Capitalize To Power Rollovers for Robinhood Retirement Account Holders

22 Março 2023 - 9:30AM

Business Wire

New Partnership Will Help Robinhood Customers Find and

Consolidate Old 401(k)s, Reducing the $1.4 Trillion Currently Held

in Left Behind 401(k) Accounts

Capitalize, the award-winning platform to find and transfer

retirement accounts, today announced a new partnership with

Robinhood Markets, Inc (NASDAQ: HOOD). Capitalize’s partnership

with Robinhood Retirement will help customers find and roll over

legacy 401(k) accounts into Robinhood’s new individual retirement

accounts (IRA). Additionally, Robinhood will be featured on

Capitalize’s leading IRA marketplace as a potential destination for

users looking to consolidate their legacy 401(k) assets.

“Since we launched Robinhood Retirement last year, we’ve seen

close to half a million customers take advantage of our IRA, the

only IRA in the market with a 1% annual match. This partnership

will make it much simpler and easier for Americans to roll over

their funds,” said Steve Quirk, Chief Brokerage Officer of

Robinhood. “To kick things off, we are giving folks an additional

1% on every dollar they transfer in from external retirement

accounts until April 18.”

“Americans have traditionally found it very hard to track and

consolidate their retirement savings given the archaic rollover

process. Partners like Robinhood understand the hurdle this

presents to growing wealth and want to help their users more

effectively save for retirement,” said Gaurav Sharma, CEO of

Capitalize. “We are grateful for the trust that Robinhood has put

in our product and team.”

Robinhood joins a growing number of leading IRA providers using

Capitalize’s enterprise rollover solution. Capitalize’s combination

of proprietary technology and scaled operations help customers of

IRA providers find legacy 401(k)s and seamlessly roll them over to

fund new or existing IRAs through an enterprise version of the

Capitalize rollover platform. Capitalize introduced its enterprise

rollover solution in 2021 as an extension of its award-winning

consumer rollover platform launched widely in 2020.

Each year, millions of Americans prematurely cash-out their

401(k) accounts at the point of job change or leave them behind.

According to a research paper by Capitalize and the Center for

Retirement Research (CRR), The True Cost of Forgotten 401(k)

Accounts, there are now over 24 million 401(k)s left behind with

former employers holding over $1.35 trillion in assets. The

difficulty in finding and rolling over these assets after changing

employers continues to be a significant hurdle to adequately saving

for retirement.

Since launching in 2020, the Capitalize platform has supported a

rapidly growing number of Americans looking to consolidate their

assets, and has significantly increased its share of the more than

$700 billion rolled over into IRAs annually. The firm’s significant

rollover volume growth has been driven by the addition of new

strategic IRA partners to its marketplace and the adoption of its

enterprise solution by IRA and other retirement services

providers.

About Capitalize

Capitalize is a New York-based technology company that helps

consumers find and roll over their old 401(k) accounts through an

easy-to-use online platform. Capitalize’s free platform manages the

entire 401(k) rollover process, using proprietary technology and

delightful customer service to dramatically simplify the process of

transferring and managing retirement accounts. Capitalize was

recognized as a World Changing Idea by Fast Company in 2022 and as

one of TIME’s 100 Best Inventions of 2021. www.hicapitalize.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230322005296/en/

Media Aditi Bhatia

Capitalize aditi.bhatia@hicapitalize.com

Robinhood Markets (NASDAQ:HOOD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

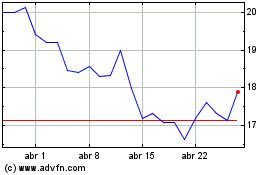

Robinhood Markets (NASDAQ:HOOD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024