- $118.1 million, or 55%, of outstanding convertible notes due in

2026 repurchased at approximately 75% of notional value, resulting

in $51 million in total debt extinguishment

- Repurchase funded from new $67 million secured four-year term

loan maturing in June 2028 together with $21 million cash on

hand

- Credit facility includes $25 million delayed draw term loan

conditionally available to fund narsoplimab commercialization

- Transactions include no equity component, preventing

shareholder dilution, and enable additional debt reduction

Omeros Corporation (Nasdaq: OMER) today announced that it has

completed a series of strategic financial transactions, further

strengthening its balance sheet and extending the maturity profile

on a substantial portion of its debt from February 2026 to June

2028, while providing a secure source of capital to support

potential commercialization of its lectin pathway inhibitor

narsoplimab and flexibility to manage the remaining balance of 2026

convertible notes.

Today, Omeros entered into a Credit and Guaranty Agreement with

certain funds managed by Athyrium Capital Management, LP

(collectively, “Athyrium”) and certain funds managed by Highbridge

Capital Management, LLC (collectively, “Highbridge”) as lenders.

The agreement provides for a senior secured term loan facility

initially of up to $92.1 million that includes a fully funded

initial term loan of $67.1 million as well as a $25.0 million

delayed draw term loan. Omeros used the proceeds of the initial

term loan and $21.2 million of cash on hand, subject to certain

post-closing adjustments, to repurchase $118.1 million aggregate

principal amount of Omeros’ existing 5.25% Convertible Senior Notes

due February 15, 2026 (the “2026 Notes”) held by Athyrium and

Highbridge, representing a total of 55 percent of the outstanding

2026 Notes. The blended repurchase price was 74.75 percent of par

value, resulting in $51 million in total debt extinguishment. In

addition, the Company retains all potential future value of the

capped call purchased in connection with the issuance of the 2026

Convertible Notes covering all shares underlying the original 2026

Notes. Neither the initial term loan nor the delayed draw term loan

includes any equity consideration for the lenders, preventing any

shareholder dilution as a consequence of these transactions.

The $25.0 million delayed draw term loan may be drawn once in

full on or prior to June 3, 2025, conditioned on receipt of

approval from the U.S. Food and Drug Administration of narsoplimab

in hematopoietic stem cell transplant-associated thrombotic

microangiopathy (TA-TMA). Proceeds of the delayed draw term loan,

if borrowed, must be used to fund the commercialization of

narsoplimab and to pay transaction costs associated with the

delayed draw term loan. The initial term loan has no original issue

discount; the delayed draw term loan would be issued with an

original issue discount of 3.00%.

“We are pleased to partner with Athyrium and Highbridge on these

strategic transactions and we appreciate their ongoing commitment

to Omeros’ continued success,” said Gregory A. Demopulos, M.D.,

chairman and chief executive officer of Omeros. “Through these

transactions, in addition to strengthening our balance sheet

materially, we have extinguished or extended maturity on the bulk

of our debt out to mid-2028. Prior to that, we expect not only that

narsoplimab will be established in the market but that we will have

commercialized OMS906, our MASP-3 inhibitor planned to enter Phase

3 trials later this year, and that our other programs, including

OMS527 for addictions and movement disorders and our

immuno-oncology platforms, will have markedly advanced and added

substantial shareholder value. Consistent with our efforts to

protect and grow shareholder value, evidenced through our recent

programmatic accomplishments and repurchase of 8 percent of our

outstanding common shares, today’s transaction-related achievements

required no contribution of Omeros equity, further preventing

shareholder dilution.”

After effecting the repurchase of the initial $118.1 million

notional-value of 2026 Notes, $97.9 million aggregate principal

amount remains outstanding. Under the credit agreement, Omeros

retains the flexibility to repurchase additional outstanding 2026

Notes for cash in open market or privately negotiated transactions,

subject to certain limitations. Omeros also has the right, until

the earlier of November 1, 2025 and the date Omeros elects to draw

under the delayed draw term loan, to exchange up to $16.9 million

principal amount of outstanding 2026 Notes for cash and additional

term loan amounts, with the holders of such notes becoming lenders

under the agreement.

The loans accrue interest at a competitive rate of adjusted term

SOFR (with a 3.00% floor) plus 8.75% per annum, payable quarterly.

The agreement has a four-year term and a scheduled maturity date of

June 3, 2028. Omeros will be required to prepay a portion of the

loans, plus any applicable premium if, on November 1, 2025, (i)

Omeros has not previously made nor delivered notice that it expects

to make certain voluntary or mandatory prepayments of at least $20

million in aggregate and (ii) the aggregate principal amount of

then outstanding 2026 Notes that are not held by the lenders equals

or exceeds $38.5 million.

All indebtedness outstanding under the agreement is guaranteed

by certain of Omeros’ subsidiaries, other than certain foreign

subsidiaries that are not material. The indebtedness is secured by

a first-priority security interest in and lien on substantially all

tangible and intangible property of the credit parties, subject to

customary exceptions, and excluding royalty interests in OMIDRIA®

and certain related rights.

As of March 31, 2024, Omeros had $230.3 million of cash and

investments on hand available to support ongoing operations and

debt service, which should be sufficient to fund operations and

debt service into 2026.

Cantor Fitzgerald LP served as financial advisor and Covington

& Burling LLP as legal counsel to Omeros Corporation on the

transactions. King & Spalding LLP and Paul Hastings LLP acted

as legal counsel to the lenders.

The transactions described in this press release are further

described in a Current Report on Form 8-K to be filed today with

the U.S. Securities and Exchange Commission.

About Omeros Corporation

Omeros is an innovative biopharmaceutical company committed to

discovering, developing and commercializing small-molecule and

protein therapeutics for large-market and orphan indications

targeting immunologic disorders including complement-mediated

diseases, cancers, and addictive and compulsive disorders. Omeros’

lead MASP-2 inhibitor narsoplimab targets the lectin pathway of

complement and is the subject of a biologics license application

pending before FDA for the treatment of hematopoietic stem cell

transplant-associated thrombotic microangiopathy. Omeros’

long-acting MASP-2 inhibitor OMS1029 is currently in a Phase 1

multi-ascending-dose clinical trial. OMS906, Omeros’ inhibitor of

MASP-3, the key activator of the alternative pathway of complement,

is advancing toward Phase 3 clinical trials for paroxysmal

nocturnal hemoglobinuria and complement 3 glomerulopathy. Funded by

the National Institute on Drug Abuse, Omeros’ lead

phosphodiesterase 7 inhibitor OMS527 is in clinical development for

the treatment of cocaine use disorder and, in addition, is being

developed as a therapeutic for other addictions as well as for a

major complication of treatment for movement disorders. Omeros also

is advancing a broad portfolio of novel immuno-oncology programs

comprised of two cellular and three molecular platforms. For more

information about Omeros and its programs, visit

www.omeros.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934, which are

subject to the “safe harbor” created by those sections for such

statements. All statements other than statements of historical fact

are forward-looking statements, which are often indicated by terms

such as “anticipate,” “believe,” “could,” “estimate,” “expect,”

“goal,” “intend,” “likely,” “look forward to,” “may,” “objective,”

“plan,” “possible,” “potential,” “predict,” “project,” “should,”

“slate,” “target,” “will,” “would” and similar expressions and

variations thereof. Forward-looking statements, including regarding

the future regulatory status of narsoplimab, anticipated success of

our drug development programs and commercialization objectives,

forecasts of the sufficiency our capital resources, expectations

regarding uses of proceeds of loans, and the potential for future

repurchases of 2026 Notes, are based on management’s beliefs and

assumptions and on information available to management only as of

the date hereof. Omeros’ actual results could differ materially

from those anticipated in these forward-looking statements for many

reasons, including, without limitation, regulatory processes and

oversight, market factors, and the risks, uncertainties and other

factors described under the heading “Risk Factors” in Omeros’

Annual Report on Form 10-K filed with the Securities and Exchange

Commission on April 1, 2024. Given these risks, uncertainties and

other factors, you should not place undue reliance on these

forward-looking statements, and the Company assumes no obligation

to update these forward-looking statements, whether as a result of

new information, future events or otherwise, except as required by

applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240603889120/en/

Jennifer Cook Williams Cook Williams Communications, Inc.

Investor and Media Relations IR@omeros.com

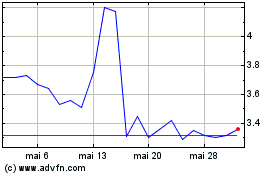

Omeros (NASDAQ:OMER)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Omeros (NASDAQ:OMER)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024