adjusted EBITDA margin assist investors and analysts in

comparing its operating performance across reporting periods on a

consistent basis by excluding items that the Company does not

believe are indicative of its core operating performance. The

Company’s management believes Adjusted net income, Adjusted

SG&A, free cash flow, Adjusted EBITDA and Adjusted EBITDA

margin are helpful in highlighting trends in its operating results,

while other measures can differ significantly depending on

long-term strategic decisions regarding capital structure, the tax

jurisdictions in which the Company operates and capital

investments. In addition, the Company utilizes Adjusted EBITDA in

certain calculations in its debt agreements.

You are encouraged to evaluate each adjustment and the reasons

GMS considers it appropriate for supplemental analysis. In

addition, in evaluating Adjusted net income, Adjusted SG&A and

Adjusted EBITDA, you should be aware that in the future, the

Company may incur expenses similar to the adjustments in the

presentation of Adjusted net income, Adjusted SG&A and Adjusted

EBITDA. The Company’s presentation of Adjusted net income, Adjusted

SG&A, Adjusted SG&A margin, Adjusted EBITDA, and Adjusted

EBITDA margin should not be construed as an inference that its

future results will be unaffected by unusual or non-recurring

items. In addition, Adjusted net income, free cash flow, Adjusted

SG&A and Adjusted EBITDA may not be comparable to similarly

titled measures used by other companies in GMS’s industry or across

different industries. Please see the tables at the end of this

release for a reconciliation of Adjusted EBITDA, free cash flow,

Adjusted SG&A and Adjusted net income to the most directly

comparable GAAP financial measures.

When calculating organic net sales growth, the Company excludes

from the calculation (i) net sales of acquired businesses until the

first anniversary of the acquisition date, and (ii) the impact of

foreign currency translation.

Forward-Looking Statements and Information

This press release includes “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. You can generally identify forward-looking statements by the

Company’s use of forward-looking terminology such as “anticipate,”

“believe,” “confident,” “continue,” “could,” “estimate,” “expect,”

“intend,” “may,” “might,” “plan,” “potential,” “predict,” “seek,”

or “should,” or the negative thereof or other variations thereon or

comparable terminology. In particular, statements about the markets

in which GMS operates, including in particular residential and

commercial construction, and the economy generally, pricing, the

demand for the Company’s products, the Company’s strategic

priorities and the results thereof, service levels and the ability

to drive value and results contained in this press release may be

considered forward-looking statements. In addition, forward looking

statements may include statements regarding the Company’s

expectations concerning management’s plans for execution of a stock

repurchase program, including the maximum amount, manner and

duration of the purchase of the Company’s common stock under its

authorized stock repurchase program. The Company has based

forward-looking statements on its current expectations,

assumptions, estimates and projections. While the Company believes

these expectations, assumptions, estimates, and projections are

reasonable, such forward-looking statements are only predictions

and involve known and unknown risks and uncertainties, many of

which are beyond its control, including current and future public

health issues, economic issues and geopolitical issues that may

affect the Company’s business. Forward-looking statements involve

risks and uncertainties, including, but not limited to, those

described in the “Risk Factors” section in the Company’s most

recent Annual Report on Form 10-K, and in its other periodic

reports filed with the SEC. In addition, the statements in this

release are made as of June 23, 2022. The Company undertakes no

obligation to update any of the forward-looking statements made

herein, whether as a result of new information, future events,

changes in expectation or otherwise. These forward-looking

statements should not be relied upon as representing the Company’s

views as of any date subsequent to June 23, 2022.

GMS Inc.

Condensed Consolidated

Statements of Operations (Unaudited)

(in thousands, except per

share data)

Three Months Ended

Year Ended

April 30,

April 30,

2022

2021

2022

2021

Net sales

$

1,288,653

$

932,203

$

4,634,875

$

3,298,823

Cost of sales (exclusive of depreciation

and amortization shown separately below)

875,853

638,353

3,146,600

2,236,120

Gross profit

412,800

293,850

1,488,275

1,062,703

Operating expenses:

Selling, general and administrative

264,473

207,321

950,125

763,629

Depreciation and amortization

32,365

28,221

119,232

108,125

Total operating expenses

296,838

235,542

1,069,357

871,754

Operating income

115,962

58,308

418,918

190,949

Other (expense) income:

Interest expense

(14,267

)

(12,726

)

(58,097

)

(53,786

)

Gain on legal settlement

—

—

—

1,382

Write-off of debt discount and deferred

financing fees

—

(4,606

)

—

(4,606

)

Other income, net

1,227

714

3,998

3,155

Total other expense, net

(13,040

)

(16,618

)

(54,099

)

(53,855

)

Income before taxes

102,922

41,690

364,819

137,094

Provision for income taxes

26,426

7,944

91,377

31,534

Net income

$

76,496

$

33,746

$

273,442

$

105,560

Weighted average common shares

outstanding:

Basic

42,977

42,994

43,075

42,765

Diluted

43,776

43,828

43,898

43,343

Net income per common share:

Basic

$

1.78

$

0.78

$

6.35

$

2.47

Diluted

$

1.75

$

0.77

$

6.23

$

2.44

GMS Inc.

Condensed Consolidated Balance

Sheets (Unaudited)

(in thousands, except per

share data)

April 30,

2022

April 30,

2021

Assets

Current assets:

Cash and cash equivalents

$

101,916

$

167,012

Trade accounts and notes receivable, net

of allowances of $9,346 and $6,282, respectively

750,046

558,661

Inventories, net

550,953

357,054

Prepaid expenses and other current

assets

20,212

19,525

Total current assets

1,423,127

1,102,252

Property and equipment, net of accumulated

depreciation of $227,288 and $193,364, respectively

350,679

311,326

Operating lease right-of-use assets

153,271

118,413

Goodwill

695,897

576,330

Intangible assets, net

454,747

350,869

Deferred income taxes

17,883

15,715

Other assets

8,795

8,993

Total assets

$

3,104,399

$

2,483,898

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

367,315

$

322,965

Accrued compensation and employee

benefits

107,925

72,906

Other accrued expenses and current

liabilities

127,938

87,138

Current portion of long-term debt

47,605

46,018

Current portion of operating lease

liabilities

38,415

33,474

Total current liabilities

689,198

562,501

Non-current liabilities:

Long-term debt, less current portion

1,136,585

932,409

Long-term operating lease liabilities

112,161

90,290

Deferred income taxes, net

46,802

12,728

Other liabilities

55,155

63,508

Total liabilities

2,039,901

1,661,436

Commitments and contingencies

Stockholders' equity:

Common stock, par value $0.01 per share,

500,000 shares authorized; 42,773

and 43,073 shares issued and outstanding

as of April 30, 2022 and 2021, respectively

428

431

Preferred stock, par value $0.01 per

share, 50,000 shares authorized; 0 shares issued

and outstanding as of April 30, 2022 and

2021

—

—

Additional paid-in capital

522,136

542,737

Retained earnings

547,977

274,535

Accumulated other comprehensive income

(loss)

(6,043

)

4,759

Total stockholders' equity

1,064,498

822,462

Total liabilities and stockholders'

equity

$

3,104,399

$

2,483,898

GMS Inc.

Condensed Consolidated

Statements of Cash Flows (Unaudited)

(in thousands)

Year Ended April 30,

2022

2021

Cash flows from operating

activities:

Net income

$

273,442

$

105,560

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

119,232

108,125

Write-off and amortization of debt

discount and debt issuance costs

2,744

7,568

Equity-based compensation

17,354

12,872

Gain on disposal of assets

(913

)

(1,011

)

Deferred income taxes

(351

)

(10,329

)

Other items, net

5,706

1,552

Changes in assets and liabilities net of

effects of acquisitions:

Trade accounts and notes receivable

(162,118

)

(101,617

)

Inventories

(156,311

)

(46,660

)

Prepaid expenses and other assets

(92

)

(2,621

)

Accounts payable

28,423

65,446

Accrued compensation and employee

benefits

32,564

4,477

Other accrued expenses and liabilities

19,931

9,942

Cash provided by operating activities

179,611

153,304

Cash flows from investing

activities:

Purchases of property and equipment

(41,082

)

(29,873

)

Proceeds from sale of assets

1,922

2,262

Acquisition of businesses, net of cash

acquired

(348,050

)

(35,976

)

Cash used in investing activities

(387,210

)

(63,587

)

Cash flows from financing

activities:

Repayments on revolving credit

facilities

(1,178,897

)

(102,189

)

Borrowings from revolving credit

facilities

1,390,222

14,750

Payments of principal on long-term

debt

(5,110

)

(8,754

)

Payments of principal on finance lease

obligations

(31,365

)

(30,371

)

Borrowings from term loan

—

511,000

Repayments of term loan

—

(869,427

)

Issuance of Senior Notes

—

350,000

Repurchases of common stock

(35,488

)

(4,160

)

Debt issuance costs

—

(6,299

)

Proceeds from exercises of stock

options

4,434

7,559

Payments for taxes related to net share

settlement of equity awards

(2,850

)

(807

)

Proceeds from issuance of stock pursuant

to employee stock purchase plan

2,332

2,076

Cash provided by (used in) financing

activities

143,278

(136,622

)

Effect of exchange rates on cash and cash

equivalents

(775

)

3,008

Decrease in cash and cash equivalents

(65,096

)

(43,897

)

Cash and cash equivalents, beginning of

year

167,012

210,909

Cash and cash equivalents, end of year

$

101,916

$

167,012

Supplemental cash flow disclosures:

Cash paid for income taxes

$

86,288

$

46,417

Cash paid for interest

46,204

49,650

GMS Inc.

Net Sales by Product Group

(Unaudited)

(dollars in thousands)

Three Months Ended

Year Ended

April 30,

2022

% of

Total

April 30,

2021

% of

Total

April 30,

2022

% of

Total

April 30,

2021

% of

Total

Wallboard

$ 491,062

38.1%

$ 376,926

40.4%

$ 1,710,851

36.9%

$ 1,346,648

40.8%

Ceilings

148,869

11.6%

121,286

13.0%

567,700

12.2%

451,766

13.7%

Steel framing

276,901

21.5%

143,266

15.4%

1,027,941

22.2%

469,048

14.2%

Complementary products

371,821

28.8%

290,725

31.2%

1,328,383

28.7%

1,031,361

31.3%

Total net sales

$ 1,288,653

$ 932,203

$ 4,634,875

$ 3,298,823

GMS Inc.

Reconciliation of Net Income

to Adjusted EBITDA (Unaudited)

(in thousands)

Three Months Ended

Year Ended

April 30,

April 30,

2022

2021

2022

2021

Net income

$

76,496

$

33,746

$

273,442

$

105,560

Interest expense

14,267

12,726

58,097

53,786

Write-off of debt discount and deferred

financing fees

—

4,606

—

4,606

Interest income

(96

)

(29

)

(163

)

(86

)

Provision for income taxes

26,426

7,944

91,377

31,534

Depreciation expense

14,993

13,572

55,437

50,480

Amortization expense

17,372

14,649

63,795

57,645

EBITDA

$

149,458

$

87,214

$

541,985

$

303,525

Stock appreciation expense(a)

1,277

621

4,403

3,173

Redeemable noncontrolling interests(b)

898

226

1,983

1,288

Equity-based compensation(c)

2,718

1,708

10,968

8,442

Severance and other permitted costs(d)

463

322

1,132

2,948

Transaction costs (acquisitions and

other)(e)

(344

)

279

3,545

1,068

Gain on disposal of assets(f)

(439

)

(482

)

(913

)

(1,011

)

Effects of fair value adjustments to

inventory(g)

217

788

3,818

788

Gain on legal settlement

—

—

—

(1,382

)

Debt transaction costs(h)

—

532

—

532

EBITDA addbacks

4,790

3,994

24,936

15,846

Adjusted EBITDA

$

154,248

$

91,208

$

566,921

$

319,371

Net sales

$

1,288,653

$

932,203

$

4,634,875

$

3,298,823

Adjusted EBITDA Margin

12.0

%

9.8

%

12.2

%

9.7

%

___________________________________

(a)

Represents changes in the fair value of

stock appreciation rights.

(b)

Represents changes in the fair values of

noncontrolling interests.

(c)

Represents non-cash equity-based

compensation expense related to the issuance of share-based

awards.

(d)

Represents severance expenses and other

costs permitted in the calculation of Adjusted EBITDA under the ABL

Facility and the Term Loan Facility, including certain unusual,

nonrecurring costs and credits due to COVID-19.

(e)

Represents costs related to acquisitions

paid to third parties.

(f)

Includes gains from the sale of

assets.

(g)

Represents the non-cash cost of sales

impact of acquisition accounting adjustments to increase inventory

to its estimated fair value.

(h)

Represents costs paid to third-party

advisors related to debt refinancing activities.

GMS Inc.

Reconciliation of Cash

Provided By Operating Activities to Free Cash Flow

(Unaudited)

(in thousands)

Three Months Ended

Year Ended

April 30,

April 30,

2022

2021

2022

2021

Cash provided by operating activities

$

199,498

$

84,808

$

179,611

$

153,304

Purchases of property and equipment

(7,921

)

(12,016

)

(41,082

)

(29,873

)

Free cash flow (a)

$

191,577

$

72,792

$

138,529

$

123,431

________________________________________

(a) Free cash flow is a non-GAAP financial

measure that we define as net cash provided by (used in) operations

less capital expenditures.

GMS Inc.

Reconciliation of Selling,

General and Administrative Expense to Adjusted SG&A

(Unaudited)

(in thousands)

Three Months Ended

Year Ended

April 30,

April 30,

2022

2021

2022

2021

Selling, general and administrative

expense

$

264,473

$

207,321

$

950,125

$

763,629

Adjustments

Stock appreciation expense(a)

(1,277

)

(621

)

(4,403

)

(3,173

)

Redeemable noncontrolling interests(b)

(898

)

(226

)

(1,983

)

(1,288

)

Equity-based compensation(c)

(2,718

)

(1,708

)

(10,968

)

(8,442

)

Severance and other permitted costs(d)

(476

)

(275

)

(1,216

)

(2,864

)

Transaction costs (acquisitions and

other)(e)

344

(279

)

(3,545

)

(1,068

)

Gain on disposal of assets(f)

439

482

913

1,011

Debt transaction costs(g)

—

(532

)

—

(532

)

Adjusted SG&A

$

259,887

$

204,162

$

928,923

$

747,273

Net sales

$

1,288,653

$

932,203

$

4,634,875

$

3,298,823

Adjusted SG&A margin

20.2

%

21.9

%

20.0

%

22.7

%

___________________________________

(a)

Represents changes in the fair value of

stock appreciation rights.

(b)

Represents changes in the fair values of

noncontrolling interests.

(c)

Represents non-cash equity-based

compensation expense related to the issuance of share-based

awards.

(d)

Represents severance expenses and other

costs permitted in the calculation of Adjusted EBITDA under the ABL

Facility and the Term Loan Facility, including certain unusual,

nonrecurring costs and credits due to COVID-19.

(e)

Represents costs related to acquisitions

paid to third parties.

(f)

Includes gains from the sale of

assets.

(g)

Represents costs paid to third-party

advisors related to debt refinancing activities.

GMS Inc.

Reconciliation of Income

Before Taxes to Adjusted Net Income (Unaudited)

(in thousands, except per

share data)

Three Months Ended

Year Ended

April 30,

April 30,

2022

2021

2022

2021

Income before taxes

$

102,922

$

41,690

$

364,819

$

137,094

EBITDA add-backs

4,790

3,994

24,936

15,846

Write-off of debt discount and deferred

financing fees

—

4,606

—

4,606

Acquisition accounting depreciation and

amortization (1)

13,226

10,257

45,779

40,311

Adjusted pre-tax income

120,938

60,547

435,534

197,857

Adjusted income tax expense

29,630

13,623

106,706

44,518

Adjusted net income

$

91,308

$

46,924

$

328,828

$

153,339

Effective tax rate (2)

24.5

%

22.5

%

24.5

%

22.5

%

Weighted average shares outstanding:

Basic

42,977

42,994

43,075

42,765

Diluted

43,776

43,828

43,898

43,343

Adjusted net income per share:

Basic

$

2.12

$

1.09

$

7.63

$

3.59

Diluted

$

2.09

$

1.07

$

7.49

$

3.54

________________________________________

(1)

Depreciation and amortization from the

increase in value of certain long-term assets associated with the

April 1, 2014 acquisition of the predecessor company and

amortization of intangible assets from the acquisitions of Titan,

Westside Building Material and Ames Taping Tools.

(2)

Normalized cash tax rate excluding the

impact of acquisition accounting and certain other deferred tax

amounts.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220623005115/en/

Investors: Carey Phelps ir@gms.com 770-723-3369

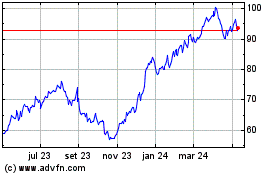

GMS (NYSE:GMS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

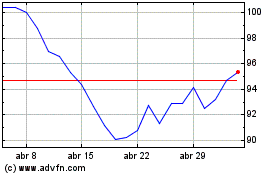

GMS (NYSE:GMS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024