Barclays Bank PLC (“Barclays”) announced today that it

will exercise its issuer call option and redeem in full its iPath®

S&P GSCI® Crude Oil Total Return Index ETNs due August 14, 2036

(CUSIP: 06738C760; Ticker: OILNF) (the “ETNs”) on January

25, 2023 (the “Redemption Date”).

After obtaining the requisite consents in connection with

Barclays’ cash tender offer and consent solicitation, Barclays, on

January 5, 2023, amended the ETNs’ indenture and global certificate

to provide Barclays with the right to redeem, in its sole

discretion, all, but not less than all, of its outstanding ETNs, on

the Redemption Date. Please see the related press release (link

below) for further details regarding the tender offer and consent

solicitation.

https://indices.barclays/dms/Public%20marketing/Barclays_Bank_PLC_Announces_Results_of_Cash_Tender_Offer_and_Consent_Solicitation_for_its_OILNF_ETN.pdf

The “Valuation Date” for the redemption of the ETNs will

be January 18, 2023, the fifth business day prior to the Redemption

Date. A holder of the ETNs on the Redemption Date will receive a

cash payment per ETN in an amount equal to the principal amount of

the holder’s ETNs times the Index Factor (as defined in the

prospectus relating to the ETNs) on the Valuation Date minus the

Investor Fee (as defined in the prospectus relating to the ETNs) on

the Valuation Date.

Holders of ETNs subject to issuer redemption may choose to

continue to hold their ETNs until the Redemption Date or choose to

sell/redeem their ETNs at a suitable time prior to that. Any

redemption of ETNs is subject to the conditions and procedures

described in the prospectus for the ETNs and will be valued on the

valuation date for the transaction as described in the section

“Specific Terms of the ETNs—Payment Upon Redemption” of the

prospectus relating to the ETNs. The procedures for redemption

include delivering a notice of redemption and signed confirmation

to Barclays prior to the relevant valuation date within the time

frames set forth in the prospectus and instructing the DTC

custodian at which the ETNs are held to book and settle a delivery

vs. payment trade with respect to the ETNs.

Anyone considering investing in the ETNs or continuing to hold

the ETNs should consider the risks described in the prospectus for

the ETNs when making an investment decision and consult with their

broker or financial adviser to evaluate their investment in the

ETNs.

The pricing supplement and prospectus relating to the ETNs can

be found on EDGAR, the SEC’s website at www.sec.gov, as well as on

the product website at the product page for the ETNs at

ipathetn.barclays/OILNF.

An investment in the ETNs involves significant risks and may

not be suitable for all investors. The ETNs are riskier than

ordinary unsecured debt securities and do not benefit from any

principal protection. For more information on risks associated with

the ETNs, please see “Selected Risk Considerations” below and the

risk factors included in the relevant pricing supplement.

Barclays is the issuer of the ETNs and Barclays Capital Inc. is

the issuer’s agent in the distribution. Please contact Barclays for

further questions:

- Financial advisors: Directly contact Barclays at

etndesk@barclays.com or 1-212-528-7990 to obtain further

information.

- Individual investors: Instruct your broker/advisor/custodian to

email us at etndesk@barclays.com or to call us at: 1-212-528-7990.

You may call in together with your broker/advisor/custodian or have

them speak to us on your behalf.

About Barclays

Barclays is a British universal bank. We are diversified by

business, by different types of customers and clients, and by

geography. Our businesses include consumer banking and payments

operations around the world, as well as a full-service corporate

and investment bank. For further information about Barclays, please

visit our website www.barclays.com.

Selected Risk Considerations

An investment in the ETNs described herein involves risks.

Selected risks are summarized here, but we urge you to read the

more detailed explanation of risks described under “Risk Factors”

in the applicable prospectus supplement and pricing supplement.

You May Lose Some or All of Your Principal: The ETNs are exposed

to any change in the level of the underlying index between the

inception date and the applicable valuation date. Additionally, if

the level of the underlying index is insufficient to offset the

negative effect of the investor fee and other applicable costs, you

will lose some or all of your investment at maturity or upon

redemption, even if the value of such index has increased or

decreased, as the case may be. Because the ETNs are subject to an

investor fee and other applicable costs, the return on the ETNs

will always be lower than the total return on a direct investment

in the index components. The ETNs are riskier than ordinary

unsecured debt securities and have no principal protection.

Credit of Barclays Bank PLC: The ETNs are unsecured debt

obligations of Barclays Bank PLC and are not, either directly or

indirectly, an obligation of or guaranteed by any third party. Any

payment to be made on the ETNs, including any payment at maturity

or upon redemption, depends on the ability of Barclays Bank PLC to

satisfy its obligations as they come due. As a result, the actual

and perceived creditworthiness of Barclays Bank PLC will affect the

market value, if any, of the ETNs prior to maturity or redemption.

In addition, if Barclays Bank PLC were to default on its

obligations, you may not receive any amounts owed to you under the

terms of the ETNs.

Issuer Redemption: Barclays Bank PLC will have the right

to redeem or call the ETNs (in whole but not in part) at its sole

discretion and without your consent on any trading day on or after

the inception date until and including maturity.

Market and Volatility Risk: The market value of the ETNs

may be influenced by many unpredictable factors and may fluctuate

between the date you purchase them and the maturity date or

redemption date. You may also sustain a significant loss if you

sell your ETNs in the secondary market. Factors that may influence

the market value of the ETNs include prevailing market prices of

the commodity markets, the U.S. stock markets or the U.S. Treasury

market, the index components included in the underlying index, and

prevailing market prices of options on such index or any other

financial instruments related to such index; and supply and demand

for the ETNs, including economic, financial, political, regulatory,

geographical or judicial events that affect the level of such index

or other financial instruments related to such index.

Concentration Risk: Because the ETNs are linked to an index

composed of futures contracts on a single commodity or in only one

commodity sector, the ETNs are less diversified than other funds.

The ETNs can therefore experience greater volatility than other

funds or investments.

No Interest Payments from the ETNs: You may not receive any

interest payments on the ETNs.

Restrictions on the Minimum Number of ETNs and Date Restrictions

for Redemptions: Except as specified in the pricing supplement, you

must redeem at least the minimum number of ETNs specified in the

pricing supplement at one time in order to exercise your right to

redeem your ETNs on any redemption date. You may only redeem your

ETNs on a redemption date if we receive a notice of redemption from

you by certain dates and times as set forth in the pricing

supplement.

Uncertain Tax Treatment: Significant aspects of the tax

treatment of the ETNs are uncertain. You should consult your own

tax advisor about your own tax situation.

To the extent that a secondary market exists, the ETNs may be

sold throughout the day through any brokerage account. Commissions

may apply and there are tax consequences in the event of sale,

redemption or maturity of ETNs. Sales in the secondary market

may result in significant losses.

The S&P GSCI® Total Return Index and the S&P GSCI® Crude

Oil Total Return Index (the “S&P GSCI Indices”) are products of

S&P Dow Jones Indices LLC (“SPDJI”), and have been licensed for

use by Barclays Bank PLC. S&P® and GSCI® are registered

trademarks of Standard & Poors’ Financial Services LLC

(“SPFS”). These trademarks have been licensed to SPDJI and its

affiliates and sublicensed to Barclays Bank PLC for certain

purposes. The S&P GSCI® Indices are not owned, endorsed, or

approved by or associated with Goldman, Sachs & Co. or its

affiliated companies. The ETNs are not sponsored, endorsed, sold or

promoted by SPDJI, SPFS, or any of their respective affiliates

(collectively, “S&P Dow Jones Indices”). S&P Dow Jones

Indices does not make any representation or warranty, express or

implied, to the owners of the ETNs or any member of the public

regarding the advisability of investing in securities generally or

in the ETNs particularly or the ability of the S&P GSCI®

Indices to track general market performance.

© 2023 Barclays Bank PLC. All rights reserved. iPath, iPath ETNs

and the iPath logo are registered trademarks of Barclays Bank PLC.

All other trademarks, servicemarks or registered trademarks are the

property, and used with the permission, of their respective

owners.

NOT FDIC INSURED · NO BANK

GUARANTEE · MAY LOSE VALUE

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230106005046/en/

Matt Scully +1 212 526 7844 Matthew.Scully@Barclays.com

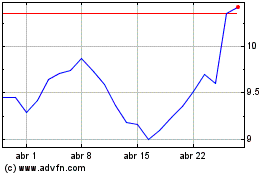

Barclays (NYSE:BCS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

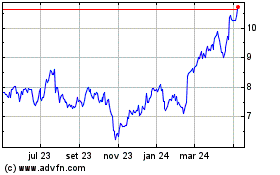

Barclays (NYSE:BCS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024