VF Corporation (NYSE: VFC) announced today that it priced €500

million aggregate principal amount of unsecured senior notes due

2026 (the “2026 Notes”) at 99.704% of the aggregate

principal amount with a coupon of 4.125% and €500 million aggregate

principal amount of unsecured senior notes due 2029 (the

“2029 Notes” and, together with the 2026 Notes, the

“Notes”) at 99.570% of the aggregate principal amount with a

coupon of 4.250%. The sale of the Notes was underwritten by J.P.

Morgan, Morgan Stanley, Barclays and Goldman Sachs & Co. LLC as

representatives of the several underwriters.

The offering of the Notes is expected to close on March 7, 2023,

subject to customary closing conditions.

The company intends to use the net proceeds from the offering

for general corporate purposes, including the repayment of

borrowings under our commercial paper program.

The company intends to use an amount equivalent to the net

proceeds from the sale of the 2029 Notes to finance, in whole or in

part, one or more Eligible Projects, as described below, designed

to contribute to selected Sustainable Development Goals as defined

by the United Nations. These Eligible Projects include new,

existing and prior investments made by the company during the

period from two years prior to the date of issuance of the 2029

Notes through the maturity date of such Notes, including in the

following categories:

- Investments in, or expenditures on, identifying and/or

developing innovative and more sustainable materials and/or

sustainable packaging solutions.

- Investments in, or expenditures on, the acquisition,

development, construction and/or installation of, renewable energy

production units or energy storage units.

- Investments in projects to improve the energy efficiency and/or

reduce the greenhouse gas footprint of our operations and supply

chain.

- Investments in sustainable building design features and in

buildings that receive a third-party verified certification of

Leadership in Energy and Environmental Design (“LEED”)

Platinum, LEED Gold, or Building Research Establishment

Environmental Assessment Method (“BREEAM”) rating of Very

Good or higher.

- Investments to achieve the zero-waste status for all the

company’s distribution centers (with zero-waste defined as a site

that diverts 95% or more of its waste away from disposal through

recycling, composting and reuse).

- Upgrade costs for improvement of wastewater quality across the

supply chain.

- Investments in “natural carbon sinks,” which are designed to

create and restore natural sources of carbon capture, such as

reforestation conservation projects, and investments in

regenerative farming, grazing and ranching practices.

The company plans to publish annual updates on the net proceeds

of the 2029 Notes, including, subject to any confidentiality

considerations, descriptions of selected projects funded with such

proceeds, and to the extent possible, their environmental impacts.

These updates will be reported publicly on the Sustainability &

Responsibility section of its website starting one year from the

date hereof and during the term of the 2029 Notes until the company

has allocated an amount equivalent to the net proceeds from the

sale of the 2029 Notes to finance, in whole or in part, one or more

Eligible Projects.

The company has filed a registration statement (including a

prospectus and related preliminary prospectus supplement for the

offering) with the Securities and Exchange Commission (the

“SEC”) for the offering to which this communication relates.

Before you invest, you should read the preliminary prospectus

supplement, the accompanying prospectus in that registration

statement and the other documents the company has filed with the

SEC for more complete information about the company and this

offering. You may get these documents for free by visiting EDGAR on

the SEC’s website at www.sec.gov. Alternatively, the company, any

underwriter or any dealer participating in the offering will

arrange to send you the preliminary prospectus supplement and the

accompanying prospectus if you request it by contacting J.P. Morgan

Securities plc by mail at 25 Bank Street, Canary Wharf London, E14

5JP, United Kingdom, Attention: Head of Debt Syndicate and Head of

EMEA Debt Capital Markets Group, or by calling +44-207-134-2468;

Morgan Stanley & Co. International plc, care of Morgan Stanley

& Co. LLC by mail at 180 Varick Street, 2nd Floor, New York, NY

10014, Attention: Prospectus Department, by email at

prospectus@morganstanley.com, or by calling 866-718-1649; Barclays

Bank PLC by mail at 1 Churchill Place, London E14 5HP, Attention:

Debt Syndicate, or by calling 1-888-603-5847; or Goldman Sachs

& Co. LLC by mail at 200 West Street, New York, New York

10282-2198, Attention: Registration Department, by email at

prospectus-ny@ny.email.gs.com, or by calling (866) 471-2526.

This press release shall not constitute an offer to sell nor a

solicitation of an offer to buy any securities and shall not

constitute an offer, solicitation or sale in any jurisdiction in

which such offer, solicitation or sale would be unlawful. The

offering of the Notes may be made only by means of a prospectus

supplement and the accompanying prospectus.

About VF

Founded in 1899, VF Corporation is one of the world’s largest

apparel, footwear and accessories companies connecting people to

the lifestyles, activities and experiences they cherish most

through a family of iconic outdoor, active and workwear brands

including Vans®, The North Face®, Timberland® and Dickies®. Our

purpose is to power movements of sustainable and active lifestyles

for the betterment of people and our planet. We connect this

purpose with a relentless drive to succeed to create value for all

stakeholders and use our company as a force for good.

Forward-Looking Statements

Certain statements included in this release are "forward-looking

statements" within the meaning of the federal securities laws.

Forward-looking statements are made based on our expectations and

beliefs concerning future events impacting VF and therefore involve

several risks and uncertainties. You can identify these statements

by the fact that they use words such as “will,” “anticipate,”

“estimate,” “expect,” “should,” and “may” and other words and terms

of similar meaning or use of future dates, however, the absence of

these words or similar expressions does not mean that a statement

is not forward-looking. All statements regarding VF’s plans,

objectives, projections and expectations relating to VF’s

operations or financial performance, and assumptions related

thereto are forward-looking statements. We caution that

forward-looking statements are not guarantees and that actual

results could differ materially from those expressed or implied in

the forward-looking statements. VF undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise, except

as required by law. Potential risks and uncertainties that could

cause the actual results of operations or financial condition of VF

to differ materially from those expressed or implied by

forward-looking statements include, but are not limited to: risks

arising from the widespread outbreak of an illness or any other

communicable disease, or any other public health crisis, including

the coronavirus (COVID-19) global pandemic; the level of consumer

demand for apparel, footwear and accessories; disruption to VF’s

distribution system; changes in global economic conditions and the

financial strength of VF’s customers, including as a result of

current inflationary pressures; fluctuations in the price,

availability and quality of raw materials and contracted products;

disruption and volatility in the global capital and credit markets;

VF’s response to changing fashion trends, evolving consumer

preferences and changing patterns of consumer behavior; intense

competition from online retailers and other direct-to-consumer

business risks; third-party manufacturing and product innovation;

increasing pressure on margins; VF’s ability to implement its

business strategy; VF’s ability to grow its international,

direct-to-consumer and digital businesses; VF’s ability to

transform its model to be more consumer-minded, retail-centric and

hyper-digital; retail industry changes and challenges; VF’s ability

to create and maintain an agile and efficient operating model and

organizational structure; VF’s and its vendors’ ability to maintain

the strength and security of information technology systems; the

risk that VF’s facilities and systems and those of our third-party

service providers may be vulnerable to and unable to anticipate or

detect data or information security breaches and data or financial

loss; VF’s ability to properly collect, use, manage and secure

business, consumer and employee data and comply with privacy and

security regulations; foreign currency fluctuations; stability of

VF’s vendors’ manufacturing facilities and VF’s ability to

establish and maintain effective supply chain capabilities;

continued use by VF’s suppliers of ethical business practices; VF’s

ability to accurately forecast demand for products; continuity of

members of VF’s management; VF’s ability to recruit, develop or

retain qualified employees; VF’s ability to protect trademarks and

other intellectual property rights; possible goodwill and other

asset impairment such as the recent impairment charges related to

the Supreme® reporting unit goodwill and indefinite-lived trademark

intangible asset; maintenance by VF’s licensees and distributors of

the value of VF’s brands; VF’s ability to execute acquisitions and

dispositions and integrate acquisitions; business resiliency in

response to natural or man-made economic, political or

environmental disruptions; changes in tax laws and additional tax

liabilities, including the timing of income inclusion associated

with our acquisition of the Timberland® brand in 2011; legal,

regulatory, political, economic, and geopolitical risks, including

those related to the current conflict in Ukraine; changes to laws

and regulations; adverse or unexpected weather conditions; VF's

indebtedness and its ability to obtain financing on favorable

terms, if needed, could prevent VF from fulfilling its financial

obligations; VF's ability to pay and declare dividends or

repurchase its stock in the future; climate change and increased

focus on environmental, social and governance issues; and tax risks

associated with the spin-off of our Jeanswear business completed in

2019. More information on potential factors that could affect VF’s

financial results is included from time to time in VF’s public

reports filed with the SEC, including VF’s Annual Report on Form

10-K and Quarterly Reports on Form 10-Q and Forms 8-K filed or

furnished with the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230223005993/en/

For further information, please contact:

Allegra Perry Vice President, Investor Relations ir@vfc.com

or

Colin Wheeler Vice President, Corporate Communications

Corporate_Communications@vfc.com

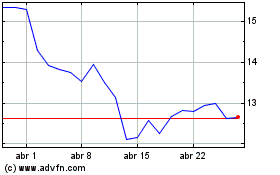

VF (NYSE:VFC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

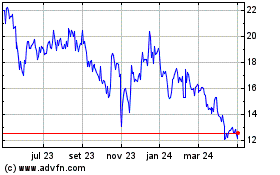

VF (NYSE:VFC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024