Amwell® (NYSE: AMWL), a leader in digital healthcare

enablement, today announced financial results for the third quarter

ended September 30, 2022.

Amwell Third Quarter 2022 Highlights:

- Recorded Total Revenue of $69.2 million in the third quarter of

2022, representing 11% growth compared to $62.2 million in the

third quarter of 2021

- Achieved subscription revenue of $31.9 million, representing

growth of 19% compared to the third quarter of 2021

- Recorded AMG Visit revenue of $28.8 million

- Reported gross margin of 40%

- Net loss was ($70.6) million compared to ($69.7) million in Q2

of 2022

- Improved adjusted EBITDA of ($41.9) million compared to ($42.8)

million in Q2 of 2022

- Total active providers(1) rose 23% to 98,500 compared to 80,000

in the third quarter of 2021

- Total visits were 1.4 million, similar to the third quarter of

2021

- Cash and short-term securities as of quarter-end were

approximately $582 million

“Q3 was another important quarter for our company, and we are

executing well through a transition time,” said Dr. Ido Schoenberg,

Chairman and co-Chief Executive Officer of Amwell, “Feedback is

excellent on Converge™, our digital care delivery enablement

platform. We made great progress with customer migrations this

quarter and we are honored that so many, including large, strategic

customers, are trusting Amwell as their technology partner for

years to come.”

Dr. Schoenberg continued, “Our approach to the market is

squarely aimed at helping organizations address the challenges they

are facing. We enable transformative patient and provider

experiences, reduce care team burnout, and free up providers to

spend their time on care by enveloping them with digital support to

streamline non-core tasks. We also empower our customers to achieve

important goals around better clinical and financial outcomes. We

are emerging as the trusted partner who can ready payers and

providers for the future of true digital first healthcare.”

Financial Outlook

The Company believes revenues will be within its original

guidance range, set at the first of the year, and is refining its

guidance as follows:

- Clear visibility to achieving revenue in the lower end of

previously provided range of $275 and $285 million

- AMG visits between 1.4 and 1.5 million

- A new Adjusted EBITDA range of between ($180) million and

($190) million, $10 million better than the prior range of ($190)

million and ($200) million

Quarterly Conference Call Details

The company will host a conference call to review the results

today, Monday November 7, 2022 at 5:00 p.m. E.T. to discuss its

financial results. The call can be accessed via a line audio

webcast at https://investors.amwell.com or by dialing

1-888-510-2008 for U.S. participants, or 1-646-960-0306 for

international participants, referencing conference ID #7830032. A

replay of the call will be available via webcast for on-demand

listening shortly after the completion of the call, at the same web

link, and will remain available for approximately 90 days.

About Amwell

Amwell is a leading digital care delivery enablement platform in

the United States and globally, connecting and enabling providers,

insurers, patients, and innovators to deliver greater access to

more affordable, higher quality care. Amwell believes that digital

care delivery will transform healthcare. The Company offers a

single, comprehensive platform to support all digital health needs

from urgent to acute and post-acute care, as well as chronic care

management and healthy living. With over a decade of experience,

Amwell powers digital health solutions for over 2,000 hospitals and

55 health plan partners with over 36,000 employers, covering over

80 million lives. For more information, please visit

https://business.amwell.com/.

American Well, Amwell, Converge, Conversa, SilverCloud and

Carepoints are registered trademarks or trademarks of American Well

Corporation in the United States and other countries. All other

trademarks used herein are the property of their respective

owners.

___________ (1)

In the quarter ended September 30, 2022,

the company changed its methodology of calculating Active Providers

as part of its efforts to account for unique providers who conduct

visits on multiple platforms. This change resulted in an

insignificant decrease in the number of active providers reported

as of June 30, 2022 and March 31, 2022. The numbers calculated

using the updated methodology resulted in year over year growth

rates for Q1 2022 and Q2 2022 of 19% and 35%, respectively.

Forward-Looking Statements

This press release contains forward-looking statements about us

and our industry that involve substantial risks and uncertainties

and are based on our beliefs and assumptions and on information

currently available to us. All statements other than statements of

historical facts contained in this press release, including

statements regarding our future results of operations, financial

condition, business strategy and plans and objectives of management

for future operations, are forward-looking statements. In some

cases, you can identify forward-looking statements because they

contain words such as “anticipate,” “believe,” “could,” “estimate,”

“expect,” “intend,” “may,” “plan,” “potential,” “predict,”

“project,” “should,” “will,” or “would,” or the negative of these

words or other similar terms or expressions.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause our actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements. Forward-looking statements

represent our beliefs and assumptions only as of the date of this

release. These statements, and related risks, uncertainties,

factors and assumptions, include, but are not limited to: weak

growth and increased volatility in the telehealth market; inability

to adapt to rapid technological changes; increased competition from

existing and potential new participants in the healthcare industry;

changes in healthcare laws, regulations or trends and our ability

to operate in the heavily regulated healthcare industry; our

ability to comply with federal and state privacy regulations; the

significant liability that could result from a cybersecurity

breach; and other factors described under ‘Risk Factors’ in our

most recent form 10-K filed with the SEC. These risks are not

exhaustive. Except as required by law, we assume no obligation to

update these forward-looking statements, or to update the reasons

actual results could differ materially from those anticipated in

the forward-looking statements, even if new information becomes

available in the future. Further information on factors that could

cause actual results to differ materially from the results

anticipated by our forward-looking statements is included in the

reports we have filed or will file with the Securities and Exchange

Commission. These filings, when available, are available on the

investor relations section of our website at investors.amwell.com

and on the SEC’s website at www.sec.gov.

AMERICAN WELL

CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

and per share amounts)

(unaudited)

September 30, 2022

December 31, 2021

Assets

Current assets:

Cash and cash equivalents

$

332,601

$

746,416

Investments

249,008

—

Accounts receivable ($164 and $2,054, from

related parties and net of allowances of $1,568 and $1,809,

respectively)

45,730

51,375

Inventories

7,969

7,530

Deferred contract acquisition costs

1,338

1,697

Prepaid expenses and other current

assets

20,598

20,278

Total current assets

657,244

827,296

Restricted cash

795

795

Property and equipment, net

1,079

2,235

Goodwill

425,196

442,761

Intangible assets, net

127,291

152,409

Operating lease right-of-use asset

14,412

16,422

Deferred contract acquisition costs, net

of current portion

3,064

2,028

Other assets

1,920

1,722

Investment in minority owned joint

venture

773

168

Total assets

$

1,231,774

$

1,445,836

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

6,175

$

12,156

Accrued expenses and other current

liabilities

45,181

58,711

Operating lease liability, current

3,623

1,918

Deferred revenue ($338 and $1,860 from

related parties, respectively)

50,151

68,841

Total current liabilities

105,130

141,626

Other long-term liabilities

2,673

5,136

Contingent consideration liabilities, net

of current portion

—

16,450

Operating lease liability, net of current

portion

12,208

14,694

Deferred revenue, net of current portion

($13 and $22 from related parties, respectively)

6,914

7,055

Total liabilities

126,925

184,961

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $0.01 par value;

100,000,000 shares authorized, no shares issued or outstanding as

of September 30, 2022 and as of December 31, 2021

—

—

Common stock, $0.01 par value;

1,000,000,000 Class A shares authorized, 242,304,366 and

229,402,453 shares issued and outstanding, respectively;

100,000,000 Class B shares authorized, 27,390,397 and 26,913,579

shares issued and outstanding, respectively; 200,000,000 Class C

shares authorized 5,555,555 issued and outstanding as of September

30, 2022 and as of December 31, 2021

2,753

2,620

Additional paid-in capital

2,133,614

2,054,275

Accumulated other comprehensive loss

(31,056

)

(6,353

)

Accumulated deficit

(1,020,865

)

(811,284

)

Total American Well Corporation

stockholders’ equity

1,084,446

1,239,258

Non-controlling interest

20,403

21,617

Total stockholders’ equity

1,104,849

1,260,875

Total liabilities and stockholders’

equity

$

1,231,774

$

1,445,836

AMERICAN WELL

CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except share

and per share amounts)

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2022

2021

2022

2021

Revenue

($729, $698, $3,106 and $11,005 from

related parties,

respectively)

$

69,209

$

62,223

$

197,957

$

180,039

Costs and operating expenses:

Costs of revenue, excluding depreciation

and amortization of intangible assets

41,507

35,184

$

114,769

104,778

Research and development

36,254

27,399

$

110,802

72,817

Sales and marketing

18,493

16,370

$

58,368

44,891

General and administrative

37,682

34,380

$

105,309

79,946

Depreciation and amortization expense

6,397

4,340

$

19,719

9,330

Total costs and operating expenses

140,333

117,673

408,967

311,762

Loss from operations

(71,124

)

(55,450

)

(211,010

)

(131,723

)

Interest income and other (expense)

income, net

1,237

(382

)

$

2,109

(97

)

Loss before expense from income taxes and

loss from equity method investment

(69,887

)

(55,832

)

(208,901

)

(131,820

)

Benefit (Expense) from income taxes

(95

)

5,454

$

(224

)

5,042

Loss from equity method investment

(593

)

(554

)

$

(1,355

)

(2,095

)

Net loss

(70,575

)

(50,932

)

(210,480

)

(128,873

)

Net loss attributable to non-controlling

interest

(491

)

562

$

(1,214

)

(332

)

Net loss attributable to American Well

Corporation

$

(70,084

)

$

(51,494

)

$

(209,266

)

$

(128,541

)

Net loss per share attributable to common

stockholders, basic and diluted

$

(0.25

)

$

(0.20

)

$

(0.77

)

$

(0.51

)

Weighted-average common shares

outstanding, basic and diluted

277,389,730

257,283,961

272,846,985

250,115,414

Net loss

$

(70,575

)

$

(50,932

)

$

(210,480

)

$

(128,873

)

Other comprehensive loss, net of tax:

Unrealized gain (loss) on

available-for-sale investments

1,002

0

(360

)

(85

)

Foreign currency translation

(11,213

)

(2,377

)

(24,343

)

(2,449

)

Comprehensive loss

(80,786

)

(53,309

)

(235,183

)

(131,407

)

Less: Comprehensive (loss) income

attributable to non-controlling interest

(491

)

562

(1,214

)

(332

)

Comprehensive loss attributable to

American Well Corporation

$

(80,295

)

$

(53,871

)

$

(233,969

)

$

(131,075

)

AMERICAN WELL

CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands, except share

and per share amounts)

(unaudited)

Nine Months Ended September

30,

2022

2021

Cash flows from operating

activities:

Net loss

$

(210,480

)

$

(128,873

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization expense

19,543

9,330

Provisions for credit losses

63

401

Amortization of deferred contract

acquisition costs

1,295

1,254

Amortization of deferred contract

fulfillment costs

452

535

Accertion of contingent consideration

—

600

Noncash compensation costs incurred by

selling shareholders

5,923

717

Stock-based compensation expense

48,419

31,756

Loss on equity method investment

1,355

2,095

Deferred income taxes

(1,390

)

(4,184

)

Changes in operating assets and

liabilities, net of acquisition:

Accounts receivable

4,796

11,325

Inventories

(439

)

28

Deferred contract acquisition costs

(2,035

)

(1,053

)

Prepaid expenses and other current

assets

(924

)

946

Other assets

(276

)

319

Accounts payable

(5,797

)

(1,332

)

Accrued expenses and other current

liabilities

1,166

(1,564

)

Other long-term liabilities

(25

)

(1,784

)

Deferred revenue

(18,023

)

(17,130

)

Net cash used in operating activities

(156,377

)

(96,614

)

Cash flows from investing

activities:

Purchases of property and equipment

(2

)

(221

)

Investment in less than majority owned

joint venture

(1,960

)

(2,548

)

Purchases of investments

(499,223

)

—

Proceeds from sales and maturities of

investments

249,855

100,000

Acquisitions of business, net of cash

acquired

—

(156,526

)

Net cash used in and provided by investing

activities

(251,330

)

(59,295

)

Cash flows from financing

activities:

Proceeds from exercise of common stock

options

5,323

18,539

Proceeds from employee stock purchase

plan

2,503

1,599

Payments for the purchase of treasury

stock

(360

)

(13,988

)

Payment of deferred offering costs

—

(1,613

)

Proceeds from Section 16(b)

disgorgement

295

—

Payment of contingent consideration

(11,790

)

—

Net cash used in and provided by financing

activities

(4,029

)

4,537

Effect of exchange rates changes on cash,

cash equivalents, and restricted cash

(2,079

)

(142

)

Net decrease in cash, cash equivalents,

and restricted cash

(413,815

)

(151,514

)

Cash, cash equivalents, and restricted

cash at beginning of period

747,211

942,711

Cash, cash equivalents, and restricted

cash at end of period

$

333,396

$

791,197

Cash, cash equivalents, and restricted

cash at end of period:

Cash and cash equivalents

332,601

790,402

Restricted cash

795

795

Total cash, cash equivalents, and

restricted cash at end of period

$

333,396

$

791,197

Supplemental disclosure of cash flow

information:

Cash (refunded) paid for income taxes

$

1,167

$

1,414

Supplemental disclosure of non-cash

investing and financing activities:

Additions to property and equipment

included in accrued expenses and accounts payable

$

—

$

312

Issuance of common stock in settlement of

earnout

$

17,243

$

—

Receivable related to exercise of common

stock options

$

—

$

142

Non-GAAP Financial Measures:

To supplement our financial information presented in accordance

with generally accepted accounting principles in the United States,

of US GAAP, we use adjusted EBITDA, which is a non-U.S GAAP

financial measure to clarify and enhance an understanding of past

performance. We believe that the presentation of adjusted EBITDA

enhances an investor’s understanding of our financial performance.

We further believe that adjusted EBITDA is a useful financial

metric to assess our operating performance from period-to-period by

excluding certain items that we believe are not representative of

our core business. We use certain financial measures for business

planning purposes and in measuring our performance relative to that

of our competitors. We utilize adjusted EBITDA as the primary

measure of our performance.

We calculate adjusted EBITDA as net loss adjusted to exclude (i)

interest income and other income, net, (ii) tax benefit and

expense, (iii) depreciation and amortization, (iv) stock-based

compensation expense, (v) public offering expenses, (vi)

acquisition-related expenses, (vii) litigation expenses related to

the defense of our patents in the patent infringement claim filed

by Teladoc and (viii) other items affecting our results that we do

not view as representative of our ongoing operations, including

noncash compensation costs incurred by selling shareholders and

adjustments made to the contingent consideration.

We believe adjusted EBITDA is a commonly used by investors to

evaluate our performance and that of our competitors. However, our

use of the term adjusted EBITDA may vary from that of others in our

industry. Adjusted EBITDA should not be considered as an

alternative to net loss before taxes, net loss, loss per share or

any other performance measures derived in accordance with U.S. GAAP

as measures of performance.

Adjusted EBITDA has important limitations as an analytical tool

and you should not consider it in isolation or as a substitute for

analysis of our results as reported under U.S. GAAP. Some of the

limitations of adjusted EBITDA include (i) adjusted EBITDA does not

properly reflect capital commitments to be paid in the future, and

(ii) although depreciation and amortization are non-cash charges,

the underlying assets may need to be replaced and adjusted EBITDA

does not reflect these capital expenditures. Our public offering

expenses, including legal, accounting and other professional

expenses, reflect cash expenditures and we expect such expenditures

to recur from time to time. Our adjusted EBITDA may not be

comparable to similarly titled measures of other companies because

they may not calculate adjusted EBITDA in the same manner as we

calculate the measure, limiting its usefulness as a comparative

measure.

In evaluating adjusted EBITDA, you should be aware that in the

future we will incur expenses similar to the adjustments in this

presentation. Our presentation of adjusted EBITDA should not be

construed as an inference that our future results will be

unaffected by these expenses or any unusual or non-recurring items.

Adjusted EBITDA should not be considered as an alternative to loss

before benefit from income taxes, net loss, earnings per share, or

any other performance measures derived in accordance with U.S.

GAAP. When evaluating our performance, you should consider adjusted

EBITDA alongside other financial performance measures, including

our net loss and other GAAP results.

Other than with respect to GAAP Revenue, the Company only

provides guidance on a non-GAAP basis. The Company does not provide

a reconciliation of forward-looking Adjusted EBITDA (non-GAAP) to

GAAP net income (loss), due to the inherent difficulty in

forecasting and quantifying certain amounts that are necessary for

such reconciliation because other deductions used to calculate

projected net income (loss) vary dramatically based on actual

events, the Company is not able to forecast on a GAAP basis with

reasonable certainty all deductions needed in order to provide a

GAAP calculation of projected net income (loss) at this time. The

amount of these deductions may be material and, therefore, could

result in projected GAAP net income (loss) being materially less

than projected Adjusted EBITDA (non-GAAP).

The following table presents a reconciliation of adjusted EBITDA

from the most comparable GAAP measure, net loss, for the three and

nine months ended September 30, 2022 and 2021:

Three Months Ended September

30,

Nine Months Ended September

30,

(in thousands)

2022

2021

2022

2021

Net loss

$

(70,575

)

$

(50,932

)

$

(210,480

)

$

(128,873

)

Add:

Depreciation and amortization

6,397

4,340

19,719

9,330

Interest income and other (expense)

income, net

(1,237

)

382

(2,109

)

97

Benefit (Expense) from income taxes

95

(5,454

)

224

(5,042

)

Stock-based compensation

21,312

12,388

48,304

31,756

Public offering expenses(1)

—

—

—

1,223

Acquisition-related expenses

—

7,419

—

8,006

Noncash expenses and contingent

consideration adjustments(2)

1,930

—

6,926

—

Litigation expense

176

371

5,575

1,918

Adjusted EBITDA

$

(41,902

)

$

(31,486

)

$

(131,841

)

$

(81,585

)

(1)

Public offering expenses include non-recurring expenses incurred

in relation to our secondary offering for the nine months ended

September 30, 2021.

(2)

Noncash expenses and contingent consideration adjustments

include, noncash compensation costs incurred by selling

shareholders and adjustments made to the contingent

consideration.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221107005709/en/

Media: Lindsay Sharifipour Press@amwell.com

Investors: Sue Dooley sue.dooley@amwell.com

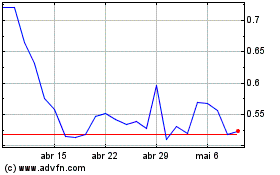

American Well (NYSE:AMWL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

American Well (NYSE:AMWL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024