The Walt Disney Company (NYSE: DIS) today reported earnings for

its first quarter ended December 31, 2022.

- Revenues for the quarter grew 8%.

- Diluted earnings per share (EPS) from continuing operations for

the quarter increased to $0.70 from $0.63 in the prior-year

quarter.

- Excluding certain items(1), diluted EPS for the quarter

decreased to $0.99 from $1.06 in the prior-year quarter.

“After a solid first quarter, we are embarking on a significant

transformation, one that will maximize the potential of our

world-class creative teams and our unparalleled brands and

franchises,” said Robert A. Iger, Chief Executive Officer, The Walt

Disney Company. “We believe the work we are doing to reshape our

company around creativity, while reducing expenses, will lead to

sustained growth and profitability for our streaming business,

better position us to weather future disruption and global economic

challenges, and deliver value for our shareholders.”

The following table summarizes the first quarter results for

fiscal 2023 and 2022 (in millions, except per share amounts):

Quarter Ended

December 31, 2022

January 1, 2022

Change

Revenues

$

23,512

$

21,819

8

%

Income from continuing operations before

income taxes

$

1,773

$

1,688

5

%

Total segment operating income(1)

$

3,043

$

3,258

(7

)%

Net income from continuing

operations(2)

$

1,279

$

1,152

11

%

Diluted EPS from continuing

operations(2)

$

0.70

$

0.63

11

%

Diluted EPS excluding certain items(1)

$

0.99

$

1.06

(7

)%

Cash used in continuing operations

$

(974

)

$

(209

)

>(100

)%

Free cash flow(1)

$

(2,155

)

$

(1,190

)

(81

)%

(1)

Diluted EPS excluding certain

items, total segment operating income and free cash flow are

non-GAAP financial measures. The most comparable GAAP measures are

diluted EPS from continuing operations, income from continuing

operations before income taxes, and cash provided by continuing

operations, respectively. See the discussion on page 2 and on pages

10 through 12 for how we define and calculate these measures and a

reconciliation thereof to the most directly comparable GAAP

measures.

(2)

Reflects amounts attributable to

shareholders of The Walt Disney Company, i.e. after deduction of

income attributable to noncontrolling interests.

SEGMENT RESULTS

The Company evaluates the performance of its operating segments

based on segment operating income, and management uses total

segment operating income as a measure of the performance of

operating businesses separate from non-operating factors. The

Company believes that information about total segment operating

income assists investors by allowing them to evaluate changes in

the operating results of the Company’s portfolio of businesses

separate from non-operational factors that affect net income, thus

providing separate insight into both operations and other factors

that affect reported results.

The following are reconciliations of income from continuing

operations before income taxes to total segment operating income

(in millions):

Quarter Ended

December 31, 2022

January 1, 2022

Change

Income from continuing operations before

income taxes

$

1,773

$

1,688

5

%

Add:

Corporate and unallocated shared

expenses

280

228

(23

)%

Restructuring and impairment charges

69

—

nm

Other expense, net

42

436

90

%

Interest expense, net

300

311

4

%

Amortization of TFCF and Hulu intangible

assets and fair value step-up on film and television costs

579

595

3

%

Total segment operating income

$

3,043

$

3,258

(7

)%

The following table summarizes the first quarter segment revenue

and segment operating income (loss) for fiscal 2023 and 2022 (in

millions):

Quarter Ended

December 31, 2022

January 1, 2022

Change

Segment Revenues:

Disney Media and Entertainment

Distribution

$

14,776

$

14,585

1

%

Disney Parks, Experiences and Products

8,736

7,234

21

%

Total Segment Revenues

$

23,512

$

21,819

8

%

Segment operating income (loss):

Disney Media and Entertainment

Distribution

$

(10

)

$

808

nm

Disney Parks, Experiences and Products

3,053

2,450

25

%

Total Segment Operating Income

$

3,043

$

3,258

(7

)%

Disney Media and Entertainment

Distribution

Revenue and operating results for the Disney Media and

Entertainment Distribution segment are as follows (in

millions):

Quarter Ended

Change

December 31, 2022

January 1, 2022

Revenues:

Linear Networks

$

7,293

$

7,706

(5

)%

Direct-to-Consumer

5,307

4,690

13

%

Content Sales/Licensing and Other

2,460

2,433

1

%

Elimination of Intrasegment Revenue(1)

(284

)

(244

)

(16

)%

$

14,776

$

14,585

1

%

Operating income (loss):

Linear Networks

$

1,255

$

1,499

(16

)%

Direct-to-Consumer

(1,053

)

(593

)

(78

)%

Content Sales/Licensing and Other

(212

)

(98

)

>(100

)%

$

(10

)

$

808

nm

(1)

Reflects fees received by the

Linear Networks from other DMED businesses for the right to air our

Linear Networks and related services.

Linear Networks

Linear Networks revenues for the quarter decreased 5% to $7.3

billion, and operating income decreased 16% to $1.3 billion. The

following table provides further detail of Linear Networks results

(in millions):

Quarter Ended

Change

December 31, 2022

January 1, 2022

Supplemental revenue detail

Domestic Channels

$

6,066

$

6,152

(1

)%

International Channels

1,227

1,554

(21

)%

$

7,293

$

7,706

(5

)%

Supplemental operating income detail

Domestic Channels

$

928

$

888

5

%

International Channels

131

369

(64

)%

Equity in the income of investees

196

242

(19

)%

$

1,255

$

1,499

(16

)%

Domestic Channels

Domestic Channels revenues for the quarter decreased 1% to $6.1

billion, and operating income increased 5% to $928 million. The

increase in operating income was due to higher results at Cable,

while results at Broadcasting were comparable to the prior-year

quarter.

The increase at Cable was due to lower programming and

production costs, partially offset by decreases in advertising and

affiliate revenue. The decrease in programming and production costs

was attributable to lower costs for sports programming and, to a

lesser extent, a lower cost mix of non-sports programming. The

decrease in sports programming and production costs was due to

lower NFL and College Football Playoff (CFP) rights costs,

partially offset by an increase in production costs. The decline in

NFL rights expense reflects the timing of costs under our new

agreement compared to the prior NFL agreement. The decrease in

costs for CFP programming was due to the timing of the CFP games

relative to our fiscal periods, partially offset by contractual

rate increases. The current quarter included two host games and two

semi-final games compared to four host games and two semi-final

games in the prior-year quarter. Lower advertising revenue was due

to a decrease in rates and fewer impressions reflecting a decline

in average viewership. Rates and impressions were impacted by the

timing of CFP games. The decrease in affiliate revenue was

attributable to a decline in subscribers, partially offset by

higher contractual rates.

Broadcasting results were comparable to the prior-year quarter

as growth at the owned television stations from higher advertising

revenue was largely offset by lower results at ABC. The decrease at

ABC was due to lower advertising revenue, partially offset by

higher affiliate revenue from contractual rate increases. Lower

advertising revenue resulted from fewer impressions reflecting a

decline in average viewership and, to a lesser extent, fewer units

delivered, partially offset by higher rates.

International Channels

International Channels revenues for the quarter decreased 21% to

$1.2 billion and operating income decreased 64% to $131 million.

The decrease in operating income was due to lower advertising

revenue, an unfavorable foreign exchange impact and a decrease in

affiliate revenue, partially offset by a decrease in programming

and production costs.

The decrease in advertising revenue was due to lower average

viewership and rates. The decline in affiliate revenue reflected

the impact of channel closures in the prior year, partially offset

by higher contractual rates. Lower programming and production costs

were due to decreased sports programming costs attributable to

lower costs for cricket rights, partially offset by higher

production costs and costs for new soccer rights.

The decreases in cricket programming costs and advertising

viewership reflected no Indian Premier League (IPL) cricket matches

aired in the current quarter compared to thirteen matches aired in

the prior-year quarter as matches shifted from fiscal 2021 into

fiscal 2022 due to COVID-19. IPL matches typically occur in the

second and third quarters of our fiscal year. The decrease in

cricket programming costs was also due to lower costs per match for

the International Cricket Council T20 World Cup compared to the

prior-year quarter.

Equity in the Income of

Investees

Income from equity investees decreased $46 million, to $196

million from $242 million, due to lower income from A+E Television

Networks attributable to lower advertising revenue and higher

programming costs.

Direct-to-Consumer

Direct-to-Consumer revenues for the quarter increased 13% to

$5.3 billion and operating loss increased $0.5 billion to $1.1

billion. The increase in operating loss was due to a higher loss at

Disney+ and a decrease in results at Hulu, partially offset by

improved results at ESPN+.

Results at Disney+ reflected higher programming and production

costs and increased technology costs, partially offset by higher

subscription revenue and a decrease in marketing costs. The

increase in programming and production costs was attributable to

more content provided on the service and higher average costs per

hour, which included an increased mix of original content. Higher

subscription revenue was due to subscriber growth, partially offset

by an unfavorable foreign exchange impact.

The decrease in results at Hulu was primarily due to higher

programming and production costs and a decrease in advertising

revenue, partially offset by subscription revenue growth. The

increase in programming and production costs was attributable to an

increase in subscriber-based fees for programming the Live TV

service, more content provided on the service and higher average

costs per hour. Higher subscriber-based fees for programming the

Live TV service were due to rate increases and more subscribers.

The decrease in advertising revenue was caused by lower

impressions, partially offset by an increase in rates. Subscription

revenue growth was due to increases in retail pricing and

subscribers.

The improvement at ESPN+ was due to growth in subscription

revenue attributable to increases in subscribers and retail

pricing.

First Quarter of Fiscal 2023 Comparison to

Fourth Quarter of Fiscal 2022

The following tables and related discussion present additional

information about our Disney+, ESPN+ and Hulu direct-to-consumer

(DTC) product offerings(1) on a sequential quarter basis.

Paid subscribers(1) as of:

(in millions)

December 31, 2022

October 1, 2022

Change

Disney+

Domestic (U.S. and Canada)

46.6

46.4

—

%

International (excluding Disney+

Hotstar)(1)

57.7

56.5

2

%

Disney+ Core(2)

104.3

102.9

1

%

Disney+ Hotstar

57.5

61.3

(6

)%

Total Disney+(2)

161.8

164.2

(1

)%

ESPN+

24.9

24.3

2

%

Hulu

SVOD Only

43.5

42.8

2

%

Live TV + SVOD

4.5

4.4

2

%

Total Hulu(2)

48.0

47.2

2

%

Average Monthly Revenue Per Paid Subscriber(1) for the quarter

ended:

December 31, 2022

October 1, 2022

Change

Disney+

Domestic (U.S. and Canada)

$

5.95

$

6.10

(2

)%

International (excluding Disney+

Hotstar)(1)

5.62

5.83

(4

)%

Disney+ Core

5.77

5.96

(3

)%

Disney+ Hotstar

0.74

0.58

28

%

Global Disney+

3.93

3.91

1

%

ESPN+

5.53

4.84

14

%

Hulu

SVOD Only

12.46

12.23

2

%

Live TV + SVOD

87.90

86.77

1

%

(1)

See discussion on page 10—DTC

Product Descriptions and Key Definitions

(2)

Total may not equal the sum of

the column due to rounding

The average monthly revenue per paid subscriber for domestic

Disney+ decreased from $6.10 to $5.95 driven by a higher mix of

subscribers to multi-product offerings, partially offset by an

increase in retail pricing.

The average monthly revenue per paid subscriber for

international Disney+ (excluding Disney+ Hotstar) decreased from

$5.83 to $5.62 due to an unfavorable foreign exchange impact.

The average monthly revenue per paid subscriber for Disney+

Hotstar increased from $0.58 to $0.74 due to higher per-subscriber

advertising revenue.

The average monthly revenue per paid subscriber for ESPN+

increased from $4.84 to $5.53 due to an increase in retail pricing,

partially offset by a higher mix of subscribers to multi-product

offerings.

The average monthly revenue per paid subscriber for the Hulu

SVOD Only service increased from $12.23 to $12.46 due to an

increase in retail pricing, partially offset by a higher mix of

subscribers to multi-product offerings and lower per-subscriber

advertising revenue.

The average monthly revenue per paid subscriber for the Hulu

Live TV + SVOD service increased from $86.77 to $87.90 due to

higher per-subscriber advertising revenue.

Content Sales/Licensing and Other

Content Sales/Licensing and Other revenues for the quarter

increased 1% to $2.5 billion and operating loss increased by $114

million to a loss of $212 million. The increase in operating loss

was due to lower TV/SVOD distribution results, higher overhead

costs and a decrease in home entertainment distribution results.

These decreases were partially offset by higher theatrical

distribution results.

The decrease in TV/SVOD distribution results was primarily due

to lower sales volumes of both film and episodic television content

reflecting the shift from licensing content to third parties to

distributing it on our DTC services. The decrease in sales of

episodic television content was also driven by the comparison to a

license of animated series in the prior-year quarter.

The decrease in home entertainment results was due to lower unit

sales of new release titles, reflecting fewer releases, and catalog

titles.

The increase in theatrical distribution results reflected the

performance of titles released in the current quarter led by Black

Panther: Wakanda Forever, as well as fewer releases, compared to

losses on titles released in the prior-year quarter, partially

offset by the comparison to income from the release of Marvel’s

Spider-Man: No Way Home co-production in the prior-year quarter.

Other releases in the current quarter included Avatar: The Way of

Water and Strange World.

Disney Parks, Experiences and

Products

Disney Parks, Experiences and Products revenues for the quarter

increased 21% to $8.7 billion and segment operating income

increased 25% to $3.1 billion. Higher operating results for the

quarter reflected increases at our domestic parks and experiences

and, to a lesser extent, our international parks and resorts.

Operating income growth at our domestic parks and experiences

was due to higher volumes and increased guest spending, partially

offset by cost inflation, higher operations support costs and

increased costs for new guest offerings. Higher volumes were

attributable to increases in passenger cruise days, attendance and

occupied room nights. Guest spending growth was due to an increase

in average per capita ticket revenue driven by Genie+ and Lightning

Lane, which were introduced in the prior-year quarter.

Increased results at our international parks and resorts were

due to growth at Disneyland Paris and higher royalties from Tokyo

Disney Resort, partially offset by a decrease at Shanghai Disney

Resort. Higher operating results at Disneyland Paris were due to an

increase in volumes and higher guest spending, partially offset by

a loss on the disposal of our ownership interest in Villages

Nature, increased costs for new guest offerings and cost inflation.

Higher volumes consisted of increases in attendance and occupied

room nights. Guest spending growth was driven by an increase in

average ticket prices and higher average daily hotel room rates.

The decrease at Shanghai Disney Resort was due to lower attendance

reflecting fewer operating days in the current quarter compared to

the prior-year quarter as a result of COVID-19-related

closures.

The following table presents supplemental revenue and operating

income detail for the Disney Parks, Experiences and Products

segment:

Quarter Ended

Change

(in millions)

December 31, 2022

January 1, 2022

Supplemental revenue detail

Parks & Experiences

Domestic

$

6,072

$

4,800

27

%

International

1,094

861

27

%

Consumer Products

1,570

1,573

—

%

$

8,736

$

7,234

21

%

Supplemental operating income detail

Parks & Experiences

Domestic

$

2,113

$

1,555

36

%

International

79

21

>100

%

Consumer Products

861

874

(1

)%

$

3,053

$

2,450

25

%

OTHER FINANCIAL INFORMATION

Corporate and Unallocated Shared

Expenses

Corporate and unallocated shared expenses increased $52 million

for the quarter, from $228 million to $280 million, driven by

higher compensation and human resource-related costs, marketing

spend on the Disney100 celebration and timing of allocations to

operating segments.

Restructuring and Impairment

Charges

In the current quarter, the Company recorded charges of $69

million related to exiting our businesses in Russia.

Other Expense, net

In the current quarter, the Company recorded a $70 million

non-cash loss to adjust its investment in DraftKings, Inc.

(DraftKings) to fair value (DraftKings loss), partially offset by a

$28 million gain on the sale of a business. In the prior-year

quarter, the Company recorded a $432 million DraftKings loss.

Interest Expense, net

Interest expense, net was as follows (in millions):

Quarter Ended

December 31, 2022

January 1, 2022

Change

Interest expense

$

(465

)

$

(361

)

(29

)%

Interest income, investment income and

other

165

50

>100

%

Interest expense, net

$

(300

)

$

(311

)

4

%

The increase in interest expense was due to higher average

rates, partially offset by lower average debt balances.

The increase in interest income, investment income and other

resulted from a favorable comparison of pension and postretirement

benefit costs, other than service cost, and higher interest income

on cash balances.

Equity in the Income of

Investees

Equity in the income of investees was as follows (in

millions):

Quarter Ended

December 31, 2022

January 1, 2022

Change

Amounts included in segment results:

Disney Media and Entertainment

Distribution

$

196

$

245

(20

)%

Disney Parks, Experiences and Products

(2

)

(3

)

33

%

Amortization of TFCF intangible assets

related to equity investees

(3

)

(3

)

—

%

Equity in the income of investees

$

191

$

239

(20

)%

Income from equity investees decreased $48 million, to $191

million from $239 million, due to lower income from A+E Television

Networks.

Income Taxes

The effective income tax rate was as follows:

Quarter Ended

December 31, 2022

January 1, 2022

Income from continuing operations before

income taxes

$

1,773

$

1,688

Income tax expense on continuing

operations

412

488

Effective income tax rate - continuing

operations

23.2

%

28.9

%

The decrease in the effective income tax rate was due to the

impact of adjustments related to prior years, which was favorable

in the current quarter and unfavorable in the prior-year quarter.

This impact was partially offset by the tax effect of employee

share-based awards, which had an unfavorable impact in the current

quarter and favorable impact in the prior-year quarter.

Noncontrolling Interests

Net income attributable to noncontrolling interests was as

follows (in millions):

Quarter Ended

December 31, 2022

January 1, 2022

Change

Net income from continuing operations

attributable to noncontrolling interests

$

(82

)

$

(48

)

(71

)%

The increase in net income from continuing operations

attributable to noncontrolling interests was primarily due to the

purchase of Major League Baseball’s 15% interest in BAMTech LLC and

lower losses at our DTC sports business, partially offset by higher

losses at Shanghai Disney Resort.

Net income attributable to noncontrolling interests is

determined on income after royalties and management fees, financing

costs and income taxes, as applicable.

Cash Flow

Cash provided by operations and free cash flow were as follows

(in millions):

Quarter Ended

December 31, 2022

January 1, 2022

Change

Cash used in operations

$

(974

)

$

(209

)

$

(765

)

Investments in parks, resorts and other

property

(1,181

)

(981

)

(200

)

Free cash flow(1)

$

(2,155

)

$

(1,190

)

$

(965

)

(1)

Free cash flow is not a financial

measure defined by GAAP. See the discussion on pages 10 through

12.

Cash used in operations increased by $765 million from $209

million in the prior-year quarter to $974 million in the current

quarter. The increase was due to collateral payments related to our

hedging program, lower operating income at Disney Media and

Entertainment Distribution and higher spending for film and

television programming, partially offset by higher operating income

at Disney Parks, Experiences and Products.

Capital Expenditures and Depreciation

Expense

Investments in parks, resorts and other property were as follows

(in millions):

Quarter Ended

December 31, 2022

January 1, 2022

Disney Media and Entertainment

Distribution

$

279

$

169

Disney Parks, Experiences and Products

Domestic

519

457

International

219

202

Total Disney Parks, Experiences and

Products

738

659

Corporate

164

153

Total investments in parks, resorts and

other property

$

1,181

$

981

Capital expenditures increased from $1.0 billion to $1.2 billion

primarily due to higher spending at Disney Media and Entertainment

Distribution and Disney Parks, Experiences and Products. Higher

spending at Disney Media and Entertainment Distribution was due to

increased technology spending to support our streaming services.

The increase in spending at Disney Parks, Experiences and Products

was primarily due to cruise ship fleet expansion.

Depreciation expense was as follows (in millions):

Quarter Ended

December 31, 2022

January 1, 2022

Disney Media and Entertainment

Distribution

$

164

$

153

Disney Parks, Experiences and Products

Domestic

452

398

International

164

168

Total Disney Parks, Experiences and

Products

616

566

Corporate

48

48

Total depreciation expense

$

828

$

767

DTC PRODUCT DESCRIPTIONS AND KEY

DEFINITIONS

Product offerings

In the U.S., Disney+, ESPN+ and Hulu SVOD Only are each offered

as a standalone service or together as part of various

multi-product offerings. Hulu Live TV + SVOD includes Disney+ and

ESPN+. Disney+ is available in more than 150 countries and

territories outside the U.S. and Canada. In India and certain other

Southeast Asian countries, the service is branded Disney+ Hotstar.

In certain Latin American countries, we offer Disney+ as well as

Star+, a general entertainment SVOD service, which is available on

a standalone basis or together with Disney+ (Combo+). Depending on

the market, our services can be purchased on our websites or

through third-party platforms/apps or are available via wholesale

arrangements.

Paid subscribers

Paid subscribers reflect subscribers for which we recognized

subscription revenue. Subscribers cease to be a paid subscriber as

of their effective cancellation date or as a result of a failed

payment method. Subscribers to multi-product offerings in the U.S.

are counted as a paid subscriber for each service included in the

multi-product offering and subscribers to Hulu Live TV + SVOD are

counted as one paid subscriber for each of the Hulu Live TV + SVOD,

Disney+ and ESPN+ services. In Latin America, if a subscriber has

either the standalone Disney+ or Star+ service or subscribes to

Combo+, the subscriber is counted as one Disney+ paid subscriber.

Subscribers include those who receive a service through wholesale

arrangements including those for which we receive a fee for the

distribution of the service to each subscriber of an existing

content distribution tier. When we aggregate the total number of

paid subscribers across our DTC streaming services, we refer to

them as paid subscriptions.

International Disney+ (excluding Disney+

Hotstar)

International Disney+ (excluding Disney+ Hotstar) includes the

Disney+ service outside the U.S. and Canada and the Star+ service

in Latin America.

Average Monthly Revenue Per Paid

Subscriber

Average monthly revenue per paid subscriber is calculated based

on the average of the monthly average paid subscribers for each

month in the period. The monthly average paid subscribers is

calculated as the sum of the beginning of the month and end of the

month paid subscriber count, divided by two. Disney+ average

monthly revenue per paid subscriber is calculated using a daily

average of paid subscribers for the period. Revenue includes

subscription fees, advertising (excluding revenue earned from

selling advertising spots to other Company businesses) and premium

and feature add-on revenue but excludes Premier Access and

Pay-Per-View revenue. The average revenue per paid subscriber is

net of discounts on offerings that carry more than one service.

Revenue is allocated to each service based on the relative retail

price of each service on a standalone basis. Hulu Live TV + SVOD

revenue is allocated to the SVOD services based on the wholesale

price of the Hulu SVOD Only, Disney+ and ESPN+ multi-product

offering. In general, wholesale arrangements have a lower average

monthly revenue per paid subscriber than subscribers that we

acquire directly or through third-party platforms.

NON-GAAP FINANCIAL

MEASURES

This earnings release presents free cash flow, diluted EPS

excluding certain items, and total segment operating income, all of

which are important financial measures for the Company, but are not

financial measures defined by GAAP.

These measures should be reviewed in conjunction with the most

comparable GAAP financial measures and are not presented as

alternative measures of cash provided by continuing operations,

diluted EPS or income from continuing operations before income

taxes as determined in accordance with GAAP. Free cash flow,

diluted EPS excluding certain items and total segment operating

income as we have calculated them may not be comparable to

similarly titled measures reported by other companies. See further

discussion of total segment operating income on page 2.

Free cash flow

The Company uses free cash flow (cash provided by continuing

operations less investments in parks, resorts and other property),

among other measures, to evaluate the ability of its operations to

generate cash that is available for purposes other than capital

expenditures. Management believes that information about free cash

flow provides investors with an important perspective on the cash

available to service debt obligations, make strategic acquisitions

and investments and pay dividends or repurchase shares.

The following table presents a summary of the Company’s

consolidated cash flows (in millions):

Quarter Ended

December 31, 2022

January 1, 2022

Cash used in operations - continuing

operations

$

(974

)

$

(209

)

Cash used in investing activities -

continuing operations

(1,292

)

(987

)

Cash used in financing activities -

continuing operations

(1,043

)

(280

)

Cash used in discontinued operations

—

(4

)

Impact of exchange rates on cash, cash

equivalents and restricted cash

164

(35

)

Change in cash, cash equivalents and

restricted cash

(3,145

)

(1,515

)

Cash, cash equivalents and restricted

cash, beginning of period

11,661

16,003

Cash, cash equivalents and restricted

cash, end of period

$

8,516

$

14,488

The following table presents a reconciliation of the Company’s

consolidated cash used in operations to free cash flow (in

millions):

Quarter Ended

December 31, 2022

January 1, 2022

Change

Cash used in operations - continuing

operations

$

(974

)

$

(209

)

$

(765

)

Investments in parks, resorts and other

property

(1,181

)

(981

)

(200

)

Free cash flow

$

(2,155

)

$

(1,190

)

$

(965

)

Diluted EPS excluding certain

items

The Company uses diluted EPS excluding (1) certain items

affecting comparability of results from period to period and (2)

amortization of TFCF and Hulu intangible assets, including purchase

accounting step-up adjustments for released content, to facilitate

the evaluation of the performance of the Company’s operations

exclusive of these items, and these adjustments reflect how senior

management is evaluating segment performance.

The Company believes that providing diluted EPS exclusive of

certain items impacting comparability is useful to investors,

particularly where the impact of the excluded items is significant

in relation to reported earnings and because the measure allows for

comparability between periods of the operating performance of the

Company’s business and allows investors to evaluate the impact of

these items separately.

The Company further believes that providing diluted EPS

exclusive of amortization of TFCF and Hulu intangible assets

associated with the acquisition in 2019 is useful to investors

because the TFCF and Hulu acquisition was considerably larger than

the Company’s historic acquisitions with a significantly greater

acquisition accounting impact.

The following table reconciles reported diluted EPS from

continuing operations to diluted EPS excluding certain items for

the first quarter:

(in millions except EPS)

Pre-Tax Income/ Loss

Tax Benefit/ Expense(1)

After-Tax Income/ Loss(2)

Diluted EPS(3)

Change vs. prior year period

Quarter Ended December 31, 2022

As reported

$

1,773

$

(412

)

$

1,361

$

0.70

11

%

Exclude:

Amortization of TFCF and Hulu intangible

assets and fair value step-up on film and television costs(4)

579

(135

)

444

0.24

Restructuring and impairment

charges(5)

69

(8

)

61

0.03

Other expense, net(6)

42

(16

)

26

0.01

Excluding certain items

$

2,463

$

(571

)

$

1,892

$

0.99

(7

)%

Quarter Ended January 1, 2022

As reported

$

1,688

$

(488

)

$

1,200

$

0.63

Exclude:

Amortization of TFCF and Hulu intangible

assets and fair value step-up on film and television costs(4)

595

(139

)

456

0.24

Other expense, net(6)

436

(102

)

334

0.18

Excluding certain items

$

2,719

$

(729

)

$

1,990

$

1.06

(1)

Tax benefit/expense is determined

using the tax rate applicable to the individual item.

(2)

Before noncontrolling interest

share.

(3)

Net of noncontrolling interest

share, where applicable. Total may not equal the sum of the column

due to rounding.

(4)

For the current quarter,

intangible asset amortization was $417 million, step-up

amortization was $159 million and amortization of intangible assets

related to TFCF equity investees was $3 million. For the prior-year

quarter, intangible asset amortization was $435 million, step-up

amortization was $157 million and amortization of intangible assets

related to TFCF equity investees was $3 million.

(5)

Charges for the current quarter

were related to exiting our businesses in Russia.

(6)

In the current quarter, other

expense, net was due to the DraftKings loss ($70 million),

partially offset by a gain on the sale of a business ($28 million).

For the prior-year quarter, other expense, net was due to the

DraftKings loss ($432 million).

CONFERENCE CALL INFORMATION

In conjunction with this release, The Walt Disney Company will

host a conference call today, February 8, 2023, at 4:30 PM EST/1:30

PM PST via a live Webcast. To access the Webcast go to www.disney.com/investors. The discussion will be

archived.

FORWARD-LOOKING STATEMENTS

Certain statements and information in this earnings release may

constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995, including

statements regarding future performance and growth; business plans,

strategic priorities and drivers of growth and profitability and

other statements that are not historical in nature. These

statements are made on the basis of management’s views and

assumptions regarding future events and business performance as of

the time the statements are made. Management does not undertake any

obligation to update these statements.

Actual results may differ materially from those expressed or

implied. Such differences may result from actions taken by the

Company, including restructuring or strategic initiatives

(including capital investments, asset acquisitions or dispositions,

new or expanded business lines or cessation of certain operations),

our execution of our business plans (including the content we

create and IP we invest in, our pricing decisions, our cost

structure and our management and other personnel decisions) or

other business decisions, as well as from developments beyond the

Company’s control, including:

- further deterioration in domestic and global economic

conditions;

- deterioration in or pressures from competitive conditions,

including competition to create or acquire content and competition

for talent;

- consumer preferences and acceptance of our content, offerings,

pricing model and price increases and the market for advertising

sales on our DTC services and linear networks;

- health concerns and their impact on our businesses and

productions;

- international, regulatory, legal, political, or military

developments;

- technological developments;

- labor markets and activities;

- adverse weather conditions or natural disasters; and

- availability of content;

each such risk includes the current and future impacts of, and

may be amplified by, COVID-19 and related mitigation efforts.

Such developments may further affect entertainment, travel and

leisure businesses generally and may, among other things, affect

(or further affect, as applicable):

- our operations, business plans or profitability;

- demand for our products and services;

- the performance of the Company’s content;

- our ability to create or obtain desirable content at or under

the value we assign the content;

- the advertising market for programming;

- income tax expense; and

- performance of some or all Company businesses either directly

or through their impact on those who distribute our products.

Additional factors are set forth in the Company’s Annual Report

on Form 10-K for the year ended October 1, 2022, including under

the captions “Risk Factors,” “Management’s Discussion and Analysis

of Financial Condition and Results of Operations,” and “Business,”

quarterly reports on Form 10-Q, including under the captions “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations,” and subsequent filings with

the Securities and Exchange Commission.

The terms “Company,” “we,” and “our” are used in this report to

refer collectively to the parent company and the subsidiaries

through which our various businesses are actually conducted.

THE WALT DISNEY

COMPANY

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(unaudited; in millions,

except per share data)

Quarter Ended

December 31, 2022

January 1, 2022

Revenues

$

23,512

$

21,819

Costs and expenses

(21,519

)

(19,623

)

Restructuring and impairment charges

(69

)

—

Other expense, net

(42

)

(436

)

Interest expense, net

(300

)

(311

)

Equity in the income of investees

191

239

Income from continuing operations before

income taxes

1,773

1,688

Income taxes on continuing operations

(412

)

(488

)

Net income from continuing operations

1,361

1,200

Loss from discontinued operations, net of

income tax benefit of $0, $14, respectively

—

(48

)

Net income

1,361

1,152

Net income from continuing operations

attributable to noncontrolling interests

(82

)

(48

)

Net income attributable to The Walt Disney

Company (Disney)

$

1,279

$

1,104

Earnings (loss) per share attributable to

Disney(1):

Diluted

Continuing operations

$

0.70

$

0.63

Discontinued operations

—

(0.03

)

$

0.70

$

0.60

Basic

Continuing operations

$

0.70

$

0.63

Discontinued operations

—

(0.03

)

$

0.70

$

0.61

Weighted average number of common and

common equivalent shares outstanding:

Diluted

1,827

1,828

Basic

1,825

1,819

(1)

Total may not equal the sum of the column

due to rounding.

THE WALT DISNEY

COMPANY

CONDENSED CONSOLIDATED BALANCE

SHEETS

(unaudited; in millions,

except per share data)

December 31, 2022

October 1, 2022

ASSETS

Current assets

Cash and cash equivalents

$

8,470

$

11,615

Receivables, net

13,993

12,652

Inventories

1,830

1,742

Content advances

1,300

1,890

Other current assets

1,319

1,199

Total current assets

26,912

29,098

Produced and licensed content costs

36,266

35,777

Investments

3,169

3,218

Parks, resorts and other property

Attractions, buildings and equipment

68,253

66,998

Accumulated depreciation

(40,641

)

(39,356

)

27,612

27,642

Projects in progress

5,430

4,814

Land

1,158

1,140

34,200

33,596

Intangible assets, net

14,347

14,837

Goodwill

77,867

77,897

Other assets

9,363

9,208

Total assets

$

202,124

$

203,631

LIABILITIES AND EQUITY

Current liabilities

Accounts payable and other accrued

liabilities

$

18,149

$

20,213

Current portion of borrowings

3,249

3,070

Deferred revenue and other

5,672

5,790

Total current liabilities

27,070

29,073

Borrowings

45,128

45,299

Deferred income taxes

8,236

8,363

Other long-term liabilities

12,812

12,518

Commitments and contingencies

Redeemable noncontrolling interests

8,743

9,499

Equity

Preferred stock

—

—

Common stock, $0.01 par value, Authorized

– 4.6 billion shares, Issued – 1.8 billion shares

56,579

56,398

Retained earnings

44,955

43,636

Accumulated other comprehensive loss

(4,478

)

(4,119

)

Treasury stock, at cost, 19 million

shares

(907

)

(907

)

Total Disney Shareholders’ equity

96,149

95,008

Noncontrolling interests

3,986

3,871

Total equity

100,135

98,879

Total liabilities and equity

$

202,124

$

203,631

THE WALT DISNEY

COMPANY

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(unaudited; in

millions)

Quarter Ended

December 31, 2022

January 1, 2022

OPERATING ACTIVITIES

Net income from continuing operations

$

1,361

$

1,200

Depreciation and amortization

1,306

1,269

Net loss on investments and dispositions

of businesses

68

436

Deferred income taxes

(15

)

726

Equity in the income of investees

(191

)

(239

)

Cash distributions received from equity

investees

176

223

Net change in produced and licensed

content costs and advances

558

507

Equity-based compensation

270

196

Pension and postretirement medical cost

amortization

1

155

Other, net

(232

)

(7

)

Changes in operating assets and

liabilities:

Receivables

(1,423

)

(1,401

)

Inventories

(88

)

(14

)

Other assets

(443

)

(115

)

Accounts payable and other liabilities

(2,378

)

(2,579

)

Income taxes

56

(566

)

Cash used in operations - continuing

operations

(974

)

(209

)

INVESTING ACTIVITIES

Investments in parks, resorts and other

property

(1,181

)

(981

)

Other, net

(111

)

(6

)

Cash used in investing activities -

continuing operations

(1,292

)

(987

)

FINANCING ACTIVITIES

Commercial paper borrowings (payments),

net

799

(124

)

Borrowings

67

33

Reduction of borrowings

(1,000

)

—

Contributions from noncontrolling

interests

178

—

Acquisition of redeemable noncontrolling

interests

(900

)

—

Other, net

(187

)

(189

)

Cash used in financing activities -

continuing operations

(1,043

)

(280

)

CASH FLOWS FROM DISCONTINUED

OPERATIONS

Cash provided by operations - discontinued

operations

—

8

Cash used in financing activities -

discontinued operations

—

(12

)

Cash used in discontinued operations

—

(4

)

Impact of exchange rates on cash, cash

equivalents and restricted cash

164

(35

)

Change in cash, cash equivalents and

restricted cash

(3,145

)

(1,515

)

Cash, cash equivalents and restricted

cash, beginning of year

11,661

16,003

Cash, cash equivalents and restricted

cash, end of year

$

8,516

$

14,488

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230208005865/en/

David Jefferson Corporate Communications 818-560-4832

Alexia Quadrani Investor Relations 818-560-6601

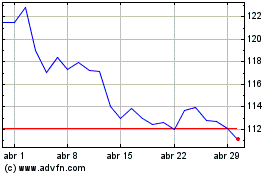

Walt Disney (NYSE:DIS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Walt Disney (NYSE:DIS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024