- During Mr. Bradford Cooke’s tenure, there has been a consistent

destruction of shareholder value, and Canagold’s flagship project,

New Polaris, has not moved in a staggering 28 years.

- Despite their failures, Mr. Cooke and the Board plan to seek

approval for a generous option plan of 20% of the company’s common

shares – all at the expense of shareholders.

- Mr. Cooke has rejected financing offers at significant market

premiums from Sun Valley, even though the Company’s treasury is

almost empty. Instead, Mr. Cooke has been pursuing a strategy that

would encumber the project with a second royalty and has started a

needless and costly proxy fight out of a selfish interest to

maintain control of Canagold.

- It's time to stop decades of value destruction with a new,

highly qualified, independent and diverse board that will put

shareholders first.

- Vote only the BLUE proxy FOR Sun Valley’s

nominees by 5:00 p.m. on Thursday, July 14, 2002. To vote, contact

Kingsdale Advisors at 1-888-213-0093 or at

contactus@kingsdaleadvisors.com.

- Even if you have voted using the management proxy, you can

still change your vote for Sun Valley’s nominees by submitting a

BLUE proxy today.

Sunvalley Company DMCC (“Sun Valley”,

www.sunvalleyinv.com), a strategic and long-term focused investor

of Canagold Resources Ltd (TSX: CCM) (“Canagold”), today

filed on SEDAR a letter to shareholders ahead of Canagold’s annual

and special meeting on Tuesday, July 19, 2022 (the

“Meeting”).

The letter, together with the information circular and BLUE

proxy form, which will be mailed to all Canagold shareholders,

details the incumbent Board’s business and financial mismanagement

as well as Sun Valley’s plan to put Canagold on track and realize

its full potential.

Shareholders are encouraged to review the letter (included

below) and vote the BLUE proxy FOR all three of Sun Valley’s

highly-experienced, independent nominees – Dr. Carmen Letton, Ms.

Sofia Bianchi and Mr. Andrew Trow.

Don’t wait, voting is fast and easy. Please vote well in

advance of the proxy voting deadline of Thursday, July 14, 2022 at

5:00 p.m. ET. If you have questions or need help voting, contact

Kingsdale Advisors at 1-888-213-0093 or at

contactus@kingsdaleadvisors.com.

The full contents of the letter are included below:

Dear Fellow Shareholders,

Sunvalley Company DMCC (“Sun Valley”,

www.sunvalleyinv.com) are owners of approximately 17.6% of the

outstanding shares of Canagold Resources Ltd. (TSX: CCM)

(“Canagold”).

As a strategic, long-term focused investor, Sun Valley is deeply

committed to Canagold’s long-term success. We believe that we can

add significantly to the technical expertise as well as the

financial strength that Canagold currently has, which is critical

at this stage because we have a very serious challenge ahead:

getting environmental permits for an arsenic rich project (i.e.,

New Polaris). We are deeply concerned that Canagold is failing this

important milestone and it would mean that the environmental

approval could get delayed by several years and the share price

will languish.

Having invested in Canagold since November 20, 2020, we are

prepared to invest even more. Sun Valley has the financial

strength to support Canagold, and on June 15, 2022, we offered

CAD$7.6 million in equity at a 20% premium above market price or a

60% premium on a flow-through basis. Sun Valley’s offer to invest

at a premium is highly favourable to other Canagold shareholders as

it reduces dilution and adds support for a higher price. It would

also fund Canagold through the 2022 drilling season and advance the

feasibility study at New Polaris.

Canagold has a history of excessive stock dilution in the past

and it is important for Canagold shareholders to receive fresh

investment at a premium to the market price to control this

dilution. Sun Valley can provide that capital.

DISMAL STATE OF CANAGOLD AT THE HANDS

OF MR. COOKE

We believe that Canagold’s potential has been crippled by

decades of business and financial mismanagement at the hands of Mr.

Bradford Cooke and the incumbent board of directors (the

“Board”).

For 35 years, Mr. Cooke has been in charge of Canagold – first

as founder and CEO, and now as Board Chair. During his tenure,

there has been a consistent destruction of value, and Canagold’s

flagship project, New Polaris, has not moved in a staggering 28

years. The New Polaris project should have been in production by

now and generated the company a far higher stock price. A normal

timeline for resource drilling and feasibility studies would be

8-10 years. Given that triple the time has passed, what has Mr.

Cooke been doing?

Since listing on the Toronto Stock Exchange in 1994, Canagold

investors have suffered an unconscionable 98% destruction of

shareholder value. An investment at Canagold’s IPO of $100 would

now be less than $2. Meanwhile, the same investment in gold would

be worth over $460 today and the same investment in the S&P500

would be worth $750.

Despite having an excellent project, Mr. Cooke has managed to

underperform gold bullion by 23,000% and the S&P500 by

37,500%. (Click here for chart – Canagold vs. Gold and

S&P500 Normalized Returns Since Inception)

MR. COOKE REJECTED MULTIPLE PREMIUM

FINANCING OFFERS TO MAINTAIN CONTROL

As of March 31, 2022, Canagold had just US$824,000 of cash on

hand. Sun Valley has offered CAD$7.6 million in equity at a 20%

premium to market price or a 60% premium on a flow-through basis.

The offer would fund Canagold through the 2022 drilling season and

advance the feasibility study at New Polaris. Our offer is highly

favourable to other Canagold shareholders as it reduces dilution

and adds support for a higher price. But Mr. Cooke has rejected

the funding and is refusing to discuss it further, which we believe

will result in project delays and undoubtedly sentence shareholders

to watching their investment decay further in price.

Instead, Mr. Cooke has attempted to encumber the project with a

second royalty, which was omitted from Canagold’s circular. A

second royalty at an early stage of a project can result in

destruction of shareholder value and further reduce the share

price. When challenged on this plan on April 28, 2022, Mr.

Cooke responded that the addition of a second royalty “was

exclusively a management decision” and implied that the opinion of

his shareholders did not matter.

Mr. Cooke’s plans for a second royalty are highly suspicious.

The likely amount that could be raised by a 2% Net Smelter Return

(NSR) is around $4 to $6 million, which we believe is insufficient

to move the project to a construction decision. It would, however,

be enough to allow the company to hibernate for a few years.

Shareholders should question why Mr. Cooke is actively pursuing a

path that damages shareholder value with the only “advantage” being

that it allows him to maintain control.

THE CURRENT BOARD IS UNFIT TO OVERSEE

THE COMPANY

Despite multiple years on the Board, three of Canagold’s

directors hold a total of just 1.17% of the company’s shares

collectively. The incumbent Board’s lack of economic interest in

Canagold is alarming. It is telling that the incumbent Board

members do not have shareholders’ best interests in mind or share

the same enthusiasm for the future of the company.

While shareholders have seen their investment plummet, between

1994 and 2021, Mr. Cooke was paid over CAD$2.6 million in cash, and

to date, has been granted millions of options. More recently, the

Board has increased executive compensation packages – with

increases in 2021 ranging from 173% to 355%, all as Canagold’s

share price plummeted by 50%.

2019

2020

2021

% Raise

2020 - 2021

CEO and Director

231,067

268,244

558,954

208%

CFO, VP, Finance and Secretary

141,129

149,440

257,980

173%

President and COO

283,966

123,470

226,898

184%

VP, Exploration

105,357

374,344

355%

VP, Corporate Development

282,798

NA

In total, in 2021 the compensation package for Canagold’s five

executives was over $1.7 million. Additionally, for 2021, Mr.

Cooke’s director fees increased a whopping 685% to $199,497 from

$25,400 in 2020.

These payouts were approved by the company’s Compensation

Committee, in which Mr. Cooke himself is a member. The Board

members are treating the company like their personal piggy bank.

Shareholders put the money in, and the directors are taking it

out.

This is unacceptable.

Now, at the upcoming 2022 Annual and Special Meeting, Canagold

is asking shareholders to approve an updated stock option plan to

increase the maximum number of common shares available for issuance

under the plan from 8,852,339 common shares to 17,311,919,

representing 20% of the I/O as of June 6, 2022. Given the dismal

performance for shareholders, how is it possible that they want to

be able to reward themselves with up to 20% of the company?

The revised stock option plan also contains many problematic

features that benefit the executives and the Board at the expense

of shareholders. Two of the provisions – namely allowing for

discretionary, non-employee director participation and the Board to

amend the plan without shareholder approval – should warrant

automatic opposition by shareholders, according to Institutional

Shareholder Services, Inc. (“ISS”), a leading and

independent third-party proxy advisor.

To make things worse, Messrs. Cooke and Burian have received

multiple WITHHOLD recommendations from ISS or Glass, Lewis &

Co. (“Glass Lewis”), another leading and independent

third-party proxy advisor. Between 2004-2021, Messrs. Cooke and

Burian have had 17 WITHHOLD recommendations. Shareholders should

ask themselves why these Board members have so many WITHHOLD

recommendations.

SUN VALLEY’S PLAN FOR NEW POLARIS,

UNDER THE GUIDANCE OF HIGHLY EXPERIENCED, INDEPENDENT AND DIVERSE

NOMINEES

We believe shareholders need an aligned, qualified Board with

directors who will hold management and themselves accountable. That

is why we are nominating three highly experienced, respected

industry leaders on your behalf to provide the much-needed

independent oversight. Our nominees – Dr. Carmen Letton, Ms.

Sofia Bianchi and Mr. Andrew Trow – bring combined expertise in

metals and mining, strategy and leadership, operations, corporate

governance and finance. (For biographies on our nominees,

please see the section Background and Reasons for

Solicitation.)

In addition to our qualified director nominees, Sun Valley works

with several Canadian advisors who have significant and relevant

experience, notably Mr. Gordon J. Bogden, a mining exploration,

development and finance expert with more than 40 years of

experience.

Once elected, our highly-experienced, independent directors will

stop all royalty discussions, re-commence drilling at New Polaris,

and provide the appropriate guidance and oversight to finally

advance the New Polaris project as fast as reasonably possible for

the benefit of all shareholders.

The aim is to:

- Immediately tender the feasibility study and start it this

year. We expect the feasibility study to take approximately 18

months to complete, but we expect it would provide sufficient data

to define the design parameters needed for permitting to begin

within six months;

- Initiate the permitting process in Q2 2023; and

- Save this year’s drilling season and continue drilling in

2022/23 to increase the resource base with a view to move inferred

mineral resources to indicated mineral resources.

We believe the feasibility study will result in a steadily

increasing share price, and once the permitting is near completion,

we expect that the shares will revalue dramatically.

IT’S TIME FOR MATERIAL CHANGE. IT’S

TIME TO STOP DECADES OF VALUE DESTRUCTION

Canagold shareholders have been generous, giving Mr. Cooke 35

years to deliver results. Enough is enough. It’s time to stop Mr.

Cooke and the Board’s value-destroying ways.

Vote for Sun Valley’s highly qualified, independent and

diverse director nominees. Your vote is critical no matter how many

shares you own. Voting is fast and easy. We encourage all Canagold

shareholders to vote only the BLUE

proxy FOR our nominees by 5:00 p.m. ET on Thursday, July 14,

2022.

It’s time for a New Canagold – one focused on shareholder value,

growth and good governance.

Sincerely,

Vikram Sodhi Managing Director and Co-Founder Sunvalley Company

DMCC

Advisors

Kingsdale Advisors is acting as strategic shareholder and

communications advisor to Sun Valley. Wildeboer Dellelce LLP and

Crawley Mackewn Brush LLP are acting as legal counsel to Sun

Valley.

About Sun Valley

Sun Valley is a private equity firm focussed on the precious

metals industry with portfolio companies and branch offices in the

Americas, Europe and Asia. Sun Valley seeks to invest in

sustainable development projects and operations with growth

potential, low cash costs of production, or the operating

flexibility to insulate against volatility in the commodity

markets.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking information within

the meaning of applicable securities laws. In general,

forward-looking information refers to disclosure about future

conditions, courses of action, and events. All statements contained

in this press release that are not clearly historical in nature or

that necessarily depend on future events are forward-looking, and

the use of any of the words “anticipates”, “believes”, “expects”,

“intends”, “plans”, “will”, “would”, and similar expressions are

intended to identify forward-looking statements. These statements

are based on current expectations of Sun Valley and currently

available information. Forward-looking statements are not

guarantees of future performance, involve certain risks and

uncertainties that are difficult to predict, and are based upon

assumptions as to future events that may not prove to be accurate.

Sun Valley undertakes no obligation to update publicly or revise

any forward-looking statements, whether as a result of new

information, future events, or otherwise, except as required by

applicable securities legislation.

Disclaimer

The information contained or referenced herein is for

information purposes only in order to provide the views of Sun

Valley and the matters which Sun Valley believes to be of concern

to shareholders described herein. The information is not tailored

to specific investment objections, the financial situations,

suitability, or particular need of any specific person(s) who may

receive the information, and should not be taken as advice in

considering the merits of any investment decision. The views

expressed herein represent the views and opinions of Sun Valley,

whose opinions may change at any time and which are based on

analyses of Sun Valley and its advisors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220627005186/en/

Daniel Henao Partner / VP Business Development Phone: 6042607046

Email: dhenao@sunvalleyinv.com Kingsdale Advisors: Tom Graham

Executive Vice President, Western Canada Direct: 587-330-1924

Email: tgraham@kingsdaleadvisors.com Media: Hyunjoo Kim Vice

President, Strategic Communications and Marketing Direct:

416-867-2357 Email: hkim@kingsdaleadvisors.com

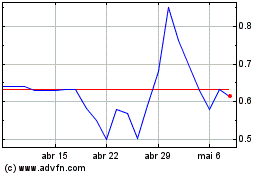

Concord Medical Services (NYSE:CCM)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Concord Medical Services (NYSE:CCM)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024