Not for distribution to U.S. newswire services

or dissemination in the United States

STLLR Gold Inc. (formerly Moneta Gold Inc.) (TSX:

ME)(OTCQX: MEAUF)(FSE: MOPA) (“STLLR”) and Nighthawk Gold

Corp. (“Nighthawk”) (TSX: NHK) are pleased to announce

the completion of their previously announced at-market merger (the

“Transaction”) by way of a court-approved plan of

arrangement (the “Arrangement”). In connection with the

Transaction, Moneta Gold Inc. (“Moneta”) changed its name to

“STLLR Gold Inc.” and effected a 2-for-1 consolidation of its

common shares.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240206545543/en/

Keyvan Salehi, P.Eng., MBA, President, CEO, and Director of

STLLR stated: “Today marks a historic moment as we complete the

merger between two promising companies, creating a stronger,

leading Canadian gold developer. The STLLR Gold era begins with two

large-scale, cornerstone gold projects, a strong balance sheet, and

an opportunity to create immense value for our combined shareholder

base. We remain steadfast in our commitment to sustainable,

collaborative and innovative practices, which we believe can enrich

the communities where we operate. I extend my heartfelt thanks to

everyone involved in realizing this vision, especially our

dedicated teams and supportive stakeholders. With this merger,

STLLR Gold is poised for robust growth, ready to redefine the

standards of excellence in the gold mining industry.”

Under the terms of the Arrangement, STLLR acquired all of the

issued outstanding common shares of Nighthawk (each, a

“Nighthawk Share”). Former holders of Nighthawk Shares

(“Nighthawk Shareholders”) received 0.21 of a common share

of STLLR (each whole share, an “STLLR Share”) for each

Nighthawk Share held (the “Exchange Ratio”). In aggregate,

39,567,651 STLLR Shares were issued today to former Nighthawk

Shareholders (including former holders who received Nighthawk

Shares on conversion of their Subscription Receipts (as defined

below)) as consideration for their Nighthawk Shares.

As a result of the Arrangement, Nighthawk has become a

wholly-owned subsidiary of STLLR and the Nighthawk Shares are

anticipated to be delisted from the Toronto Stock Exchange (the

“TSX”) at market close on or about February 8, 2024. In

connection with the delisting, Nighthawk intends to apply to cease

to be a reporting issuer under applicable Canadian securities

laws.

Executive Leadership and Board of Directors

STLLR will be led by Keyvan Salehi, as President, CEO and

Director. The rest of the STLLR management team is comprised of

Salvatore Curcio, CA, CPA as CFO, John McBride, MSc., P.Geo, as VP

Exploration, Dennis Wilson as VP Sustainability, and Allan

Candelario, CFA as VP Investor Relations & Corporate

Development.

The STLLR Board will be led by Josef Vejvoda, CIM, ICD.D as

Non-Executive Chair and includes Keyvan Salehi, Morris Prychidny,

CPA, CA, Blair Zaritsky, CPA, CA, Edie Hofmeister, MA, JD, Rodney

A. Cooper, P.Eng, MBA, Acc. Dir., and Krista Muhr.

Jose Vizquerra, MSc., the President, CEO and Director of O3

Mining, remains as the Special Advisor to the STLLR Board. Mr.

Vizquerra is a seasoned mining executive with extensive experience

in project development, business development, exploration and

capital markets. He currently serves as a Director of Osisko Mining

Inc. (“Osisko”) and Silver Mountain Resources Inc., and as

an advisor to the boards of Discovery Metals Corp. and Palamina

Corp. Mr. Vizquerra was preciously the EVP of Strategic Development

for Osisko, President & CEO of Oban Mining Corp. (before the

amalgamation to form Osisko), Head of Business Development for

Compania de Minas Buenaventura, and was a production and

exploration geologist at the Red Lake Gold Mines.

Subscription Receipt Financing

In connection with closing of the Transaction, the escrow

release conditions in respect of an aggregate of 38,235,294

subscription receipts (the “Subscription Receipts”) of

Nighthawk issued on December 19, 2023 at a price of C$0.34 per

Subscription Receipt (the “Subscription Receipt Financing”)

were satisfied and the gross proceeds in the amount of

approximately C$13.0 million were released to Nighthawk. The net

proceeds are expected to be used to partially fund the

environmental baseline work at both the Tower Gold and Colomac Gold

Projects, and for general working capital and administration

purposes. Each Subscription Receipt automatically converted into

one Nighthawk Share and one-half of one common share purchase

warrant of Nighthawk (the “Subscription Receipt Warrants”)

for no additional consideration. The STLLR Shares and common share

purchase warrants of STLLR issued today in exchange of the

Nighthawk Shares and Subscription Receipt Warrants upon conversion

of the Subscription Receipts are not subject to any statutory hold

provisions.

Information for Nighthawk Shareholders

In order to receive STLLR Shares in exchange for Nighthawk

Shares, registered shareholders of Nighthawk must complete, sign,

date and return the letter of transmittal that was mailed to each

Nighthawk Shareholder prior to closing. The letter of transmittal

is also available under Nighthawk’s profile on SEDAR+ at

www.sedarplus.ca. For those Nighthawk Shareholders whose Nighthawk

Shares are registered in the name of a broker, investment dealer,

bank, trust company, trust or other intermediary or nominee, they

should contact such nominee for assistance in depositing their

Nighthawk Shares and should follow the instructions of such

intermediary or nominee.

Convertible Securities

Pursuant to the Arrangement, each Nighthawk option (a

“Nighthawk Option”) has been transferred to STLLR, with the

holder thereof receiving as consideration an option to purchase

from STLLR (each, a “STLLR Option”) such number of STLLR

Shares equal to the Exchange Ratio multiplied by the number of

Nighthawk Shares subject to the Nighthawk Option, at an exercise

price per STLLR Share equal to the current Nighthawk Option

exercise price divided by the Exchange Ratio. The STLLR Options are

exercisable until the original expiry date of the respective

Nighthawk Option for which they were replaced, provided that STLLR

Options held by directors, officers or employees of Nighthawk who

did not continue with positions at STLLR following the completion

of the Arrangement, will remain outstanding for a period

terminating on the earlier of (i) three years following the

Effective Date; and (ii) the original expiry date of such Nighthawk

Options.

Nighthawk broker warrant (“Broker Warrants”) were also

adjusted in accordance with the adjustment provisions in the

relevant broker warrant certificate such that, following the

completion of the Arrangement, each holder of Broker Warrants will

receive, upon exercise thereof, that number of STLLR Shares

determined in accordance with the Exchange Ratio and the

anti-dilution provisions of such Broker Warrants, in lieu of each

Nighthawk Share to which it was otherwise entitled to receive upon

exercise, provided that if the foregoing would result in the

issuance of a fraction of a STLLR Share on any particular exercise,

then the number of STLLR Shares otherwise issuable will be rounded

down to the nearest whole number of STLLR Shares.

Prior to the completion of the Transaction, Nighthawk had

outstanding a class of Nighthawk warrants listed on the TSX under

the trading symbol “NHK.WT” (the “Listed Nighthawk

Warrants”). STLLR has assumed the obligations in respect of the

Listed Nighthawk Warrants and each is now exercisable to acquire

0.21 of a STLLR Share. STLLR has entered into a supplemental

warrant indenture, a copy of which will be made available on

STLLR’s SEDAR+ profile at www.sedarplus.ca. The Listed Nighthawk

Warrants were delisted from the TSX and will be relisted for

trading on STLLR’s trading profile, under the trading symbol

“STLR.WT”, and will remain listed on the TSX until the earliest to

occur of their exercise, expiry or delisting.

Further information about the Transaction is set forth in the

materials prepared by Nighthawk and STLLR in respect of the special

meetings of the shareholders of Nighthawk and STLLR which were

mailed to Nighthawk and STLLR shareholders and filed under the

respective Nighthawk and STLLR profile on SEDAR+ at

www.sedarplus.ca.

Ticker Symbol Change

It is anticipated that STLLR will commence trading on or about

the TSX on February 8, 2024 under the ticker symbol “STLR” with the

CUSIP and ISIN numbers 86101P101 and CA86101P1018,

respectively. The CUSIP and ISN numbers for the Subscription

Receipt Warrants are 86101P119 and CA86101P1190. The CUSIP and ISN

numbers for the Listed Nighthawk Warrants are 86101P127 and

CA86101P1273. On the OTCQX, STLLR is proposing a ticker symbol

change to “STLRF”.

None of the securities issued pursuant to the Transaction or the

Subscription Receipt Financing have been or will be registered

under the United States Securities Act of 1933, as amended (the

“U.S. Securities Act”), or any securities laws of any state

of the United States, and any securities issued pursuant to the

Transaction or the Subscription Receipt Financing have been or will

be issued in reliance upon available exemptions from such

registration requirements. This news release does not constitute an

offer to sell or the solicitation of an offer to buy any

securities.

Early Warning Disclosure

Prior to the completion of the Transaction, STLLR held nil

Nighthawk Shares. Following the completion of the Transaction,

STLLR holds all of the issued and outstanding Nighthawk Shares. An

early warning report will be filed by STLLR under Nighthawk’s

SEDAR+ profile at www.sedarplus.ca in accordance with applicable

securities laws. To obtain a copy of the early warning report,

please contact the Corporate Secretary on behalf of STLLR, DSA

Corporate Services Inc., at ops@dsacorp.ca or +1 (416)

848-7727.

Advisors and Counsel

SCP Resource Finance LP and Laurentian Bank Securities Inc.

acted as financial advisors to Nighthawk. Cassels Brock &

Blackwell LLP acted as Nighthawk’s legal counsel.

Maxit Capital LP and Evans & Evans, Inc. acted as financial

advisors to Moneta. McCarthy Tetrault LLP acted as Moneta’s legal

counsel.

About STLLR Gold

STLLR Gold Inc. (TSX: STLR; OTCQX: STLRF; FSE: MOPA) has

ambitions to become the leading Canadian gold development company.

STLLR actively advancing two cornerstone, robust, gold projects in

Canada: Tower Gold Project in the Timmins Mining Camp in Ontario

and the Colomac Gold Project located north of Yellowknife,

Northwest Territories. These two projects demonstrate long-life

potential and are surrounded by exploration land with immense

upside. STLLR’s experienced management team, with a track record of

successfully advancing projects and operating mines, is working

towards rapidly advancing these projects.

Forward-Looking Information

This news release contains “forward-looking information” within

the meaning of applicable Canadian securities legislation.

Forward-looking information includes, but is not limited to,

information with respect to the potential benefits to be derived

from the Transaction, including, but not limited to, the goals,

synergies, strategies, opportunities, profile, mineral resources

and potential production, project timelines, prospective

shareholding, integration and comparables to other transactions,

the future financial or operating performance of STLLR and STLLR’s

mineral properties and project portfolios, STLLR’s intended use of

the net proceeds from the sale of Subscription Receipts, the

advancement of the Tower Gold and Colomac Gold Projects,

re-defining junior gold mining, becoming the leading Canadian gold

development company, long-life potential of the Tower and Colomac

Gold Projects and exploration upside of the land packages.

Generally, forward-looking information can be identified by the use

of forward-looking terminology such as “accelerate”, “add” or

“additional”, “advancing”, “anticipates” or “does not anticipate”,

“appears”, “believes”, “can be”, “conceptual”, “confidence”,

“continue”, “convert” or “conversion”, “deliver”, “demonstrating”,

“estimates”, “encouraging”, “expand” or “expanding” or “expansion”,

“expect” or “expectations”, “fast-track”, “forecasts”, “forward”,

“goal”, “improves”, “increase”, “intends”, “justification”,

“leading”, “plans”, “potential” or “potentially”, “pro-forma”,

“promise”, “prospective”, “prioritize”, “reflects”, “re-rating”,

“robust”, “scheduled”, “stronger”, “suggesting”, “support”,

“updating”, “upside”, “will be” or “will consider”, “work towards”,

or variations of such words and phrases or state that certain

actions, events or results “may”, “could”, “would”, “might”, or

“will be taken”, “occur”, or “be achieved”.

Forward-looking information is based on the opinions and

estimates of management at the date the information is made, and is

based on a number of assumptions and is subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

STLLR to be materially different from those expressed or implied by

such forward-looking information, including risks associated with

required regulatory approvals, the exploration, development and

mining such as economic factors as they effect exploration, future

commodity prices, changes in foreign exchange and interest rates,

actual results of current exploration activities, government

regulation, political or economic developments, the ongoing wars

and their effect on supply chains, environmental risks, COVID-19

and other pandemic risks, permitting timelines, capex, operating or

technical difficulties in connection with development activities,

employee relations, the speculative nature of gold exploration and

development, including the risks of diminishing quantities of

grades of reserves, contests over title to properties, and changes

in project parameters as plans continue to be refined as well as

those risk factors discussed in the joint management information

circular of Nighthawk and Moneta dated December 20, 2023, available

on www.sedarplus.ca. Although STLLR has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such information. Accordingly, readers should not place undue

reliance on forward-looking information. STLLR does not undertake

to update any forward-looking information, except in accordance

with applicable securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240206545543/en/

FOR FURTHER INFORMATION PLEASE CONTACT: STLLR Gold Inc. –

Investor Relations Tel: +1 (416) 863-2105; Email:

info@nighthawkgold.com Website: www.STLLRgold.com

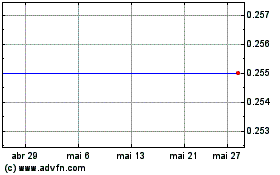

Nighthawk Gold (TSX:NHK)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Nighthawk Gold (TSX:NHK)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024