Proposed transaction provides

flyExclusive with additional growth capital and will add trading

liquidity through incremental equity ownership

Business combination transforms Jet.AI into a

pure-play AI solutions company

flyExclusive Inc. (NYSE American: FLYX), a publicly traded

provider of premium jet charter experiences, has entered a

definitive agreement to acquire the aviation business of Jet.AI

Inc. (NASDAQ: JTAI), an innovative private aviation and artificial

intelligence company.

flyExclusive will acquire the business in conjunction with

Jet.AI’s focus on being a pure-play AI solutions company. The

transaction will occur following Jet.AI’s spin of the business into

a new company (“SpinCo”), which would then be acquired by

flyExclusive (collectively, the “Business Combination”). Jet.AI

shareholders will retain their Jet.AI stock and receive new Class A

common shares in flyExclusive as part of the transaction. The

Business Combination is contingent upon the closing conditions

outlined in the agreement.

This strategic Business Combination is a natural fit for

flyExclusive to acquire Jet.AI’s aviation business, as both

companies operate planes from Textron Aviation and HondaJet and the

acquired assets will help support flyExclusive’s 2025 growth plans.

As one of the largest and most well-established companies in

private aviation, flyExclusive brings a robust fleet and leading

operational expertise. This deal is mutually beneficial as it is

expected to provide flyExclusive with additional growth capital and

enhanced shareholder liquidity and to allow Jet.AI to focus as a

pure-play AI solutions company.

flyExclusive’s Founder and Chief Executive Officer, Jim Segrave

noted “The proposed transaction with Jet.AI is the latest example

of the value flyExclusive’s vertically integrated private aviation

platform provides to industry participants. The transaction

benefits flyExclusive investors and will augment our continued

growth and market share expansion as an industry leader. Additional

growth capital and new shareholders provide an early tailwind in

2025 as we onboard additional high-performance aircraft and serve

strong demand for our differentiated customer service.’

"This Business Combination with flyExclusive offers our

shareholders the opportunity to benefit from growth in both private

aviation and AI," said Jet.AI Founder and Executive Chairman Mike

Winston. "flyExclusive, the fifth-largest operator in the industry

by hours flown, is a natural fit, with clear synergies given the

common aircraft we operate.”

Transaction Details

The Business Combination is structured as an all-stock

transaction, spinning off Jet.AI’s charter business assets into the

SpinCo, which in turn will be acquired by flyExclusive. Key details

of the transaction include:

- Ownership: The Business Combination consideration will

be in the form of a number of fully paid and non-assessable shares

of Class A common stock of flyExclusive equal to the quotient of

the purchase price, divided by the average volume-weighted average

price of flyExclusive’s stock for the thirty trading days

immediately prior to the effective date. Jet.AI shareholders will

retain their Jet.AI stock while receiving new Class A common shares

in flyExclusive to account for the portion of the aviation business

being spun-off.

- Purchase Price: The purchase price shall be determined

based on Jet.AI’s Net Cash multiplied by the Applicable Premium

Percentage. Net Cash of at least $12 million is a condition to

closing the Business Combination and will consist of the Company’s

cash on hand (including any deposits held by Textron Aviation)

subtracting any cash net working capital requirement mutually

agreed upon, and transaction costs triggered by the closing of the

Business Combination. To satisfy closing conditions and to meet the

company’s ongoing financing requirements, Jet.AI has signed a $50

million non-binding term sheet with Hexstone Capital LP on economic

terms substantially similar to those of its existing $16.5 million

arrangement with Ionic Ventures LLC. The applicable premium

percentage paid for the aviation business will be between 115% and

120% equivalent to a dollar value today contemplated in the range

of $12mm to $22mm, depending on the Net Cash value at the close of

transaction.

- Timing: The transaction is expected to close in the

second quarter of 2025, subject to various closing conditions,

including but not limited to Jet.AI financing, regulatory review,

and shareholder approval.

About flyExclusive flyExclusive is a vertically

integrated, FAA-certificated air carrier providing private jet

experiences by offering customers a choice of on-demand charter,

Jet Club, and fractional ownership services to destinations across

the globe. flyExclusive has one of the world’s largest fleets of

Cessna Citation aircraft, and it operates a combined total of

approximately 100 jets, ranging from light to large cabin sizes.

The company manages all aspects of the customer experience,

ensuring that every flight is on a modern, comfortable, and safe

aircraft. flyExclusive’s in-house repair station, aircraft paint,

cabin interior renovation, and avionics installation capabilities,

are all provided from its campus headquarters in Kinston, North

Carolina. To learn more, visit www.flyexclusive.com.

About Jet.AI Jet.AI currently operates in two segments,

Software and Aviation, respectively. The Software segment features

the B2C CharterGPT app, the Ava agentic booking AI, and the B2B

Jet.AI Operator platform. The CharterGPT app and Ava both use

natural language processing and machine learning to improve the

private jet booking experience. The Jet.AI operator platform offers

a suite of stand-alone software products to enable FAA Part 135

charter providers to add revenue, maximize efficiency, and reduce

environmental impact. The Aviation segment features jet aircraft

fractions, jet cards, on-fleet charter, management, and buyer’s

brokerage. Jet.AI is an official partner of the Las Vegas Golden

Knights, 2023 NHL Stanley Cup® champions. The Company was founded

in 2018 and is based in Las Vegas, NV and San Francisco, CA.

Additional Information and Where to Find It

In connection with the Business Combination, flyExclusive and

Jet.AI intend to file relevant materials with the SEC, including a

registration statement on Form S-4, which will include a proxy

statement/prospectus. After the registration statement is declared

effective by the SEC, the definitive proxy statement/prospectus and

other relevant documents will be mailed to the shareholders of

Jet.AI as of the record date established for voting on the Business

Combination and will contain important information about the

Business Combination and related matters. Shareholders of Jet.AI

and other interested persons are advised to read, when available,

these materials (including any amendments or supplements thereto)

and any other relevant documents in connection with Jet.AI’s

solicitation of proxies for the meeting of shareholders to be held

to approve, among other things, the proposed Business Combination

because they will contain important information about Jet.AI,

flyExclusive and the Business Combination. Shareholders will also

be able to obtain copies of the preliminary proxy

statement/prospectus, the definitive proxy statement/prospectus and

other relevant materials in connection with the transaction without

charge, once available, at the SEC’s website at www.sec.gov or by

directing a request to: Jet.AI Inc., 10845 Griffith Peak Drive,

Suite 200, Las Vegas, NV 89135, Attention: John Yi, email:

Jet.AI@gateway-grp.com or Telephone: (949) 574-3860.

Participants in the Solicitation

Jet.AI and its respective directors and executive officers may

be deemed participants in the solicitation of proxies from Jet.AI’s

shareholders in connection with the Business Combination. Jet.AI’s

shareholders and other interested persons may obtain, without

charge, more detailed information regarding the directors and

officers of Jet.AI as reflected in the annual report on Form 10-K

for the period ended December 31, 2023, filed with the SEC on April

1, 2024, as amended by Form 10-K/A filed on April 29, 2024.

Information regarding the persons who may, under SEC rules, be

deemed participants in the solicitation of proxies to Jet.AI’s

shareholders in connection with the Business Combination will be

set forth in the proxy statement/prospectus for the Business

Combination when available. Additional information regarding the

interests of participants in the solicitation of proxies in

connection with the Business Combination will be included in the

proxy statement/prospectus that flyExclusive and Jet.AI intend to

file with the SEC. You may obtain free copies of these documents as

described in the preceding paragraph.

flyExclusive and its directors and executive officers may also

be deemed to be participants in the solicitation of proxies from

the shareholders of Jet.AI in connection with the Business

Combination. A list of the names of such directors and executive

officers and information regarding their interests in the Business

Combination will be included in the proxy statement/prospectus for

the Business Combination when available.

No Solicitation or Offer

This communication is for informational purposes only and is

neither an offer to purchase, nor a solicitation of an offer to

sell, subscribe for or buy any securities or the solicitation of

any vote in any jurisdiction pursuant to the Business Combination

or otherwise, nor shall there be any sale, issuance or transfer of

securities in any jurisdiction in contravention of applicable law.

No offer of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended, and otherwise in accordance with

applicable law.

Forward-Looking Statements This press release contains

certain statements that may be deemed to be “forward-looking

statements” within the meaning of the federal securities laws,

including the safe harbor provisions under the Private Securities

Litigation Reform Act of 1995, including with respect to Business

Combination and its potential benefits. Statements that are not

historical are forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Forward-looking statements relate

to future events or our future performance or future financial

condition. These forward-looking statements are not historical

facts, but rather are based on current expectations, estimates and

projections about our companies, our industry, our beliefs and our

assumptions. These forward-looking statements generally are

identified by the words “believe,” “project,” “expect,”

“anticipate,” “estimate,” “intend,” “strategy,” “future,”

“opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,”

“will continue,” “will likely result,” and similar expressions or

the negative of these terms or other similar expressions, but the

absence of these words does not mean that a statement is not

forward-looking. Forward-looking statements are predictions,

projections and other statements about future events that are based

on current expectations and assumptions and, as a result, are

subject to risks and uncertainties that could cause the actual

results to differ materially from the expected results. As a

result, caution must be exercised in relying on forward-looking

statements, which speak only as of the date they were made. Factors

that could cause actual results to differ materially from those

expressed or implied in forward-looking statements include the risk

that the Business Combination might not be completed in a timely

manner or at all, which could adversely affect the price of

Jet.AI’s common stock or flyExclusive’s securities; the failure to

satisfy the conditions to the consummation of the Business

Combination, including required Jet.AI financing, board and

shareholder approvals; potential dilution to Jet.AI shareholders

from any financing; the occurrence of any event, change or other

circumstance that could give rise to the termination of the

definitive agreement for the Business Combination; the effect of

the announcement or pendency of the transaction on Jet.AI’s or

flyExclusive’s business generally; risks that the Business

Combination disrupts current plans or operations of Jet.AI or

flyExclusive; the outcome of any legal proceedings that may be

instituted against Jet.AI or flyExclusive related to the Business

Combination; the ability to realize any of the benefits anticipated

in the Business Combination; risks relating to agreements with

third parties; the companies’ ability to raise funding in the

future, as needed, and the terms of such funding, including

potential dilution caused thereby; the companies’ ability to

maintain the listing of its securities on a national securities

exchange; and those risks that can be found in the companies’ most

recent Annual Report on Form 10-K and subsequent filings with the

Securities and Exchange Commission. These filings identify and

address other important risks and uncertainties that could cause

actual events and results to differ materially from those contained

in the forward-looking statements. Readers are cautioned not to put

undue reliance on forward-looking statements, and Jet.AI assumes no

obligation and does not intend to update or revise these

forward-looking statements, whether because of new information,

future events, or otherwise, except as provided by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250214042816/en/

flyExclusive Media: Jillian Wilson, Marketing Specialist

media@flyexclusive.com Investor Relations: Sloan Bohlen,

Solebury Strategic Communications investors@flyexclusive.com Jet.AI

Inc. Gateway Group, Inc. 949-574-3860 Jet.AI@gateway-grp.com

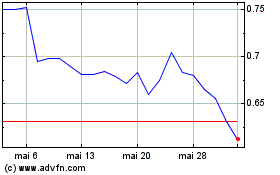

Jet AI (NASDAQ:JTAI)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Jet AI (NASDAQ:JTAI)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025