Appaloosa Files Proxy Proposals for SES S.A.

27 Fevereiro 2025 - 2:00AM

Business Wire

Significant shareholder in both SES and

Intelsat S.A. supports combination of the two companies

Fixed satellite industry facing existential

threat that is only addressed in part by the transaction

SES must adapt its corporate culture to a

far more competitive environment and abandon the trappings of a

staid oligopoly of quasi-governmental incumbents

Proposals are intended to modernize the

Company’s share capital and board structure and to address

underperforming capital investment practices by returning excess

capital to shareholders

Appaloosa LP (“Appaloosa”), which manages funds holding more

than 7% economic interests in both SES S.A. (“SES” or the

“Company”) and Intelsat, SA, submitted proxy proposals urging the

SES Board of Directors (the “Board”) to take immediate steps to

address shortfalls in corporate governance, capital allocation and

management accountability.

Appaloosa issued the following statement in connection with the

proposals:

SES today finds itself in a vastly more competitive environment

than anything it has ever faced in its history. Indeed, this

reality is not lost on the equity markets, which value the

Company’s shares significantly beneath the lows of the Covid era.

As a long-term substantial shareholder of SES, Appaloosa LP

supports the pending combination of the Company with Intelsat SA

(in which Appaloosa also holds a comparable interest). We believe

the merger synergies and the prospect of an infusion of senior

management talent from the transaction address, in part, some of

the Company’s challenges. Nevertheless, further changes must be

made if the Company is to confront the present existential threat.

SES must abandon an outdated status quo and forge a corporate

culture that embraces commercial opportunity and eschews its

history as a government ward.

To that end, we believe the following structural and governance

measures merit urgent attention from the Board:

1. Modernize the Share Capital

Structure

Under SES’ current share structure, the Luxembourg Government

directly and indirectly holds a separate class of shares (class B)

that votes on a disproportionate basis to its economic interest in

the Company (33.33% voting rights vs. 16.67% economic

interest).

Perhaps this disparity may have been excused in the past when

the satellite industry conducted business as a staid oligopoly of

quasi-governmental incumbents shielded from material competitive

threats. In the current context, however, the structure is an

antiquated relic that disenfranchises shareholders and discourages

investors and customers from taking the Company seriously as an

authentic commercial enterprise.

We therefore propose that the existing class B shares be

converted into class A shares at a conversion rate of 0.4/1,

resulting in a single ordinary share class with the Government

maintaining a 16.67% participation. The special rights attached to

class B shares would also disappear in conjunction with the

conversion. In their place, we believe the Lux Government’s

legitimate interests in maintaining domicile, proportionate board

representation and substantive operations in Luxembourg can be

narrowly addressed through specific provisions added to the

Company’s articles of association or by contractual agreement.

The Government’s approval rights over new shareholders beyond

certain thresholds, however, should be removed from the articles of

association. Such rights are no longer appropriate in light of the

Luxembourg law dated 14 July 2023, which we understand establishes

a national screening mechanism for foreign direct investments and

implements Regulation (EU) 2019/452.

As a result of these measures, the Government’s legitimate

concerns can be addressed but its ability to disproportionately

influence the Company’s business affairs curtailed. Ultimately,

modernizing the Company’s capital structure to conform with

international standards will contribute to SES’ continued viability

and inure to the benefit of both public shareholders and the Grand

Duchy of Luxembourg.

2. Modernize the Board Structure

The SES Board is configured for considerations that are no

longer relevant today and fall well short of internationally

recognized governance standards. Large boards are typically

unwieldy and often fail to take timely action in a rapidly changing

competitive environment. In particular, the current configuration

is overly hierarchical and bureaucratic. The structure allows

members to become entrenched, gives undue authority to the

Government representatives and discourages board refreshment.

To foster a streamlined, nimble and effective governing body, we

propose the following:

- Reduce the number of Board members to a total of no more than

9, with the Government receiving no more seats than its

proportionate interest merits (i.e., 16.67%) on a rounded

basis;

- Eliminate staggered terms and allow shareholders to elect each

member annually;

- Eliminate the positions of Vice Chairman; and

- Formally adopt a policy and program of regular board

refreshment, beginning with the appointment of new members to at

least 2 of the seats.

3. Return Value to Shareholders

SES shares trade at a discount to their book value of more than

50% and a dividend yield well into double-digits, notwithstanding a

recent speculative rebound over a potential windfall from spectrum

sales. Clearly, the marketplace is reacting to the Company’s (and

industry’s) woeful record of deploying capital at sub-par returns,

lackluster execution and inability to deliver on even its own often

timid objectives. These price levels question both the long-term

viability of the enterprise and whether shareholders will ever

recapture capital trapped in a vicious cycle of poor investment.

While benefits from the Intelsat acquisition may extend the runway,

SES’ long-term prospects will be at risk until the Company can

restore the market’s faith in its ability to manage capital.

We believe the first step to restoring credibility is to

implement a strict program of capital return to shareholders and

adhere to it. It is also the best means of ensuring that SES

shareholders participate in the Euro 2.4 billion of validated

Intelsat synergies. We therefore propose that the SES Board adopt a

policy of annually returning surplus capital, defined as the sum of

opening excess cash and short-term investments plus operating cash

flows and asset sale proceeds (including spectrum proceeds)

generated during the year after allowing for:

(1)

debt repayments necessary to reduce the

ratio of gross debt-to-EBITDA (excluding on-going

transaction-related expenses) to a threshold of 3.75x;

(2)

capital investments necessary in the

previous 12 months to maintain the Company’s existing GEO satellite

network;

(3)

the equity component of funds expended to

complete the build-out of the Company’s existing MEO network;

and

(4)

the funds needed to complete the Intelsat

stock purchase transaction pursuant to the Share Purchase Agreement

dated April 30, 2024.

Appaloosa believes these proposals are critical to enhancing

governance, capital deployment and management accountability in

order to bring best-in-class standards to SES. Meeting these

standards is a critical step in fostering a commercially proactive

corporate culture, which is the Company’s best hope of surviving a

competitive onslaught that is just now unfolding. We urge our

fellow shareholders to support these proposals at SES’ upcoming

Annual General Meeting of Shareholders.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226495142/en/

Media Jonathan Gasthalter/Nathaniel Garnick/Sam Fisher

Gasthalter & Co. +1 (212) 257-4170

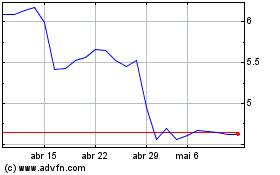

SES (EU:SESG)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

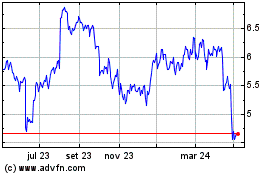

SES (EU:SESG)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025