Institutional Shareholder Services Inc. Recommends Canagold Shareholders Vote FOR Change only on Sun Valley's BLUE Proxy Card

07 Julho 2022 - 6:53PM

Business Wire

- The world's leading provider of corporate governance and

responsible investment solutions and independent proxy advisor

supports Sun Valley’s call for change at Canagold.

- ISS notes that Sun Valley’s slate and strategic plan would

“introduce a credible potential financing option to fund a

feasibility study, a proposed timetable that can serve to enhance

the accountability of the board and management, refreshed

perspectives and technical experience, and further alignment of

board action with those of the company's broader shareholder

base”.

- ISS recognizes "the strength in the qualifications of the

dissident nominees” and agrees with Sun Valley there are major

deficiencies in Canagold’s Option Plan – with the estimated cost of

the plan, its dilution and the company’s burn rate all being

“Excessive”.

- Sun Valley urges shareholders to vote ONLY the BLUE

proxy FOR Sun Valley’s nominees by 5:00 p.m. on Thursday,

July 14, 2022. To vote, contact Kingsdale Advisors at

1-888-213-0093 or at contactus@kingsdaleadvisors.com.

Sunvalley Company DMCC (“Sun Valley”), a strategic and

long-term focused investor owning 17.6% of Canagold Resources Ltd

(TSX: CCM) (“Canagold” or “CCM”), is pleased to

announce that the world's leading provider of corporate governance

and responsible investment solutions and independent proxy advisor

Institutional Shareholder Services Inc. (“ISS”) has

recommended that Canagold shareholders vote FOR the boardroom

change and a New Canagold only on the BLUE proxy card. The

analysis undertaken by ISS strongly supports the arguments Sun

Valley has been making and is a clear rejection of the stay the

course thesis adopted by the incumbent directors of CCM.

ISS recommends voting FOR Sun Valley’s plan for the New Canagold

–

“The dissident slate, and strategic plan by

extension, introduce a credible potential financing option to fund

a feasibility study, a proposed timetable that can serve to enhance

the accountability of the board and management, refreshed

perspectives and technical experience, and further alignment of

board action with those of the company's broader shareholder base

due to the dissident's significantly larger amount of ‘skin in the

game’ versus the incumbent board.”

In its full report, ISS affirmed Sun Valley’s case for urgent

change at Canagold and that “the situation at CCM reflects a

reality that the status quo has been poor enough that change is

warranted”:

- “The length of time over which [the New Polaris Project] has

gone on appears to be far beyond the norm” – “the company has been

unable to complete a feasibility study for New Polaris in 28

years; although the company has retained a financial advisor,

it has not disclosed a timetable to produce a feasibility

study which the board and management can be held accountable

for; the long-term trend in value for the company's shares is

downward”;

- Canagold’s rejection of a premium financing offer is

“somewhat puzzling” – “As the company's cash balance was

US$824,000 on March 31, 2022, a financing will most likely need to

be completed this year to at least keep the company

running”;

- “The financing opportunity presented by the dissident seems to

be on terms that are as good or better than the financings the

company has generally participated in historically”;

- By voting FOR Sun Valley’s candidates, it would “deliver

shareholder value by completing an appropriately sized capital

raise, a feasibility study, and advancing the permitting process of

New Polaris so that a mine may be built – things that have not

occurred under the stewardship of the current board during the

company's entire existence”;

- ISS agrees that the unjustified increase in executive

compensation goes against good governance as “the company does not

provide rationale for increasing cash awards in this manner,

particularly without disclosed performance criteria in the case of

annual bonuses, at a time when it is running out of

cash”.

Furthermore, ISS questions whether Mr. Bradford Cooke would have

“sufficient time, resources, and incentives” to be operating in the

best interests of all shareholders of CCM due to Mr. Cooke’s

significant role at Endeavour Silver Corp. as a result of

“Endeavour's size, its increased complexity as a much larger

producer, the fact Cooke maintained a CEO role (now executive

chairman), and the quantum of compensation Cooke is receiving from

Endeavour”.

Vote the BLUE proxy

We urge Canagold shareholders to vote ONLY the BLUE proxy

FOR all three of Sun Valley’s highly-experienced, independent

nominees – Dr. Carmen Letton, Ms. Sofia Bianchi and Mr. Andrew Trow

in advance of the proxy voting deadline of Thursday, July 14, 2022

at 5:00 p.m. ET. If you have questions or need help voting, contact

Kingsdale Advisors at 1-888-213-0093 or at

contactus@kingsdaleadvisors.com.

Advisors

Kingsdale Advisors is acting as strategic shareholder and

communications advisor to Sun Valley. McMillan LLP is acting as

legal counsel to Sun Valley.

About Sun Valley

Sun Valley is a private equity firm focussed on the precious

metals industry with portfolio companies and branch offices in the

Americas, Europe and Asia. Sun Valley seeks to invest in

sustainable development projects and operations with growth

potential, low cash costs of production, or the operating

flexibility to insulate against volatility in the commodity

markets.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking information within

the meaning of applicable securities laws. In general,

forward-looking information refers to disclosure about future

conditions, courses of action, and events. All statements contained

in this press release that are not clearly historical in nature or

that necessarily depend on future events are forward-looking, and

the use of any of the words “anticipates”, “believes”, “expects”,

“intends”, “plans”, “will”, “would”, and similar expressions are

intended to identify forward-looking statements. These statements

are based on current expectations of Sun Valley and currently

available information. Forward-looking statements are not

guarantees of future performance, involve certain risks and

uncertainties that are difficult to predict, and are based upon

assumptions as to future events that may not prove to be accurate.

Sun Valley undertakes no obligation to update publicly or revise

any forward-looking statements, whether as a result of new

information, future events, or otherwise, except as required by

applicable securities legislation.

Disclaimer

The information contained or referenced herein is for

information purposes only in order to provide the views of Sun

Valley and the matters which Sun Valley believes to be of concern

to shareholders described herein. The information is not tailored

to specific investment objectives, the financial situations,

suitability, or particular need of any specific person(s) who may

receive the information, and should not be taken as advice in

considering the merits of any investment decision. The views

expressed herein represent the views and opinions of Sun Valley,

whose opinions may change at any time and which are based on

analyses of Sun Valley and its advisors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220707005839/en/

Daniel Henao Partner / VP Business Development Phone: 6042607046

Email: dhenao@sunvalleyinv.com

Kingsdale Advisors: Tom Graham Executive Vice President, Western

Canada Direct: 587-330-1924 Email:

tgraham@kingsdaleadvisors.com

Media: Hyunjoo Kim Vice President, Strategic Communications and

Marketing Direct: 416-867-2357 Email:

hkim@kingsdaleadvisors.com

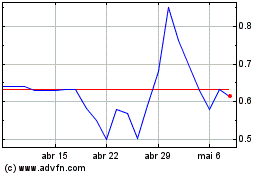

Concord Medical Services (NYSE:CCM)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Concord Medical Services (NYSE:CCM)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024