Regulatory News:

The approval obtained by the EIB is for a new credit facility

of 40 million euros

The new credit facility foresees that MedinCell

(Paris:MEDCL) repays in anticipation a previous 20

million euros loan signed in 2018 with the EIB

30 million euros of the credit facility could be drawn in Q4

2022, and the disbursement of the remaining 10 million euros is

subject to conditions that are expected to be met in 2023

Each tranche of the new credit facility will be reimbursed 5

years after drawdown

The signature of the new EIB credit facility is expected in a

few weeks after finalization of the legal documentation

New EIB financing extends MedinCell’s cash visibility until

at least the first quarter 2024

As the commercialization of the first treatment based on

MedinCell’s breakthrough technology is expected in 2023, the

European Investment Bank reiterates its support to the French

company with a new financing package of 40 million euros.

The new bullet credit facility agreement will take over from a

previous 20 million euros loan granted in 2018 by EIB, which terms

have been modified in June 2022 to pave the way for the new

agreement by including Teva Pharmaceuticals' revenues in the

calculation of the variable remuneration and the absence of

penalties for possible early repayments.

“We have a strong relationship with the European Investment Bank

which has been a strategic partner of MedinCell for many years,

said Jaime Arango, CFO of MedinCell. Conditions to draw the two

first parts of the new credit facility are already met and those to

draw the last part of 10 million euros should be filled in the

coming months. Therefore, the renewed support allows us to extend

our cash visibility until at least the first quarter of 2024, while

limiting the potential dilution for existing shareholders in the

short term. At that point, the company should have reached a new

level of maturity with regular revenue coming from a first product

on market, with at least two investigational products in clinical

Phase 3 and others in Phase 1 or 2, and with other programs at

formulation or preclinical stage developed on our own or with

partners.”

Main terms and conditions of credit facility

agreement

The credit facility is divided into a first tranche of 20

million euros (tranche A) and two tranches of 10 million euros

(tranches B and C). The disbursement of each tranche is subject to

the completion of certain conditions precedent specified in the

credit facility agreement.

The maturity date is five years after disbursement for each

tranche, which means that first reimbursement should occur in Q4

2027. The remuneration is tailored for each tranche separately,

with cash interest paid annually, capitalized interest paid at

maturity, and the potential capital gain under warrants based on

success of the future increase in the company's share price.

Tranche A

20 million euros drawable in Q4

2022

Remuneration

- 2% cash interest paid annually

- 4% capitalized interests paid at maturity of the tranche

- Warrants (see below)

Tranche B

10 million euros drawable in Q4

2022

Remuneration

- 2% cash interest paid annually

- Either 3% or 6% capitalized interests paid at maturity of the

tranche (depending on the number of projects in phase 3 and the

regulatory status for mdc-IRM at the time of disbursement)

- Warrants (see below)

Tranche C

10 million euros drawable under

following conditions expected to be met in 2023

- At least one product approved by the FDA > mdc-IRM approval

expected in H1 2023

- A new IND accepted OR at least one new program in Phase 3 >

mdc-TJK go to Phase 3 announced on August 29, 2022

Remuneration

- 2% cash interest paid annually

- Either 2 or 3% capitalized interests paid at maturity of the

tranche (depending on the number of projects in phase 3 and at

least one IND approved at the time of disbursement)

- Warrants (see below)

The three tranches will be available within 36 months following

the signature of the credit facility agreement.

The loan may, in certain circumstances, be prepaid, in whole or

in part, for a prepayment fee, either at the election of MedinCell

or because of EIB’s demand following certain prepayment events.

Subject to certain terms and conditions, upon the occurrence of

usual events of default EIB may demand immediate repayment by

MedinCell of all or part of the outstanding loan and/or cancel the

undisbursed tranches.

Terms and Conditions of the warrant’s agreement (to be signed

with the credit facility agreement)

A warrant is a security that entitles the holder (the EIB) to

buy new stock of the issuing company (MedinCell), at a fixed price

called the exercise price.

As part of the remuneration of the first tranche (A), MedinCell

will issue 175.000 warrants to the benefit of EIB. The number of

warrants to be issued to EIB as part of the remuneration of the

second and third tranches (B and C) will be determined based on the

average stock price before the subscription by the EIB. The

subscription price will be 0.01 euro per warrant. Each warrant will

entitle EIB to one ordinary share of MedinCell in exchange for the

exercise price.

The strike price of each warrant will be equal to 95% of the

volume weighted average of the trading price of MedinCell’s

ordinary shares over several trading days preceding the day the

issue price is set. The warrants will have a maturity of fifteen

years and will be exercisable following the earliest to occur of a

change of control event, or the maturity date (5 years) of each

tranche, or an event of default under the credit facility

agreement, or a repayment demand by the EIB under the loan

agreement.

EIB shall be entitled to a put option as an alternative to the

exercise of the warrants (subject to a cap equal to the drawn

amount under the credit facility agreement). It will require

MedinCell to buy back all or part of the warrants then exercisable

but not yet exercised in certain circumstances (for instance in

case of change of control or at the maturity date of the first

tranche or in case of event of default). In the context of a public

offering and under certain conditions, Medincell will benefit from

a call option to require EIB to sell to MedinCell (or a substitute

third party) all the warrants. Medincell will also benefit from a

right of first refusal on the warrants offered for sale to a third

party, subject to certain exceptions.

Should the EIB exercise the put option MedinCell will pay the

difference between the market value of the MedinCell's share at

that time and the exercise price of each warrant to EIB by means of

available cash, non-dilutive financing or alternatively a capital

raise. In the latter, if the first tranche of the warrants were

issued today and if the put option were exercised at 2x the

exercise price, the remuneration to EIB resulting warrants would

correspond to about 1 million euros for tranche A and about 2

million euros for each of tranche B and C .

MedinCell and the EIB will communicate upon definitive signature

of the credit facility and warrants agreements, which remain

conditional on the finalization of the legal documentation that is

expected in the coming weeks.

About MedinCell

MedinCell is a pharmaceutical company at premarketing stage that

develops a portfolio of long-acting injectable products in various

therapeutic areas by combining its proprietary BEPO® technology

with active ingredients already known and marketed. Through the

controlled and extended release of the active pharmaceutical

ingredient, MedinCell makes medical treatments more efficient,

particularly thanks to improved compliance, i.e. compliance with

medical prescriptions, and to a significant reduction in the

quantity of medication required as part of a one-off or chronic

treatment. The BEPO® technology makes it possible to control and

guarantee the regular delivery of a drug at the optimal therapeutic

dose for several days, weeks or months starting from the

subcutaneous or local injection of a simple deposit of a few

millimeters, fully bioresorbable. MedinCell collaborate with tier

one pharmaceuticals companies and foundations to improve Global

Health through new therapeutic options. Based in Montpellier,

MedinCell currently employs more than 150 people representing over

30 different nationalities.

www.medincell.com

This press release contains forward-looking statements,

including statements regarding Company’s expectations for (i) the

timing, progress and outcome of its clinical trials; (ii) the

clinical benefits and competitive positioning of its product

candidates; (iii) its ability to obtain regulatory approvals,

commence commercial production and achieve market penetration and

sales; (iv) its future product portfolio; (v) its future partnering

arrangements; (vi) its future capital needs, capital expenditure

plans and ability to obtain funding; and (vii) prospective

financial matters regarding our business. Although the Company

believes that its expectations are based on reasonable assumptions,

any statements other than statements of historical facts that may

be contained in this press release relating to future events are

forward-looking statements and subject to change without notice,

factors beyond the Company's control and the Company's financial

capabilities.

These statements may include, but are not limited to, any

statement beginning with, followed by or including words or phrases

such as "objective", "believe", "anticipate", “expect”, "foresee",

"aim", "intend", "may", "anticipate", "estimate", "plan",

"project", "will", "may", "probably", “potential”, "should",

"could" and other words and phrases of the same meaning or used in

negative form. Forward-looking statements are subject to inherent

risks and uncertainties beyond the Company's control that may, if

any, cause actual results, performance, or achievements to differ

materially from those anticipated or expressed explicitly or

implicitly by such forward-looking statements. A list and

description of these

risks, contingencies and uncertainties can be found in the

documents filed by the Company with the Autorité des Marchés

Financiers (the "AMF") pursuant to its regulatory obligations,

including the Company's registration document, registered with the

AMF on September 4, 2018, under number I. 18-062 (the "Registration

Document"), as well as in the documents and reports to be published

subsequently by the Company. In particular, readers' attention is

drawn to the section entitled "Facteurs de Risques" on page 26 of

the Registration Document.

Any forward-looking statements made by or on behalf of the

Company speak only as of the date they are made. Except as required

by law, the Company does not undertake any obligation to publicly

update these forward-looking statements or to update the reasons

why actual results could differ materially from those anticipated

by the forward-looking statements, including in the event that new

information becomes available. The Company's update of one or more

forward-looking statements does not imply that the Company will

make any further updates to such forward-looking statements or

other forward-looking statements. Readers are cautioned not to

place undue reliance on these forward-looking statements.

This press release is for information purposes only. The

information contained herein does not constitute an offer to sell

or a solicitation of an offer to buy or subscribe for the Company's

shares in any jurisdiction, in particular in France. Similarly,

this press release does not constitute investment advice and should

not be treated as such. It is not related to the investment

objectives, financial situation, or specific needs of any

recipient. It should not deprive the recipients of the opportunity

to exercise their own judgment. All opinions expressed in this

document are subject to change without notice. The distribution of

this press release may be subject to legal restrictions in certain

jurisdictions. Persons who come to know about this press release

are encouraged to inquire about, and required to comply with, these

restrictions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220905005395/en/

MedinCell David Heuzé Communication leader

david.heuze@medincell.com +33 (0)6 83 25 21 86

NewCap Louis-Victor Delouvrier/Olivier Bricaud Investor

Relations medincell@newcap.eu +33 (0)1 44 71 94 94

NewCap Nicolas Merigeau Media Relations medincell@newcap.eu +33

(0)1 44 71 94 94

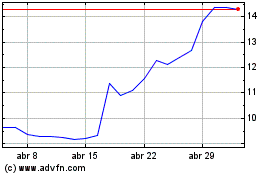

Medincell (EU:MEDCL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Medincell (EU:MEDCL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024