NGL Energy Partners LP Announces $600 Million Permanent ABL Commitment

16 Fevereiro 2023 - 6:45PM

Business Wire

NGL Energy Partners LP (NYSE:NGL) (“NGL,” “our,” “we,” or the

“Partnership”) announced a permanent commitment in our ABL Facility

of $600 million. On April 13, 2022, the Partnership amended the ABL

Facility to increase the commitments to $600 million under the

accordion feature within the ABL Facility and agreed to reduce the

commitments back to the original $500 million on or before March

31, 2023. This Amendment extends the maturity date of the

additional $100 million of commitments through February 2026, the

remaining term of the ABL Facility.

“As I mentioned on our earnings call on February 9th, we were in

the process of increasing our ABL Facility to $600 million

permanently. This amendment provides NGL additional financial

flexibility to support the significant growth in our Water

Solutions segment and a higher commodity price environment,” stated

Brad Cooper, NGL’s CFO.

Forward-Looking Statements

This press release includes “forward-looking statements.” All

statements other than statements of historical facts included or

incorporated herein may constitute forward-looking statements.

Actual results could vary significantly from those expressed or

implied in such statements and are subject to a number of risks and

uncertainties. While NGL believes such forward-looking statements

are reasonable, NGL cannot assure they will prove to be correct.

The forward-looking statements involve risks and uncertainties that

affect operations, financial performance, and other factors as

discussed in filings with the Securities and Exchange Commission.

Other factors that could impact any forward-looking statements are

those risks described in NGL’s Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q, and other public filings. You are

urged to carefully review and consider the cautionary statements

and other disclosures made in those filings, specifically those

under the heading “Risk Factors.” NGL undertakes no obligation to

publicly update or revise any forward-looking statements except as

required by law.

NGL provides Adjusted EBITDA guidance that does not include

certain charges and costs, which in future periods are generally

expected to be similar to the kinds of charges and costs excluded

from Adjusted EBITDA in prior periods, such as income taxes,

interest and other non-operating items, depreciation and

amortization, net unrealized gains and losses on derivatives, lower

of cost or net realizable value adjustments, gains and losses on

disposal or impairment of assets, gains and losses on early

extinguishment of liabilities, equity-based compensation expense,

acquisition expense, revaluation of liabilities and items that are

unusual in nature or infrequently occurring. The exclusion of these

charges and costs in future periods will have a significant impact

on the Partnership’s Adjusted EBITDA, and the Partnership is not

able to provide a reconciliation of its Adjusted EBITDA guidance to

net income (loss) without unreasonable efforts due to the

uncertainty and variability of the nature and amount of these

future charges and costs and the Partnership believes that such

reconciliation, if possible, would imply a degree of precision that

would be potentially confusing or misleading to investors.

About NGL Energy Partners LP

NGL Energy Partners LP, a Delaware limited partnership, is a

diversified midstream energy company that transports, stores,

markets and provides other logistics services for crude oil,

natural gas liquids and other products and transports, treats and

disposes of produced water generated as part of the oil and natural

gas production process. For further information, visit the

Partnership’s website at www.nglenergypartners.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230216005837/en/

David Sullivan, 918-481-1119 Vice President - Finance

David.Sullivan@nglep.com

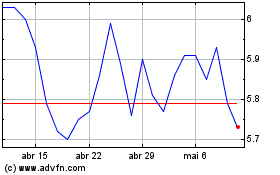

NGL Energy Partners (NYSE:NGL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

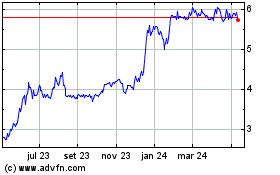

NGL Energy Partners (NYSE:NGL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024