- Mr. Burian’s undisclosed management cease trade order at Assure

Holdings Corp. raises further and serious questions regarding

Canagold’s oversight and disclosure record

- Like Mr. Cooke, Mr. Burian also sold shares ahead of Canagold’s

2020 private placement, then purchased shares shortly after at a

deeply discounted price

- Three weeks since questions arose around Mr. Cooke’s trading

and Canagold disclosure and still no answers

- Vote only the BLUE proxy FOR Sun Valley’s

nominees by 5:00 p.m. on Thursday, July 14, 2022. To vote, contact

Kingsdale Advisors at 1-888-213-0093 or at

contactus@kingsdaleadvisors.com or visit TheNewCanagold.com.

Sun Valley Investments (“Sun Valley”), a strategic and

long-term focused investor of Canagold Resources Ltd. (TSX: CCM)

(“Canagold” or the “Company”), has uncovered that

another Canagold director – Mr. Martin Burian – has previously

engaged in suspicious trading activity before material information

was released to the public. Additionally, Mr. Burian failed to

disclose a management cease trade order (“MCTO”) at Assure

Holdings Corp., raising further and serious questions regarding

Canagold’s oversight and disclosure record.

BIRDS OF A FEATHER FLOCK TOGETHER:

FIRST MR. COOKE AND NOW MR. BURIAN’S INEXPLICABLE TRADING ACTIVITY

EXPOSED

Following a review of Mr. Burian’s SEDI filings in respect of

Canagold, the following was discovered:

DATE

EVENT

PRICE

PROCEEDS

After 20 months of inactivity, Mr. Burian

disposes of ALL his shareholdings in the public market.

July 7, 2020

Sells 24,820 shares in the

market

$0.135

$3,350

Sells 200,000 shares in the

market

$0.135

$27,000

July 8, 2020

Sells 100,000 shares in the

market

$0.140

$14,000

Sells 50,000 shares in the

market

$0.145

$7,250

Mr. Cooke was also inactive for 20 months,

then began selling his shares on July 8, 2020, just one day after

Mr. Burian began selling his shares.

There was no mention of Mr. Burian’s

disposal of shares or insider participation.

There was also no mention of Mr. Cooke’s

disposal of shares or insider participation.

Aug.19, 2020

Canagold announces a dilutive

private placement

Mr. Burian purchases 300,000 shares.

Mr. Cooke also purchased shares on Oct. 7,

after weeks of selling.

Oct. 7, 2020

Canagold closes the first tranche

of its dilutive private placement

$0.08

$24,000

On behalf of all shareholders, Sun Valley is, again,

demanding that Mr. Cooke and Canagold provide a full explanation

for these inexplicable trading activities and disclosures.

Shareholders deserve to know the truth.

UNDISCLOSED MCTO FOR MR.

BURIAN

Canagold touts “strong qualifications” as key reasons to vote

for Mr. Burian. In their June 13, 2022 management information

circular, Mr. Burian is claimed to be a professional director and a

professional accountant, holding various designations with “strong

qualifications to provide Board oversight in continuous disclosure

obligations and regulatory compliance in North America…”

However, Sun Valley has uncovered details which conflict with

Canagold’s assertion.

- In addition to being Lead Director at Canagold, Mr. Burian has

been the Lead Director of Assure Holdings Corp. (“Assure”)

since May 2017. That month, Mr. Burian, on behalf of the board of

Assure Holdings, Inc., signed a certificate in a filing statement

for Assure’s going public transaction which stated, “The foregoing

as it relates to Assure Holdings, Inc. constitutes full, true and

plain disclosure of all material facts relating to the securities

of Assure Holdings, Inc.”

- On March 12, 2018, Assure announced the resignation of its

auditor and Matthew Willer, then president and director of Assure.

The auditor cited a “reportable event” with respect to “unresolved

issues,” as such terms are defined in NI 51-102, in connection with

their resignation. Assure initially indicated that it disagreed

with some of the reasons for the unresolved issues, reasons for the

resignation and facts presented by the auditor. Subsequent

investigations by a forensic accountant uncovered that Preston

Parsons, the founder and then Chairman and CEO of Assure, and Mr.

Willer were responsible for the unauthorized use of the company’s

funds, breach of fiduciary position, concealment of inappropriate

conduct, and commingling of personal and business expenses.

- During this time, Mr. Burian was both a member of the Audit

Committee and the chair of the Compensation Committee.

- The findings of the investigations included:

- certain amounts previously characterized as shareholder

distributions in the Q2 2017 unaudited financial statements were to

be reclassified as amounts due from Mr. Parsons ($600,000) and Mr.

Willer ($188,702) to Assure;

- excess compensation amounts paid to Mr. Willer than what was

authorized under his employment agreement in calendar year 2017;

and

- utilization of the company’s funds amounting to $849,695 by Mr.

Parsons and $39,531 by Mr. Willer for personal use from May 25,

2017 to March 31, 2018.

- More troubling is that Assure indicated that insufficient

internal controls allowed for concealment of information from the

company and emphasized the need to remediate the company’s control

environment over financial reporting.

- Mr. Parsons subsequently resigned as Chairman and CEO on May

15, 2018, but continued in his capacity as a director. He also

entered into settlement negotiations and agreed to repay the total

debt of $2.2 million (including accrued interest) by surrendering

and cancelling 1,461,392 of his shares held in Assure at a price of

$1.50 per share.

- As a result of the auditor’s resignation and Assure’s delay in

filing its annual financial statements for the year ended December

31, 2017 and related MD&A, the British Columbia Securities

Commission (“BCSC”) granted a MCTO on May 1, 2018,

restricting trading in securities of Assure by management until the

annual filings have been completed. Assure subsequently also failed

to file its financial statements for Q1 2018 and related MD&A

in time. As a result, the BCSC imposed a failure-to-file cease

trade order (“FTF CTO”) on the company with effect from August 7,

2018 and the TSX Venture Exchange suspended trading in securities

of the company on August 8, 2018. The MCTO and the FTF CTO were

revoked on August 20, 2018. Canagold’s proxy circular dated June

13, 2022, for the upcoming meeting, failed to disclose the MCTO as

required by securities laws.

MR. COOKE AND THE BOARD HAVE A FLAGRANT

DISREGARD FOR GOOD GOVERNANCE YET REWARD THEMSELVES AT THE EXPENSE

OF SHAREHOLDERS

Under Mr. Cooke and the incumbent Board, there have been decades

of underperformance, ongoing shareholder value destruction,

inexplicable trading of Canagold shares and eroding of good

governance practices.

Despite all this, Mr. Cooke and the Board have rewarded

themselves and the Company’s executives with hefty payouts:

- Mr. Cooke was rewarded with over $2.6 million in cash

- The Board increased 2021 executive compensation plans, with

increases ranging from 173% to 355%

- In 2021, the Board also gave themselves an 1,127% increase in

the value of directors’ fees. Mr. Cooke’s director fees increased

by a whopping 685% to $199,497 from $25,400. Now, the Board is

looking to reload their stock option plan and dilute shareholders

by 20% – a plan that Institutional Shareholder Services Inc.

(“ISS”), an independent, third-party proxy advisor,

recommended that shareholder vote AGAINST.

- Canagold’s Compensation Committee reviews the compensation of

senior officers and management, and the Board provides approvals,

without any formal objectives, criteria and analysis. Mr. Cooke

sits on the Compensation Committee, contrary to good corporate

governance practices.

STOP MR. COOKE AND THE BOARD’S

DESTRUCTION OF CANAGOLD: VOTE THE BLUE PROXY TODAY

Enough is enough. Directors have a fiduciary duty to their

companies. Mr. Cooke and Mr. Burian have inexplicable trading

activity, with multiple occasions of selling shares before the

release of significant information; shares are then bought back at

a discount.

Sun Valley has the right plan and the resources to turn Canagold

around. As announced on July 7, 2022, ISS

recommends Canagold shareholders vote FOR change using Sun Valley’s

BLUE proxy only.

Don’t wait, voting is fast and easy. Following the

discovery of such unconscionable governance issues, many

shareholders who previously voted for management are eager to

change their vote to the BLUE proxy FOR Sun Valley’s

nominees. To vote the BLUE proxy, please contact Kingsdale Advisors

at 1-888-213-0093 or at contactus@kingsdaleadvisors.com.

Please vote well in advance of the proxy voting deadline of

Thursday, July 14, 2022, at 5:00 p.m. ET.

Advisors

Kingsdale Advisors is acting as strategic shareholder and

communications advisor to Sun Valley. McMillan LLP is acting as

legal counsel to Sun Valley.

About Sun Valley

Sun Valley is a private equity firm focussed on the precious

metals industry with portfolio companies and branch offices in the

Americas, Europe and Asia. Sun Valley seeks to invest in

sustainable development projects and operations with growth

potential, low cash costs of production, or the operating

flexibility to insulate against volatility in the commodity

markets.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking information within

the meaning of applicable securities laws. In general,

forward-looking information refers to disclosure about future

conditions, courses of action, and events. All statements contained

in this press release that are not clearly historical in nature or

that necessarily depend on future events are forward-looking, and

the use of any of the words “anticipates”, “believes”, “expects”,

“intends”, “plans”, “will”, “would”, and similar expressions are

intended to identify forward-looking statements. These statements

are based on current expectations of Sun Valley and currently

available information. Forward-looking statements are not

guarantees of future performance, involve certain risks and

uncertainties that are difficult to predict, and are based upon

assumptions as to future events that may not prove to be accurate.

Sun Valley undertakes no obligation to update publicly or revise

any forward-looking statements, whether as a result of new

information, future events, or otherwise, except as required by

applicable securities legislation.

Disclaimer

The information contained or referenced herein is for

information purposes only in order to provide the views of Sun

Valley and the matters which Sun Valley believes to be of concern

to shareholders described herein. The information is not tailored

to specific investment objectives, the financial situations,

suitability, or particular need of any specific person(s) who may

receive the information, and should not be taken as advice in

considering the merits of any investment decision. The views

expressed herein represent the views and opinions of Sun Valley,

whose opinions may change at any time and which are based on

analyses of Sun Valley and its advisors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220711005775/en/

Sun Valley: Daniel Henao Partner / VP Business Development

Phone: 6042607046 Email: dhenao@sunvalleyinv.com

Kingsdale Advisors: Tom Graham Executive Vice President, Western

Canada Direct: 587-330-1924 Email:

tgraham@kingsdaleadvisors.com

Media: Hyunjoo Kim Vice President, Strategic Communications and

Marketing Direct: 416-867-2357 Email:

hkim@kingsdaleadvisors.com

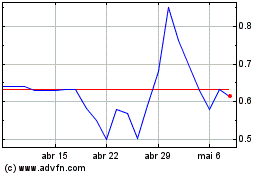

Concord Medical Services (NYSE:CCM)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Concord Medical Services (NYSE:CCM)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024