Exceeded third quarter expectations and

on-track to hit full-year targets

Progressing on roll-out and execution of

JetForward strategy

JetBlue Airways Corporation (NASDAQ: JBLU) today reported its

financial results for the third quarter of 2024.

"We met or exceeded all of our financial targets for the third

quarter and progressed on the implementation of our JetForward

strategy, sustaining the momentum we established in the second

quarter," said Joanna Geraghty, JetBlue's chief executive officer.

"Thanks to our crewmembers' efforts and our improved operational

performance in the third quarter, we saw a double digit increase in

customer satisfaction year-over-year. I am proud to lead this

incredible team, particularly as they continue to deliver the

JetBlue experience in the face of operational challenges like

Hurricanes Helene and Milton."

"We are pleased by our positive year-over-year unit revenue

performance in the third quarter. Our self-help capacity actions

have helped to better match supply with demand during off-peak

flying. Demand remained healthy in peak periods and close-in, and

was further supported by improving competitive capacity,

particularly in the Latin region, and the ramp of our revenue

initiatives," said Marty St. George, JetBlue's president. "During

the quarter, we announced new products and perks, such as lounges

and a premium co-branded credit card, and progressed on the

implementation of our reliability and network initiatives. Today,

we are also announcing the upcoming enhancement of our Even More

Space offering."

JetBlue to Launch EvenMore® to Meet Growing Premium Travel

Demand

In support of its "products and perks customers value" priority

move under JetForward, JetBlue today announced plans to evolve its

Even More Space extra legroom seat into a compelling new offering

with enhanced merchandising and greater visibility. The new

approach is designed to boost customer consideration for JetBlue

and strengthen the airline’s competitive position in the premium

leisure segment.

Starting from mid-November, we plan to give Even More Space

greater visibility in the booking process by offering it to

customers directly on the flight search results page on

jetblue.com. In addition, customers may continue to purchase Even

More Space seats in the seat selection map. As we move into 2025,

JetBlue will rebrand the offering EvenMore® to include new benefits

and amenities with the existing extra legroom seat, creating an

appealing offering for customers considering buying up for more

space and perks. JetBlue plans to announce the new amenities early

next year prior to the launch.

"We’re thrilled to enhance our popular extra legroom seats,

giving customers even more reasons to choose JetBlue," said Marty

St. George. "A key part of the EvenMore® transformation is making

it easier for customers to find and book these enhanced options

right from the start."

Progressing on Roll-Out and Implementation of JetForward

Strategy

- Reliable & Caring Service

- Realized benefits from initiatives to drive operational

reliability, with on-time performance improving by 12 points and

customer satisfaction scores improving by double digits

year-over-year in 3Q.

- Best East Coast Leisure Network

- Year-to-date, optimized over 20% of JetBlue's 2023 network,

representing 15 station closures and over 50 route exits.

- Redeployed aircraft to our strengths in leisure-focused routes

originating from Northeast airports, such as Providence, Rhode

Island's T.F. Green International Airport and Hartford,

Connecticut's Bradley International Airport, where JetBlue is

well-positioned to build scale locally.

- Products & Perks Customers

Value

- Announced enhancements to the airport experience with lounges

coming to John F. Kennedy International Airport's Terminal 5, in

late 2025, and Boston Logan International Airport coming soon

thereafter.

- Expanded co-brand portfolio with the announcement of a premium

co-branded credit card.

- Launched changes to Blue Basic fare, allowing customers to

bring a carry-on bag onboard, making JetBlue's basic economy

offering one of the industry’s best values for price-conscious

customers.

- A Secure Financial Future

- Raised ~$3.2 billion of financing to retire existing debt,

prefund capital expenditures in 2024 and 2025, and support the

runway of JetForward.

Third Quarter 2024 Financial Results

- Net loss for the third quarter of 2024 under U.S. Generally

Accepted Accounting Principles ("GAAP") of $60 million or $0.17

loss per share. Excluding special items, adjusted net loss for the

third quarter of 2024 of $54 million(1) or $0.16(1) loss per

share.

- Third quarter 2024 system capacity decreased by 3.6%

year-over-year.

- Operating revenue of $2.4 billion for the third quarter of

2024, an increase of 0.5% year-over-year.

- Operating expense of $2.4 billion for the third quarter of

2024, a decrease of 4.2% year-over-year.

- Operating expense per available seat mile ("CASM") for the

third quarter of 2024 decreased 0.7% year-over-year.

- Operating expense, excluding special items for the third

quarter of 2024, decreased 4.1%(1) year-over-year.

- Operating expense per available seat mile, excluding fuel,

other non-airline operating expenses, and special items ("CASM

ex-Fuel")(1) for the third quarter of 2024 increased 4.8%(1)

year-over-year.

- Operating margin of (1.6)% for the third quarter of 2024, an

increase of five points year-over-year.

- Average fuel price in the third quarter of 2024 of $2.67 per

gallon.

Third Quarter 2024 Key Highlights

- Improved adjusted operating margin by ~five points

year-over-year to (0.4)%.

- Delivered improved operational performance with a completion

factor of ~98%, up from ~96% in 3Q23.

- Third quarter year-over-year unit revenue increased by 4.3%,

underpinned by healthy demand in peak periods, improved close-in

bookings, competitive capacity moderation in the Latin region and

self-help capacity measures.

- Progressed on our $300 million 2024 revenue initiative target,

delivering ~$275 million of incremental top-line benefit

year-to-date, ~$135 million more than 2Q24.

- Executed on our cost initiatives, as evidenced by structural

cost program savings of $169 million to-date and fleet

modernization cost avoidance of $95 million to-date.

- Ended the quarter with ~$4.1 billion in liquidity, excluding

our undrawn $600 million revolving credit facility.

- Signed an agreement alongside World Fuel Services and Valero

Energy Corporation to bring first-ever ongoing supply of blended

sustainable aviation fuel to New York, with initial delivery

expected in 2024.

Outlook

"Our number one goal remains returning to operating

profitability, and growing our unit revenue is imperative to reach

operating profitability. As underlying trends from the third

quarter have broadly continued into the fourth quarter so far, we

expect unit revenue growth to remain positive and sequentially

consistent when adjusting for the CrowdStrike benefit in the third

quarter and the negative impacts of Hurricane Milton and the

election in the fourth quarter. As we look to 2025, I am encouraged

by the backdrop for our revenue performance to continue improving,

particularly as additional JetForward initiatives begin yielding

benefits," said Marty St. George.

Fourth Quarter and Full Year 2024

Outlook

Estimated 4Q 2024

Estimated FY 2024

Available Seat Miles ("ASMs")

Year-Over-Year

(7.0%) - (4.0%)

(4.5%) - (2.5%)

Revenue Year-Over-Year

(7.0%) - (3.0%)

(5.0%) - (4.0%)

CASM Ex-Fuel (1) Year-Over-Year

13.0% - 15.0%

7.0% - 8.0%

Fuel Price per Gallon (2), (3)

$2.50 - $2.65

$2.75 - $2.80

Interest Expense

$155 - $165 million

$370 - $380 million

Capital Expenditures

~$450 million

~$1.6 billion

"In the third quarter we improved operating margin by five

points versus our July expectations, driven primarily by improved

revenue performance, better operational performance and lower fuel

expense. We remain on track to deliver on our full-year CASM

ex-Fuel target as we remain laser focused on controlling costs and

sustaining our cost advantage," said Ursula Hurley, JetBlue's chief

financial officer. "To help support our runway to execute on our

JetForward strategy, we've also taken steps to bolster our

liquidity position through strategic financing efforts. As I look

to next year, I remain confident we have the right foundation to

begin delivering results on our $800 - $900 million EBIT (1)

target."

Earnings Call Details

JetBlue will hold a conference call to discuss its quarterly

earnings today, October 29, 2024 at 10:00 a.m. Eastern Time. A live

broadcast of the conference call will also be available via the

internet at http://investor.jetblue.com. The webcast replay

and presentation materials will be archived on the company’s

website for at least 30 days.

For further details, see the third quarter 2024 Earnings

Presentation available via the internet at http://investor.jetblue.com.

About JetBlue

JetBlue is New York's Hometown Airline®, and a leading carrier

in Boston, Fort Lauderdale-Hollywood, Los Angeles, Orlando and San

Juan. JetBlue, known for its low fares and great service, carries

customers to more than 100 destinations throughout the United

States, Latin America, the Caribbean, Canada and Europe. For more

information and the best fares, visit jetblue.com.

Notes

(1)

Non-GAAP financial measure; Note A

provides a reconciliation of each non-GAAP financial measure used

in this release to the most directly comparable GAAP financial

measure and explains the reasons management believes that

presentation of these non-GAAP financial measures provides useful

information to investors regarding JetBlue's financial condition

and results of operations. In addition, refer to Note A for further

details on non-GAAP forward-looking information.

(2)

Includes fuel taxes, hedges and other fuel

fees.

(3)

JetBlue utilizes the forward Brent crude

curve and the forward Brent crude to jet crack spread to calculate

the unhedged portion of its current quarter. Fuel price is based on

forward curve as of October 11, 2024.

Forward-Looking Information

This Earnings Release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, as amended. We intend such forward-looking statements to be

covered by the safe harbor provisions for forward-looking

statements contained in Section 27A of the Securities Act of 1933,

as amended (the "Securities Act"), and Section 21E of the

Securities Exchange Act of 1934, as amended (the "Exchange Act").

All statements other than statements of historical facts contained

in this Release are forward-looking statements. In some cases, you

can identify forward-looking statements by terms such as "expects,"

"plans" "intends," "anticipates," "indicates," "remains,"

"believes," "estimates," "forecast," "guidance," "outlook," "may,"

"will," "should," "seeks," "goals," "targets" or the negative of

these terms or other similar expressions. Additionally,

forward-looking statements include statements that do not relate

solely to historical facts, such as statements which identify

uncertainties or trends, discuss the possible future effects of

current known trends or uncertainties, or which indicate that the

future effects of known trends or uncertainties cannot be

predicted, guaranteed, or assured. Forward-looking statements

contained in this Earnings Release include, without limitation,

statements regarding our outlook and future results of operations

and financial position, including our expected return to

profitability, expectations with respect to our headwinds, our

product offerings, and our business strategy and plans and

objectives for future operations, including our JetForward

initiatives. Forward-looking statements involve risks,

uncertainties and assumptions, and are based on information

currently available to us. Actual results may differ materially

from those expressed in the forward-looking statements due to many

factors, including, without limitation, the risk associated with

the execution of our strategic operating plans in the near-term and

long-term; our extremely competitive industry; risks related to the

long-term nature of our fleet order book; volatility in fuel prices

and availability of fuel; increased maintenance costs associated

with fleet age; costs associated with salaries, wages and benefits;

risks associated with a potential material reduction in the rate of

interchange reimbursement fees; risks associated with doing

business internationally; our reliance on high daily aircraft

utilization; our dependence on the New York metropolitan market;

risks associated with extended interruptions or disruptions in

service at our focus cities; risks associated with airport

expenses; risks associated with seasonality and weather; our

reliance on a limited number of suppliers for our aircraft,

engines, and our Fly-Fi® product; risks related to new or increased

tariffs imposed on commercial aircraft and related parts imported

from outside the United States; the outcome of legal proceedings

with respect to the NEA and our wind-down of the NEA; risks

associated with cybersecurity and privacy, including information

security breaches; heightened regulatory requirements concerning

data security compliance; risks associated with reliance on, and

potential failure of, automated systems to operate our business;

our inability to attract and retain qualified crewmembers; our

being subject to potential unionization, work stoppages, slowdowns

or increased labor costs; reputational and business risk from an

accident or incident involving our aircraft; risks associated with

damage to our reputation and the JetBlue brand name; our

significant amount of fixed obligations and the ability to service

such obligations; our substantial indebtedness and impact on our

ability to meet future financing needs; financial risks associated

with credit card processors; risks associated with seeking

short-term additional financing liquidity; failure to realize the

full value of intangible or long-lived assets, causing us to record

impairments; risks associated with disease outbreaks or

environmental disasters affecting travel behavior; compliance with

environmental laws and regulations, which may cause us to incur

substantial costs; the impacts of federal budget constraints or

federally imposed furloughs; impact of global climate change and

legal, regulatory or market response to such change; increasing

attention to, and evolving expectations regarding, environmental,

social and governance matters; changes in government regulations in

our industry; acts of war or terrorism; and changes in global

economic conditions or an economic downturn leading to a continuing

or accelerated decrease in demand for air travel. It is routine for

our internal projections and expectations to change as the year or

each quarter in the year progresses, and therefore it should be

clearly understood that the internal projections, beliefs, and

assumptions upon which we base our expectations may change prior to

the end of each quarter or year.

Given the risks and uncertainties surrounding forward-looking

statements, you should not place undue reliance on these

statements. You should understand that many important factors, in

addition to those discussed or incorporated by reference in this

Report, could cause our results to differ materially from those

expressed in the forward-looking statements. Further information

concerning these and other factors is contained in JetBlue's

filings with the U.S. Securities and Exchange Commission (the

"SEC"), including but not limited to in our Annual Report on Form

10-K for the year ended December 31, 2023, as may be updated by our

other SEC filings. In light of these risks and uncertainties, the

forward-looking events discussed in this Report might not occur.

Our forward-looking statements speak only as of the date of this

Report. Other than as required by law, we undertake no obligation

to update or revise forward-looking statements, whether as a result

of new information, future events, or otherwise.

JETBLUE AIRWAYS

CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(unaudited, in millions,

except per share amounts)

Three Months Ended

September 30,

Nine Months Ended

September 30,

(percent changes based on unrounded

numbers)

2024

2023

Percent Change

2024

2023

Percent Change

OPERATING REVENUES

Passenger

$

2,198

$

2,201

(0.1)

$

6,518

$

6,842

(4.7)

Other

167

152

9.8

484

448

8.2

Total operating revenues

2,365

2,353

0.5

7,002

7,290

(3.9)

OPERATING EXPENSES

Aircraft fuel

584

701

(16.8)

1,835

2,108

(12.9)

Salaries, wages and benefits

827

790

4.7

2,434

2,304

5.7

Landing fees and other rents

176

176

0.1

518

499

3.8

Depreciation and amortization

165

155

6.4

487

462

5.5

Aircraft rent

21

33

(37.0)

73

99

(26.2)

Sales and marketing

81

80

1.0

245

237

3.2

Maintenance, materials and repairs

160

168

(4.8)

442

512

(13.7)

Special items

27

33

(17.3)

590

168

NM (1)

Other operating expenses

362

373

(3.0)

1,078

1,064

1.4

Total operating expenses

2,403

2,509

(4.2)

7,702

7,453

3.4

OPERATING LOSS

(38

)

(156

)

(75.9)

(700

)

(163

)

NM

Operating margin

(1.6

)%

(6.6

)%

5.0

pts.

(10.0

)%

(2.2

)%

(7.8)

pts.

OTHER INCOME (EXPENSE)

Interest expense

(100

)

(53

)

89.0

(215

)

(145

)

47.7

Interest income

30

19

55.0

66

50

34.5

Capitalized interest

3

5

(32.3)

12

14

(17.2)

Gain (loss) on investments, net

(2

)

—

NM

(25

)

6

NM

Gain on debt extinguishments

22

—

NM

22

—

NM

Other

7

11

(41.8)

26

14

91.1

Total other expense

(40

)

(18

)

NM

(114

)

(61

)

(84.1)

LOSS BEFORE INCOME TAXES

(78

)

(174

)

(55.3)

(814

)

(224

)

NM

Pre-tax margin

(3.3

)%

(7.4

)%

4.1

pts.

(11.6

)%

(3.1

)%

(8.5)

pts.

Income tax benefit

18

21

(17.8)

63

17

NM

NET LOSS

$

(60

)

$

(153

)

(60.9)

$

(751

)

$

(207

)

NM

LOSS PER COMMON SHARE

Basic

$

(0.17

)

$

(0.46

)

$

(2.18

)

$

(0.63

)

Diluted

$

(0.17

)

$

(0.46

)

$

(2.18

)

$

(0.63

)

WEIGHTED AVERAGE SHARES

OUTSTANDING:

Basic

346.9

333.3

344.0

331.0

Diluted

346.9

333.3

344.0

331.0

(1) Not meaningful or greater than 100%

change.

JETBLUE AIRWAYS

CORPORATION

COMPARATIVE OPERATING

STATISTICS

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

(percent changes based on unrounded

numbers)

2024

2023

Percent Change

2024

2023

Percent Change

Revenue passengers (thousands)

10,596

10,911

(2.9)

30,556

32,309

(5.4)

Revenue passenger miles (RPMs)

(millions)

14,491

14,777

(1.9)

41,685

42,950

(2.9)

Available seat miles (ASMs) (millions)

16,740

17,362

(3.6)

49,940

51,484

(3.0)

Load factor

86.6

%

85.1

%

1.5

pts.

83.5

%

83.4

%

0.1

pts.

Aircraft utilization (hours per day)

(1)

10.2

10.7

(4.7)

10.2

10.9

(6.4)

Average fare

$

207.46

$

201.73

2.8

$

213.31

$

211.77

0.7

Yield per passenger mile (cents)

15.17

14.89

1.9

15.64

15.93

(1.8)

Passenger revenue per ASM (cents)

13.13

12.68

3.6

13.05

13.29

(1.8)

Operating revenue per ASM (cents)

14.13

13.55

4.3

14.02

14.16

(1.0)

Operating expense per ASM (cents)

14.35

14.45

(0.7)

15.42

14.48

6.5

Operating expense per ASM, excluding fuel

(cents) (2)

10.62

10.13

4.8

10.48

9.96

5.2

Departures

80,037

85,971

(6.9)

241,161

262,488

(8.1)

Average stage length (miles)

1,298

1,253

3.6

1,290

1,223

5.5

Average number of operating aircraft

during period

286

283

1.2

286

281

1.8

Average fuel cost per gallon

$

2.67

$

3.04

(12.2)

$

2.83

$

3.11

(9.0)

Fuel gallons consumed (millions)

219

230

(5.1)

647

677

(4.4)

Average number of full-time equivalent

crewmembers

19,788

20,661

(4.2)

20,036

20,706

(3.2)

(1) Includes aircraft temporarily removed

from service, including aircraft impacted by the Pratt &

Whitney engine groundings and lack of engine availability (2) Refer

to Note A at the end of our Earnings Release for more information

on this non-GAAP financial measure.

JETBLUE AIRWAYS

CORPORATION

SELECTED CONSOLIDATED BALANCE

SHEET DATA

(in millions)

September 30, 2024

December 31, 2023

(unaudited)

Cash and cash equivalents

$

2,594

$

1,166

Total investment securities

1,508

564

Total assets

16,627

13,853

Total debt

8,231

4,716

Stockholders' equity

2,644

3,337

Note A - Non-GAAP Financial Measures

We report our financial results in accordance with GAAP;

however, we present certain non-GAAP financial measures in this

Earnings Release. Non-GAAP financial measures are financial

measures that are derived from the condensed consolidated financial

statements, but that are not presented in accordance with GAAP. We

present these non-GAAP financial measures because we believe they

provide useful supplemental information that enables a meaningful

comparison of our results to others in the airline industry and our

prior year results. Investors should consider these non-GAAP

financial measures in addition to, and not as a substitute for, our

financial measures prepared in accordance with GAAP. Further, our

non-GAAP information may be different from the non-GAAP information

provided by other companies. The information below provides an

explanation of each non-GAAP financial measure used in this

Earnings Release and shows a reconciliation of each non-GAAP

financial measure used in this Earnings Release to the most

directly comparable GAAP financial measure.

With respect to JetBlue’s CASM Ex-Fuel (1) guidance and EBIT (2)

targets, JetBlue is not able to provide a reconciliation of

forward-looking measures where the quantification of certain

excluded items reflected in the measures cannot be calculated or

predicted at this time without unreasonable efforts. In these

cases, the reconciling information that is unavailable includes a

forward-looking range of financial performance measures beyond our

control, such as interest rates and fuel costs, which are subject

to many economic and political factors beyond our control. For the

same reasons, we are unable to address the probable significance of

the unavailable information, which could have a potentially

unpredictable and potentially significant impact on our future GAAP

financial results.

(1) CASM Ex-Fuel is a non-GAAP measure that excludes fuel, other

non-airline operating expenses, and special items. (2) EBIT is a

non-GAAP measure that excludes interest and income taxes from net

income (loss).

Operating expense per available seat mile, excluding fuel,

other non-airline operating expenses, and special items ("CASM

ex-fuel")

CASM is a common metric used in the airline industry. Our CASM

for the relevant periods are summarized in the table below. We

exclude aircraft fuel, operating expenses related to other

non-airline businesses, such as JetBlue Technology Ventures and

JetBlue Travel Products, and special items from total operating

expenses to determine Operating Expenses ex-fuel, which is a

non-GAAP financial measure, and we exclude the same items from CASM

to determine CASM ex-fuel, which is also a non-GAAP financial

measure. We believe the impact of these special items distorts our

overall trends and that our metrics are more comparable with the

presentation of our results excluding such impact.

We believe Operating Expenses ex-fuel and CASM ex-fuel are

useful for investors because they provide investors the ability to

measure our financial performance excluding items that are beyond

our control, such as fuel costs, which are subject to many economic

and political factors, as well as items that are not related to the

generation of an available seat mile, such as operating expense

related to certain non-airline businesses and special items. We

believe these non-GAAP measures are more indicative of our ability

to manage airline costs and are more comparable to measures

reported by other major airlines.

For the three months ended September 30, 2024, special items

included union contract costs and voluntary opt-out costs. For the

nine months ended September 30, 2024, special items included

Spirit-related costs, union contract costs, voluntary opt-out

costs, and Embraer E190 fleet transition costs.

For the three and nine months ended September 30, 2023, special

items included Spirit-related costs and union contract costs.

The table below provides a reconciliation of our total operating

expenses (GAAP measure) to Operating Expenses ex-fuel, and our CASM

to CASM ex-fuel for the periods presented.

NON-GAAP FINANCIAL

MEASURE

RECONCILIATION OF OPERATING

EXPENSE AND OPERATING EXPENSE PER ASM (CASM), EXCLUDING

FUEL

(unaudited)

Three Months Ended September

30,

$

Cents per ASM

($ in millions; per ASM data in cents;

percent changes based on unrounded numbers)

2024

2023

Percent Change

2024

2023

Percent Change

Total operating expenses

$

2,403

$

2,509

(4.2)

14.35

14.45

(0.7)

Less:

Aircraft fuel

584

701

(16.8)

3.49

4.04

(13.7)

Other non-airline expenses

14

16

(10.7)

0.08

0.09

(7.4)

Special items

27

33

(17.3)

0.16

0.19

(14.3)

Operating expenses, excluding

fuel

$

1,778

$

1,759

1.1

10.62

10.13

4.8

Nine Months Ended September

30,

$

Cents per ASM

($ in millions; per ASM data in cents;

percent changes based on unrounded numbers)

2024

2023

Percent Change

2024

2023

Percent Change

Total operating expenses

$

7,702

$

7,453

3.4

15.42

14.48

6.5

Less:

Aircraft fuel

1,835

2,108

(12.9)

3.67

4.09

(10.3)

Other non-airline expenses

46

49

(5.7)

0.09

0.09

(2.8)

Special items

590

168

NM (1)

1.18

0.33

NM

Operating expenses, excluding

fuel

$

5,231

$

5,128

2.0

10.48

9.96

5.2

(1) Not meaningful or greater than 100%

change.

Operating Expense, Operating Loss, Adjusted Operating Margin,

Pre-tax Loss, Adjusted Pre-tax Margin, Net Loss and Loss per Share,

excluding Special Items, Gain (Loss) on Investments and Gain on

Debt Extinguishments

Our GAAP results in the applicable periods were impacted by

credits and charges that were deemed special items.

For the three months ended September 30, 2024, special items

included union contract costs and voluntary opt-out costs. For the

nine months ended September 30, 2024, special items included

Spirit-related costs, union contract costs, voluntary opt-out

costs, and Embraer E190 fleet transition costs.

For the three and nine months ended September 30, 2023 special

items included Spirit-related costs and union contract costs.

Certain net gains and losses on our investments and the gain on

debt extinguishments were also excluded from our September 30, 2024

and 2023 non-GAAP results.

We believe the impact of these items distort our overall trends

and that our metrics are more comparable with the presentation of

our results excluding the impact of these items. The table below

provides a reconciliation of our GAAP reported amounts to the

non-GAAP amounts excluding the impact of these items for the

periods presented.

NON-GAAP FINANCIAL

MEASURE

RECONCILIATION OF OPERATING

EXPENSE, OPERATING LOSS, ADJUSTED OPERATING MARGIN, PRE-TAX LOSS,

ADJUSTED PRE-TAX MARGIN, NET LOSS, LOSS PER SHARE, EXCLUDING

SPECIAL ITEMS, GAIN (LOSS) ON INVESTMENTS AND GAIN ON DEBT

EXTINGUISHMENTS

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

(in millions except percentages)

2024

2023

2024

2023

Total operating revenues

$

2,365

$

2,353

$

7,002

$

7,290

RECONCILIATION OF OPERATING

EXPENSE

Total operating expenses

$

2,403

$

2,509

$

7,702

$

7,453

Less: Special items

27

33

$

590

$

168

Total operating expenses excluding special

items

$

2,376

$

2,476

$

7,112

$

7,285

Percent change

(4.1

)%

(2.4

)%

RECONCILIATION OF OPERATING

LOSS

Operating loss

$

(38

)

$

(156

)

$

(700

)

$

(163

)

Add back: Special items

27

33

590

168

Operating income (loss) excluding special

items

$

(11

)

$

(123

)

$

(110

)

$

5

RECONCILIATION OF ADJUSTED OPERATING

MARGIN

Operating margin

(1.6

)%

(6.6

)%

(10.0

)%

(2.2

)%

Operating income (loss) excluding special

items

$

(11

)

$

(123

)

$

(110

)

$

5

Total operating revenues

2,365

2,353

7,002

7,290

Adjusted operating margin

(0.4

)%

(5.2

)%

(1.6

)%

0.1

%

RECONCILIATION OF PRE-TAX LOSS

Loss before income taxes

$

(78

)

$

(174

)

$

(814

)

$

(224

)

Add back: Special items

27

33

590

168

Less: Gain (loss) on investments, net

(2

)

—

(25

)

6

Less: Gain on debt extinguishments

22

—

22

—

Loss before income taxes excluding special

items, gain (loss) on investments and gain on debt

extinguishments

$

(71

)

$

(141

)

$

(221

)

$

(62

)

RECONCILIATION OF ADJUSTED PRE-TAX

MARGIN

Pre-tax margin

(3.3

)%

(7.4

)%

(11.6

)%

(3.1

)%

Loss before income taxes excluding special

items

$

(71

)

$

(141

)

$

(221

)

$

(62

)

Total operating revenues

2,365

2,353

7,002

7,290

Adjusted pre-tax margin

(3.0

)%

(6.0

)%

(3.2

)%

(0.9

)%

RECONCILIATION OF NET LOSS

Net loss

$

(60

)

$

(153

)

$

(751

)

$

(207

)

Add back: Special items

27

33

590

168

Less: Income tax benefit related to

special items

6

9

14

30

Less: Gain (loss) on investments, net

(2

)

—

(25

)

6

Less: Income tax benefit (expense) related

to gain (loss) on investments, net

—

—

6

(1

)

Less: Gain on debt extinguishments

22

—

22

—

Less: Income tax expense related to gain

on debt extinguishments

(5

)

—

(5

)

—

Net loss excluding special items, gain

(loss) on investments and gain on debt extinguishments

$

(54

)

$

(129

)

$

(173

)

$

(74

)

NON-GAAP FINANCIAL

MEASURE

RECONCILIATION OF OPERATING

EXPENSE, OPERATING LOSS, ADJUSTED OPERATING MARGIN, PRE-TAX LOSS,

ADJUSTED PRE-TAX MARGIN, NET LOSS, LOSS PER SHARE, EXCLUDING

SPECIAL ITEMS, GAIN (LOSS) ON INVESTMENTS AND GAIN ON DEBT

EXTINGUISHMENTS (CONTINUED)

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

CALCULATION OF LOSS PER SHARE

2024

2023

2024

2023

Loss per common share

Basic

$

(0.17

)

$

(0.46

)

$

(2.18

)

$

(0.63

)

Add back: Special items

0.07

0.10

1.72

0.51

Less: Income tax benefit related to

special items

0.02

0.03

0.04

0.08

Less: Gain (loss) on investments, net

(0.01

)

—

(0.07

)

0.02

Less: Income tax benefit related to gain

(loss) on investments, net

—

—

0.02

—

Less: Gain on debt extinguishments

0.06

—

0.06

—

Less: Income tax expense related to gain

on debt extinguishments

(0.01

)

—

(0.01

)

—

Basic excluding special items, gain (loss)

on investments and gain on debt extinguishments

$

(0.16

)

$

(0.39

)

$

(0.50

)

$

(0.22

)

Diluted

$

(0.17

)

$

(0.46

)

$

(2.18

)

$

(0.63

)

Add back: Special items

0.07

0.10

1.72

0.51

Less: Income tax benefit related to

special items

0.02

0.03

0.04

0.08

Less: Gain (loss) on investments, net

(0.01

)

—

(0.07

)

0.02

Less: Income tax benefit related to gain

(loss) on investments, net

—

—

0.02

—

Less: Gain on debt extinguishments

0.06

—

0.06

—

Less: Income tax expense related to gain

on debt extinguishments

(0.01

)

—

(0.01

)

—

Diluted excluding special items, gain

(loss) on investments and gain on debt extinguishments

$

(0.16

)

$

(0.39

)

$

(0.50

)

$

(0.22

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029557401/en/

JetBlue Investor Relations Tel: +1 718 709 2202

ir@jetblue.com JetBlue Corporate Communications Tel: +1 718

709 3089 corpcomm@jetblue.com

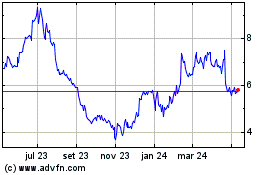

JetBlue Airways (NASDAQ:JBLU)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

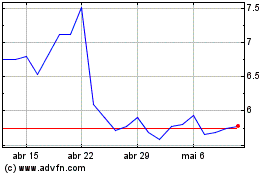

JetBlue Airways (NASDAQ:JBLU)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024