Baidu Considers IPO of Streaming Video Unit iQiyi

13 Fevereiro 2018 - 9:24PM

Dow Jones News

By Maria Armental

Baidu Inc. is considering listing online-video unit iQiyi in the

U.S. as a separate public company while increasing investment in

its mobile and artificial intelligence.

The investments, coupled with exiting parts of the business no

longer deemed key to its operations, "will sow the seed for Baidu's

future growth in autonomous driving and conversational AI,

particularly in the home environment," Chief Financial Officer

Herman Yu said in a prepared statement.

IQiyi, which in 2016 broke the $1 billion revenue mark and last

year became the only Chinese service to license Netflix Inc. shows,

competes with the likes of Alibaba Group Holding Ltd.'s Youku Tudou

and Tencent Holdings Ltd.'s Tencent Video.

In New York trading, Baidu's American depositary receipts have

outperformed the market, rising 22% over the past 12 months. Its

ADRs rose 4.6% to $235.80 in after-hours trading Tuesday.

As it released fourth-quarter and annual results on Tuesday,

Baidu confirmed it had filed preliminary documents for an initial

public offering in the U.S. If it ultimately goes through with the

IPO, Baidu said it expects to remain iQiyi's controlling

shareholder.

Founded in 2000, Baidu built its business around online search.

But as the core search business reaches maturity, Baidu has moved

to make AI the centerpiece of its business plan.

Baidu has pledged to deliver a self-driving bus by the end of

the year and fully autonomous cars by 2021.

The heavy investment comes with a price tag, however, and

research and development costs reached 3.7 billion yuan ($569

million) in the most recent period, up 25% from the year

earlier.

Meanwhile, content costs reached 3.75 billion yuan ($577

million), up 46% from the year-ago period, with most of that

increase coming from iQiyi as Baidu pushed to stay ahead in China's

fiercely competitive video-streaming sector.

Overall, fourth-quarter profit edged up to 4.16 billion yuan

($639 million), or 12.38 yuan an ADR. Excluding stock-based

compensation and other items, profit rose to 14.90 yuan an ADR from

13.23 yuan a year earlier.

Revenue rose 29% to 23.56 billion yuan ($3.62 billion), beating

internal projections.

Analysts surveyed by Thomson Reuters expected 13.38 yuan an ADR

in adjusted profit and 23.05 billion yuan in revenue.

Revenue from online marketing, which contributes the bulk of

Baidu's top line, rose 26% in the latest period as Baidu reported a

2% increase in the number of active online marketing customers and

continued to squeeze more money from each advertiser.

Meanwhile, Baidu's other service revenue, which is typically

driven by iQiyi subscription services, surged 53% to 3.14 billion

yuan.

For the current quarter, Baidu expects 19.86 billion yuan to

20.97 billion yuan in revenue ($3.05 billion to $3.22 billion),

compared with analysts' estimates of 21.18 billion yuan.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

February 13, 2018 18:09 ET (23:09 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

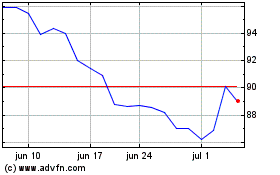

Baidu (NASDAQ:BIDU)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Baidu (NASDAQ:BIDU)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024