Coty Expands Its Future Shareholder Returns, Alongside Expected Capital Structure Improvement

12 Dezembro 2022 - 7:36PM

Business Wire

Coty Starting to Hedge Stock Price for Expected

Buyback in CY25 of Around $200M, Adding to Previously Announced

$200M Hedged Buyback in CY24 Coty to Continue its Disciplined

Deleveraging Trajectory Towards 2x by CY25

Coty Inc. (NYSE: COTY) today announced it is entering into

agreements with several banks to start hedging a planned share

buyback program of approximately $200 million in calendar 2025.

This program adds to the Company’s previously announced $200

million hedged buyback in CY24. Coty anticipates continued strong

free cash flow generation and steady deleveraging progress in the

coming years, continuing to target leverage towards 4x exiting

CY22, towards 3x exiting CY23, and towards 2x CY25.

Similar to the initial program announced in June 2022, Coty has

entered into total return swaps in respect of its Class A Common

Stock with several banks to hedge its potential exposure at around

prevailing stock price trading levels over the applicable hedging

periods for a planned share buyback program of approximately $200

million. Any total return swap settled in shares would be covered

by the Company’s existing share repurchase authorization.

About Coty Inc. Founded in Paris in 1904, Coty is one of

the world’s largest beauty companies with a portfolio of iconic

brands across fragrance, color cosmetics, and skin and body care.

Coty serves consumers around the world, selling prestige and mass

market products in more than 130 countries and territories. Coty

and our brands empower people to express themselves freely,

creating their own visions of beauty; and we are committed to

making a positive impact on the planet. Learn more at coty.com or

on LinkedIn and Instagram.

Cautionary Note Regarding Forward-looking Statements The

statements contained in this press release include certain

“forward-looking statements” within the meaning of the securities

laws. These forward-looking statements reflect Coty’s current views

with respect to, among other things, its leverage targets and

deleveraging plans, future equity distribution and share repurchase

plans, as well as its outlook, expected guidance, trends and

strategic information. These forward-looking statements are

generally identified by words or phrases, such as “anticipate,”

“are going to,” “estimate,” “plan,” “project,” “expect,” “believe,”

“intend,” “foresee,” “forecast,” “will,” “may,” “should,”

“outlook,” “continue,” “target,” “aim,” “potential” and similar

words or phrases. These statements are based on certain assumptions

and estimates that Coty considers reasonable and are not guarantees

of Coty’s future performance, but are subject to a number of risks

and uncertainties, many of which are beyond Coty’s control, which

could cause actual events or results to differ materially from such

statements, including the factors identified in “Risk Factors”

included in Coty’s Annual Report on Form 10-K for the fiscal year

ended June 30, 2021 and its subsequent quarterly reports on Form

10-Q. All forward-looking statements made in this press release are

qualified by these cautionary statements. These forward-looking

statements are made only as of the date of this press release, and

Coty does not undertake any obligation, other than as may be

required by law, to update or revise any forward-looking or

cautionary statements to reflect changes in assumptions, the

occurrence of events, unanticipated or otherwise, or changes in

future operating results over time or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221212005827/en/

Investor Relations Olga Levinzon 212-389-7733

Olga_Levinzon@cotyinc.com

Media Antonia Werther +31 621 394495

Antonia_Werther@cotyinc.com

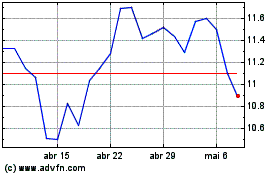

Coty (NYSE:COTY)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Coty (NYSE:COTY)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024