Hewlett Packard Enterprise Raises Shareholder Return Target to $7 Billion Under New CEO

22 Fevereiro 2018 - 9:02PM

Dow Jones News

By Maria Armental

Rising sales of storage and networking devices powered Hewlett

Packard Enterprise Co.'s core business during the holiday quarter,

helping the company raise its annual profit targets while boosting

planned returns to shareholders.

The Silicon Valley company, born from the 2015 split of

Hewlett-Packard, also saw profit rise fivefold in its fiscal first

quarter, helped by the U.S. tax overhaul.

Hewlett Packard Enterprise plans to lift its dividend by 50% in

its third quarter and buy back more than $5.5 billion of its stock

through the end of its fiscal 2019, targeting a return of about $7

billion to shareholders. The announcement Thursday from Chief

Executive Antonio Neri, who has been in the role since Feb. 1,

comes as several tech companies have revealed their plans in recent

weeks on how they plan to spend cash currently held abroad.

HPE also said it would significantly increase its contribution

to workers' 401(k) retirement plans and set some money aside for

employee degree-assistance programs.

Investors had been looking for signs of what HPE intended to do

with its cash, which stood at $7.67 billion as of Jan. 31, and sent

the company's shares up 11% to $18.16 in after-hours trading.

Shares in HP Inc., the other half of the iconic company founded

in 1939 in a Palo Alto, Calif., garage, rose 5.2% after hours as

the printer and personal-computer maker raised its annual outlook

and said the U.S. tax-law changes could result in "near-term

shareholder return opportunities." The company, which also reported

first-quarter results Thursday, showed double-digit revenue growth

in both its printing and computer businesses.

HPE CEO Mr. Neri, a longtime veteran of the company, is filling

a role left by Meg Whitman, who has described him having a deep

business-to-business enterprise technology background.

Ms. Whitman's tenure at Hewlett-Packard was marked by a series

of sales and splits that reshaped the storied company. Mr. Neri, a

trained engineer, rose through the ranks to run the servers and

networking business.

On Thursday, Mr. Neri said he was focused on establishing a new

culture as part of HPE's latest transformation, "and to really

architect the company from the ground up with a clean sheet

approach."

Mr. Neri is also charged with executing HPE Next, a three-year

plan announced in June that calls for at least $750 million in net

cost-savings, including about $250 million this year.

Asked Thursday if company spending plans included large mergers

and acquisitions, Mr. Neri said that while HPE intends to focus on

innovation and partnerships, it would be open to a deal "if there's

an opportunity there with the right valuation."

Over all, HPE's first-quarter profit was $1.44 billion, or 89

cents a share, compared with $267 million, or 16 cents a share, a

year earlier. Excluding one-time items, HPE earned 34 cents a

share.

Revenue rose 11% to $7.67 billion.

Analysts surveyed by Thomson Reuters had expected 22 cents a

share in adjusted profit and $7.07 billion in revenue.

Data-center networking and storage revenue, part of its hybrid

IT segment, rose 27% and 24%, respectively, in the latest

period.

HPE raised its annual adjusted per-share profit target by 20

cents to a range of $1.35 to $1.45 a share. For the current

quarter, HPE expects to earn between 29 cents and 33 cents on an

adjusted per-share basis, which came in ahead of analysts'

expectations.

--Austen Hufford contributed to this article.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

February 22, 2018 18:47 ET (23:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

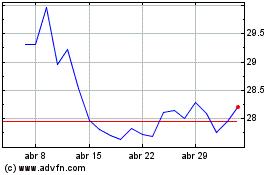

HP (NYSE:HPQ)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

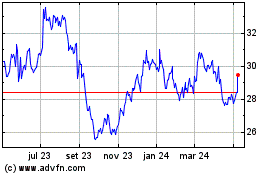

HP (NYSE:HPQ)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024