Sea Limited (NYSE: SE) (“Sea” or the “Company”) today announced

its financial results for the second quarter ended June 30,

2022.

“Our solid results for the quarter reflect our continued

progress in enhancing efficiency and strengthening our ecosystem,”

said Forrest Li, Sea’s Chairman and Group Chief Executive Officer.

“Shopee’s unit economics improved significantly driven by gains in

both monetization and efficiency across our markets, even as we

sustained a healthy growth rate against tough comparisons. At

Garena, we saw positive outcomes from our focus on user retention

and efforts to bring more engaging experiences to our large global

games community, with quarterly active users stable

quarter-on-quarter. We also benefited from expanding synergies

between Shopee and SeaMoney as our underserved user base adopted

more of our financial products and services, resulting in strong

growth and narrowing losses at SeaMoney.”

“Our success has always been defined by our ability to focus on

the right thing at the right time, quickly make the right strategic

decisions, and remain agile and adaptable in our execution. During

the pandemic lockdowns, we rapidly scaled our businesses to answer

to the fast-rising market demand for online consumption and

services. That allowed us to significantly expand our businesses

and total addressable markets, strengthen our market leadership,

and scale up more efficiently.”

“As we navigate the current environment of increased macro

uncertainty with that same nimble and decisive approach, we believe

it is vital to be thoughtful, prudent, and disciplined. While we

have strong resources and are well on-track to achieve our

self-sufficiency targets, we are nevertheless rapidly prioritizing

profitability and cash flow management. We are confident that this

focus, combined with our demonstrated ability to execute, our scale

and leadership, and our proven business models, will position us

for long-term sustained success.”

Second Quarter 2022 Highlights

- Group

- Total GAAP revenue was US$2.9 billion, up 29.0%

year-on-year.

- Total gross profit was US$1.1 billion, up 17.1%

year-on-year.

- Total net loss was US$(931.2) million compared to US$(433.7)

million for the second quarter of 2021. Total net loss excluding

share-based compensation and impairment of goodwill1 was US$(569.8)

million compared to US$(321.2) million for the second quarter of

2021.

- Total adjusted EBITDA2 was US$(506.3) million compared to

US$(24.1) million for the second quarter of 2021.

- E-commerce

- GAAP revenue was US$1.7 billion, up 51.4% year-on-year. Based

on constant currency assumptions3, GAAP revenue was up 56.2%

year-on-year.

- GAAP revenue included US$1.5 billion of GAAP marketplace

revenue4, up 61.9% year-on-year, and US$0.3 billion of GAAP product

revenue4, up 13.6% year-on-year. GAAP revenue and GAAP marketplace

revenue as % of total gross merchandise value (“GMV”) increased

from 7.7% and 6.1% a year ago to 9.2% and 7.7%, respectively.

- Gross orders totaled 2.0 billion, an increase of 41.6%

year-on-year.

- GMV was US$19.0 billion, an increase of 27.2% year-on-year.

Based on constant currency assumptions3, GMV was up 31.4%

year-on-year.

- Gross profit margin for e-commerce continued to improve

sequentially quarter-on-quarter, as we have seen faster growth of

transaction-based fees and advertising income, which have higher

profit margin compared to product revenue and revenue generated

from other value-added services.

- Adjusted EBITDA2 for Shopee overall was US$(648.1) million

compared to US$(579.8) million for the second quarter of 2021.

Adjusted EBITDA loss per order improved by 21% to reach US$0.33 in

the second quarter of 2022, compared to US$0.41 for the same period

in 2021.

- In Southeast Asia and Taiwan, adjusted EBITDA loss per order

before allocation of headquarters’ common expenses (“HQ costs”) was

less than 1 cent in the second quarter of 2022, representing 95%

improvement year-on-year.

- In Brazil, such losses also continued to improve by more than

35% year-on-year to reach US$1.42 in the second quarter of

2022.

- HQ costs sequentially increased by US$27.5 million

quarter-on-quarter, which was at a slower pace compared to the

first quarter of 2022. The increase was predominantly driven by

increase in research and development staff and server hosting cost,

as we expanded our technological capabilities and service

offerings.

- In Southeast Asia overall, Indonesia and Taiwan respectively,

Shopee continued to rank first in the Shopping category by average

monthly active users and total time spent in app for the second

quarter of 2022, according to data.ai5.

- In Brazil, Shopee continued to see strong performance with GAAP

revenue increasing by more than 270% year-on-year in the second

quarter of 2022. In the same quarter, Shopee also became first by

average monthly active users in the shopping category in Brazil,

while maintaining its top ranking by total time spent in app,

according to data.ai5.

- Globally, Shopee was the top ranked app on Google Play in the

Shopping category by total time spent in app and second by average

monthly active users in the second quarter of 2022, according to

data.ai5.

- Digital Entertainment

- GAAP revenue was US$900.3 million, compared to US$1.0 billion

for the second quarter of 2021.

- Bookings6 were US$717.4 million, compared to US$1.2 billion for

the second quarter of 2021.

- Adjusted EBITDA2 was US$333.6 million, compared to US$740.9

million for the second quarter of 2021.

- Adjusted EBITDA represented 46.5% of bookings for the second

quarter of 2022, compared to 62.8% for the second quarter of

2021.

- Quarterly active users were 619.3 million, compared to 725.2

million for the second quarter of 2021 and 615.9 million for the

first quarter of 2022.

- Quarterly paying users were 56.1 million, representing paying

user ratio of 9.1% for the second quarter compared to 12.7% for the

same period in 2021.

- Average bookings per user were US$1.2, compared to US$1.6 for

the second quarter of 2021.

- Our self-developed global hit game, Free Fire, continued to

maintain top global rankings in user and grossing metrics. Free

Fire was the most downloaded mobile game globally in the second

quarter of 2022, and ranked third highest by average monthly active

users on Google Play in the same quarter, according to

data.ai5.

- Free Fire also continued to be the highest grossing mobile game

in Southeast Asia and Latin America for the second quarter of 2022,

according to data.ai5. Free Fire has maintained this leading

position for the past 12 consecutive quarters.

- Digital Financial Services

- GAAP revenue was US$279.0 million, up 214.4% year-on-year.

- Adjusted EBITDA2 was US$(111.5) million, compared to US$(155.0)

million for the second quarter of 2021.

- Quarterly active users7 across our SeaMoney products and

services reached 52.7 million, up 53.3% year-on-year.

- We continued to roll out more SeaMoney offerings across more

markets, and have expanded synergies between Shopee and SeaMoney.

Close to 40% of the quarterly active buyers on Shopee in Southeast

Asia have used SeaMoney products or services in the second quarter

of 2022.

- Total payment volume for the mobile wallet was US$5.7 billion,

up 35.7% year-on-year.

E-commerce Full Year 2022 Guidance Update

In our efforts to adapt to increasing macro uncertainties, we

are proactively shifting our strategies to further focus on

efficiency and optimization for the long-term strength and

profitability of the e-commerce business. Given this strategic

shift, we will be suspending e-commerce GAAP revenue guidance for

the full year 2022. We believe such efforts will further strengthen

our ability to better capture the long-term growth opportunities in

our markets, which we remain highly positive about.

1

We recorded an impairment of goodwill of

US$177.3 million in the second quarter of 2022. The impairment was

primarily due to the change in carrying amount of goodwill

associated with our prior acquisitions, mainly driven by the lower

valuations amid the market uncertainties.

2

For definitions of total adjusted EBITDA

and adjusted EBITDA for digital entertainment, e-commerce and

digital financial services segments, please refer to the “Non-GAAP

Financial Measures” section.

3

Current and comparative prior period local

currency amounts are converted into United States dollars using the

same exchange rates, rather than the actual exchange rates during

the respective periods.

4

GAAP marketplace revenue mainly consists

of transaction-based fees and advertising income and revenue

generated from other value-added services. GAAP product revenue

mainly consists of revenue generated from direct sales.

5

Rankings data for data.ai is based on

combined data from the Google Play and iOS App Stores, unless

otherwise stated. Time spent in app rankings is available for

Google Play only. Southeast Asia rankings are based on Indonesia,

Malaysia, Philippines, Singapore, Thailand, and Vietnam. Latin

America rankings are based on Argentina, Brazil, Chile, Colombia,

Mexico, and Uruguay. Rankings data for Free Fire includes both Free

Fire and Free Fire MAX.

6

GAAP revenue for the digital entertainment

segment plus change in digital entertainment deferred revenue. This

operating metric is used as an approximation of cash spent by our

users in the applicable period that is attributable to our digital

entertainment segment.

7

Quarterly active users for digital

financial services segment are defined as users who had at least

one financial transaction with SeaMoney products and services

during the quarter. Transactions include payments or receipts with

our mobile wallet, loan disbursements, maintenance of balance in

our banks or purchase of insurance policies on the Shopee

platform.

Unaudited Summary of Financial

Results

(Amounts are expressed in thousands of US

dollars “$” except for per share data)

For the Three Months

ended June 30,

2021

2022

$

$

YOY%

Revenue

Service revenue

Digital Entertainment

1,024,267

900,258

(12.1

)%

E-commerce and other services

999,658

1,755,686

75.6

%

Sales of goods

256,623

286,655

11.7

%

2,280,548

2,942,599

29.0

%

Cost of revenue

Cost of service

Digital Entertainment

(292,696

)

(260,529

)

(11.0

)%

E-commerce and other services

(816,748

)

(1,329,665

)

62.8

%

Cost of goods sold

(240,210

)

(262,187

)

9.1

%

(1,349,654

)

(1,852,381

)

37.2

%

Gross profit

930,894

1,090,218

17.1

%

Other operating income

72,007

71,104

(1.3

)%

Sales and marketing expenses

(921,362

)

(973,767

)

5.7

%

General and administrative expenses

(242,992

)

(476,045

)

95.9

%

Research and development expenses

(172,563

)

(370,926

)

115.0

%

Impairment of goodwill

-

(177,280

)

-

Total operating expenses

(1,264,910

)

(1,926,914

)

52.3

%

Operating loss

(334,016

)

(836,696

)

150.5

%

Non-operating loss, net

(25,061

)

(32,765

)

30.7

%

Income tax expense

(75,191

)

(64,771

)

(13.9

)%

Share of results of equity investees

599

3,033

406.3

%

Net loss

(433,669

)

(931,199

)

114.7

%

Net loss excluding share-based

compensation and impairment of goodwill

(1)

(321,184

)

(569,811

)

77.4

%

Basic and diluted loss per share based on

net loss excluding share-based compensation and

impairment of goodwill attributable to Sea

Limited’s ordinary shareholders (1)

(0.61

)

(1.03

)

68.9

%

Change in deferred revenue of Digital

Entertainment

155,863

(182,904

)

(217.3

)%

Adjusted EBITDA for Digital Entertainment

(1)

740,944

333,619

(55.0

)%

Adjusted EBITDA for E-commerce (1)

(579,774

)

(648,145

)

11.8

%

Adjusted EBITDA for Digital Financial

Services (1)

(154,986

)

(111,517

)

(28.0

)%

Adjusted EBITDA for Other Services (1)

(23,275

)

(72,555

)

211.7

%

Unallocated expenses (2)

(7,020

)

(7,653

)

9.0

%

Total adjusted EBITDA (1)

(24,111

)

(506,251

)

1,999.7

%

(1)

For a discussion of the use of non-GAAP

financial measures, see “Non-GAAP Financial Measures”.

(2)

Unallocated expenses are mainly related to

share-based compensation, impairment of goodwill, and general and

corporate administrative costs such as professional fees and other

miscellaneous items that are not allocated to segments. These

expenses are excluded from segment results as they are not reviewed

by the Chief Operating Decision Maker (“CODM”) as part of segment

performance.

Three Months Ended June 30, 2022 Compared to Three Months

Ended June 30, 2021

Revenue

Our total GAAP revenue increased by 29.0% to US$2.9 billion in

the second quarter of 2022 from US$2.3 billion in the second

quarter of 2021.

- Digital Entertainment: GAAP revenue was US$0.9 billion compared

to US$1.0 billion in the second quarter of 2021. The decrease was

mainly due to the softening of bookings post-COVID.

- E-commerce and other services: GAAP revenue increased by 75.6%

to US$1.8 billion in the second quarter of 2022 from US$1.0 billion

in the second quarter of 2021. This increase was primarily driven

by the growing adoption of products and services across our

e-commerce and digital financial services businesses.

- Sales of goods: GAAP revenue increased by 11.7% to US$286.7

million in the second quarter of 2022 from US$256.6 million in the

second quarter of 2021, primarily due to the increase in our

product offerings.

Cost of Revenue

Our total cost of revenue increased by 37.2% to US$1.9 billion

in the second quarter of 2022 from US$1.3 billion in the second

quarter of 2021.

- Digital Entertainment: Cost of revenue decreased by 11.0% to

US$260.5 million in the second quarter of 2022 from US$292.7

million in the second quarter of 2021. The decrease was largely in

line with the decrease in our digital entertainment revenue.

- E-commerce and other services: Cost of revenue for our

e-commerce and other services segment combined increased by 62.8%

to US$1.3 billion in the second quarter of 2022 from US$0.8 billion

in the second quarter of 2021. The increase was primarily due to

higher costs of logistics from order growth, and other costs driven

by the growth of our e-commerce marketplace. Improvement in gross

profit margins was mainly due to faster growth of higher margin

revenue streams.

- Cost of goods sold: Cost of goods sold increased by 9.1% to

US$262.2 million in the second quarter of 2022 from US$240.2

million in the second quarter of 2021. The increase was largely in

line with the increase in our revenue from sales of goods.

Other Operating Income

Our other operating income was US$71.1 million and US$72.0

million in the second quarter of 2022 and 2021, respectively. Other

operating income mainly consists of rebates from e-commerce related

logistics services providers.

Sales and Marketing Expenses

Our total sales and marketing expenses increased by 5.7% to

US$1.0 billion in the second quarter of 2022 from US$0.9 billion in

the second quarter of 2021. The table below sets forth breakdown of

the sales and marketing expenses of our major reporting segments.

Amounts are expressed in thousands of US dollars (“$”).

For the Three Months

ended June 30,

2021

2022

YOY%

Sales and Marketing Expenses

$

$

Digital Entertainment

82,038

87,100

6.2

%

E-commerce

649,196

674,120

3.8

%

Digital Financial Services

166,270

162,466

(2.3

)%

- Digital Entertainment: Sales and marketing expenses increased

by 6.2% to US$87.1 million in the second quarter of 2022 from

US$82.0 million in the second quarter of 2021. The increase was

primarily due to our continued efforts to deepen the engagement

with our gamers’ community and investment in long-term brand

building.

- E-commerce: Sales and marketing expenses increased by 3.8% to

US$674.1 million in the second quarter of 2022 from US$649.2

million in the second quarter of 2021. The increase was primarily

attributable to higher events and media spending and staff cost

increase attributable to headcount growth.

- Digital Financial Services: Sales and marketing expenses

decreased by 2.3% to US$162.5 million in the second quarter of 2022

from US$166.3 million in the second quarter of 2021. The decrease

was mainly due to the greater efficiency across our platforms.

General and Administrative Expenses

Our general and administrative expenses increased by 95.9% to

US$476.0 million in the second quarter of 2022 from US$243.0

million in the second quarter of 2021. This increase was primarily

due to increase in allowance for credit losses from our digital

financial services business driven by loans receivables growth,

higher staff cost as well as higher office facilities and related

expenses, to support the business growth.

Research and Development Expenses

Our research and development expenses increased by 115.0% to

US$370.9 million in the second quarter of 2022 from US$172.6

million in the second quarter of 2021, primarily attributable to

higher staff cost from increased headcount growth, as we invested

in our technological capabilities and expanded our service

offerings.

Impairment of Goodwill

We recorded an impairment of goodwill of US$177.3 million in the

second quarter of 2022, compared to nil in the second quarter of

2021. The goodwill impairment was primarily due to the change in

carrying amount of goodwill associated with our prior acquisitions,

mainly driven by the lower valuations amid the market

uncertainties.

Non-operating Income or Losses, Net

Non-operating income or losses mainly consist of interest

income, interest expense, investment gain (loss) and foreign

exchange gain (loss). We recorded a net non-operating loss of

US$32.8 million in the second quarter of 2022, compared to a net

non-operating loss of US$25.1 million in the second quarter of

2021. The non-operating loss in the second quarter of 2022 was

primarily due to investment losses recognized amid lower valuations

in the broader market.

Income Tax Expense

We had a net income tax expense of US$64.8 million and US$75.2

million in the second quarter of 2022 and 2021, respectively. The

income tax expense in the second quarter of 2022 was primarily due

to corporate income tax and withholding tax expenses incurred by

our digital entertainment segment.

Net Loss

As a result of the foregoing, we had net losses of US$931.2

million and US$433.7 million in the second quarter of 2022 and

2021, respectively.

Net Loss Excluding Share-based Compensation and Impairment of

Goodwill

Net loss excluding share-based compensation and impairment of

goodwill, was US$569.8 million and US$321.2 million in the second

quarter of 2022 and 2021, respectively.

Basic and Diluted Loss Per Share Based on Net Loss Excluding

Share-based Compensation and Impairment of Goodwill Attributable to

Sea Limited’s Ordinary Shareholders

Basic and diluted loss per share based on net loss excluding

share-based compensation and impairment of goodwill, was US$1.03

and US$0.61 in the second quarter of 2022 and 2021,

respectively.

Webcast and Conference Call Information

The Company’s management will host a conference call today to

review Sea’s business and financial performance.

Details of the conference call and webcast are as follows:

Date and time:

7:30 AM U.S. Eastern Time on August 16,

2022 7:30 PM Singapore / Hong Kong Time on August 16, 2022

Webcast link:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=ToMUCZDA

Dial in numbers:

US Toll Free: 1-888-317-6003

Hong Kong: 800-963-976

International: 1-412-317-6061

Singapore: 800-120-5863

United Kingdom: 08-082-389-063

Passcode for Participants:

7429691

A replay of the conference call will be available at the

Company’s investor relations website (www.sea.com/investor/home).

An archived webcast will be available at the same link above.

About Sea Limited

Sea Limited (NYSE: SE) is a leading global consumer internet

company founded in Singapore in 2009. Its mission is to better the

lives of consumers and small businesses with technology. Sea

operates three core businesses across digital entertainment,

e-commerce, as well as digital payments and financial services,

known as Garena, Shopee and SeaMoney, respectively. Garena is a

leading global online games developer and publisher. Shopee is the

largest pan-regional e-commerce platform in Southeast Asia and

Taiwan. SeaMoney is a leading digital payments and financial

services provider in Southeast Asia.

Forward-Looking Statements

This announcement contains forward-looking statements. These

statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“may,” “could,” “will,” “expect,” “anticipate,” “aim,” “future,”

“intend,” “plan,” “believe,” “estimate,” “likely to,” “potential,”

“confident,” “guidance,” and similar statements. Among other

things, statements that are not historical facts, including

statements about Sea’s beliefs and expectations, the business,

financial and market outlook, and projections from its management

in this announcement, as well as Sea’s strategic and operational

plans, contain forward-looking statements. Sea may also make

written or oral forward-looking statements in its periodic reports

to the U.S. Securities and Exchange Commission (the “SEC”), in its

annual report to shareholders, in press releases, and other written

materials, and in oral statements made by its officers, directors,

or employees to third parties. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause

actual results to differ materially from those contained in any

forward-looking statement, including but not limited to the

following: Sea’s goals and strategies; its future business

development, financial condition, financial results, and results of

operations; the expected growth in, and market size of, the digital

entertainment, e-commerce and digital financial services industries

in the markets where it operates, including segments within those

industries; expected changes or guidance in its revenue, costs or

expenditures; its ability to continue to source, develop and offer

new and attractive online games and to offer other engaging digital

entertainment content; the expected growth of its digital

entertainment, e-commerce and digital financial services

businesses; its expectations regarding growth in its user base,

level of engagement, and monetization; its ability to continue to

develop new technologies and/or upgrade its existing technologies;

its expectations regarding the use of proceeds from its financing

activities, including its follow-on equity offerings and

convertible notes offerings; growth and trends of its markets and

competition in its industries; government policies and regulations

relating to its industries, including the effects of any government

orders or actions on its businesses; general economic, political,

social and business conditions in its markets; and the impact of

widespread health developments, including the COVID-19 pandemic,

and the responses thereto (such as voluntary and in some cases,

mandatory quarantines as well as shut downs and other restrictions

on travel and commercial, social and other activities, and the

availability of effective vaccines or treatments) and the impact of

economies reopening further to the COVID-19 pandemic. Further

information regarding these and other risks is included in Sea’s

filings with the SEC. All information provided in this press

release and in the attachments is as of the date of this press

release, and Sea undertakes no obligation to update any

forward-looking statement, except as required under applicable

law.

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are

prepared and presented in accordance with U.S. GAAP, we use the

following non-GAAP financial measures to help evaluate our

operating performance:

- “Net loss excluding share-based compensation and impairment of

goodwill” represents net loss before share-based compensation and

impairment of goodwill. This financial measure helps to identify

underlying trends in our business that could otherwise be distorted

by the effect of certain expenses that are included in net loss.

The use of this measure has its limitations in that it does not

include all items that impact the net loss or income for the

period, and share-based compensation and impairment of goodwill are

significant expenses.

- “Net loss excluding share-based compensation and impairment of

goodwill attributable to Sea Limited’s ordinary shareholders”

represents net loss attributable to Sea Limited’s ordinary

shareholders before share-based compensation and impairment of

goodwill. This financial measure helps to identify underlying

trends in our business that could otherwise be distorted by the

effect of certain expenses that are included in net loss. The use

of this measure has its limitations in that it does not include all

items that impact the net loss or income for the period, and

share-based compensation and impairment of goodwill are significant

expenses.

- “Basic and diluted loss per share based on net loss excluding

share-based compensation and impairment of goodwill attributable to

Sea Limited’s ordinary shareholders” represents net loss excluding

share-based compensation and impairment of goodwill attributable to

Sea Limited’s ordinary shareholders divided by the weighted average

number of shares outstanding during the period.

- “Adjusted EBITDA” for our digital entertainment segment

represents operating income (loss) before share-based compensation

and impairment of goodwill plus (a) depreciation and amortization

expenses, and (b) the net effect of changes in deferred revenue and

its related cost for our digital entertainment segment. We believe

that the segment adjusted EBITDA helps to identify underlying

trends in our operating results, enhancing their understanding of

the past performance and future prospects.

- “Adjusted EBITDA” for our e-commerce segment, digital financial

services segment and other services segment represents operating

income (loss) before share-based compensation and impairment of

goodwill plus depreciation and amortization expenses. We believe

that the segment adjusted EBITDA helps to identify underlying

trends in our operating results, enhancing their understanding of

the past performance and future prospects.

- “Total adjusted EBITDA” represents the sum of adjusted EBITDA

of all our segments combined, plus unallocated expenses. We believe

that the total adjusted EBITDA helps to identify underlying trends

in our operating results, enhancing their understanding of the past

performance and future prospects.

These non-GAAP financial measures have limitations as analytical

tools. None of the above financial measures should be considered in

isolation or construed as an alternative to revenue, net

loss/income, or any other measure of performance or as an indicator

of our operating performance. These non-GAAP financial measures

presented here may not be comparable to similarly titled measures

presented by other companies. Other companies may calculate

similarly titled measures differently, limiting their usefulness as

comparative measures to Sea’s data. We compensate for these

limitations by reconciling the non-GAAP financial measures to their

nearest U.S. GAAP financial measures, all of which should be

considered when evaluating our performance. We encourage you to

review our financial information in its entirety and not rely on

any single financial measure.

The tables below present selected financial information of our

reporting segments, the non-GAAP financial measures that are most

directly comparable to GAAP financial measures, and the related

reconciliations between the financial measures. Amounts are

expressed in thousands of US dollars (“$”) except for number of

shares & per share data.

For the Three Months ended

June 30, 2022

Digital Entertainment

E- commerce

Digital Financial Services

Other Services(1)

Unallocated expenses(2)

Consolidated

$

$

$

$

$

$

Operating income (loss)

456,811

(726,127

)

(122,735

)

(75,604

)

(369,041

)

(836,696

)

Net effect of changes in deferred

revenue and its related cost

(134,100

)

-

-

-

-

(134,100

)

Depreciation and Amortization

10,908

77,982

11,218

3,049

-

103,157

Share-based compensation

-

-

-

-

184,108

184,108

Impairment of goodwill

-

-

-

-

177,280

177,280

Adjusted EBITDA

333,619

(648,145

)

(111,517

)

(72,555

)

(7,653

)

(506,251

)

For the Three Months ended

June 30, 2021

Digital Entertainment

E- commerce

Digital Financial Services

Other Services(1)

Unallocated expenses(2)

Consolidated

$

$

$

$

$

$

Operating income (loss)

597,713

(627,509

)

(159,821

)

(24,894

)

(119,505

)

(334,016

)

Net effect of changes in deferred

revenue and its related cost

135,262

-

-

-

-

135,262

Depreciation and Amortization

7,969

47,735

4,835

1,619

-

62,158

Share-based compensation

-

-

-

-

112,485

112,485

Adjusted EBITDA

740,944

(579,774

)

(154,986

)

(23,275

)

(7,020

)

(24,111

)

(1)

A combination of multiple business

activities that does not meet the quantitative thresholds to

qualify as reportable segments are grouped together as “Other

Services”.

(2)

Unallocated expenses are mainly related to

share-based compensation, impairment of goodwill, and general and

corporate administrative costs such as professional fees and other

miscellaneous items that are not allocated to segments. These

expenses are excluded from segment results as they are not reviewed

by the CODM as part of segment performance.

For the Three Months

ended June 30,

2021

2022

$

$

Net loss

(433,669)

(931,199)

Share-based compensation

112,485

184,108

Impairment of goodwill

-

177,280

Net loss excluding share-based

compensation and impairment of goodwill

(321,184)

(569,811)

Net loss (profit) attributable to

non-controlling interests

227

(1,912)

Net loss excluding share-based

compensation and impairment of goodwill

attributable to Sea Limited’s ordinary

shareholders

(320,957)

(571,723)

Weighted average shares used in loss per

share computation:

Basic and diluted

523,247,645

557,445,126

Basic and diluted loss per share based on

net loss excluding share-based compensation and

impairment of goodwill attributable to Sea

Limited’s ordinary shareholders

(0.61)

(1.03)

UNAUDITED INTERIM CONDENSED

CONSOLIDATED STATEMENT OF OPERATIONS

Amounts expressed in thousands of US

dollars (“$”) except for number of shares & per share

data

For the Six Months

ended June 30,

2021

2022

$

$

Revenue

Service revenue

Digital Entertainment

1,805,602

2,035,427

E-commerce and other services

1,772,040

3,255,297

Sales of goods

466,550

551,446

Total revenue

4,044,192

5,842,170

Cost of revenue

Cost of service

Digital Entertainment

(540,936

)

(569,714

)

E-commerce and other services

(1,491,286

)

(2,506,142

)

Cost of goods sold

(435,667

)

(506,068

)

Total cost of revenue

(2,467,889

)

(3,581,924

)

Gross profit

1,576,303

2,260,246

Operating income (expenses):

Other operating income

147,095

144,759

Sales and marketing expenses

(1,600,284

)

(1,978,941

)

General and administrative expenses

(491,850

)

(872,178

)

Research and development expenses

(313,693

)

(711,334

)

Impairment of goodwill

-

(177,280

)

Total operating expenses

(2,258,732

)

(3,594,974

)

Operating loss

(682,429

)

(1,334,728

)

Interest income

14,969

29,841

Interest expense

(49,606

)

(23,029

)

Investment loss, net

(19,770

)

(59,036

)

Foreign exchange gain

6,094

13,399

Loss before income tax and share of

results of equity investees

(730,742

)

(1,373,553

)

Income tax expense

(126,216

)

(146,577

)

Share of results of equity investees

1,198

8,795

Net loss

(855,760

)

(1,511,335

)

Net profit attributable to non-controlling

interests

(372

)

(1,585

)

Net loss attributable to Sea Limited’s

ordinary shareholders

(856,132

)

(1,512,920

)

Loss per share:

Basic and diluted

(1.65

)

(2.72

)

Weighted average shares used in loss per

share computation:

519,037,660

556,834,663

Basic and diluted

UNAUDITED INTERIM CONDENSED

CONSOLIDATED BALANCE SHEETS

Amounts expressed in thousands of US

dollars (“$”)

As of December

31,

As of June 30,

2021

2022

$

$

ASSETS

Current assets

Cash and cash equivalents

9,247,762

6,493,232

Restricted cash

1,551,635

1,317,370

Accounts receivable, net of allowance for

credit losses of $5,772 and $7,693, as of

December 31, 2021 and June 30, 2022

respectively

388,308

264,582

Prepaid expenses and other assets

1,401,863

1,451,797

Loans receivable, net of allowance for

credit losses of $91,504 and $195,806, as of

December 31, 2021 and June 30, 2022

respectively

1,500,954

2,012,593

Inventories, net

117,499

127,176

Short-term investments

911,281

1,287,510

Amounts due from related parties

16,095

17,851

Total current assets

15,135,397

12,972,111

Non-current assets

Property and equipment, net

1,029,963

1,283,704

Operating lease right-of-use assets,

net

649,680

931,025

Intangible assets, net

52,517

65,516

Long-term investments

1,052,861

1,360,385

Prepaid expenses and other assets

124,521

269,876

Loans receivable, net of allowance for

credit losses of $6,172 and $2,034, as of

December 31, 2021 and June 30, 2022

respectively

28,964

23,519

Restricted cash

38,743

52,417

Deferred tax assets

103,755

112,368

Goodwill

539,624

396,796

Total non-current assets

3,620,628

4,495,606

Total assets

18,756,025

17,467,717

UNAUDITED INTERIM CONDENSED

CONSOLIDATED BALANCE SHEETS

Amounts expressed in thousands of US

dollars (“$”)

As of December

31,

As of June 30,

2021

2022

$

$

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities

Accounts payable

213,580

238,959

Accrued expenses and other payables

3,531,187

3,839,437

Advances from customers

244,574

242,663

Amounts due to related parties

74,738

53,445

Bank borrowings

100,000

–

Operating lease liabilities

186,494

241,639

Deferred revenue

2,644,463

1,935,111

Income tax payable

181,400

188,540

Total current liabilities

7,176,436

6,739,794

Non-current liabilities

Accrued expenses and other payables

76,234

91,602

Operating lease liabilities

491,313

735,806

Deferred revenue

104,826

281,060

Convertible notes (1)

3,475,708

4,177,291

Deferred tax liabilities

6,992

7,274

Unrecognized tax benefits

107

107

Total non-current liabilities

4,155,180

5,293,140

Total liabilities

11,331,616

12,032,934

UNAUDITED INTERIM CONDENSED

CONSOLIDATED BALANCE SHEETS

Amounts expressed in thousands of US

dollars (“$”)

As of December

31,

As of June 30,

2021

2022

$

$

Shareholders’ equity

Class A Ordinary shares

204

256

Class B Ordinary shares

74

23

Additional paid-in capital (1)

14,622,292

14,127,662

Accumulated other comprehensive loss

(28,519

)

(160,167

)

Statutory reserves

6,144

6,443

Accumulated deficit (1)

(7,201,498

)

(8,600,993

)

Total Sea Limited shareholders’

equity

7,398,697

5,373,224

Non-controlling interests

25,712

61,559

Total shareholders’ equity

7,424,409

5,434,783

Total liabilities and shareholders’

equity

18,756,025

17,467,717

(1)

The Company adopted ASU 2020-06 on January

1, 2022 using modified retrospective method and the cumulative

effects have been adjusted via retained earnings opening balance.

As a result of adoption, our Convertible Notes balances has

increased and additional paid-in capital and accumulated deficit

have decreased accordingly.

UNAUDITED INTERIM CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

Amounts expressed in thousands of US

dollars (“$”)

For the Six Months ended

June 30,

2021

2022

$

$

Net cash generated from (used in)

operating activities

450,726

(1,209,121)

Net cash used in investing activities

(1,649,827)

(2,078,203)

Net cash generated from financing

activities

180,358

439,937

Effect of foreign exchange rate changes on

cash, cash equivalents and restricted cash

(31,750)

(127,734)

Net decrease in cash, cash equivalents and

restricted cash

(1,050,493)

(2,975,121)

Cash, cash equivalents and restricted cash

at beginning of the period

7,053,393

10,838,140

Cash, cash equivalents and restricted cash

at end of the period

6,002,900

7,863,019

Net cash used in investing activities amounted to US$2.1 billion

for the first half of 2022.

This was primarily attributable to an increase in loans

receivable of US$757 million and purchase of property and equipment

of US$540 million to support the growth of our businesses, as well

as net placement of US$427 million into time deposits and liquid

investment products for better cash yield management.

UNAUDITED SEGMENT INFORMATION

The Company has three reportable segments, namely digital

entertainment, e-commerce and digital financial services. The Chief

Operating Decision Maker (“CODM”) reviews the performance of each

segment based on revenue and certain key operating metrics of the

operations and uses these results for the purposes of allocating

resources to and evaluating the financial performance of each

segment. Amounts are expressed in thousands of US dollars

(“$”).

For the Three Months ended

June 30, 2022

Digital Entertainment

E- commerce

Digital Financial Services

Other Services(1)

Unallocated expenses(2)

Consolidated

$

$

$

$

$

$

Revenue

900,258

1,749,350

279,020

13,971

-

2,942,599

Operating income (loss)

456,811

(726,127

)

(122,735)

(75,604

)

(369,041

)

(836,696

)

Non-operating loss, net

(32,765

)

Income tax expense

(64,771

)

Share of results of equity investees

3,033

Net loss

(931,199

)

For the Three Months ended

June 30, 2021

Digital Entertainment

E- commerce

Digital Financial Services

Other Services(1)

Unallocated expenses(2)

Consolidated

$

$

$

$

$

$

Revenue

1,024,267

1,155,193

88,737

12,351

-

2,280,548

Operating income (loss)

597,713

(627,509

)

(159,821)

(24,894

)

(119,505

)

(334,016

)

Non-operating loss, net

(25,061

)

Income tax expense

(75,191

)

Share of results of equity investees

599

Net loss

(433,669

)

(1)

A combination of multiple business

activities that does not meet the quantitative thresholds to

qualify as reportable segments are grouped together as “Other

Services”.

(2)

Unallocated expenses are mainly related to

share-based compensation, impairment of goodwill, and general and

corporate administrative costs such as professional fees and other

miscellaneous items that are not allocated to segments. These

expenses are excluded from segment results as they are not reviewed

by the CODM as part of segment performance.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220815005740/en/

For enquiries: Investors / analysts: ir@sea.com Media:

Martin Reidy, media@sea.com

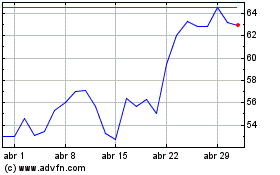

Sea (NYSE:SE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Sea (NYSE:SE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024