Strive Launches Strive 500 ETF (NYSE: STRV), Mandating the Top 500 U.S. Companies to Focus on Excellence Over Politics

20 Setembro 2022 - 8:10AM

Business Wire

Strive believes that pro-fiduciary shareholder

engagement can positively impact corporate performance

Strive sends shareholder letters to Disney and

Apple in first act of corporate engagement on behalf of STRV

investors

Strive delivers a new mandate to corporate

America: hiring should be based on merit, not social agendas

Strive Asset Management (“Strive”) launches its second index

fund, the Strive 500 ETF (NYSE: STRV, expense ratio: 0.0545%),

which seeks to track the returns of the Solactive GBS United States

500 Index. STRV provides diversified large-cap exposure to

established U.S. corporations at a competitive rate.

Strive, through its approach to proxy voting and shareholder

engagement, aims to unlock value for investors by mandating

companies to focus on maximizing value over all other agendas.

Strive believes that pro-fiduciary shareholder engagement can

positively impact the risk-return profile of a corporation for

investors. Strive’s priority is to serve its clients’ financial

interests without regard to social or political objectives.

“Our message to America’s largest companies is simple: focus on

your mission, not someone else’s social agenda. Hire talent based

on merit over other social factors. We hope to drive positive

change through our shareholder engagement,” said Vivek Ramaswamy,

executive chairman and co-founder of Strive.

Strive sent shareholder letters to Disney and Apple, two of the

world’s largest companies. This follows Strive’s September 6th

shareholder letter to the board of directors of Chevron. These

three companies are included in the holdings of the Strive 500 ETF,

and all three letters are available on www.strive.com.

The Solactive GBS United States 500 Index highlights the largest

500 companies in the U.S. stock market and is based on the

Solactive Global Benchmark Series. Constituents are selected based

on company market capitalization and weighted by free-float market

capitalization. The index is calculated based on price return in

USD and is reconstituted quarterly. The benchmark does not pursue

any environmental, social, governance (ESG) objectives, nor does it

align with the objectives of the Paris Agreement. Investors can

learn more at www.strivefunds.com/strv.

About Strive Asset Management

Strive is an Ohio-based asset management firm whose mission is

to restore the voices of everyday citizens in the American economy

by leading companies to focus on excellence over politics. Strive

will compete directly with the world’s largest asset managers by

launching funds that advance “Excellence Capitalism” in boardrooms

across corporate America. The company was co-founded by Vivek

Ramaswamy and Anson Frericks in 2022. Learn more at

www.strive.com.

IMPORTANT INFORMATION

Investors should consider the investment objectives, risks,

charges and expenses carefully before investing. For a prospectus

or summary prospectus with this and other information about the

Fund, please call 855-427-7360 or visit our website at

www.strivefunds.com. Read the prospectus or summary

prospectus carefully before investing.

Investments involve risk. Principal loss is possible. Large

Capitalization Companies Risk. Large-capitalization companies

may trail the returns of the overall stock market.

Large-capitalization stocks tend to go through cycles of doing

better – or worse – than the stock market in general. Equity

Investing Risk. An investment in the Fund involves risks

similar to those of investing in any fund holding equity

securities, such as market fluctuations, changes in interest rates

and perceived trends in stock prices. The values of equity

securities could decline generally or could underperform other

investments. Index Calculation Risk. The Index relies on

various sources of information to assess the criteria of issuers

included in the Index, including fundamental information that may

be based on assumptions and estimates. New Fund Risk. The

Fund is a recently organized management investment company with

limited operating history. As a result, prospective investors have

a limited track record or history on which to base their investment

decision.

Strive Asset Management, LLC is the sub-adviser for the Fund,

and has been given the responsibility to vote proxies related to

the securities held by the Fund, pursuant to its Proxy Voting

Policies and Procedures (Proxy Policy). Information about the

delegation of voting responsibility and Strive’s Proxy Policy can

be found in the Fund’s Statement of Additional Information,

here.

Holdings are subject to change. STRV’s current holdings can be

found here.

ESG investing is defined as utilizing environmental, social, and

governance (ESG) criteria as a set of standards for a company’s

operations that socially conscious investors use to screen

potential investments.

The Strive ETFs are distributed by Quasar Distributors, LLC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220920005490/en/

Media PR for Strive strive@gregoryfca.com

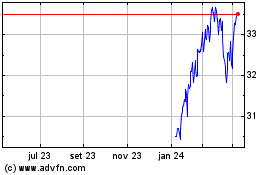

Strive 500 ETF (NYSE:STRV)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

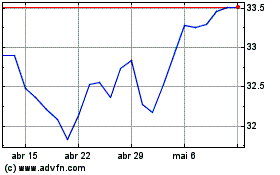

Strive 500 ETF (NYSE:STRV)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024