AM Best Affirms Credit Ratings of Blue Whale Re Ltd.

13 Julho 2022 - 11:13AM

Business Wire

AM Best has affirmed the Financial Strength Rating of A

(Excellent) and the Long-Term Issuer Credit Rating of “a+”

(Excellent) of Blue Whale Re Ltd. (Blue Whale) (Burlington, VT).

The outlook of these Credit Ratings (ratings) is stable.

The ratings reflect Blue Whale’s balance sheet strength, which

AM Best assesses as very strong, as well as its strong operating

performance, neutral business profile and appropriate enterprise

risk management (ERM).

The ratings also reflect Blue Whale’s strategic position as the

captive insurer for Pfizer Inc. (Pfizer) [NYSE: PFE], a leading

global pharmaceutical company. As Blue Whale insures or reinsures

Pfizer’s global property exposures, it plays an important role in

Pfizer’s overall ERM and assumes a critical role in protecting the

Pfizer enterprise’s assets.

The stable outlooks reflect AM Best’s view that the company’s

operations will continue to generate operating results that

engender supportive capitalization for the ratings.

Blue Whale’s capitalization is very strong, albeit reliant on

its parent. It operates at conservative underwriting leverage

levels; however, it provides coverages with extremely large limits,

and its gross exposures per loss occurrence are elevated. Although

Blue Whale benefits from reinsurance protection, it is heavily

dependent on reinsurance, with very substantial net retentions. Its

reinsurance is provided by a large panel of reinsurers that provide

significant capacity. AM Best takes into consideration the quality

of the reinsurers, and the substantial financial resources and

support available to the captive as part of the Pfizer

enterprise.

Blue Whale’s operating results continue to be strong, digesting

infrequent substantial losses in line with its mission. The company

has adjusted premium for hard market conditions offset by the

company’s decreasing property insurance requirements following

Pfizer’s divestiture of Upjohn Inc., including the Caribbean

production and warehouse facilities.

Due to the nature of the relationship between Blue Whale and

Pfizer, changes in AM Best’s perception of Pfizer’s ability and/or

willingness to support Blue Whale can impact Blue Whale’s ratings.

Pfizer’s market-based credit risk measures indicate general

strength and take into account the company’s strategic shift toward

newer pharmaceuticals, with Pfizer having completed divestiture of

its over-the-counter pharmaceutical business and contribution of

its mature pharmaceuticals going off patent to a joint venture.

Since the emergence of COVID-19, Pfizer also has increased usage of

Blue Whale by adding incremental product liability coverage

(normally wholly retained by the parent) for a portion of its

vaccine-related products distributed in several developing

countries as a ‘belt and suspenders’ precaution beyond its required

sovereign indemnifications. Based on the parent’s corporate

strategy, and Blue Whale’s current reinsurance program, Blue Whale

appears well-positioned to continue to address Pfizer’s insurance

needs.

AM Best remains the leading rating agency of alternative risk

transfer entities, with more than 200 such vehicles rated in the

United States and throughout the world. For current Best’s Credit

Ratings and independent data on the captive and alternative risk

transfer insurance market, please visit

www.ambest.com/captive.

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual

ratings referenced in this release, please see AM Best’s Recent

Rating Activity web page. For additional information regarding the

use and limitations of Credit Rating opinions, please view Guide to

Best's Credit Ratings. For information on the proper use of Best’s

Credit Ratings, Best’s Performance Assessments, Best’s Preliminary

Credit Assessments and AM Best press releases, please view Guide to

Proper Use of Best’s Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London, Amsterdam,

Dubai, Hong Kong, Singapore and Mexico City. For more information,

visit www.ambest.com.

Copyright © 2022 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220713005610/en/

Kourtnie Beckwith Financial Analyst +1 908 439

2200, ext. 5124 kourtnie.beckwith@ambest.com

Christopher Sharkey Manager, Public Relations

+1 908 439 2200, ext. 5159

christopher.sharkey@ambest.com

Dan Teclaw Associate Director +1 908 439 2200,

ext. 5394 dan.teclaw@ambest.com

Jeff Mango Managing Director, Strategy &

Communications +1 908 439 2200, ext. 5204

jeffrey.mango@ambest.com

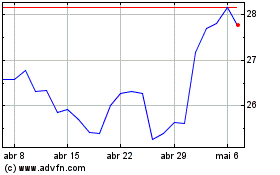

Pfizer (NYSE:PFE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Pfizer (NYSE:PFE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024