Marley Spoon: Profitable Q4 While Delivering Full Year Guidance

30 Janeiro 2023 - 8:53PM

Business Wire

Appendix 4C – Q4 2022 & Business Activity

Report

Marley Spoon AG (“Marley Spoon” or the “Company” ASX: MMM), a

leading global subscription-based meal kit provider, is pleased to

share with investors its highlights from the quarter ended 31

December 2022 (“Q4 2022”) and guidance for FY 2023.

Highlights:

- FY 2022 net revenue of €401m, +24% growth year-over-year (YoY)

(+16% in constant currency), in line with full year guidance

- Q4 2022 net revenue of €89m, +5% growth year-over-year (nearly

flat at -0.5% in constant currency)

- Global Contribution Margin (CM) in Q4 of 32.3%, up 3.5 points

vs. the previous quarter and 1.3 points better than the previous

corresponding period (PCP). Improvements in all regions vs. Q3

- FY 2022 CM at 28.7%, in-line with guidance

- Positive Q4 Operating EBITDA of €5m1, exceeding guidance, and

an improvement of €6m vs. the previous quarter and €9.8m vs. the

PCP

- Operating Cash Flow at €(4.7m) and year end cash balance of

€19m following completion of Q4 capital raise

Marley Spoon CEO, Fabian Siegel, highlighted, "I am pleased to

report that Marley Spoon delivered on expectations and performed to

plan. We finished the year strongly with positive Operating EBITDA

of €5m in Q4, exceeding our guidance range. The performance was

driven by strong margin expansion across all regions and the

successful execution of our measured growth strategy.

I would like to thank all our team members for this great

performance. We delivered on our plan and achieved our full year

guidance in a challenging year that was impacted by supply chain

disruptions, inflationary pressures, severe weather events and

muted consumer confidence. Despite these headwinds we ended the

year with our highest contribution margin globally and with a

profitable Q4 and H2 2022.

Our 2023 outlook is cautiously optimistic. We see consumer

demand softening due to continued inflation and economic

challenges, which are eroding consumer purchasing power and

confidence. However, we have significant scope to grow as our

category transitions online and our meal kit offer is superior to

supermarkets. We will leverage our multi-brand portfolio while

continuing to focus on increased choice, personalization and

offerings for budget-conscious consumers.

The Company’s planned sequential reduction in marketing spend

throughout the year and the Contribution Margin expansion led to a

record Operating EBITDA result that was significantly improved

versus the prior year and the prior quarter, landing at €5m,

excluding one-time charges from severance payments and historical

sales tax corrections in the US, and €(8.8m) for the FY. This

translated to a Q4 2022 net income loss of €(2.5m), or €(39.9m) for

the full year.

2023 OUTLOOK AND GUIDANCE

Marley Spoon CFO, Jennifer Bernstein, commented, “Despite

several headwinds in 2022, we delivered on our plan and met our

guidance expectations. We grew the business, maintained margins vs.

2021, exited the year on a very strong margin trajectory and

significantly improved profitability year-over-year. Looking into

2023, we are cautiously optimistic. We anticipate a potential

impact on consumer behavior from inflation and are mindful of

consumers’ budget concerns. We have recently launched “Super Saver”

recipes in the US as part of our initiative to offer 100 weekly

recipes to customers and will launch them later this quarter in the

EU. We will also continue leveraging our multi-brand portfolio

while highlighting that meal kits offer more cost control than

shopping in the supermarket. For full year 2023, we are guiding to

single digit net revenue growth vs. the PCP while planning to

deliver margin expansion driven by improved operational

capabilities, despite ongoing inflation. Our continued focus on

operating in a disciplined way, paired with expanded margin and

conservative growth, gives us the confidence to guide to a positive

Operating EBITDA for 2023 on a full year basis. This should lead to

positive operating cash flow which will help us as we carefully

manage within our lean balance sheet capacity.”

2023 Guidance:

- Single digit net revenue growth vs. FY 2022 in constant

currency

- Contribution Margin expansion to between 30% - 32%

- Full year positive Operating EBITDA

For the Q4 and full year report and preliminary results visit

https://tinyurl.com/muatbzpb. The Q4 2022 and full year

presentation of preliminary results can be found via

https://tinyurl.com/3hvcepf6.

About Marley Spoon

Marley Spoon (MMM:ASX, GICS: Internet & Direct Marketing

Retail) is a global direct-to-consumer brand company that is

solving everyday recurring problems in delightful and sustainable

ways. Founded in 2014, Marley Spoon currently operates in three

primary regions: Australia, United States and Europe (Austria,

Belgium, Germany, Denmark, Sweden and the Netherlands).

With Marley Spoon’s meal-kits, you decide what to eat, when to

eat, and leave behind the hassle of grocery shopping. To help make

weeknights easier and dinners more delicious, our meal kits contain

step-by-step recipes and pre-portioned seasonal ingredients to cook

better, healthy meals for your loved ones.

As consumer behaviour moves towards valuing the convenience

aspect of online ordering, Marley Spoon’s global mission through

its various brands, such as Marley Spoon, Martha Stewart &

Marley Spoon, Dinnerly, and Chefgood is to help millions of people

to enjoy easier, smarter and more sustainable lives.

12022 Operating EBITDA excludes severance payments in the amount

of €0.3m as well as a one-time sales tax charge in the US of

€0.1m

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230130005745/en/

COMPANY INFORMATION: Fabian Siegel, Marley Spoon CEO

fabian@marleyspoon.com

INVESTOR QUERIES: Michael Brown, Pegasus 0400 248 080

mbrown@pegasusadvisory.com.au

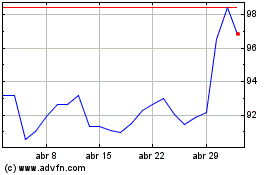

3M (NYSE:MMM)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

3M (NYSE:MMM)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024