The Chemours Company Announces Private Offering of $600,000,000 of Senior Notes Due 2033

13 Novembro 2024 - 11:00AM

Business Wire

The Chemours Company (Chemours) (NYSE: CC) today announced that

it intends to offer $600,000,000 aggregate principal amount of new

senior notes due 2033 (the “Notes”), subject to market and other

conditions. The Notes will be senior unsecured obligations of

Chemours and will be guaranteed by certain of its subsidiaries.

Chemours intends to use the net proceeds from the offering to

redeem all of its outstanding euro-denominated 4.000% senior notes

due 2026 and the remainder of the net proceeds for general

corporate purposes.

The Notes and related guarantees are being offered only to

persons reasonably believed to be qualified institutional buyers in

reliance on Rule 144A under the Securities Act of 1933, as amended

(the “Securities Act”), or outside the United States to non-U.S.

persons in compliance with Regulation S under the Securities Act.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy the Notes and related guarantees.

Any offers of the Notes and related guarantees are being made only

by means of a private offering memorandum.

The Notes and related guarantees have not been registered under

the Securities Act, or the securities laws of any other

jurisdiction, and may not be offered or sold in the United States

without registration or an applicable exemption from registration

requirements.

About The Chemours Company

The Chemours Company (NYSE: CC) is a global leader in providing

industrial and specialty chemicals products for markets, including

coatings, plastics, refrigeration and air conditioning,

transportation, semiconductor and advanced electronics, general

industrial, and oil and gas. Through our three businesses – Thermal

& Specialized Solutions, Titanium Technologies, and Advanced

Performance Materials – we deliver application expertise and

chemistry-based innovations that solve customers’ biggest

challenges. Our flagship products are sold under prominent brands

such as Opteon™, Freon™, Ti-Pure™, Nafion™, Teflon™, Viton™, and

Krytox™. Headquartered in Wilmington, Delaware and listed on the

NYSE under the symbol CC, Chemours has approximately 6,100

employees and 28 manufacturing sites and serves approximately 2,700

customers in approximately 110 countries.

For more information, we invite you to visit chemours.com or

follow us on X (formerly Twitter) @Chemours or LinkedIn.

Forward-Looking Statements

This press release contains forward-looking statements, within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934, which involve

risks and uncertainties. Forward-looking statements provide current

expectations of future events based on certain assumptions and

include any statement that does not directly relate to a historical

or current fact. The words “believe,” “expect,” “will,”

“anticipate,” “plan,” “estimate,” “target,” “project” and similar

expressions, among others, generally identify “forward-looking

statements,” which speak only as of the date such statements were

made. These forward-looking statements address, among other things,

the offering of Notes and Chemours’ intended use of the net

proceeds therefrom, which are subject to substantial risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by such statements. These risks and

uncertainties include, but are not limited to, the ability of

Chemours to complete the offering on favorable terms, if at all,

and general market conditions which might affect the offering.

Forward-looking statements are based on certain assumptions and

expectations of future events that may not be accurate or realized.

Forward-looking statements also involve risks and uncertainties,

many of which are beyond Chemours’ control. Additionally, there may

be other risks and uncertainties that Chemours is unable to

identify at this time or that Chemours does not currently expect to

have a material impact on its business. Factors that could cause or

contribute to these differences include whether the offering of

Notes is completed and other risks, uncertainties and other factors

discussed in Chemours’ filings with the U.S. Securities and

Exchange Commission, including in Chemours’ Quarterly Report on

Form 10-Q for the quarter ended September 30, 2024, and in

Chemours’ Annual Report on Form 10-K for the year ended December

31, 2023. Chemours assumes no obligation to revise or update any

forward-looking statement for any reason, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112197049/en/

INVESTORS Brandon Ontjes Vice President, Investor

Relations +1.302.773.3300 investor@chemours.com

Kurt Bonner Manager, Investor Relations +1.302.773.0026

investor@chemours.com

NEWS MEDIA Cassie Olszewski Media Relations &

Reputation Leader +1.302.219.7140 media@chemours.com

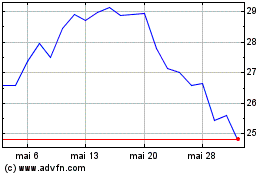

Chemours (NYSE:CC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Chemours (NYSE:CC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024