- Fiscal year total revenues increase 13.7% to $467.9 million

as compared to fiscal 2021

- Fiscal year pre-tax income increases 22.1% to $61.9 million

as compared to fiscal 2021

- At year end, consolidated cash balance was $42.2 million

with no borrowings on the Company’s credit facility

- Company introduces fiscal 2023 guidance with expectations

for growth in total revenues and pre-tax income compared to fiscal

2022

- Second special dividend declared by Board of Directors as

Company continues to return value to shareholders in the form of

stock repurchases and dividends totaling over $70 million during

the past 24 months

Build-A-Bear Workshop, Inc. (NYSE: BBW) today reported results

for the fourth quarter and fiscal year 2022 ended January 28,

2023.

Sharon Price John, Build-A-Bear Workshop President and Chief

Executive Officer commented, “We are pleased to have delivered

another strong quarterly performance with double-digit growth in

total revenues contributing to an increase of over 30% in pre-tax

profit versus the prior year’s fourth quarter. In fiscal 2022, we

expanded total revenues and pre-tax income resulting in the highest

annual profit in our company’s 25-year history. We believe the

fundamental catalyst of our positive performance has been the

on-going disciplined execution of our multi-year strategic plan

which positions us to further scale our business and generate

profitable growth in 2023 and beyond. We have built a

cross-functional foundation designed to drive and monetize the

value of our strong brand equity. We have expanded our total

addressable market beyond kids, extended our brand access beyond

malls and enhanced consumer engagement beyond our iconic store

experience.

“With the positive momentum continuing into the first quarter of

fiscal 2023, we look to our promising future with an even stronger

brand, an elevated digital and organizational infrastructure, a

proven multi-dimensional strategy and a motivated seasoned team

committed to continue to drive shareholder value,” concluded Ms.

John.

Fourth Quarter 2022 Highlights (13 weeks ended January 28,

2023 compared to the 13 weeks ended January 29, 2022):

- Total revenues were $145.1 million, an increase of 11.6%

compared to $130.0 million in the fiscal 2021 fourth quarter;

- Net retail sales were $138.2 million, a 10.0% increase compared

to $125.6 million in the fiscal 2021 fourth quarter;

- Consolidated e-commerce demand (orders generated online to be

fulfilled from either the Company’s warehouse or its stores)

increased 0.9% compared to the fiscal 2021 fourth quarter; and

- Commercial and international franchise revenues were $6.9

million, an increase of 60.5% compared to $4.3 million in the

fiscal 2021 fourth quarter;

- Gross profit margin was 55.0%, an increase of 150 basis points

from 53.5% in the fiscal 2021 fourth quarter. Gross profit margin

expansion in the 2022 fourth quarter reflected increased

merchandise margin primarily driven by lower freight costs versus

the prior year and leverage on fixed occupancy expense;

- Selling, general and administrative (“SG&A”) expenses were

$53.6 million, or 36.9% of total revenues, compared to $49.4

million, or 38.0% of total revenues, in the fiscal 2021 fourth

quarter. The increase in SG&A expenses was driven by higher

store payroll, incentive compensation, and marketing expenses.

SG&A expenses as a percentage of total revenues improved by 110

basis points driven by favorable leverage of fixed costs due to the

increase in total revenues;

- Pre-tax income increased 30.3% to $26.2 million, compared to

pre-tax income of $20.1 million in the fiscal 2021 fourth

quarter;

- Income tax expense was $5.7 million, an effective tax rate of

21.8% in the fiscal 2022 fourth quarter compared to an income tax

benefit of $4.0 million in the fiscal 2021 fourth quarter. The

income tax benefit in the fiscal 2021 fourth quarter reflected the

full reversal of the Company’s tax valuation allowance in North

America of $7.8 million;

- Net income decreased 14.9% to $20.5 million, or $1.39 per

diluted share, compared to net income of $24.1 million, or $1.48

per diluted share, in the fiscal 2021 fourth quarter. On an

adjusted basis, net income increased 20.9% to $19.1 million, or

$1.30 per diluted share, compared to adjusted net income of $15.8

million, or $0.97 per diluted share, in the fiscal 2021 fourth

quarter which excludes the reversal of the tax valuation allowance

in North America (see reconciliation of GAAP to non-GAAP results);

and

- Earnings before interest, taxes, depreciation and amortization

(“EBITDA”) was $29.4 million, an increase of 26.2%, or $6.1

million, from the fiscal 2021 fourth quarter.

Fiscal Year 2022 Highlights (52 weeks ended January 28, 2023

compared to the 52 weeks ended January 29, 2022):

- Total revenues were $467.9 million, an increase of 13.7%

compared to $411.5 million in fiscal 2021;

- Consolidated net retail sales were $446.2 million, an increase

of 12.2% compared to $397.7 million in fiscal 2021;

- Consolidated e-commerce demand (orders generated online to be

fulfilled from either the Company’s warehouse or its stores)

decreased 7.8% compared to fiscal 2021 and, for reference, fiscal

2022 e-commerce demand showed an increase of 137.1% compared to

pre-pandemic fiscal 2019. The shift in e-commerce demand in fiscal

2022 compared to fiscal 2021 reflects the trend of consumers

embracing a return to in-person shopping as well as disruption from

a planned website upgrade during the year;

- Commercial and international franchise revenues were $21.8

million, an increase of 58.0% compared to $13.8 million in fiscal

2021;

- Pre-tax income increased 22.1% to $61.9 million compared to

pre-tax income of $50.7 million in fiscal 2021;

- Income tax expense was $13.9 million, an effective tax rate of

22.5%, compared to income tax expense of $3.4 million in fiscal

2021. Income tax expense in fiscal 2021 reflected the full reversal

of the Company’s tax valuation allowance in North America of $7.8

million;

- Net income increased 1.5% to $48.0 million, or $3.15 per

diluted share, compared to net income of $47.3 million, or $2.93

per diluted share in fiscal 2021. On an adjusted basis, net income

was $47.0 million, or $3.08 per diluted share, compared to adjusted

net income of $38.3 million, or $2.37 per diluted share in fiscal

2021 which excludes the reversal of the tax valuation allowance in

North America (see reconciliation of GAAP to non-GAAP results);

and

- EBITDA was $74.4 million, an increase of 18.1%, or $11.4

million, from EBITDA of $63.0 million in fiscal 2021.

Store Activity:

As of January 28, 2023, the Company had 488 global locations

through a combination of its corporately-managed, third-party

retail and international franchise models, a net increase of nine

locations compared to the end fiscal 2021.

This reflects 350 corporately-managed stores with four net

openings as compared to the end of fiscal 2021, representing seven

net store openings in North America and three net store closings in

Europe.

Through the Company’s third-party retail business model, there

were 70 locations at the end of fiscal 2022 with relationships that

include Carnival Cruise Lines, Great Wolf Lodge Resorts, Landry’s

and Beaches Family Resorts reflecting nine net openings at the end

of fiscal 2022.

The Company’s international franchisees finished fiscal 2022

with 68 locations, reflecting four net closures.

Balance Sheet:

As of January 28, 2023, cash and cash equivalents totaled $42.2

million compared to $32.8 million as of January 29, 2022. The

Company ended the fiscal year with no borrowings under its

revolving credit facility.

Total inventory at year-end was $70.5 million, a decrease of

$1.3 million from fiscal 2021 year-end. For fiscal 2022, capital

expenditures totaled $13.6 million compared to $8.1 million in

fiscal 2021 and depreciation and amortization was $12.5 million

compared to $12.3 million in fiscal 2021.

Return of Capital to Shareholders:

During fiscal 2022, the Company utilized $24.1 million in cash

to repurchase 1,533,503 shares of its common stock. As of March 9,

2023, the Company had $46.5 million available under the current

$50.0 million stock repurchase program adopted on August 31,

2022.

As announced March 8, 2023, the Company’s Board of Directors

declared a special cash dividend of $1.50 per share that will be

paid on April 6, 2023, to all stockholders of record as of March

23, 2023, following a $1.25 per share special cash dividend

declared on November 30, 2021.

Build-A-Bear Workshop President and Chief Executive Officer

Sharon Price John commented, “We continue to return value to our

shareholders as our company has grown and delivered record-setting

profitability. This strategic use of capital including our share

repurchase program and these special dividends totaling over $70

million during the past 24 months, reflect our Board of Directors’

ongoing confidence in the strategy and business outlook.”

Fiscal 2023 Outlook:

The Company is providing guidance for fiscal 2023 with

expectations of delivering growth in total revenues and pre-tax

income compared to fiscal 2022. While the Company notes that its

fiscal 2023 is a 53-week year compared to a 52-week year in fiscal

2022, it expects to deliver growth in total revenues and pre-tax

income versus the prior year exclusive of the projected benefit of

the 53rd week. For reference, the additional week in fiscal 2023,

which will be reflected in the Company’s fourth quarter, is

estimated to be $7 million in total revenues with approximately 35%

flow-through to EBITDA.

For fiscal 2023, the Company currently expects:

- Total revenues to increase in the range of 5% to 7% compared to

fiscal 2022 with growth in all three operating segments;

- Pre-tax income growth of 10% to 15% compared to fiscal 2022,

surpassing the record high that the Company achieved in fiscal

2022;

- To open 20 to 30 experience locations, through a combination of

third-party retail and corporately-managed business models, with

the majority planned for the second half of the year;

- Capital expenditures in the range of $15 million to $20

million;

- Depreciation and amortization of approximately $13 million to

$14 million; and

- Tax rate to approximate 25% excluding discrete items.

The Company’s guidance considers a variety of factors ranging

from anticipated ongoing inflationary pressures to the expected

benefit of reduced freight costs. Additionally, the Company noted

that its outlook assumes no further material changes in the

operations of its supply chain including the ability to receive and

ship product on a timely basis, the macro-economic and

geo-political environment, or relevant foreign currency exchange

rates.

Note Regarding Non-GAAP Financial Measures

In this press release, the Company’s financial results are

provided both in accordance with generally accepted accounting

principles (GAAP) and using certain non-GAAP financial measures. In

particular, the Company provides historic income and income per

diluted share adjusted to exclude certain costs and accounting

adjustments, which are non-GAAP financial measures. These results

are included as a complement to results provided in accordance with

GAAP because management believes these non-GAAP financial measures

help identify underlying trends in the Company’s business and

provide useful information to both management and investors by

excluding certain items that may not be indicative of the Company’s

on-going operating results. These measures should not be considered

a substitute for or superior to GAAP results. These non-GAAP

financial measures are defined and reconciled to the most

comparable GAAP measure later in this document.

Today’s Conference Call Webcast:

Build-A-Bear Workshop will host a live internet webcast of its

quarterly investor conference call at 9 a.m. ET today. The dial-in

number for the live conference call is (877) 407-3982 or (201)

493-6780 for international callers. The access code is

Build-A-Bear. The audio broadcast may be accessed at the Company’s

investor relations website, http://IR.buildabear.com. The call is

expected to conclude by 10 a.m. ET.

A replay of the conference call webcast will be available in the

investor relations website for one year. A telephone replay will be

available beginning at approximately noon ET today until midnight

ET on March 16, 2023. The telephone replay is available by calling

(844) 512-2921. The access code is: 13736006.

About Build-A-Bear

Build-A-Bear is a multi-generational global brand focused on its

mission to “add a little more heart to life” appealing to a wide

array of consumer groups who enjoy the personal expression in

making their own “furry friends” to celebrate and commemorate life

moments. Nearly 500 interactive brick-and-mortar experience

locations operated through a variety of formats provide guests of

all ages a hands-on entertaining experience, which often fosters a

lasting and emotional brand connection. The company also offers

engaging e-commerce/digital purchasing experiences on

www.buildabear.com including its online “Bear-Builder” as well as

the “Bear Builder 3D Workshop”. In addition, extending its brand

power beyond retail, Build-A-Bear Entertainment, a subsidiary of

Build-A-Bear Workshop, Inc., is dedicated to creating engaging

content for kids and adults that fulfills the company’s mission,

while the company also offers products at wholesale and in

non-plush consumer categories via licensing agreements with leading

manufacturers. Build-A-Bear Workshop, Inc. (NYSE: BBW) posted total

revenues of $467.9 million in fiscal 2022. For more information,

visit the Investor Relations section of buildabear.com.

Forward-Looking Statements:

This press release contains certain statements that are, or may

be considered to be, “forward-looking statements” for the purpose

of federal securities laws, including, but not limited to,

statements that reflect our current views with respect to future

events and financial performance. We generally identify these

statements by words or phrases such as “may,” “might,” “should,”

“expect,” “plan,” “anticipate,” “believe,” “estimate,” “intend,”

“predict,” “future,” “potential” or “continue,” the negative or any

derivative of these terms and other comparable terminology. All of

the information concerning our future liquidity, future revenues,

margins and other future financial performance and results,

achievement of operating of financial plans or forecasts for future

periods, sources and availability of credit and liquidity, future

cash flows and cash needs, success and results of strategic

initiatives and other future financial performance or financial

position, as well as our assumptions underlying such information,

constitute forward-looking information.

These statements are based only on our current expectations and

projections about future events. Because these forward-looking

statements involve risks and uncertainties, there are important

factors that could cause our actual results, level of activity,

performance or achievements to differ materially from the results,

level of activity, performance or achievements expressed or implied

by these forward-looking statements, including those factors

discussed under the caption entitled “Risks Related to Our

Business” and “Forward-Looking Statements” in our Annual Report on

Form 10-K filed with the Securities and Exchange Commission (“SEC”)

on April 15, 2021 and other periodic reports filed with the SEC

which are incorporated herein.

All of our forward-looking statements are as of the date of this

Press Release only. In each case, actual results may differ

materially from such forward-looking information. We can give no

assurance that such expectations or forward-looking statements will

prove to be correct. An occurrence of or any material adverse

change in one or more of the risk factors or other risks and

uncertainties referred to in this Press Release or included in our

other public disclosures or our other periodic reports or other

documents or filings filed with or furnished to the SEC could

materially and adversely affect our continuing operations and our

future financial results, cash flows, available credit, prospects

and liquidity. Except as required by law, the Company does not

undertake to publicly update or revise its forward-looking

statements, whether as a result of new information, future events

or otherwise.

All other brand names, product names, or trademarks belong to

their respective holders.

BUILD-A-BEAR WORKSHOP, INC. AND SUBSIDIARIES

Unaudited Condensed Consolidated Statements of Operations

(dollars in thousands, except share and per share data)

13 Weeks 13 Weeks Ended Ended

January 28, % of Total January 29, % of

Total

2023

Revenues (1)

2022

Revenues (1)

Revenues: Net retail sales $

138,180

95.2

$

125,638

96.7

Commercial revenue

6,059

4.2

3,701

2.8

International franchising

871

0.6

623

0.5

Total revenues

145,110

100.0

129,962

100.0

Cost of merchandise sold: Cost of merchandise sold - retail (1)

62,148

45.0

57,694

45.9

Cost of merchandise sold - commercial (1)

2,767

45.7

2,398

64.8

Cost of merchandise sold - international franchising (1)

393

45.1

357

57.3

Total cost of merchandise sold

65,308

45.0

60,449

46.5

Consolidated gross profit

79,802

55.0

69,513

53.5

Selling, general and administrative expense

53,608

36.9

49,380

38.0

Interest (income), net

(8)

(0.0)

(16)

(0.0)

Income before income taxes

26,202

18.1

20,149

15.5

Income tax expense (benefit)

5,692

3.9

(3,978)

(3.1)

Net income $

20,510

14.1

$

24,127

18.6

Income per common share: Basic $

1.42

$

1.53

Diluted $

1.39

$

1.48

Shares used in computing common per share amounts: Basic

14,469,633

15,804,481

Diluted

14,767,725

16,294,679

(1)

Selected statement of operations data expressed as a percentage of

total revenues, except cost of merchandise sold - retail, cost of

merchandise sold - commercial and cost of merchandise sold -

international franchising that are expressed as a percentage of net

retail sales, commercial revenue and international franchising,

respectively. Percentages will not total due to cost of merchandise

sold being expressed as a percentage of net retail sales,

commercial revenue or international franchising and immaterial

rounding.

BUILD-A-BEAR WORKSHOP, INC. AND

SUBSIDIARIES Unaudited Condensed Consolidated Statements of

Operations (dollars in thousands, except share and per share

data)

52 Weeks 52 Weeks Ended

Ended January 28, % of Total January

29, % of Total

2023

Revenues (1)

2022

Revenues (1) Revenues: Net retail sales $

446,181

95.3

$

397,690

96.6

Commercial revenue

18,523

4.0

11,505

2.8

International franchising

3,233

0.7

2,327

0.6

Total revenues

467,937

100.0

411,522

100.0

Costs and expenses: Cost of merchandise sold - retail (1)

211,489

47.4

186,382

46.9

Cost of merchandise sold - commercial (1)

8,591

46.4

5,648

49.1

Cost of merchandise sold - international franchising (1)

1,985

61.4

1,537

66.1

Total cost of merchandise sold

222,065

47.5

193,567

47.0

Consolidated gross profit

245,872

52.5

217,955

53.0

Selling, general and administrative expense

183,929

39.3

167,250

40.6

Interest expense (income), net

19

0.0

(5)

(0.0)

Income before income taxes

61,924

13.2

50,710

12.3

Income tax expense

13,939

3.0

3,445

0.8

Net income $

47,985

10.3

$

47,265

11.5

Income per common share: Basic $

3.21

$

3.06

Diluted $

3.15

$

2.93

Shares used in computing common per share amounts: Basic

14,940,770

15,460,634

Diluted

15,249,819

16,122,583

(1)

Selected statement of operations data expressed as a percentage of

total revenues, except cost of merchandise sold - retail, cost of

merchandise sold - commercial and cost of merchandise sold -

international franchising that are expressed as a percentage of net

retail sales, commercial revenue and international franchising,

respectively. Percentages will not total due to cost of merchandise

sold being expressed as a percentage of net retail sales,

commercial revenue or international franchising and immaterial

rounding.

BUILD-A-BEAR WORKSHOP, INC. AND

SUBSIDIARIES Unaudited Condensed Consolidated Balance

Sheets (dollars in thousands, except per share data)

January 28, January 29,

2023

2022

ASSETS Current assets: Cash, cash equivalents and restricted

cash

$

42,198

$

32,845

Inventories, net

70,485

71,809

Receivables, net

15,374

11,701

Prepaid expenses and other current assets

19,374

13,643

Total current assets

147,431

129,998

Operating lease right-of-use asset

71,791

77,671

Property and equipment, net

50,759

48,966

Deferred tax assets

6,592

7,613

Other assets, net

4,221

2,076

Total Assets

$

280,794

$

266,324

LIABILITIES AND STOCKHOLDERS' EQUITY Current

liabilities: Accounts payable

$

10,286

$

21,849

Accrued expenses

37,358

25,543

Operating lease liability short term

27,436

25,245

Gift cards and customer deposits

19,425

20,937

Deferred revenue and other

6,646

3,808

Total current liabilities

101,151

97,382

Operating lease liability long term

59,080

73,307

Deferred franchise revenue

529

734

Other liabilities

917

1,218

Stockholders' equity: Common stock, par value $0.01 per

share

148

162

Additional paid-in capital

69,868

75,490

Accumulated other comprehensive loss

(12,274

)

(12,470

)

Retained earnings

61,375

30,501

Total stockholders' equity

119,117

93,683

Total Liabilities and Stockholders' Equity

$

280,794

$

266,324

BUILD-A-BEAR WORKSHOP, INC. AND SUBSIDIARIES

Unaudited Selected Financial and Store Data (dollars in

thousands)

13 Weeks 13 Weeks 52 Weeks

52 Weeks Ended Ended Ended Ended

January 28, January 29, January 28, January

29,

2023

2022

2023

2022

Other financial data: Retail gross margin ($)

(1) $

76,032

$

67,944

$

234,692

$

211,308

Retail gross margin (%) (1)

55.0%

54.1%

52.6%

53.1%

Capital expenditures (2) $

6,882

$

3,537

$

13,634

$

8,130

Depreciation and amortization $

3,187

$

3,124

$

12,480

$

12,276

Store data (3): Number of corporately-managed retail

locations at end of period

North America

312

305

Europe

38

41

Asia

—

—

Total corporately-managed retail

locations

350

346

Number of franchised stores at end of period

68

72

Number of third-party retail locations at end of period

70

61

Corporately-managed store square footage at end of period

(4) North America

726,209

711,768

Europe

54,725

61,090

Total square footage

780,934

772,858

(1)

Retail gross margin represents net retail sales less cost of

merchandise sold - retail. Retail gross margin percentage

represents retail gross margin divided by net retail sales. Store

impairment is excluded from retail gross margin.

(2)

Capital expenditures represents cash paid for property, equipment,

and other assets.

(3)

Excludes e-commerce. North American stores are located in the

United States and Canada. In Europe, stores are located in the

United Kingdom and Ireland. Seasonal locations not included in

store count.

(4)

Square footage for stores located in North America is leased square

footage. Square footage for stores located in Europe is estimated

selling square footage. Seasonal locations not included in the

store count.

BUILD-A-BEAR WORKSHOP, INC. AND

SUBSIDIARIES Reconciliation of GAAP to Non-GAAP figures

(dollars in thousands)

13 Weeks 13

Weeks Ended Ended January 28, January

29,

2023

2022

Income before income taxes (pre-tax)

$

26,202

$

20,149

Interest (income), net

(8

)

(16

)

Depreciation and amortization expense

3,187

3,124

Earnings before interest, taxes, depreciation and amortization

(EBITDA)

$

29,381

$

23,257

52 Weeks 52 Weeks

Ended Ended January 28, January 29,

2023

2022

Income before income taxes (pre-tax)

$

61,924

$

50,710

Interest (income) expense, net

19

(5

)

Depreciation and amortization expense

12,480

12,276

Earnings before interest, taxes, depreciation and amortization

(EBITDA)

$

74,423

$

62,981

Reconciliation of GAAP to Non-GAAP Results (dollars

in thousands, except per share data)

13 Weeks

13 Weeks 52 Weeks 52 Weeks Ended

Ended Ended Ended January 28,

January 29, January 28, January 29,

2023

2022

2023

2022

Income before income taxes (pre-tax)

$

26,202

$

20,149

$

61,924

$

50,710

Income (loss) before income tax adjustments: United Kingdom

Lockdown Business & Restart Grants (1)

-

10

-

(842

)

COVID activity (2)

-

26

-

70

Impairment, bad debt, and lease modification (3)(4)

(665

)

(1,107

)

(1,616

)

(1,054

)

Foreign exchange (gains) losses (5)

(676

)

498

583

521

Adjusted income before income taxes (adjusted pre-tax)

24,861

19,576

60,891

49,405

Income tax (expense) benefit

(5,692

)

3,978

(13,939

)

(3,445

)

Tax adjustments: Income tax impact: adjustments (6)

(26

)

56

70

78

Valuation allowance (7)

(7,761

)

-

(7,761

)

Adjusted income tax (expense)

(5,718

)

(3,727

)

(13,869

)

(11,128

)

Net income

20,510

24,127

47,985

47,265

Adjustments

(1,367

)

(8,278

)

(963

)

(8,988

)

Adjusted net income

$

19,143

$

15,849

$

47,022

$

38,277

Net income per diluted share (EPS)

$

1.39

$

1.48

$

3.15

$

2.93

Adjusted net income per diluted share (adjusted EPS)

$

1.30

$

0.97

$

3.08

$

2.37

(1)

Represents the business grants received and adjusted from the

United Kingdom government for business in the retail, hospitality

and leisure sectors. These grants were provided on a per-property

basis to support businesses through the latest lockdown

restrictions as a result of the COVID pandemic and to resume

business when restrictions were eased.

(2)

Represents COVID related expenses at our stores, warehouse, and

headquarters.

(3)

Represents the lease modification impacts of exercising early

termination options in leases offset by non-cash impairment charges

related to store fixed assets, receivables, and inventory in the 13

and 52 weeks ended January 28, 2023 and January 29, 2022.

(4)

Represents non-cash adjustments including asset impairment charges

related to store fixed assets and right-of-use operating lease

assets and bad debt expense in the 13 and 52 weeks ending January,

28, 2023 and January 29, 2022.

(5)

Represents the consolidated impact of foreign exchange rates on the

re-measurement of balance sheet items not denominated in functional

currency recorded under the provisions of U.S. GAAP. This does not

include any impact on margin associated with the translation of

revenues or the foreign subsidiaries' purchase of inventory in U.S.

dollars.

(6)

Represents the aggregate tax impact of the pre-tax adjustments for

North American adjustments for the 13 and 52 weeks ended January

28, 2023 and January 29, 2022. Europe had a full valuation

allowance and did not realize an income tax effect on these

adjustments for the 13 and 52 weeks ended January 28, 2023 and

January 29, 2022.

(7)

Represents the reversal of the full valuation allowance on its net

deferred tax assets in North America for the 13 weeks ended January

29, 2022.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230309005313/en/

Investors: Voin Todorovic Build-A-Bear Workshop 314.423.8000

x5221 Media: Public Relations PR@buildabear.com

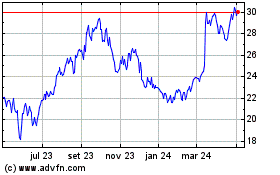

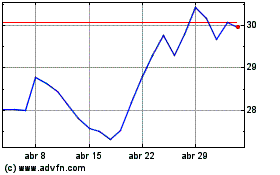

Build A Bear Workshop (NYSE:BBW)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Build A Bear Workshop (NYSE:BBW)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024