Revenue Up 23%; Orders Rise 74%; Backlog Up

121%

Sypris Solutions, Inc. (Nasdaq/GM: SYPR) today reported

financial results for its first quarter ended April 2, 2023.

HIGHLIGHTS

─────────────────────

- Revenue for the first quarter increased 23.4%

year-over-year, driven by double digit expansion of shipments at

both segments.

- Orders for the period rose 73.6% from the

prior-year period, while backlog increased 121.0%, reflecting

positive demand from customers across both segments of the

business.

- Revenue for Sypris Electronics expanded 42.0%

year-over-year, driven by increased sales to customers serving the

communications markets and improved material availability compared

to the prior-year period.

- Orders for Sypris Electronics increased 91.4%

during the period, driving firm backlog up to over $131.6 million,

representing a $73.1 million or 125.0% increase over the prior-year

period and an 11.0% increase from year end.

- Revenue for Sypris Technologies increased

13.7% year-over-year reflecting positive growth across the energy,

commercial vehicle and recreational vehicle markets.

- Orders for Sypris Technologies energy products

increased 25.7% during the first quarter compared to the same

period in 2022, pushing backlog up 61.0% over the prior-year period

and 19.6% from year end.

- During the quarter, Sypris Electronics

announced that it had received an award to produce and test

electronic interface modules for a U.S. Department of Defense

missile weapons system as part of an ongoing modernization program.

Production is expected to begin in 2023.

- Subsequent to quarter end, Sypris Electronics

announced that it received additional releases under a multi-year

production contract to produce and test power supply modules for a

large, mission-critical U.S. Navy electronic warfare program, with

deliveries to begin in 2023. The upgrade will provide the

capability to jam incoming missiles that threaten a warship, cue

decoys, and adapt quickly to evolving threats.

- During the quarter, Sypris Technologies

announced that it had entered into an amendment to its existing

supply agreement with Detroit Diesel Corporation, a subsidiary of

Daimler Truck North America, to produce a new series of part

numbers for driveline components for use in Detroit® Diesel-branded

drive axles. The components to be produced by Sypris will be

essential to the performance of the drive axles of Freightliner’s

heavy-duty trucks. Production is expected to begin in 2023.

- Subsequent to quarter end, Sypris Technologies

announced that it was awarded a new program to supply drivetrain

components for use in the production of a new model of side-by-side

utility-terrain vehicles, with production expected to begin in

2024.

- The Company updated its full-year outlook for

2023, maintaining the expected increase in revenue at 25%-30%

year-over-year while adjusting the gross margin guidance to a

150-200 basis point increase, with unfavorable foreign currency

exchange rates impacting margins in the near term. Cash flow from

operations is expected to remain strong, reflecting increased

year-over-year profitability.

─────────────────────

“We were pleased with our first quarter performance, as both

operating segments reported significant growth in revenue and

orders. Our teammates have done an excellent job navigating

inflationary pressures, supply chain challenges, customer demand

volatility and currency fluctuations to position the business for

further growth and increased profitability during the remainder of

2023,” commented Jeffrey T. Gill, President and Chief Executive

Officer.

“Backlog for Sypris Electronics continued to increase on both a

year-over-year and on a sequential basis, resulting in our largest

book of business in over a decade. The record $131.6 million

backlog is expected to support revenue growth, with deliveries now

scheduled well into 2025. Customer funding has already been secured

for a portion of these key programs, which enables us to lock in

multi-year component purchases and help mitigate potential future

supply chain issues.

“Demand from Sypris Technologies customers serving the

automotive, commercial vehicle, sport utility and off-highway

markets has remained relatively stable, with new product line

shipments offsetting headwinds for automotive and commercial

vehicle components as our customers adjust inventory levels to

align with OEM build schedules. While we continue to experience

some volatility within this market, current forecasts are

predicting a slight increase in the North American Class 8 truck

market production for 2023.

“We continue to invest in new equipment, maintain or upgrade

existing assets, and drive continuous improvement initiatives to

add capacity and support more cost-efficient operations in the

future. The successful extension of long-term contracts with two of

our key Sypris Technologies’ customers in 2022 and new awards in

2023 support our revenue base and provide opportunities to expand

these relationships in the coming years.

“Shipment of Sypris Technologies energy products increased 27.0%

year-over-year, while orders during the quarter increased 25.7%.

With open quotes outstanding on several large projects both

domestically and internationally, additional opportunities for

growth may exist with these projects and other projects in support

of elevated domestic natural gas production and rising domestic oil

production. We are also actively pursuing applications for our

products in adjacent markets to further diversify our industry and

customer portfolios.”

First Quarter Results

The Company reported revenue of $32.3 million for the first

quarter of 2023, compared to $26.2 million for the prior-year

comparable period. Additionally, the Company reported a net loss of

$0.2 million, or $0.01 per share, as compared to net income of $0.2

million, or $0.01 per diluted share, for the prior-year period.

Sypris Technologies

Revenue for Sypris Technologies was $19.5 million in the first

quarter of 2023 compared to $17.2 million for the prior-year

period, reflecting the strength of the commercial vehicle market

and increased energy-related product sales. Gross profit for the

first quarter of 2023 was $2.6 million, or 13.5% of revenue,

compared to $3.1 million, or 18.3% of revenue, for the same period

in 2022. Gross profit for the first quarter of 2023 was negatively

impacted by foreign currency exchange rates for our Mexican

subsidiary, resulting in a decrease of $0.4 million. Additionally,

gross profit was negatively impacted by an unfavorable mix for our

energy product sales and higher material prices passed through to

our customers without additional markup.

Sypris Electronics

Revenue for Sypris Electronics was $12.8 million in the first

quarter of 2023 compared to $9.0 million for the prior-year period.

Increased shipments for a communications program contributed to the

growth over the prior-year comparable period. Additionally,

material availability improved compared to the prior-year period,

which supported the increase in sales. Gross profit for the first

quarter of 2023 was $1.5 million, or 11.9% of revenue, compared to

$1.4 million, or 15.3% of revenue, for the same period in 2022 due

to higher volumes offset by an unfavorable mix.

Outlook

Commenting on the future, Mr. Gill added, “Demand remains strong

from customers serving the automotive, commercial vehicle and sport

utility markets, with Class 8 production expected to increase

slightly above 2022 levels driven by solid order backlogs within

the industry. Similarly, demand from customers in the defense and

communications sector remains robust, while the outlook for the

energy market continues to move in the right direction.

“With a strong backlog, new program wins and long-term contract

extensions in place, we are confident that 2023 has the potential

to be very positive for Sypris. As a result, we are pleased to

confirm our revenue outlook for 2023, which includes a 25-30%

growth in the top line. While unfavorable foreign currency exchange

rates are anticipated to impact margins for the full year, we

anticipate a 150-200 basis point expansion in gross margin and

continued strength in cash flow from operations on a year-over-year

basis supported by strong earnings growth.”

Webcast and Conference Call Information

Sypris Solutions will host a listen only conference call to

discuss the Company's financial results today, May 16, 2023, at

9:00 a.m. (Eastern Time). To listen to the call, participants

should dial (833) 316-0560 approximately 10 minutes prior to the

start of the call (ask to be joined into the Sypris Solutions, Inc.

call).

The live broadcast of Sypris’ quarterly conference call will

also be available online at www.sypris.com on May 16, 2023,

beginning at 9:00 a.m. (Eastern Time). The online replay will be

available at approximately 11:00 a.m. (Eastern Time) and continue

for 30 days. Related presentation materials will be posted to the

“Investor Information” section of the Company’s website at

www.sypris.com, located under the sub-heading “Upcoming Events,”

prior to the call.

About Sypris Solutions

Sypris Solutions is a diversified manufacturing and engineering

services company serving the defense, transportation,

communications, and energy industries. For more information about

Sypris Solutions, visit its Web site at www.sypris.com.

Forward Looking Statements

This press release contains “forward-looking” statements

within the meaning of the federal securities laws.

Forward-looking statements include our plans and expectations of

future financial and operational performance. Each

forward-looking statement herein is subject to risks and

uncertainties, as detailed in our most recent Form 10-K and Form

10-Q and other SEC filings. Briefly, we currently believe that

such risks also include the following: our failure to achieve and

maintain profitability on a timely basis by steadily increasing our

revenues from profitable contracts with a diversified group of

customers, which would cause us to continue to use existing cash

resources or require us to sell assets to fund operating losses;

cost, quality and availability or lead times of raw materials such

as steel, component parts (especially electronic components),

natural gas or utilities including increased cost relating to

inflation; the cost, quality, timeliness, efficiency and yield of

our operations and capital investments, including the impact of

inflation, tariffs, product recalls or related liabilities,

employee training, working capital, production schedules, cycle

times, scrap rates, injuries, wages, overtime costs, freight or

expediting costs; risks of foreign operations, including foreign

currency exchange rate risk exposure, which could impact our

operating results; dependence on, retention or recruitment of key

employees and highly skilled personnel and distribution of our

human capital; volatility of our customers’ forecasts and our

contractual obligations to meet current scheduling demands and

production levels, which may negatively impact our operational

capacity and our effectiveness to integrate new customers or

suppliers, and in turn cause increases in our inventory and working

capital levels; our failure to successfully complete final contract

negotiations with regard to our announced contract “orders”, “wins”

or “awards”; significant delays or reductions due to a prolonged

continuing resolution or U.S. government shut down reducing the

spending on products and services that Sypris Electronics provides;

adverse impacts of new technologies or other competitive pressures

which increase our costs or erode our margins; breakdowns,

relocations or major repairs of machinery and equipment, especially

in our Toluca Plant; the fees, costs and supply of, or access to,

debt, equity capital, or other sources of liquidity; the

termination or non-renewal of existing contracts by customers; the

costs and supply of insurance on acceptable terms and with adequate

coverage; our reliance on revenues from customers in the oil and

gas and automotive markets, with increasing consumer pressure for

reductions in environmental impacts attributed to greenhouse gas

emissions and increased vehicle fuel economy; the impact of

COVID-19 and economic conditions on our future operations; possible

public policy response to the pandemic, including U. S or foreign

government legislation or restrictions that may impact our

operations or supply chain; our failure to successfully win new

business or develop new or improved products or new markets for our

products; war, geopolitical conflict, terrorism, or political

uncertainty, including disruptions resulting from the

Russia-Ukraine war arising out of international sanctions, foreign

currency fluctuations and other economic impacts; our reliance on a

few key customers, third party vendors and sub-suppliers; inventory

valuation risks including excessive or obsolescent valuations or

price erosions of raw materials or component parts on hand or other

potential impairments, non-recoverability or write-offs of assets

or deferred costs; disputes or litigation involving governmental,

supplier, customer, employee, creditor, stockholder, product

liability, warranty or environmental claims; failure to adequately

insure or to identify product liability, environmental or other

insurable risks; unanticipated or uninsured product liability

claims, disasters, public health crises, losses or business risks;

the costs of compliance with our auditing, regulatory or

contractual obligations; labor relations; strikes; union

negotiations; costs associated with environmental claims relating

to properties previously owned; pension valuation, health care or

other benefit costs; our inability to patent or otherwise protect

our inventions or other intellectual property rights from potential

competitors or fully exploit such rights which could materially

affect our ability to compete in our chosen markets; changes in

licenses, security clearances, or other legal rights to operate,

manage our work force or import and export as needed; cyber

security threats and disruptions, including ransomware attacks on

our systems and the systems of third-party vendors and other

parties with which we conduct business, all of which may become

more pronounced in the event of geopolitical conflicts and other

uncertainties, such as the conflict in Ukraine; our ability to

maintain compliance with the Nasdaq listing standards minimum

closing bid price; risks related to owning our common stock,

including increased volatility; or unknown risks and uncertainties.

We undertake no obligation to update our forward-looking

statements, except as may be required by law.

SYPRIS SOLUTIONS, INC. Financial Highlights (In

thousands, except per share amounts)

Three Months Ended

April 2,

April 3,

2023

2022

(Unaudited) Revenue

$

32,292

$

26,166

Net (loss) income

$

(175

)

$

237

(Loss) income per common share: Basic

$

(0.01

)

$

0.01

Diluted

(0.01

)

0.01

Weighted average shares outstanding: Basic

21,796

21,681

Diluted

21,796

22,675

Sypris Solutions, Inc. Consolidated Statements of

Operations (in thousands, except for per share data)

Three Months Ended

April 2,

April 3,

2023

2022

(Unaudited) Net revenue: Sypris Technologies

$

19,500

$

17,155

Sypris Electronics

12,792

9,011

Total net revenue

32,292

26,166

Cost of sales: Sypris Technologies

16,861

14,023

Sypris Electronics

11,270

7,634

Total cost of sales

28,131

21,657

Gross profit: Sypris Technologies

2,639

3,132

Sypris Electronics

1,522

1,377

Total gross profit

4,161

4,509

Selling, general and administrative

3,745

3,389

Operating income

416

1,120

Interest expense, net

226

248

Other expense, net

71

169

Income before taxes

119

703

Income tax expense, net

294

466

Net (loss) income

$

(175

)

$

237

(Loss) income per common share: Basic

$

(0.01

)

$

0.01

Diluted

$

(0.01

)

$

0.01

Dividends declared per common share

$

-

$

-

Weighted average shares outstanding: Basic

21,796

21,681

Diluted

21,796

22,675

Sypris Solutions, Inc. Consolidated Balance Sheets

(in thousands, except for share data)

April 2,

December 31,

2023

2022

(Unaudited)

(Note)

ASSETS Current assets: Cash and cash equivalents

$

19,481

$

21,648

Accounts receivable, net

10,720

8,064

Inventory, net

52,489

42,133

Other current assets

8,384

8,133

Total current assets

91,074

79,978

Property, plant and equipment, net

16,772

15,532

Operating lease right-of-use assets

4,072

4,251

Other assets

4,524

4,383

Total assets

$

116,442

$

104,144

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities:

Accounts payable

$

20,816

$

17,638

Accrued liabilities

35,348

33,316

Operating lease liabilities, current portion

1,196

1,168

Finance lease obligations, current portion

1,169

1,102

Equipment financing obligations, current portion

400

398

Note payable - related party, current portion

4,500

2,500

Total current liabilities

63,429

56,122

Operating lease liabilities, net of current portion

3,398

3,710

Finance lease obligations, net of current portion

2,410

2,536

Equipment financing obligations, net of current portion

1,430

738

Note payable - related party, net of current portion

1,991

3,989

Other liabilities

22,795

17,474

Total liabilities

95,453

84,569

Stockholders’ equity: Preferred stock, par value $0.01 per share,

975,150 shares authorized; no shares issued

-

-

Series A preferred stock, par value $0.01 per share, 24,850 shares

authorized; no shares issued

-

-

Common stock, non-voting, par value $0.01 per share, 10,000,000

shares authorized; no shares issued

-

-

Common stock, par value $0.01 per share, 30,000,000 shares

authorized; 22,395,862 shares issued and 22,395,843 outstanding in

2023 and 22,175,664 shares issued and 22,175,645 outstanding in

2022

224

221

Additional paid-in capital

155,748

155,535

Accumulated deficit

(115,511

)

(115,336

)

Accumulated other comprehensive loss

(19,472

)

(20,845

)

Treasury stock, 19 in 2022 and 2021, respectively

-

-

Total stockholders’ equity

20,989

19,575

Total liabilities and stockholders’ equity

$

116,442

$

104,144

Note: The balance sheet at December 31, 2022, has been

derived from the audited consolidated financial statements at that

date but does not include all information and footnotes required by

accounting principles generally accepted in the United States for a

complete set of financial statements.

Sypris Solutions, Inc.

Consolidated Cash Flow Statements (in thousands)

Three Months Ended

April 2,

April 3,

2023

2022

(Unaudited)

Cash flows from operating activities: Net (loss) income

$

(175

)

$

237

Adjustments to reconcile net (loss) income to net cash used in

operating activities: Depreciation and amortization

774

763

Deferred income taxes

(136

)

247

Non-cash compensation expense

263

176

Deferred loan costs recognized

2

2

Net loss on the sale of assets

-

10

Provision for excess and obsolete inventory

(87

)

64

Non-cash lease expense

179

186

Other noncash items

33

12

Contributions to pension plans

(10

)

(22

)

Changes in operating assets and liabilities: Accounts receivable

(2,691

)

(4,741

)

Inventory

(9,942

)

(1,166

)

Prepaid expenses and other assets

154

653

Accounts payable

3,118

1,403

Accrued and other liabilities

7,277

(1,077

)

Net cash used in operating activities

(1,241

)

(3,253

)

Cash flows from investing activities: Capital expenditures

(708

)

(901

)

Net cash used in investing activities

(708

)

(901

)

Cash flows from financing activities: Proceeds from equipment

financing obligation

210

-

Principal payments on finance lease obligations

(271

)

(238

)

Principal payments on equipment financing obligations

(95

)

(82

)

Indirect repurchase of shares for minimum statutory tax

withholdings

(48

)

(17

)

Net cash used in financing activities

(204

)

(337

)

Effect of exchange rate changes on cash balances

(14

)

390

Net decrease in cash and cash equivalents

(2,167

)

(4,101

)

Cash and cash equivalents at beginning of period

21,648

11,620

Cash and cash equivalents at end of period

$

19,481

$

7,519

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230516005315/en/

Richard L. Davis Chief Financial Officer (502)

329-2000

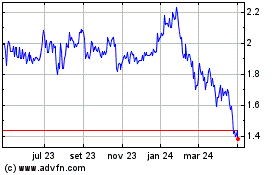

Sypris Solutions (NASDAQ:SYPR)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

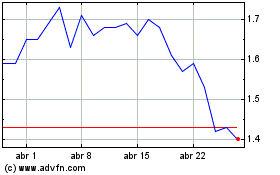

Sypris Solutions (NASDAQ:SYPR)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024